Oil: taking the plunge

What does oil’s rebound mean for investors?

17 April 2019

After spiralling by 45% in Q4 last year, oil prices have rebounded close to 50% from their lows, according to West Texas Intermediate figures.

With the barrel slightly above $60, many investors are wondering if energy equity represents an attractive investment.

Given our expectations for a slightly higher average oil price in 2019 - around $70 per barrel - our immediate response would be “yes”.

However, not all oil companies are made equal; it’s important to target specific parts of the sector.

US vs. Europe: a very different proposition

There are significant differences between US (XOP) and European (SXEP index) oil sectors.

The European oil sector (SXEP Index) is mostly comprised of integrated oil companies with exposure to the entire oil production value chain.

On the other hand, in the US, exploration and production (E&P) companies represent the vast majority of the energy sector (roughly 80%).

Pick your position: up, mid or down

Understanding the composition of an oil index is critical as each point in the value chain (up-, mid- or down-stream) responds to different drivers and the performance of each sub-sector relative to the underlying commodity may vary significantly.

|

Part of value chain |

Sector |

Drivers |

|---|---|---|

|

Upstream |

Exploration |

Oil prices, production growth |

|

Midstream |

Storage & Transport |

Production growth, oil curve |

|

Downstream |

Refiners |

Spread, capacity, inventories, transport costs |

Broadly speaking, the closer you are to the well, the more exposed you are to the variations in oil prices.

While it does make sense to see E&P’s performance mimic oil prices, the behaviour of services companies may be more surprising.

A lagging second derivative

Oil services companies’ share prices appear to follow oil prices, but this has little to do with any real and immediate impact.

Indeed, this group’s revenues are not linked to the price of oil but rather to E&Ps’ propensity to invest.

This is why earnings for services companies tend to bottom or peak slightly later than E&Ps and to exhibit much larger swings: oil prices and E&Ps earnings are ‘only’ 30% and 40% below their 2015 peak, respectively. Meanwhile, services companies’ earnings are still 70% lower.

We doubt this is about to change.

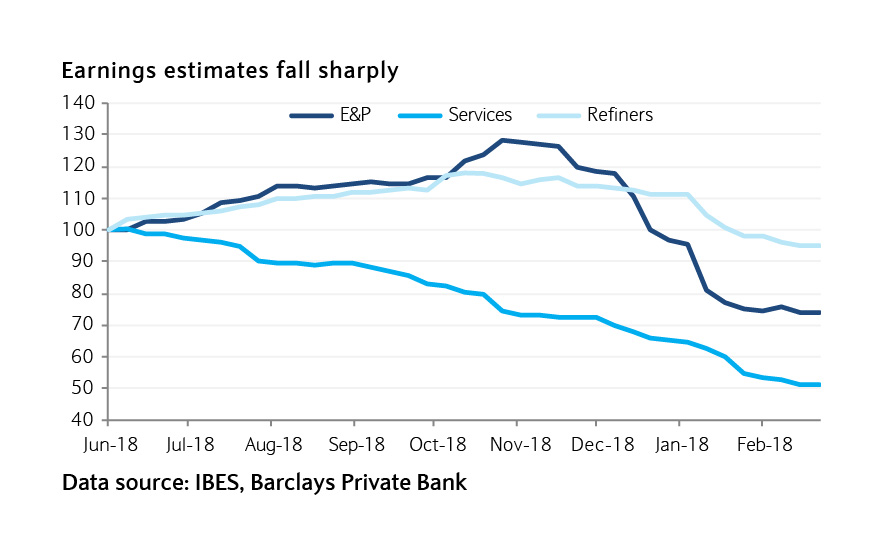

This year’s consensus estimates have seen steady downgrades for oil services companies, while E&Ps saw upgrades between June and November 2018.

Similarly, the latest rebound in oil prices triggered modest upgrades to E&P earnings forecasts while services’ have remained stubbornly flat.

We believe the market is gradually coming to the realisation that services companies, although they may eventually benefit from higher oil prices, are also facing powerful and secular headwinds - chiefly a tech-induced deflationary cycle. This will likely weigh on their growth outlook.

We believe the market is gradually coming to the realisation that services companies, although they may eventually benefit from higher oil prices, are also facing powerful and secular headwinds

What does this mean for investors?

Oil is an eclectic sector: finding the right position in the value chain at any point of the cycle is critical.

In the current context, and based on our expectations that oil prices are unlikely to move significantly higher from here, we expect oil services companies’ earnings power to remain challenged, especially as major integrated oil companies are unlikely to ramp up investments.

E&Ps (US) and integrated (Europe) appear more attractive to us.

Although the resurgence of mergers and acquisition (M&A) activity in the former may offer additional upside, at this point, our preference goes to European majors. We believe they offer a better degree of visibility and better resilience, should oil prices settle at or slightly below their current levels.

Related articles

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.