Market Perspectives April 2019

Find out our latest key investment themes. And with volatility set to stay elevated in 2019, can markets head higher still this year?

05 April 2019

Major central banks have recently signalled a slower pace of rate rises than had been expected. While our economists do not expect a large increase in inflation this year, there is a risk that higher inflation takes markets off guard.

Economic growth and inflation are likely to be around long-term averages in the short term. In response to a growth scare in the fourth quarter (Q4) of last year, and resulting fall in commodity prices, most central banks shifted their focus to growth risks as inflation pressure subsided.

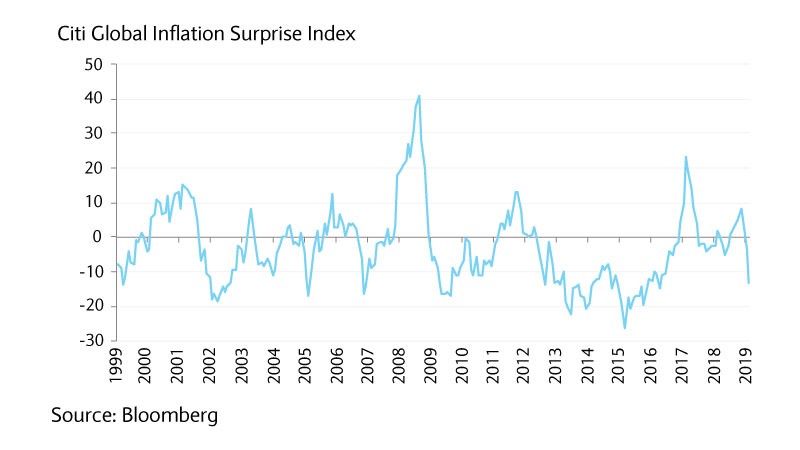

That said, after a long period of relatively subdued inflation and with little sign of a sharp pick-up recently (see chart below), there are many factors that could push inflation higher.

There are several risks that could trigger higher inflation in the second half of 2019:

In the longer term, the increasing emerging market (EM) middle class and its expanding purchasing power will lead EMs to no longer export lower inflation but rather higher inflation to the rest of the world. In the developed world, the debate around the use of quantitative easing to finance government deficits is likely to also generate discussions around inflation risks.

From a financial markets point of view, we look at how portfolios can be positioned to minimise the risk in case of renewed inflation pressures. The main takeaway is that cash holdings should be reduced to the bare minimum to meet liquidity needs.

With cash on deposit returning very little at the moment, inflation is the most significant risk for cash holdings. For investors holding cash in the belief of an imminent recession or market downturn, we believe that gold is a more attractive proposition.

With the Fed signalling that US rates are firmly on hold, higher inflation would translate into lower real yields. Gold tends to benefit from a fall in real yields as its drawback of not paying income becomes less relevant.

Another hedge against inflation is to invest in physical assets such as property. Compared to financial assets, physical assets have not benefited as much from the flood in liquidity seen since quantitative easing started. However, the increased focus towards infrastructure, fiscal spending and a more even distribution of revenues between capital and labour would make the asset class more appealing.

As a whole, moderate inflation tends to be positive for equities as it supports revenue growth. That said, the main cause for inflation should be analysed before making investment decisions.

If inflation fears are driven by faster-than-expected wage growth, while companies exposed to consumer spending may benefit, this may be more than offset by higher labour costs. On the other hand, should inflation rise due to higher energy prices, then producers will benefit but many purchasers of energy may suffer.

Some companies may withstand the effects of inflation better than others. We believe companies with strong pricing power (eg luxury brands), low price elasticity (staples) or inflation-indexed revenues (concessions) look better positioned to do so than many others.

Whatever causes inflation, the sequences of events will be crucial. Indeed, if markets start believing inflation is rising without the support of strong economic growth, investors may question the sustainability of the economic cycle.

This could hurt equity markets, as happened in 2018 when yields moved higher as growth started to fade. As we would not expect this to happen this time, instead we would focus on companies with pricing power, product demand that is little affected by price changes or with inflation-indexed revenues in times of rising inflation.

Fixed income investments and inflation do not usually go hand in hand given that any unexpected inflation will eat into the nominal coupon and repayment of debt instruments.

Institutional investors, with pension funds primarily use inflation-linked bonds in order to manage inflation risk. But like anything in financial markets the hedge comes with a price tag. In this case it comes in the form of the real yield (nominal yield adjusted for inflation) rather than the higher yield nominal bonds offer.

Breakeven rates are used to assess the relative attractiveness of inflation-adjusted yields compared to the yield of nominal bonds. In the US, 10-year breakevens are just short of 2%: the implied average yearly consumer price index over the next 10 years.

This is similar to the average of the past 20 years but well below of the average in the last 40 years, for example. In the UK, breakevens have been highly distorted by FX volatility and concerns around Brexit-related inflationary shocks. At 3.2% the 10-year breakeven does not appear cheap. The UK retail price index (RPI) and consumer price index will likely fall further from their 2017 peak, according to the latest BOE forecast update.

With the recent strength in sterling against the US dollar and the diminishing risk of a hard Brexit, it is hard to imagine the RPI shooting up significantly above current breakeven levels (see chart). For sterling investors, better opportunities in physical assets, such as real estate or infrastructure, are likely to exist.

Find out our latest key investment themes. And with volatility set to stay elevated in 2019, can markets head higher still this year?

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.