Market Perspectives April 2019

Find out our latest key investment themes. And with volatility set to stay elevated in 2019, can markets head higher still this year?

With global equities off to a strong start this year, can the momentum be sustained and how should investors position themselves for a more volatile environment?

Following a strong rebound in equity markets so far this year, we expect low-to-mid single digit positive returns over the rest of 2019, albeit with higher levels of volatility. Earnings growth will likely slow but remain positive while valuations should be supported, as recession fears are kept in check by low interest rates and low real interest rates. In addition to short term opportunities, we believe three main investment themes are worthy of consideration: investing late in the economic cycle, yield enhancement and inflation risk.

As we enter the later stage of the economic cycle, exposure to secular growth equities (such as healthcare and software) seems preferable to equities offering purely cyclical exposure (such as autos and semiconductors). In addition, the income generated by equities will likely be an important component of total returns in a period of higher price volatility.

At this stage of the cycle, focusing on a company’s willingness and ability to grow its dividend appears more relevant than the level of yield it offers. Additionally, fears over inflation risk can be mitigated by exposure to sectors offering pricing power (luxury goods), product demand that is little affected by price changes (staples) or inflation-indexed revenues (concessions).

In our opinion, US markets remain best placed over the medium term from a regional perspective. Investors could consider combining US exposure with secular growth opportunities in emerging markets.

Our base case is for the S&P 500 index to end 2019 at 2900-3000. Following the sharp downward revisions to consensus expectations since October, earnings growth expectations of around 4% in 2019 look more reasonable (see chart below). In fact, consensus may be too cautious as it implies margin contraction despite mid single digit sales growth. It is very unusual for margins to shrink when the top line is this healthy. As such, we expect 5% earnings growth this year and modest downward revisions to 2020 estimates.

We do not expect valuations to expand this late in the economic cycle. Any hopes of multiples’ expansion are likely to be offset by renewed fears that the Federal Reserve (Fed) will lift interest rates. Similarly, any short-term market stress should be met by rate cuts or slower-than-planned rate rises from central banks. All in, this means that, despite short-term moves, multiples should stay within their current range.

Although US equities are likely to grind higher over the next three to six months, this cycle has persisted for a long time. The Fed is doing its best to support growth but is reacting to data. This lag raises the chances of inflation risks creeping up or recession fears resurfacing. As such, we prefer to combine ‘defensive’ and ‘growth’ exposures in sectors like software, digital content, healthcare and some parts of industrials.

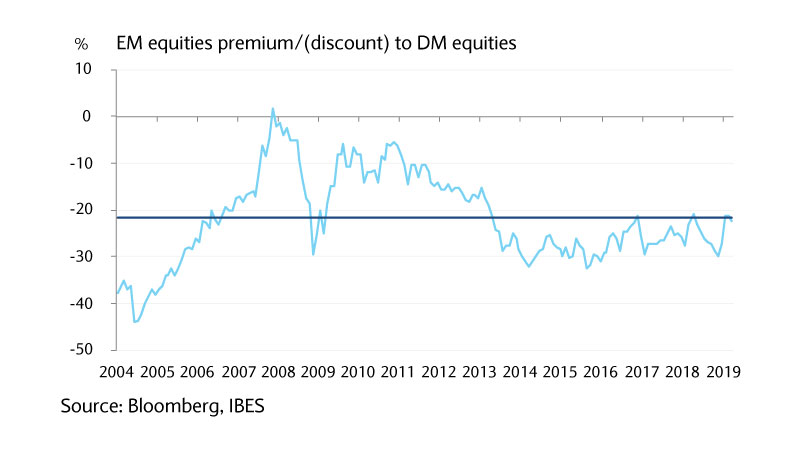

Outside of the US, we believe that emerging markets offer compelling long-term opportunities, driven by the inexorable rise of the middle class and a shift from investment to consumption. This marks the rationale for combining US and emerging market equities. In the short term, the outlook for emerging markets appears bright, supported by relatively stable US dollar exchange rates, low interest rates and stabilising growth prospects. However, this equilibrium is fragile.

Within emerging markets, we prefer Asian to Latin American equities. While the growth momentum should be more favourable to the latter, following a significant slowing in 2018, we believe that positive surprises are more likely to come from the east.

Indeed, Chinese authorities have been injecting a large-scale stimulus into their economy for a few quarters. Although its impact has been minimal so far, we expect it will ultimately boost economic activity. Should increased economic momentum coincide with receding trade tensions between China and the US, then consensus expectations in the region appear too low.

The eurozone remains a market that, broadly speaking, one should buy when everybody else hates it and sell when everybody starts turning positive. Unfortunately, the region’s complicated political backdrop and challenged banking sector will likely continue to weigh on market sentiment this year. So, while value is plentiful in Europe, taking a long-term view at the regional level is difficult. Instead, short-term opportunities may offer a better approach. For long-term investors, there are pockets of growth but these are not large enough to have much influence on the broader market.

UK equities have also been victims of political uncertainty. Here, though, the country’s equity market has benefited from a natural hedge in the form of a weaker sterling. As around three-quarters of sales by FTSE 100 constituents are earned outside the UK, the index is highly sensitive to currency movements and their impact on company profits. The binary nature of Brexit prevents us from taking a strong view on the UK market at this stage. With investors having avoided investing in the country for some time, we suspect that when inflows return they will be both material and long-lasting.

Japanese equity indices, like the UK's, are guided mainly by currency variations. With an outlook that calls for limited change in the yen/US dollar exchange rate, we struggle to build a high degree of conviction in Japan’s Nikkei or Topix indices. Nevertheless, the country continues to improve its corporate governance framework. This should lead to gradually improving shareholder returns which may be better captured by targeting specific companies rather than exposure to the broader market.

Following a strong rebound in equity markets so far this year, we expect low-to-mid single digit positive returns over the rest of 2019.

Find out our latest key investment themes. And with volatility set to stay elevated in 2019, can markets head higher still this year?

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.