Market Perspectives May 2019

Find out our latest key investment themes. With global equities close to record highs and significant political uncertainty, where next for markets?

The window for Emerging Markets bond performance is still open

03 May 2019

By Michel Vernier, Head of Fixed Income Strategy

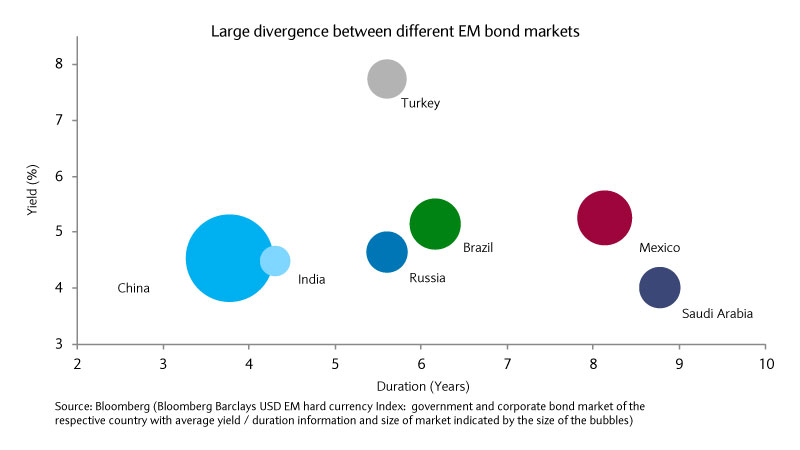

Stable global economic growth and a more accommodative US Federal Reserve should continue to benefit emerging markets (EM) bonds, whose valuations seem currently more attractive relative to comparable developed market bonds resulting in enhanced yield opportunities.

However, investors should be selective due to the diversity of emerging markets which translates to different risk and return profiles as well as different valuations within the EM complex.

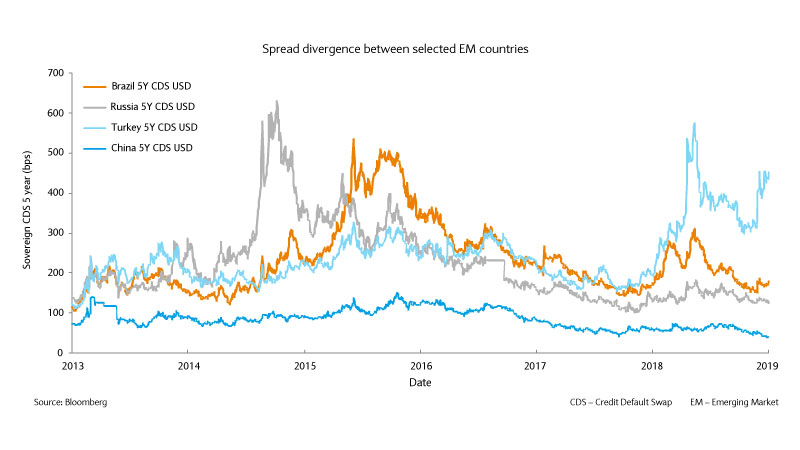

While Brazilian and Russian government and corporate bonds in aggregate trade closer to their five-year spread lows, Argentinean, Turkish or Mexican bond spreads are still trading wide for example.

This performance divergence between certain countries and sectors within the EM complex has led to opportunities though respective challenges and risks must be considered in the investment case.

Below we highlight a brief overview of selected EM areas together with our view of where spreads adequately price the respective risks:

Brazilian bonds on average have recovered since the election in October of the new president, Jair Bolsonaro, who promotes reforms to bring back economic growth after the deep recession back in 2015 and 2016.

Growth and asset prices are highly dependent on the success of the envisaged pension, privatisation and deregulation reforms.

As much as it is likely that pension reforms will be watered down and delayed, we believe Brazilian bonds should be supported by the recovery in growth and the reforms.

While spreads of the sovereign bonds are extremely tight, we see value in the corporate financial sector. The sector benefits from improved business sentiment, solid loan growth and higher capital levels while bonds pay an additional premium to the respective Brazilian sovereign bonds.

Chinese bonds were only recently included in the Bloomberg Aggregate Bond Indices

Chinese bonds were only recently included in the Bloomberg Aggregate Bond Indices and constitute the largest complex within the Bloomberg Barclays EM USD Aggregate Index. With a market value of over US$400bn it is larger than Brazil, Mexico and Argentina complex valuations together.

Trade tensions in particular will likely continue to weigh on China’s exports which is one of the key reasons for the reduction of the 2019 growth target to 6 – 6.5% by the National People’s congress in March.

A more accommodative central bank and announced value-added tax cuts, for example, show the willingness of the government to support domestic growth which shows signs of stabilisation.

Chinese bond spreads on average trade at very tight levels offering only a small yield premium, while more value can be found in the high yield property sector on a selective basis due to the higher risk.

The upcoming general elections, of which results are expected on 23 May, get by far the biggest attention at the moment. The market seems to favour the ruling Bharatiya Janata Party (BJP) party led by Narendra Modi with the expectation of further economical reforms.

Meanwhile, the Indian central bank has eased external borrowing regulations and its more dovish stance has already spurred loan and earnings growth for Indian banks recently.

This provides a better basis for further improvement of the banks’ asset quality which still suffers from relatively high non-performing loan ratios.

Indian oil refiners in the meantime should benefit from a rangebound trading oil price. Any potential populist measures in order to curb inflation and any potential spike in the oil price on the other hand may hurt the sector.

The general election has potential to provide further volatility but spreads compared to other Asian credits already look relatively high and offer entry points.

The country suffers from generally low currency reserves which have been used to defend the Turkish lira in the global currency market in light of the large and growing current account deficit.

Before the election in March, populist measures were put into place to stop the slide in the lira and curb very high inflation. But this may only be temporary in nature.

Consensus growth is forecast at 0.2% for 2019 which together with the hard currency US dollar indebtedness bears risks for Turkish corporate issuers. The relatively low leverage, strong liquidity and dollar revenue streams have helped multinational companies in Turkey so far and support the respective bonds.

Turkish banks and specifically government-related banks enjoy the support of the government which recently announced more supportive measures. Banks have built high reserves to deal with the high proportion of non-performing loans and have increased their capital ratios in order to deal with any potential spike in non-performing loans.

The highly vulnerable currency and the economic challenges put the sector generally at risk for further spread volatility. Risk/reward seems balanced and any spread volatility may offer more opportunities.

Apart from the sanctions from foreign governments, the economy in Russia as well as the credit quality of the major issuers seems relatively healthy.

The Russian economy has shown resilience to the sanctions, growing 2.3% in 2018, mainly helped by exports.

Russia’s fiscal surplus of 2% of gross domestic product has led to growing foreign-exchange reserves while a higher oil price should further boost the surplus. Meanwhile, slowing fixed investments and lower growth in consumption, which could be further depressed by the recent VAT hike, point to a slowdown in 2019.

Russian government bond spreads are trading close to the 2018 lows (five-year credit default swaps now: 127 basis points) while renewed sanction risk could change the direction quite dramatically again.

Sanctions would most likely have a direct, or at least indirect, impact on the energy and mining sector as well as the bank sector, which make the respective bonds highly vulnerable for repricing.

Find out our latest key investment themes. With global equities close to record highs and significant political uncertainty, where next for markets?

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.