Market Perspectives May 2019

Find out our latest key investment themes. With global equities close to record highs and significant political uncertainty, where next for markets?

03 May 2019

By Gerald Moser, Chief Market Strategist

Inflation surprises are one of our investment themes.

When assessing the macroeconomic landscape we believe that dovish central banks are likely to be supportive for growth but this could translate into inflation surprising to the upside.

Labour markets are tight in all major developed economies, with the unemployment rate often at multi-decade lows.

In the past, this would typically have led to wage growth and eventually higher inflation, as measured by the consumer price index. This time around, the relationship between low unemployment and wage growth has been weaker.

Some of the explanations for this are more use of technology, the increasing share of the “gig” economy or the lack of bargaining power for workers.

All of these explanations certainly play a role but we think there is a risk that the low unemployment level ultimately pushes wages higher.

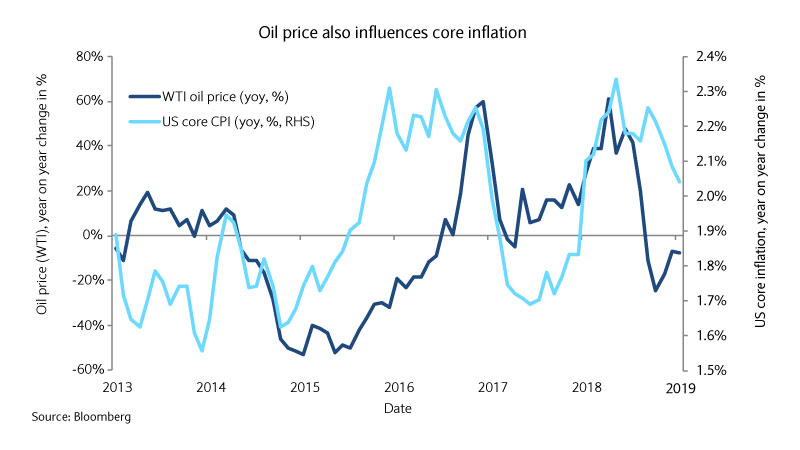

In addition to labour markets, another factor that we highlighted as a risk for inflation is the oil price. There is a distinction in some inflation measurements to correct for a large swing in energy prices which can be volatile.

While headline inflation includes oil and food price changes in addition to shifts in the cost of goods and services, core inflation solely focuses on price changes stemming from the movement in cost of goods and services.

Despite this distinction, an increase in the oil price also influences core inflation through secondary channels.

Despite this distinction, an increase in the oil price also influences core inflation through secondary channels. There are many products that include oil prices in their production process and this ultimately leads to a relatively close relationship between core inflation and the oil price.

The oil price peaked above $75 per barrel in October last year, before collapsing to below $45 per barrel in December. This had a deflationary impact on prices. However, a conjunction of supply restrain from the Organisation of the Petroleum Exporting Countries and Russia, unexpected supply constraint in Venezuela and Libya, lower than expected output from shale oil fields in the US and a rebound in demand as economic growth picked up all contributed to the oil price rising by more than 50% since its low in December.

Furthermore, the toughening of US sanctions on Iran, meaning the US will not renew in May the waivers it issued for eight countries to import oil from Iran, is likely to tighten supply further. This may be despite commitments from Saudi Arabia and the United Arab Emirates to step up their output to fill the gap.

The oil price is still slightly below where it was a year ago, hence still moderating overall year-on-year price changes. However, it might soon start to be a positive contributor to inflation, adding one more factor to a potential inflation surprise.

In any case, the consensus was not for the oil price to rise as fast and as high as it already has and this is another factor to take into consideration. We continue to see opportunities in US inflation-linked bonds as well as in gold. With central banks taking a decisively dovish stance, inflation surprises could push real yields lower. The effect would be positive for gold prices.

Find out our latest key investment themes. With global equities close to record highs and significant political uncertainty, where next for markets?

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.