Time for the Bank of England to abandon rate-hike rhetoric?

24 October 2019

5 minute read

As a resolution to Brexit moves tantalisingly closer, with the European Union (EU) and UK government agreeing another deal and parliament passing the bill on the deal in principle, are UK rates more likely to move down than up?

The trend by central banks globally this year towards more accommodative monetary policy has been something that the Bank of England (BOE) has been reluctant to move toward.

Bank of England policy and Brexit

The minutes from previous BOE meetings still focus on interest rates potentially moving either way if a no-deal Brexit occurs, depending on how the economy reacts. By contrast, markets expect rates would move down in the case of such an outcome.

Furthermore, the infamous “limited and to a gradual extent” increase in interest rates has remained in the minutes, albeit in the most recent meeting, this was caveated with there being a smooth Brexit departure. However, there are signs that this could be changing given recent speeches by the BOE’s monetary policy committee (MPC) members.

Interestingly, MPC member Michael Saunders, historically one of the, if not the most, “hawkish” members of the current MPC, appeared to suggest that interest rates could fall even if a deal is reached. “If the UK avoids a no-deal Brexit, monetary policy also could go either way and I think it is quite plausible that the next move in [the] bank rate would be down rather than up.”

Governor Mark Carney (who has never been on the losing side of the vote in all previous meetings) has noted that while the recent deal struck between the UK and the EU is good news. However, it does not necessarily mean the BOE would hike rates should the deal be finalised. Business investment is likely to recover, he said, but “it won’t all come back, obviously, because we don’t know the exact nature of the future relationship.”

Muted inflation pressures

Meanwhile, MPC member Dave Ramsden, speaking two weeks’ prior, sees “less of a case for a more accommodative monetary position,” as a result of declining productivity and falling business investment translating into cost-push pressures. This would imply that demand would not be affected and inflation would run above the 2.0% target.

The economic data so far are at odds with Ramsden’s conclusion, with all the September purchasing managers’ indexes (PMI) dipping into contractionary territory. Also, the August employment numbers showed the number of jobs falling for the first time since November 2017 as well as vacancies shrinking for the eighth consecutive month.

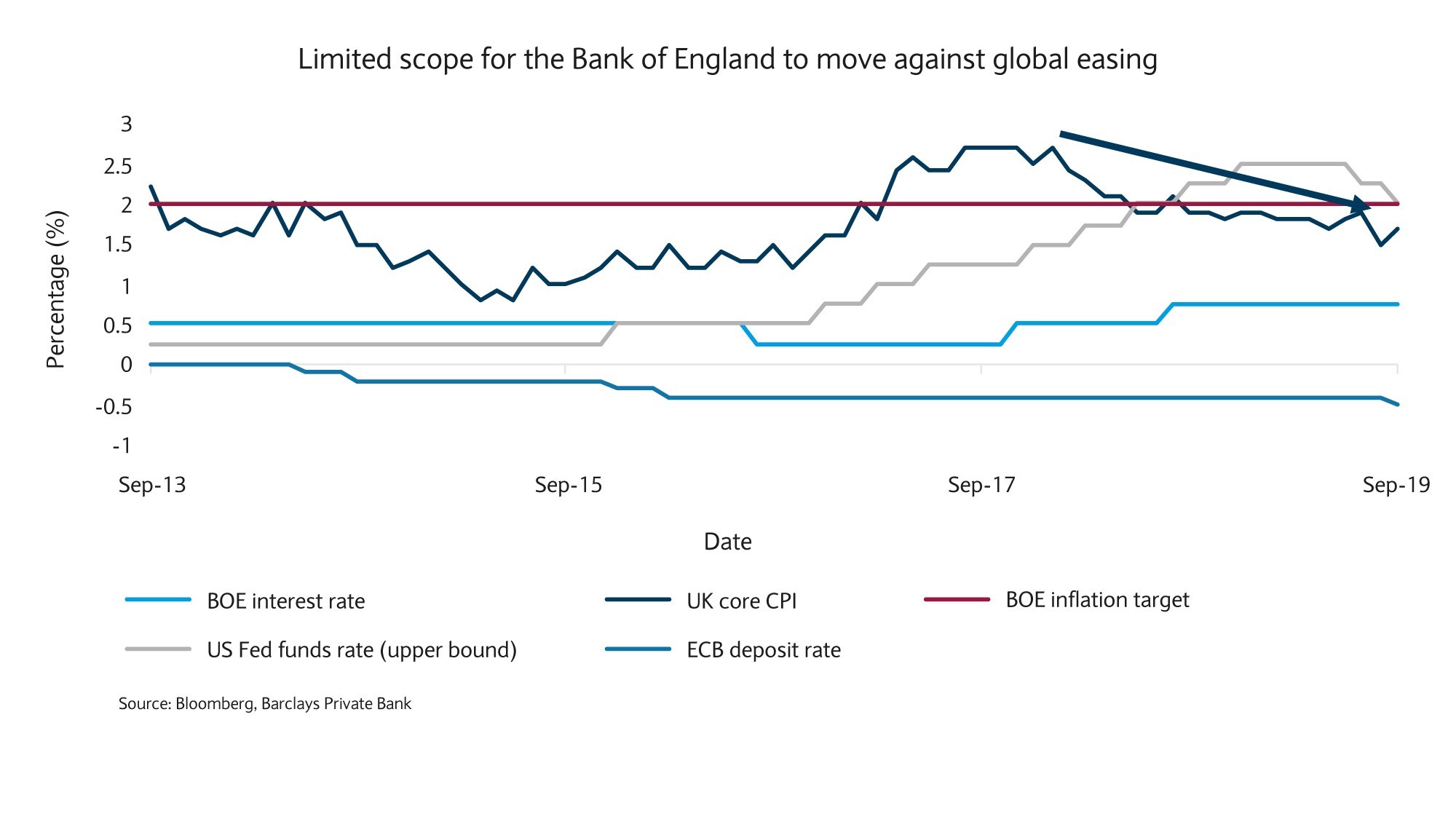

Inflationary pressures also appear muted. The consumer price index is 0.3 percentage points below the BOE’s target (see chart) and market consensus is for it to be 1.9% in 2019, while on target at 2% for 2020.

Economic resurrection?

A resolution to the Brexit debacle doesn’t mean the economy will all of a sudden resurrect. This year’s slowdown in global demand, even with clarity on how the UK leaves the EU, will be a headwind for businesses that was not there before 2016’s decisive vote to leave.

With a no-deal implying a likely imminent recession, while even the bull case for a resolution points to less economic upside than many investors envisioned, unsurprisingly UK rate futures point to rate cuts as opposed to hikes in 2020.

BOE rate cuts

We believe that BOE policy will need to adapt to the worsening growth risks and join the rest of the major global central banks.

Two rate cuts during the first half of 2020 seem likely. In a hard Brexit scenario, the central bank will likely provide further support with a cut of at least 25 basis points (bps), if not 50bps in one or two steps.

While rates on the “long end” of the curve are repricing towards a more constructive Brexit outcome, it is likely that the long end will ultimately focus on the longer term prospects of the UK economy again.

Related articles

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.