Market Perspectives May 2019

Find out our latest key investment themes. With global equities close to record highs and significant political uncertainty, where next for markets?

03 May 2019

By Gerald Moser, Chief Market Strategist

From time to time we will use a section of our monthly “Market Perspectives” to introduce and discuss broad topics in financial markets. We start this series with a look at secondary funds in private equity.

Private capital is an important piece of an investment puzzle as it allows investors to harvest an illiquidity premium and diversify away from publicly traded markets. But an investment in private capital, of course, is only possible if the liquidity needs are already covered with the rest of the portfolio.

Investments in private markets can be defined according to the target asset (equity and debt), the purpose (leveraged buy-out, infrastructure, real estate, energy and power), the way of investing (direct or fund of funds), the stage of the investment (venture capital or growth capital) or the maturity of the private equity fund (primary or secondary).

In this article, we focus on the differentiation between primary and secondary funds, providing more explanations on secondary investments.

In a traditional primary private capital fund, investors agree to commit capital to a fund which invests this capital based on investment opportunities which are broadly defined according to the categories aforementioned.

The capital can be drawn at any point, usually in the first few years, as fund managers find investment opportunities. But it can take time for the capital to be invested and start generating returns.

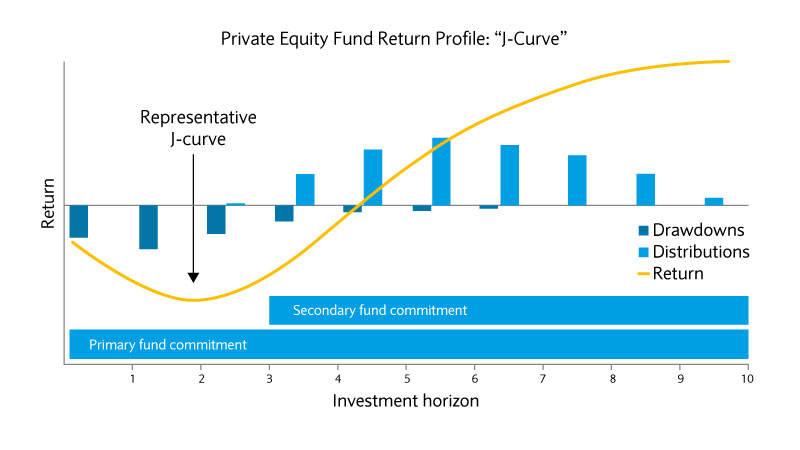

This delay in generating any return on investment is called the J-curve effect. It illustrates the general trend for private equity investment to have negative cash flow earlier on before turning into investment gains as the portfolio matures.

Initial negative cash flows come from management fees, investment costs, underperforming investments or investment in non-profitable companies.

Investing in private equity can be daunting. It is a long-term investment, with limited opportunities to exit it, no visibility on how the funds will be invested (the so-called “blind pool” risk) and no investment control. On top of this, returns are uncertain as committed capital could never be called if fund managers cannot find suitable investment opportunities.

Secondary investments offer several appealing characteristics which mitigate those risks while still offering most of the advantages of private equity:

Find out our latest key investment themes. With global equities close to record highs and significant political uncertainty, where next for markets?

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.