BBB-rated bonds: a cause of concern?

06 September 2019

6 minute read

By Michel Vernier, CFA, Head of Fixed Income Strategy

Leverage in the non-financial sector has increased substantially. At the same time the proportion of BBB-rated bonds has surged to become the largest segment of the investment grade bond market. Given the late stage of the cycle and potential for higher default rates, how worried should investors be?

In August’s Market Perspectives we wrote about the increasing level of leverage prevalent in various segments of the economy. While not a danger in itself, investors should be wary of the areas where excessive leverage could potentially put future returns at risk. One area worth a closer look is the non-financial corporate sector, particularly investment grade BBB- rated issuers.

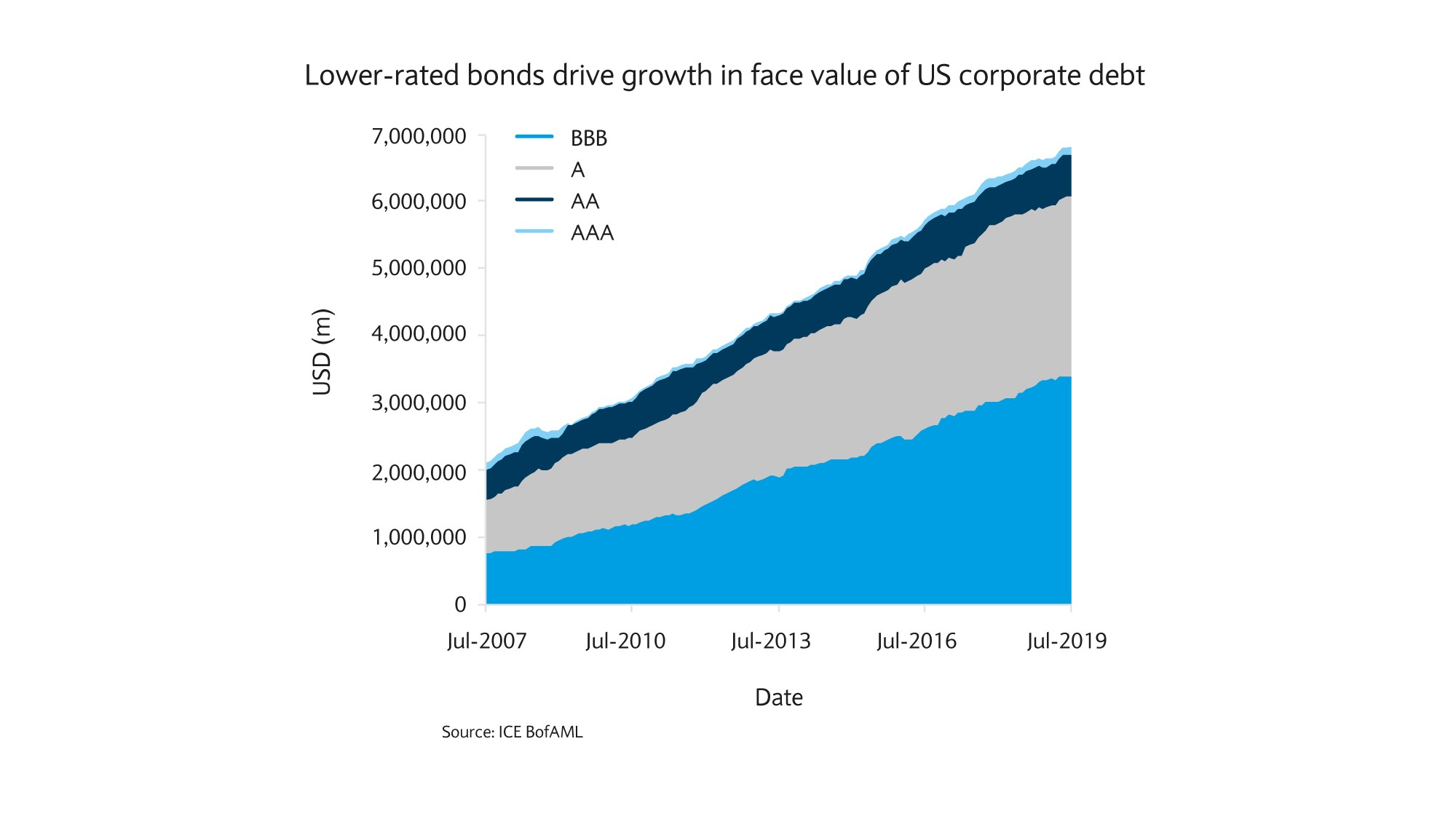

The size of the BBB-rated bond market soars

The rise of the lowest rating in the investment grade universe, BBB-rated bonds, since the credit crisis of 2008 confirms the decreasing credit quality of the bond market (see chart). The amount of BBB-rated debt outstanding in the US has almost tripled since 2008, to around $2tn.

The proportion of BBB-rated bonds has surged from 23% in 2008 to now over 50% in Europe as well as in the US. The largest drivers of this expansion have been new BBB bond issuance, rating downgrades and new entrants. Corporate issuers have enjoyed an extended period of low rates, which has supported the credit expansion.

The amount of BBB-rated debt outstanding in the US has almost tripled since 2008, to around $2tn.

Leverage still seems manageable

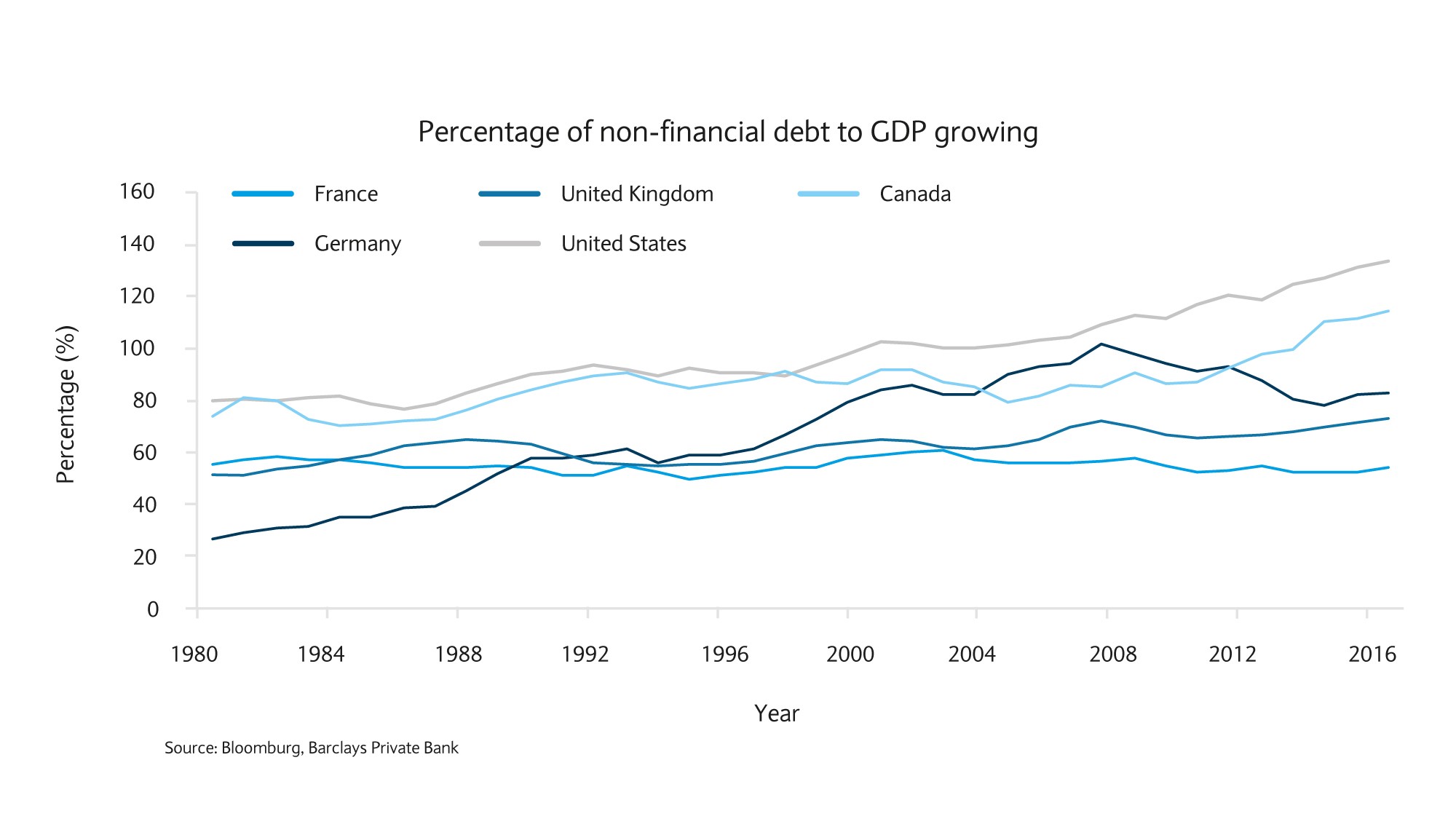

The high proportion of BBB-rated bonds is primarily a reflection of the record levels of debt within the non-financial corporates’ segment. According to the latest International Monetary Fund Financial Stability Report, business financing of non- financial corporates, including loans and debt securities in the US and euro area, has doubled in the last 14 years and stands well over $10tn for each market.

Excluding the UK and Germany, the percentage of non-financial debt to gross domestic product (GDP) for most of the countries with large investment grade bond markets is higher than it was before the credit crisis in 2008 (see chart below).

Also the balance sheet quality of US BBB-rated issuers has deteriorated somewhat. However, while net leverage (equity/net total debt) has increased in average from 2.1x to 2.6x between 2007 and 2018, the debt service ratio seems relatively healthy, given the low interest charge.

Default rates contained

Repayment of capital and coupon is the primary concern for buy-and-hold investors. So the probability of default is crucial. Investment grade default rates seem relatively contained. At 0.1% in July, the 12 months-trailing default rate in BBB-rated bonds compares with the 0.3% average default rate over the last 99 years. By contrast, the rate for US high yield bonds is 3% (ten times higher).

Importantly, even the credit crisis in 2008 did not push default rates within the BBB-segment, in a 5-year rolling period, over 2.5%. Additionally, during the 1987 crisis the rate peaked at 5%. So while default rates look set to rise, they still seem manageable.

Investment grade default rates seem relatively contained. At 0.1% in July, the 12 months-trailing default rate in BBB-rated bonds compares with the 0.3% average default rate over the last 99 years.

Beware ‘fallen-angel’ downgrades

The high degree of leverage, and large size of the BBB-bond market, raises questions about the risk of rating downgrades. Although a downgrade within the five-year period does not change the default rate as such, it still may expose investors to more price volatility during the holding period.

The risk of an investment grade bond being downgraded to high yield is known as “fallen angel” risk. Given many large institutional investors are forced to sell fallen angel bonds, due to investment restrictions, a downgrade to high yield status can hit the price substantially.

That said, the ratio of fallen angel bonds within the BBB-rated population is at very low levels compared to the historical average. Since 1983, on average 5.2% of BBB-rated companies have been downgraded to junk status. This rate, however, can fluctuate over time. For example, in 2002 this ratio peaked at just short of 17%.

It is likely that the fallen angel default rate will rise from its current low level. In addition, downgrades are likely to become more frequent in the late-cycle stage of the economy, as companies face lower growth prospects.

The ratio of fallen angel bonds relative to the BBB-rated population is at very low levels compared to the historical average.

BBB-rated bonds remain appealing

Despite the increasing risk, we do not believe that the BBB segment should be shunned for three reasons:

- Default rates have been contained even during periods of severe crisis, while the average default rate of BB-rated companies, for example, was more than four-times higher than the historical average

- Both, liquidity ratios and cash from operations are at healthy levels for the majority of the BBB-rated issuers, while funding rates are unlikely to rise substantially in the near future

- As much as lower growth will lead to challenges, companies have several levers to manage leverage. Historically, companies have actively managed the degree of leverage in the balance sheet and have often sacrificed a higher rating in order to optimise the funding crisis.

While companies have used low interest rates to partly fund a higher dividend pay-out ratio and share buybacks for the equity holders, as well as funding acquisitions, they are likely to adjust their policy before the respective rating is at risk.

Selection and active management key

As always, we believe that bond selection and active management will remain important. The key factors to watch out for are:

- Issuers from more cyclical sectors like automotives, consumer or energy are naturally more exposed to downgrades than issuers from more defensive sectors;

- While leverage in the BBB segment stands at 2.6x on average, around 12% of BBB-rated issuers have a leverage profile that is similar to BB-rated bonds. Furthermore, according to Moody’s the likelihood that a BBB-rated company will be downgraded is five times higher than a BBB+-rated company getting downgraded within a year; and

- Risk of downgrade or default varies substantially between higher quality BBB-rated issuers (BBB+/Baa1) and lower rated BBB-rated issuer (BBB-/Baa3).

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.