Market Perspectives August 2020

Financial markets remain fixated on pandemic risks, and hopes of a COVID-19 vaccine, as spikes in infections occur in regions of leading economies.

07 August 2020

8 minute read

By Nikola Vasiljevic, Zurich, Switzerland, Head of Quantitative Strategy

The traditional 60-40 equity-bond portfolio allocation split seems to be less effective in delivering the desired returns for many investors in a low-rate environment and eroding diversification attributes. How might investors allocate portfolios in such a world?

The 60/40 portfolio, or 60% allocated to equities and 40% to bonds, has been one of the cornerstones of investing for many decades. This simple asset mix is widely used as the main benchmark for retirement fund allocations.

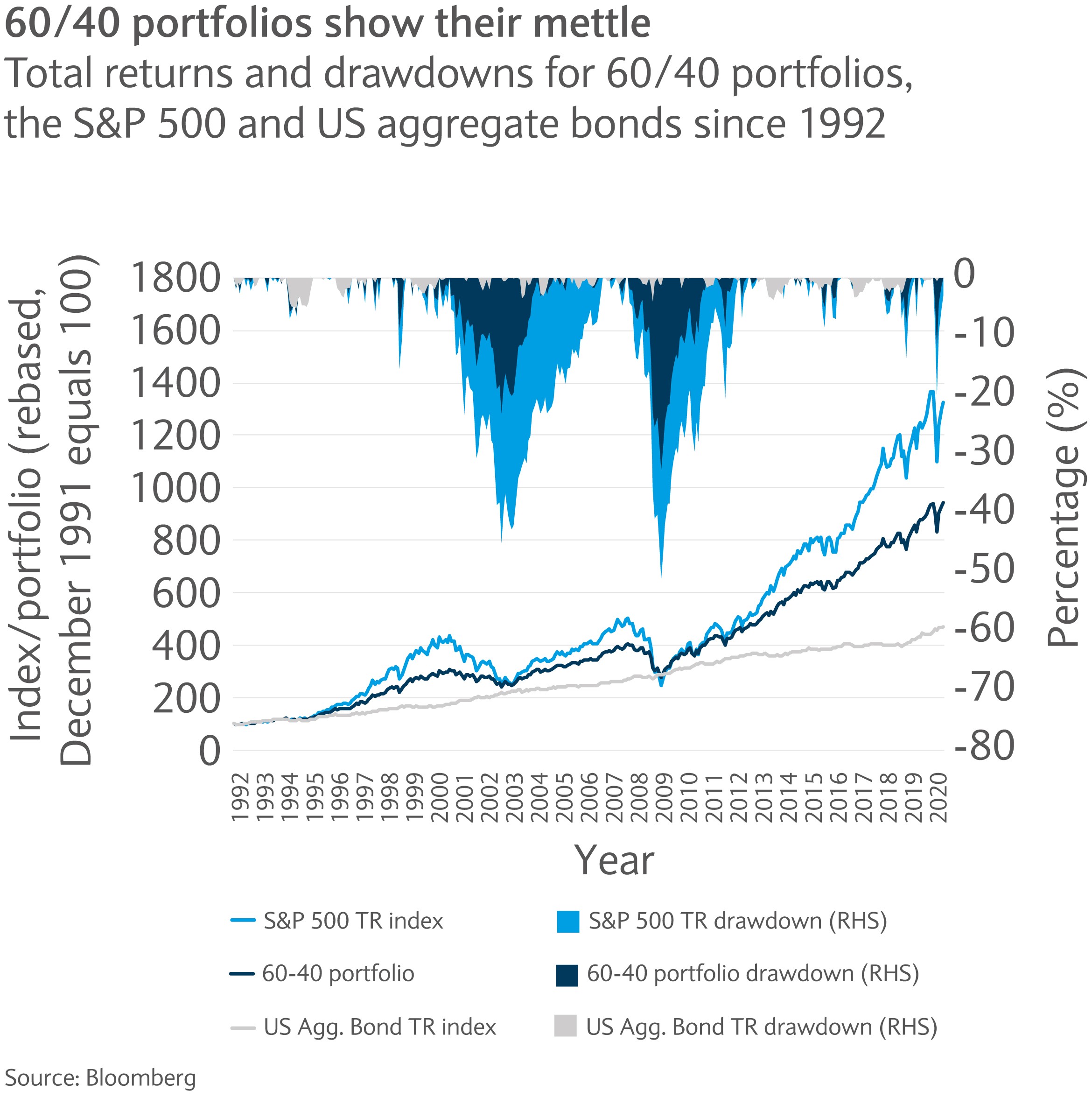

From 1992 until 2019, the 60/40 portfolio – based on S&P 500 and US aggregate bonds – delivered an attractive annual total return of 8.5%, with volatility of 8.8%. During the same period, equities averaged 9.8% a year, but at the cost of substantially higher volatility of 14.4%.

The risk-return characteristics of the portfolio were considerably improved by adding exposure to interest rate premium on top of the growth-driven equity premium. Moreover, bonds mitigated losses during the dot-com bubble of 20 years ago and the global financial crisis (see chart). In the end, the 60/40 portfolio approach’s maximum drawdown was -32.5%, while equity portfolios’ worst drawdown in the period topped out at -51%.

There are several reasons why this simple investment strategy has traditionally performed well. First, driven by the stable growth and falling interest rates, equities and bonds have made a strong contribution to total returns. Second, the correlation between equities and bonds has been negative this century. So bonds generally served as an excellent hedging component in a portfolio. Arguably, the negative correlation between both asset classes was a consequence of the low-inflation environment.

Despite the great appeal of the investment thesis behind the 60/40 portfolio, the macro-financial dynamics in recent years – and in particular since the COVID-19 outbreak – raise some doubts about its continued success.

In recent years, global growth has slowed. In developed markets, characterised by an aging population, the extraordinary demand for fixed income has helped drive interest rates close to the zero bound. Low, but relatively stable, inflation rates – combined with an extremely accommodative monetary policy – resulted in negative real cash rates.

Political risks and trade tensions fuelled volatility outbursts on several occasions. In addition, the world is coming to terms with operating in the era of COVID-19. While economies have already suffered, the full repercussions are yet to be seen. After an initial slump, many equity markets have rebounded to February 2020 valuations. One thing seems clear. The future looks uncertain.

Over a longer investment horizon (say ten years) yield levels have generally been a good predictor of future bond returns. Given the low yields on offer today (around 1.25% compared with an average US bond yield of 4.5% since1992), bonds are likely to provide investors with much lower income for some time, than typically seen in the last 30 years.

Low inflation levels represent yet another drag for nominal bond returns. Interest rates are hovering around zero in many developed markets. This leaves little room for capital gains unless short-term yields march deeply into the negative territory. The long-term outlook for bond returns appears weak.

Turning to equities, lower dividend yields, suppressed growth and relatively high valuations all point to muted returns in coming years. The heightened uncertainty created by the pandemic is likely to persist for a while, which could trigger episodes of elevated market volatility.

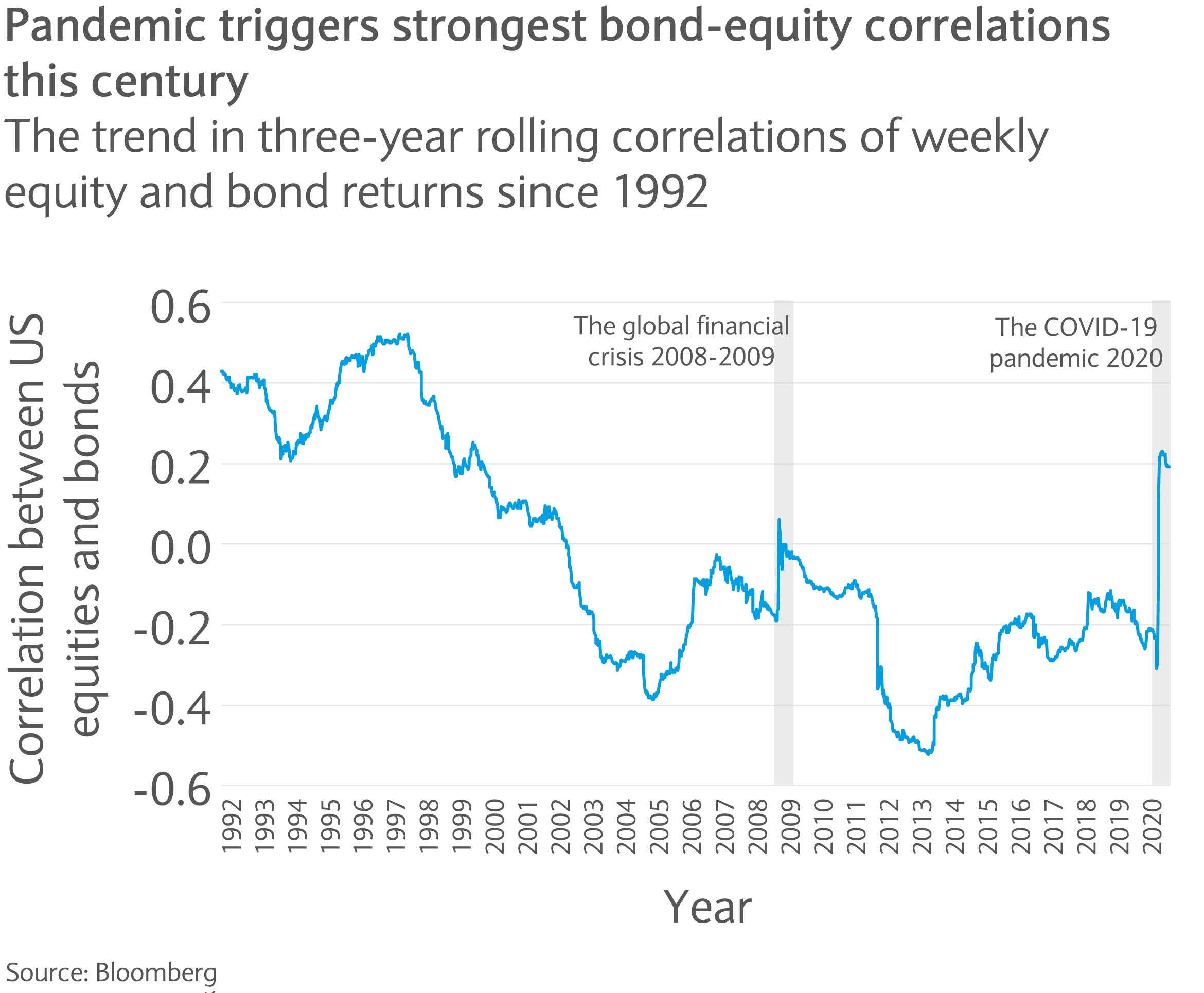

Equity-bond three-year rolling correlations have been particularly pronounced this year (see chart). At the outset of the pandemic, the correlation turned sharply positive for the first time since 2008. Admittedly, the unprecedented nature of the spike might suggest that it is an outlier and correlations may soon revert to negative values.

However, the diversification benefits of 60/40 splits have slowly eroded in the last seven years. Many factors could influence future equity-bond correlation. However, the zero lower bound and inflation risks represent a real concern for the effectiveness of 60/40 portfolio.

To tackle lower return prospects, some suggest ditching bond holdings for equities. Indeed, this is likely to boost long-term returns. That said, the equity risk exposure would probably increase substantially. But if you can stomach the risk of higher short-term market turbulence, elevated equity allocations might be worth considering.

In our view, a more efficient and flexible way to address this issue is to consider inclusion of other asset classes. Financial markets have evolved into highly dynamic and complex systems, and it is necessary to build international portfolios that provide carefully tailored multi-factor exposure. This would allow for more manoeuvring space across a spectrum of macro-financial regimes.

In fixed income, high-yielding and emerging market bonds offer credit risk premium and currency carry. Quality and dividend investment styles could provide exposure to “bond-like” equities. Hedge funds typically offer a market-neutral exposure which improves portfolio diversification. Illiquidity premium can be accessed via private equity and debt. Last but not least, to generate alpha, it is crucial to account for secular trends, actively seek opportunities and selectively pick investments for each of the asset classes.

Financial markets remain fixated on pandemic risks, and hopes of a COVID-19 vaccine, as spikes in infections occur in regions of leading economies.

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.