Climate change: how investors can respond

27 October 2019

8 minute read

12 November 2019

By Damian Payiatakis, Head of Impact Investing

With climate change inevitable, what options do investors have to protect their portfolios from its risks and potentially boost returns?

In general, investors want any factor with a material influence on financial returns to be considered in decision-making. Climate change is now a material factor. It presents risks across industries and companies, while offering tremendous opportunities for new investments.

As a starting point on integrating considerations of climate change into portfolios, we look at the impact of climate change, practices to improve decision-making and sectors to explore for investment opportunities.

Exposure to climate change

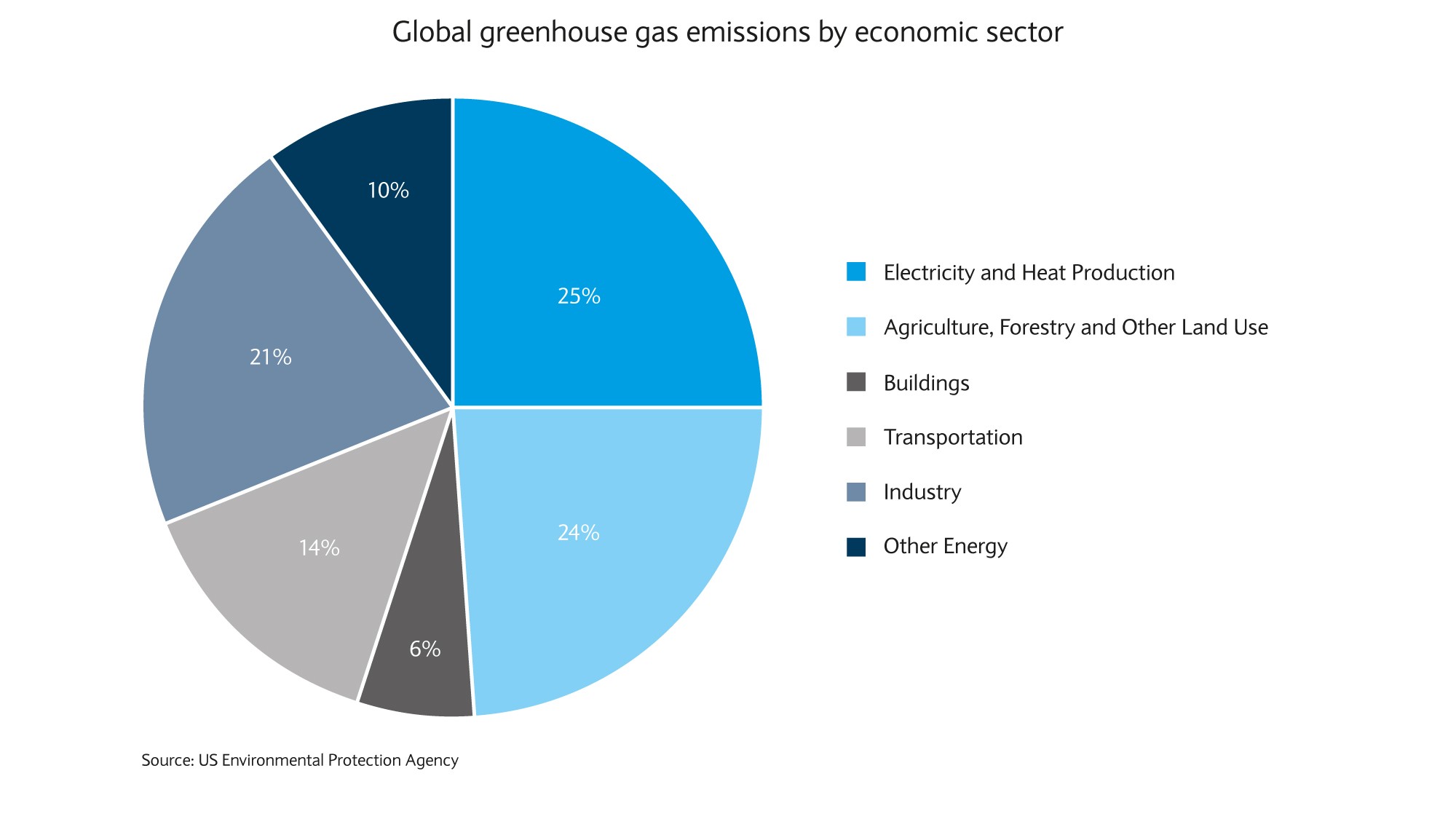

No company is immune from risks or the impact of climate change. All companies will have some contribution and exposure via their operations, energy needs and supply chain (see chart).

When thinking of companies impacted by climate change, our first thoughts tend to be of carbon-intensive sectors – fossil fuels, utilities, transportation or industrials – predominantly affected by transition risk. That said, physical risks can still impact them depending on the region and the nature of operations.

The above industries face a broad range of transition risks from regulatory changes that will drive higher costs, to technology risks as newer, cheaper and less carbon-intensive alternatives come to market. Companies in these industries potentially face the most risk of litigation around their role in “climate denial”, implying additional costs for legal fees and possibly settlements and awards.

Other industries, such as agriculture, food, construction and insurance are still significantly exposed to climate risks. They face some transition risks, but primarily their exposure is to physical ones. For example, damage to infrastructure or crops due to extreme weather events, costs for repair and insurance payouts after physical damage.

Finally, even industries with low direct climate impact, such as IT, financials or healthcare, may still face material risks in both transition and physicality. For example, energy and water-intensive data centres are exposed to technology risks and the chance of damage due to extreme weather. These sectors also face possible reputational, and revenue, risks given the high carbon-intensive client base some serve.

Assessing the management of risks

Additionally, investors need to assess how well individual organisations and their senior executives are managing climate change risk. This is particularly important if an investor still wants allocations across a wide set of industries, even high carbon-intensive ones. Finding companies that are better prepared than their peers can reduce carbon risk exposure while maintaining industry exposure.

Making better investment selections

We now outline three practices that can improve investment judgement about climate risks and opportunities. Expertise and insight in these areas can potentially generate additional risk-adjusted returns over time.

First, carbon footprinting is the starting point for many investors to understand their exposure to climate risks. The primary approach is to calculate the tonnes of atmospheric carbon dioxide equivalent per million dollars of revenue for a single investment or a portfolio. This provides a view of both the impact made, and when compared to alternatives, relative risk of carbon exposure.

However, carbon footprinting does have limitations. Data on carbon is imperfect in scope and consistency, and disclosure from smaller, private companies is often limited. Furthermore, it is a backwards-looking measure. However, it is increasingly available and reasonably accurate. As such, it can identify relatively carbon-intensive companies and help to facilitate decisions to de-risk and decarbonise a portfolio.

Scenario analysis

Scenario analysis is a newer technique that seeks to forecast the financial impact of different climate scenarios, usually a certain increase in average temperature – for instance, comparing the effect of an increase of a 1.5C scenario to a 2C or 4C one. Scenario analysis can help improve strategic asset allocation to more effectively account for the climate transition over the long term.

It is also possible to model risk-return outcomes of scenarios on different industries or companies. Understanding the relative implications of different scenarios helps to identify priority risks and opportunities as part of investment decision-making and build more climate-resilient portfolios.

Finally, engagement with investees, or potential investees, on climate-related matters can help identify risks and influence investments. By speaking with management, investors can access and interrogate information beyond published reports and data. Having identified climate-related risks they may question management on their preparedness or plans.

Often engagement aims to encourage data disclosure in line with the G20 Financial Stability Board’s Taskforce on Climate-related Financial Disclosures recommendations to improve future assessment. Together this provides a higher level of qualitative insight to inform an investor’s decision-making and judgement about the future value of an investment.

Applying these practices aims to enable a portfolio with lower climate risks, in that it has less exposure to carbon emissions, greater resilience across many potential scenarios and informed by greater insight into an organisation’s preparedness for climate change.

Sector opportunities

On the other hand, investors who want to use their capital to make a positive contribution to the transition to a low-carbon economy have a range of investment opportunities. Given the scale of climate change challenges, these tend to also be growth markets for companies with effective solutions. We now highlight five markets which have multiple entry points for investors.

Renewable energy

Given energy production’s central role in greenhouse gas emissions, switching to clean energy technologies is critical. While one of the more established markets, considerably more investment is needed. For instance, it is estimated that $14tn of investment is required over the next 20 years for the energy transition if we aim to stay within the 2C trajectory.

There are various technologies to consider, including solar, wind, hydro, biofuel and geothermal. Opportunities exist across the value chain – large-scale energy storage, creation of smarter grids or even local energy grids.

Electric mobility

Transitioning transportation, including its energy consumption, to lower carbon intensity is critical to achieving climate targets. Electric cars are the most visible opportunity, but are still in the early stage of market growth.

Of the 95m cars sold in 2018, only two million were electric vehicles, bringing total electric cars to 5.1m – with China accounting for almost half of the market. Beyond cars, there are also options in light goods transport, scooters, rail, buses, mass-transit or even short-haul planes.

There are also electric vehicles-related opportunities in the likes of battery materials, manufacturing assembly and component recycling. Furthermore, to effectively enable electric mobility means improving charging infrastructure for private use and businesses along with the road network.

Energy efficiency

Finding ways to use less energy, or existing energy, more efficiently is key to achieving climate targets. Construction and heating and cooling buildings accounts for approximately 36% of global final energy usage – which is set to increase with climate change. In green buildings alone, there may be a $3.4tn opportunity through 2025 from emerging markets.

Beyond upgrading buildings or constructing more efficient ones, there are opportunities to improve energy efficiency in industrial processes or technology companies, as well as providing devices and sensors that enable this change.

Water and waste management

While environmental issues in their own right, water and waste have clear linkages to climate change.

Water forms a critical input across numerous sectors such as industrials, agriculture, food and beverages, and clothing manufacturing. Physical risks to water availability are frequently driven by climate change. Investments needed to ensure water security are estimated to be up to $22.6tn by 2050. This includes addressing a range of challenges from water conservation, filtration, waste water treatment, desalination and water recovery.

Waste not only pollutes the environment, but produces various greenhouse gases as it breaks down or is incinerated, or in the energy to collect, transport and process wastes. For emerging markets alone, there may be a $115bn market for waste management solutions.

Agriculture

Lastly, one of the industries that is most affected by climate change is agriculture – though the nature and extent will vary considerably by region.

Land use, including agriculture, forestry, and land clearing, is one of the largest contributors to greenhouse gases, at 22%. When extended to include the entire food chain (including fertiliser, transport, processing, and sales) this rises to 29%. At the same time, it forms a critical carbon sink absorbing up to 20% of carbon emissions.

The result is that agriculture is exposed to both physical and transition risks as well as being open to investment opportunities to help adapt to and mitigate the climate change. For investors, the industry will be reshaped under any climate scenario – and across the value chain including alternative proteins, food waste, farm machinery, precision water and nutrient provision.

Market opportunities

Investors can find options in both public and private markets. As well, by considering wider concepts such as circular economy, smart cities, and green infrastructure, cut across multiple sectors.

Numerous publically-listed companies are generating revenue from goods and services that solve specific climate-related issues. For instance, the fast-growing green and sustainable bond markets offer corporate, national, and supranational debt specifically issued to support climate mitigation and adaption activities.

Private markets provide more access to organisations with new, disruptive technologies that tend to be earlier stage and not public. Meanwhile, infrastructure can provide opportunities in public works that tend to have more stable returns with low correlation to other investments. These private options can also provide better illiquidity premium and yield enhancement, respectively, for investors.

Next steps

With the world seeking to transition to a low-carbon economy, the organisations prepared for this, or offering solutions to deliver this, are more likely to be successful both financially and environmentally.

For investors, any investment or portfolio needs to consider its effects and forthcoming risks. To adjust portfolios and investment strategy for climate change requires two broad mindset shifts – how to preserve value by assessing implications of climate change and how to identify the opportunities to promote this change.

As a starting point, its useful to articulate your beliefs around climate change so that these can be included alongside other investment considerations. Thereafter, this can serve as a basis to review your existing portfolio, and future investments.

In the end, the opportunity to protect and grow your assets, and make a positive contribution to our world, should be attractive to every investor.

The opportunity to protect and grow your assets, and make a positive contribution to our world, should be attractive to every investor

We give you versatility and a choice of services

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.