Navigating uncertain seas

02 August 2019

4 minute read

At a geriatric 10 years old, the US has seen its longest period of economic growth in history.

Despite no immediate signs of a recession, rising volatility in the markets suggests we are in a late cycle economy.

“It’s possible to make good returns late-cycle, but it often requires a different approach to mid-cycle investing and plenty of market knowledge to navigate the heightened volatility,” says Gerald Moser, Chief Market Strategist at Barclays Private Bank.

Current instability across the markets is being fed by shifting political environments in the US, Europe and the Middle East.

Adding to this are uncertainties about the path of US interest rates and ongoing global trade tensions.

Given these concerns, should investors move from equities into cash-heavy portfolios?

William Hughes, Discretionary Portfolio Management (DPM) Product Specialist at Barclays Private Bank, stresses the importance of not seeing periods of market volatility in isolation. “This implies short-term investment, over which period markets are less directional and therefore less certain to exceed cash returns,” he explains.

Bond market volatility might have hit its highest level in two and a half years but equity markets typically perform relatively well up to the very end of the cycle. As such Henk Potts, Senior Investment Strategist at Barclays Private Bank, believes it’s worth staying invested but being more selective about exposure to equities: “While the upside in broad developed market indices is likely limited from here, we continue to see opportunities,” Potts adds.

Hughes agrees: “Investors should take a longer term approach, which accepts the cyclicality of global markets and the associated volatility.

“At Barclays Private Bank, we prefer to deemphasise the significance of the cycle and place a greater focus on finding high-quality companies that we want to own for the long term,” he adds.

Why active investing?

Passive investments have attracted a great deal of attention in recent years, whereby the investor holds a broad and indiscriminate exposure to the entire market.

If you consider the monetary and fiscal environment of the last decade: developed nations have kept interest rates low enabling companies to borrow more for longer, and central banks have provided ample liquidity, which placed upwards pressure on asset prices.

This has aided the relatively narrow distribution of market returns over this period.

However, as the investment milieu shifts and asset price dispersion intensifies, active strategies aimed at dampening the volatility of sharp market downturns through careful security selection, are likely to play a more important role.

Hughes says: “Active management is best placed to earn investors excess returns in choppy markets, whereby company returns have a high dispersion and are driven by company fundamentals and market dynamics (as opposed to sentiment).”

“This provides active managers the opportunity for identifying the companies that will ‘win’ through fundamental analysis and for those managers to exceed the market returns by avoiding the ‘losers’,” he explains.

Keep calm and carry on

“In the long run, we are all dead,” said John Maynard Keynes, a renowned British economist. There can often be an over-emphasis on long-term investing as a risk mitigation strategy, but investors that look beyond economic cycles often thrive.

“Take Amazon and Google - they survived the dotcom bubble because they became instrumental in the way today’s economy works,” Potts says.

“For this reason, many investors are looking towards companies that address issues such as climate change, machine learning and big data to offer long-term value,” he adds.

The cyclical parts of the equity market, such as automobiles and semiconductors, are typically more at risk late in the economic cycle. This is because demand is more likely to be impacted by macroeconomic fluctuations, unlike services such as healthcare and utilities.

A long-term view also leaves less room for behavioural bias, reduces surplus costs such as taxes or trading expenses and allows investors to take advantage of high-return opportunities.

“We ask our discretionary investors to take a long term-view equal in length to our own,” says Alistair Randall, Managing Director of DPM at Barclays Private Bank.

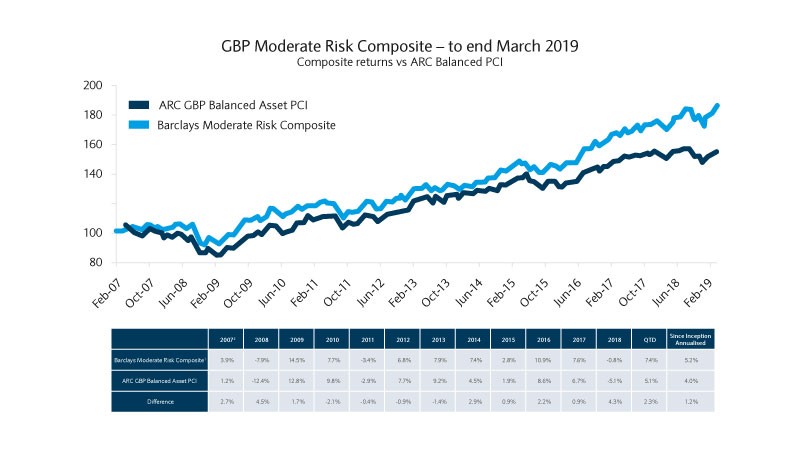

“Those who have stayed the course through bouts of volatility over the last five to ten years have been rewarded with strong returns in excess of the market and our industry peers, as reported by ARC,” Randall says.

ARC is an independent consultancy that provides performance reporting relative to the wider industry. They do this by consolidating performance of over 150,000 portfolios from more than 65 investment managers and private banks including Credit Suisse, Deutsche Bank, HSBC, JP Morgan Private Bank and UBS.

The charts below show how the composite performance of Barclays’ Discretionary Portfolios over the past five years has exceeded the ARC peer group average.

This demonstrates the power of long-term compounding returns and the fruits of staying invested though uncertainty periods, which can precede the most rewarding times for investors.

All figures are net of AMC. Returns may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future performance

Source: Q1 Market Intelligence Report (MIR) as at 31st March 2019 for Barclays KCFO GBP

All figures are net of AMC. Returns may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future performance

Source: Q1 Market Intelligence Report (MIR) as at 31st March 2019 for Barclays KCFO GBP

These strong returns also demonstrate the advantages of having a team of experts manage your portfolio. The skill, experience and global network of Barclays have allowed the multi-asset class discretionary team to outperform industry peers with reasonable consistency over the last five years.

Since inception, the returns of the Barclays composite1 have exceeded the ARC peer group by an average of 1.2% per annum2. While it isn’t an indicator of future performance, it does highlight the expertise of Barclays’ portfolio managers as well as the opportunities opened up by investing across a range of asset classes.

Source: Barclays, Asset Risk Consultant PCI www.assetrisk.com 31 March 2019

Past performance is not a reliable guide to future performance

Returns are net of underlying transaction costs and the 'all-in-one' fee (including custody, brokerage and annual management charge). Returns may increase or decrease as a result of currency fluctuations.

This range of asset classes includes equities, fixed income and alternative assets, available in sterling, euros and US dollars.

“Holding investments through turbulent markets may feel counter-intuitive for many investors. However, in order to time the market, investors must execute their exit and re-entry to the market very precisely otherwise run the risk of suffering opportunity cost and missing out on market gains,” concludes Hughes.

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research.

All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing. Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it. Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents.

Past performance is not a reliable guide to future performance

Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.. This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted.

You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.