Market Perspectives July 2019

Find out our latest key investment themes. As more dovish central banks and trade tensions drive sentiment, what are prospects for the rest of 2019?

05 July 2019

By Michel Vernier, CFA, Head of Fixed Income Strategy

After the recent bond rally, yields in the developed markets are trading at depressed levels. Investors continue to look for alternatives and emerging markets offer enhanced yields. Volatility will likely increase due to global growth concerns, therefore selection will be key, but emerging market bonds still offer an attractive risk-reward.

Emerging markets bonds still offer an attractive risk-reward.

We highlighted in our previous publications that emerging markets bonds offer attractive yields on an absolute and relative basis, relative to investment grade or high yield sectors in developed markets.

Historically, accommodative central bank policy has supported flows into emerging markets bonds, which has supported bond prices. Meanwhile, central banks, like the US Federal Reserve Bank (Fed) or European Central Bank (ECB), paved the way for looser monetary policy in June. This has led to another wave of flows into emerging markets in the search for enhanced yields.

Not only emerging markets debt, but US and European high yield bonds have also delivered exceptional returns this year. We still believe that emerging markets bonds are preferable to high yield alternatives, although selection in both markets is key.

In the following sections we compare key aspects between emerging markets and high yield debt.

Default rates for US high yield and emerging markets bonds are at historical lows. Emerging markets corporate default rates (12-month trailing) of 1.4% in 2018 were significantly lower than the historical average of 2.8%. In the US, high yield default rates are also at depressed levels, at 2.8%, while European default rates for speculative corporates were 1.3% by end of last year.

Default rates for both US high yield and emerging markets bonds are at historical lows.

Given that more challenging market and economic conditions lie ahead, it is likely that default risk will increase from the current depressed levels globally. That said, supportive financial conditions and moderate growth should limit the risk of a sudden spike in both markets.

In the developed world, defaults among high yield bonds will likely occur with issuers who maintain a high operating leverage. Naturally, these can be found among smaller-sized issuers as opposed to established blue chip heavyweights.

Historically, the dynamics of default rates within emerging markets differ from the developed markets. Default rates in these segments were usually clustered in certain regions or countries, coinciding with times when they were in distress. During 2001-2002 for example, Argentina accounted for nearly 40% of emerging markets corporate defaults. In 2015-2016, the sharp decline in commodity prices saw a surge in default rates in Latin America, specifically in Brazil, which was hit by recession and bribery scandals. In the same period, default rates in Asia-Pacific continued to decline.

It is important to note that, while the proportion of non-financial corporate investment grade issuers in emerging markets stood at around 20% 20 years ago, today investment grade issuers make up roughly 50%. The improved credit quality should be taken into account when comparing US high yield and emerging markets over the long term.

While both high yield and emerging markets are prone to downturns, the dynamics are different.

Given the very high integration in the global value chain, Asian issuers are highly exposed to global growth and vulnerable to any global slowdown. Unsurprisingly, this makes the region most vulnerable to the ongoing trade tensions.

Meanwhile, oil and commodity exporting countries are dependent on the commodity cycle. While supply-driven commodity price weakness may be looked through by investors, given the more temporary nature, demand driven weakness will have a more sustained effect on fiscal balances. The oil price volatility may lead to some pressure for oil producers like Brazil, Russia and the Gulf states, most notably Oman.

Overall, however, we believe that countries like Brazil and India, for example, should be able to cope well, even in a situation where either growth or commodity prices decline.

In the developed world we believe that companies with high operating leverage and cyclical exposure can be vulnerable in a period of declining operating profit. In this environment interest coverage can drop sharply, putting coupon payments and redemption at risk.

Additionally, US oil producers which have a comparable high breakeven cost for oil, will suffer when oil becomes more volatile. In such a scenario, we would favour national energy champions of established emerging markets countries to US high yield energy issuers.

US oil producers which have a comparable high oil breakeven cost, will suffer when oil becomes more volatile.

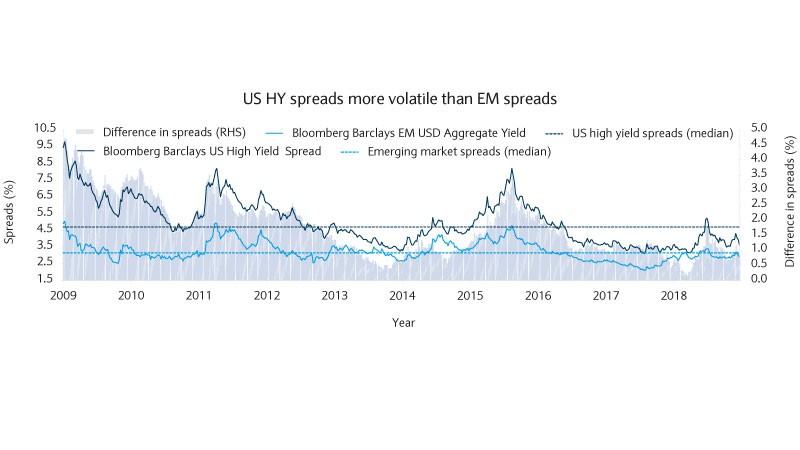

The recent Fed-induced rally led to a substantial tightening of both emerging markets and high yield bond spreads. While the average spread of the Bloomberg Barclays Emerging Market Aggregate Bond Index is just short of 300 basis points (bps), US high yield average spreads are trading at 380 bps.

High yield bonds may seem to offer better value than emerging markets bonds. However, the risks underlying lower quality issuers in the high yield markets reveal themselves in times of economic uncertainty. For example, during the sell-off in late 2018, average spreads of US high yield bonds widened dramatically to 540 bps from 300 bps, while the average spread of emerging markets bonds widened to 350 bps from 280 bps in the same period.

The risks underlying lower quality issuers in the high yield markets reveal themselves in times of economic uncertainty.

Looking back to the 2015/2016 commodity crisis, the higher beta of US high yield spreads became even clearer: average spreads of emerging markets bonds widened by 160 bps while the average spread of US high yield bonds widened by 440 bps causing significantly higher price volatility.

In an environment where spread volatility is likely to increase, we think that emerging markets bond spreads offer better value than high yield spreads. But again, selection will be key.

Although we are not expecting a US recession in the near term, it is worth noting that emerging markets bond spreads traded at their tightest level in around 10 months before the last two US recessions. Meanwhile, US high yield bonds saw their tightest levels 18 months before. This suggests a longer period of stable returns is available in emerging markets bonds in a late-cycle environment.

Find out our latest key investment themes. As more dovish central banks and trade tensions drive sentiment, what are prospects for the rest of 2019?

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.