Market Perspectives April 2019

Find out our latest key investment themes. And with volatility set to stay elevated in 2019, can markets head higher still this year?

As we expect asset class returns to be relatively muted considering current valuations and the macroeconomic outlook, yields and carry have a role to play in attempts to boost total returns.

The strongest price performance for equity markets usually happens towards the end of a recession, as financial markets start to discount the coming recovery.

At that time, earnings expectations are overly pessimistic and the market prices out any future growth prospects, while the equity risk premium, or the additional compensation sought for taking equity risk over the risk-free return offered by say 10-year Treasuries, is at its highest. In such conditions, it is not unusual to see equity markets deliver 20% to 30% price returns over a few months.

For government bonds, price performance plays, on average, a much smaller role in total return than for equities. However, price return usually contributes the most to total return at the start of a recessionary episode.

This generally leads investors to invest in relatively low risk assets and push up government bond prices. Meanwhile, central banks tend to cut rates and inject liquidity in the economy, also contributing to higher prices by pushing yields lower.

We neither expect a strong expansion nor a recession this year and therefore equity and fixed-income markets are unlikely to see strong price performance contribution to total return.

We forecast low to mid single-digit price return for equities. In addition, current valuations across most asset classes look fair to expensive and do not leave much room for price appreciation at those levels without meaningful fundamental support.

Of course, there might be opportunities for strong price return if and when financial markets start pricing a higher probability of a recession. This is what happened in the final quarter of 2018, when markets feared that a Chinese slowdown and rising trade tensions would tilt the global economy into recession. While we expect more volatility, it is difficult to predict when volatile events will occur.

Waiting for the best buying opportunity to emerge before investing does not come without cost: the longer investors wait for the ultimate interest rate level or entry point to be reached, the higher the expected return has to be in order to make up for the period of low return.

In financial markets this concept is expressed by forward rates and used in the foreign exchange (FX) and rates market in particular. Forward rates tell you how much the rate at a target date has to be if you choose to wait and invest in the lower yielding alternative in the meantime. This lower yielding alternative naturally would offer shorter maturities, lower yielding currency or higher quality bonds.

Returns of cash compared to EM bonds

| Strategy | Coupon | Return over period | |||

|---|---|---|---|---|---|

| Year 1 | Year 2 | Year 3 | Year 4 | End of period | |

| Scenario 1:Invest in EM bonds now | 5.5 | 5.5 | 5.5 | 5.5 | 22 |

| Scenario 2: Wait 1 year to invest | 2.5 | 6.5 | 6.5 | 6.5 | 22 |

| Scenario 3: Wait 2 years to invest | 2.5 | 2.5 | 8.5 | 8.5 | 22 |

As we highlighted in our fixed-income section, we believe that US dollar (USD) emerging market (EM) hard currency bonds seem fairly valued. The following example shows a simple example of how carry can work in investors’ favour. Let us assume an investor with an investment horizon of four years decides to park money in USD cash at 2.5% per year instead of investing in USD EM bonds at a yield of 5.5%.

The table, which excludes re-invested coupons (compounding) or changes of US monetary policy and the like, shows that EM bond yields must rise by 100 basis points (bps) in the second year to make up for the lower return in the first year. If investors park the money for two years, the EM bond yields must surge to 8.5% in order to achieve the same return as would be achieved from investing from the beginning.

In equities, the most obvious factor to look at is dividend yield. Although it may vary between regions and sectors, dividend yield is often a key component of total return over time. Yet, there is a danger of using a higher-than-average yield as an indication of improved future returns.

This is particularly true at a time when interest rates may not be the tailwind they have been in recent years. Over the past 10 years, extremely accommodative monetary policies around the world have pushed many companies to use cheap leverage to increase or sustain their dividend payouts despite, in some cases, challenging fundamentals.

This leaves them vulnerable should their cost of borrowing rise or their revenues fail to grow fast enough to accommodate higher interest expenses. Some high yielding companies may be “value traps”. While dividend yields might look attractive alongside other valuation metrics, the high discount the market is assigning to the company might reflect financial stresses that should warn investors looking to buy those companies.

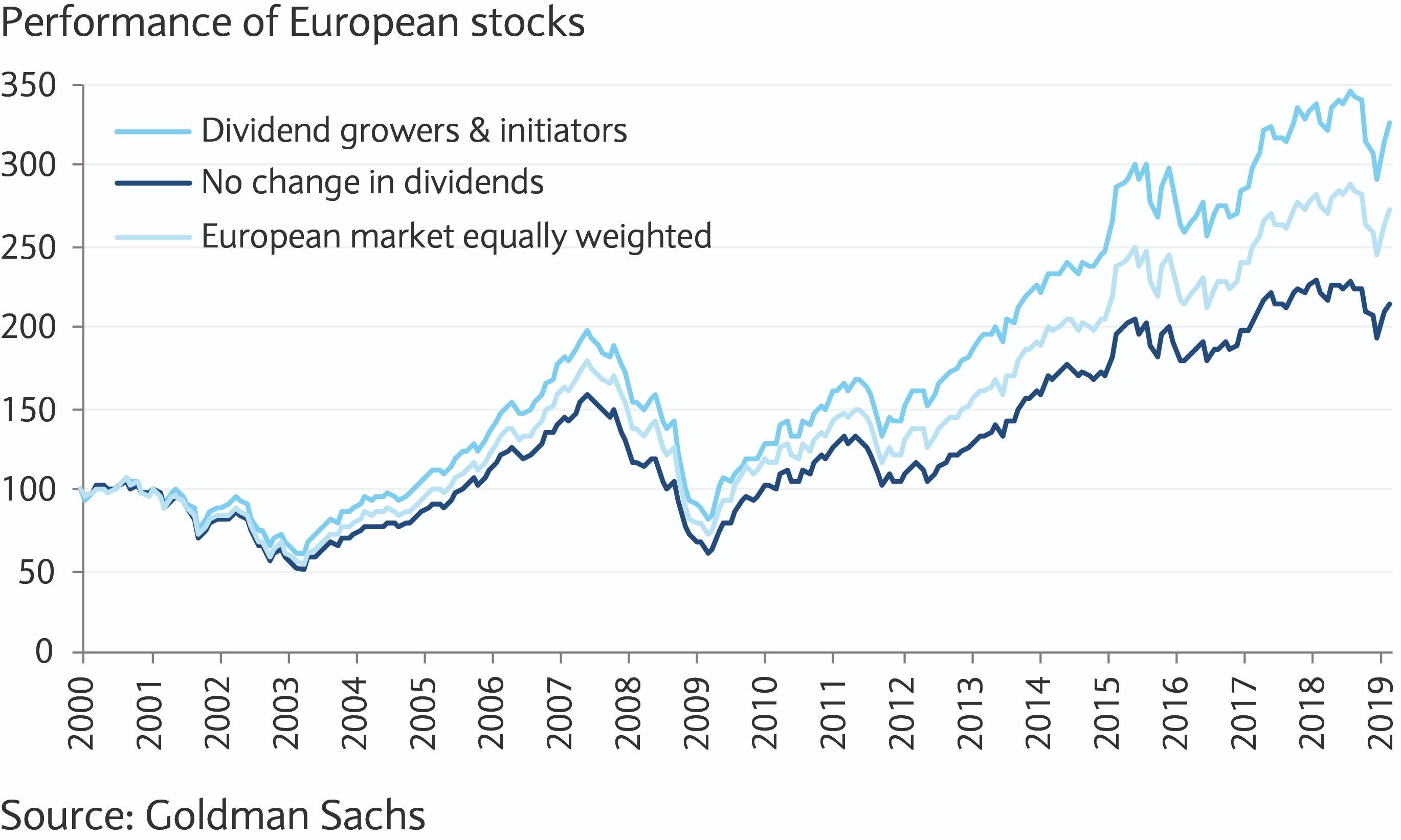

As such, instead of looking at current yields, we believe that focusing on a company’s willingness and ability to grow its dividend over time can be more rewarding. In Europe, for example, dividend growers have outperformed consistently.

At the sector level, this suggests avoiding traditional bond proxies such as regulated utilities or low-growth telecoms and seeking dividend growers across industrials or healthcare where the long-term potential appears more supportive. We also believe that if yield is a primary objective, option strategies can offer a way to mitigate downside risk while benefiting from a more predictable income stream through premiums or coupons.

Find out our latest key investment themes. And with volatility set to stay elevated in 2019, can markets head higher still this year?

Barclays Private Bank provides discretionary and advisory investment services, investments to help plan your wealth and for professionals, access to market.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modelling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modelling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.