Mid-Year Outlook 2023

Explore our “Mid-Year Outlook”, the investment strategy update from Barclays Private Bank.

Macro - Global

12 June 2023

By Henk Potts, London UK, Market Strategist EMEA

Please note: All data referenced in this article is sourced from Bloomberg unless otherwise stated, and is accurate at the time of publishing.

Coming into 2023, it looked like being another very challenging year for the global economy, against the backdrop of heightened geopolitical tensions, the impact of elevated inflation levels on consumption and the tightening of financial conditions. The potential for an escalation of the war in Ukraine, concerns over China’s intentions towards Taiwan and the intensification of the trade wars, were further risks faced by the economy.

Whilst many of these issues remain relevant, the political backdrop has been more stable than predicted and economic activity has been far more resilient than anticipated. Consumer spending has been supported by dynamic labour markets, healthy balance sheets and excess savings. The service sector has continued to recover from the depths of the COVID-19 pandemic and the reopening of China’s economy has boosted domestic demand and eased global supply constraints.

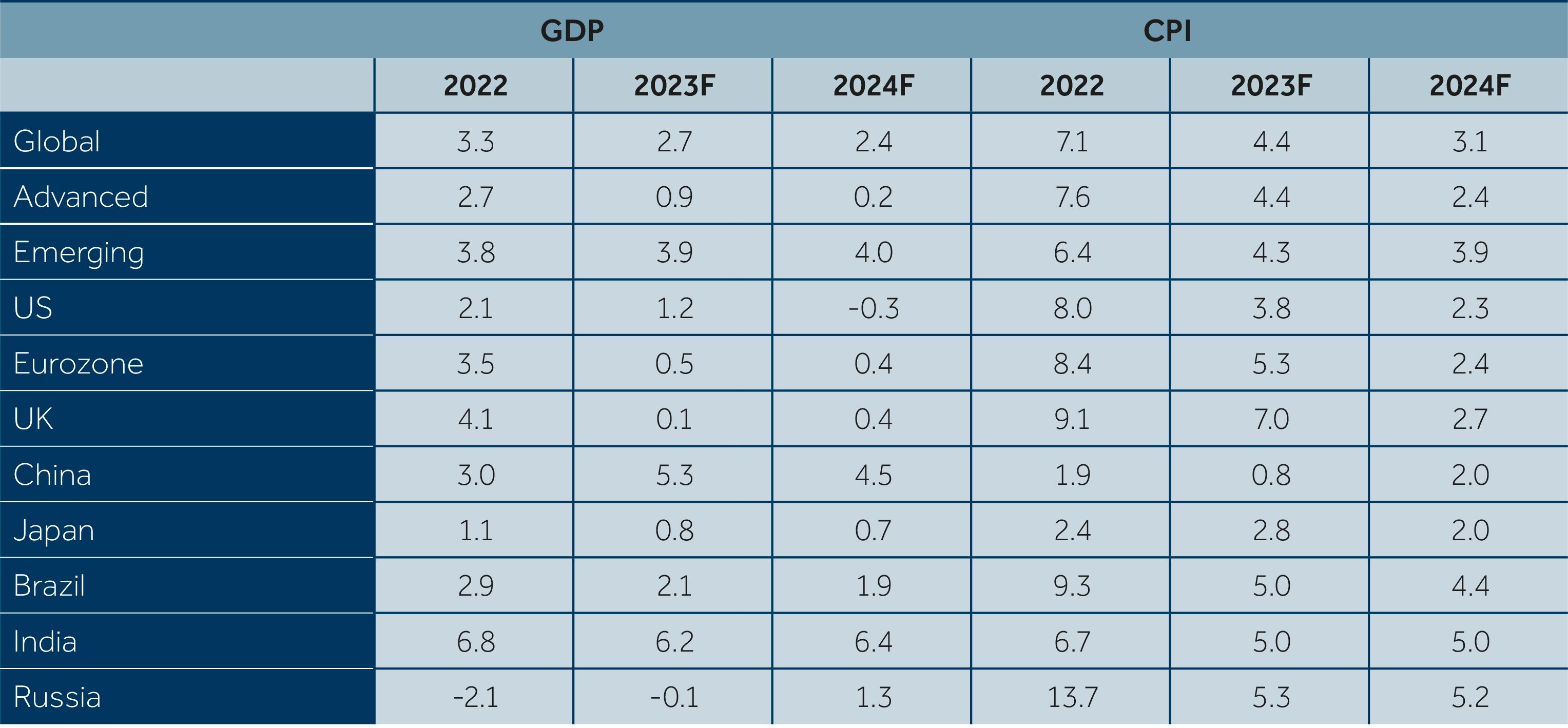

Despite the recent resilience, there remains much uncertainty around economic prospects. With a shallow recession anticipated in the UK and US, it will be difficult for advanced economies to generate meaningful growth over the next couple of years. As such, advanced economies are forecast to grow at 0.9% this year, and only 0.2% in 2024 (see table).

Source: Barclays Investment Bank, Barclays Private Bank, June 2023

At a global level, the real gross domestic product (GDP) growth forecast for this year has been lifted to 2.7%, from January’s 2.4% projection, supported by the recovery in China and India’s strong growth profile. Consequently, China is forecast to grow by 5.3% this year, with India expected to be the fastest growing major economy, hitting 6.2% for 2023.

At the start of the year, the inflation trajectory looked like being a key driver for economic activity, sentiment and interest rates. Whilst price pressures have moderated, they have eased at a disappointingly slow rate. The impact of higher food prices, elevated energy prices and stronger wage growth has kept inflation above what had been anticipated at the start of the year.

Nevertheless, peak price pressures seem to be past in major economies and are expected to ease towards the central bank target levels over the next 12-18 months.

Base effects are starting to impact year-on-year inflation calculations and government fiscal support is helping to partly offset the impact of higher energy bills. Higher levels of inventory, a relaxation of economic restrictions and an increase in capacity have already led to a material weakening of goods inflation.

Higher interest rates will slow demand, and labour market supply and demand dynamics are also beginning to improve. Participation rates are slowly normalising, which is helping to take some of the heat out of wage rises, although European negotiated salaries still pose some upside risk.

Weaker commodity prices are also adding to downward price pressures. As such, global consumer prices are forecast to average 3.7% in the third quarter (Q3) of this year, 3.4% in Q4 and 3.0% in 2024, much better than the 7.1% surge seen in 2022.

The slower-than-expected easing in inflation, surprising strength of the labour market and resilient economic activity, have kept the pressure up on central bankers. As a result, the peaks in interest rates have been much higher than had been anticipated in January.

The hiking cycle is expected to last into the second half of this year, with further increases likely from the US Federal Reserve, Bank of England and the European Central Bank. That said, a pivot to an easing stance appears to be on the cards in 2024, with interest rate cuts skewed towards the latter half of the year.

One recent economic threat, that had appeared remote at the start of 2023, was a banking crisis. The wave of uncertainty sparked by concerns over the mid-tier US banks, and demise of Credit Suisse in March, brought back distressing memories of the global financial crisis (GFC) fifteen years ago. The latest turbulence, however, was more a crisis of confidence and lack of liquidity than more serious, broad-based concerns over asset quality.

History is littered with runs on banks, although the digital age means that the speed and intensity of withdrawals can be far more aggressive than seen in the past.

Despite the dangers of bank runs, policymakers and regulators possess extensive toolkits to help contain and isolate risks. On this occasion, officials used their widespread powers to guarantee deposits, provide liquidity and orchestrate takeovers. Although these solutions are far from perfect, they are considerably better than the disorderly failures and nationalisations that were seen during the GFC.

The economic ramifications of the financial sector turmoil are still coming to light. That said, bank lending standards have already been tightened and regulators are likely to up capital and liquidity provisions, which could hit loan growth. Confidence levels are also vulnerable to a banking shock, however, surveys so far suggest that the influence on both business and consumer sentiment appears to be manageable.

Fears emanating from the banking crisis, coupled with higher interest rates, could develop into a more serious credit crunch. This has added to the risk of a harder economic landing than is currently being projected. If financial conditions tightened dramatically, this could affect the path of monetary policy.

Most importantly, a re-run of the GFC seems unlikely at this stage. Capital levels are much higher than in 2008. Liquidity is much healthier and leverage levels have been radically reduced. Systemically important banks are subject to far more stringent stress tests when compared to the past.

That’s not to say that further pressures on the system will not occur, but the risk of a failure of the financial system undermining the health of the global economy has been structurally reduced.

The bipartisan suspension of the debt ceiling until 1 January 2025 significantly reduces concerns the country would default on its debt for the first time, an outcome that could have been both calamitous for the domestic economy and the global financial system.

Under the deal, which lasts beyond the next presidential election, federal spending on defence and domestic programmes will be capped for two years. The Congressional Budget Office said the legislation would result in $1.5 trillion of savings over the next decade1. This minor fiscal contraction is expected to have only a marginal impact on growth and anticipated US rate path. Accounting for a 0.1 percentage point trim to anticipated growth for 2023 and 2024.

After the turmoil of muti-decade high inflation and the steepest hiking cycle since the 1980s, policymakers will assess the impact of easing price pressures, rate moves and the extent of the slowdown on the economy.

Consumer activity in most advanced economies is likely to be depressed over the rest of the year as disposable incomes are further squeezed, saving rates rise and the tailwind from additional pandemic savings fades.

Business investment, and confidence, are expected to remain constrained by heightened economic uncertainty, rising wages and higher borrowing costs. Meanwhile, government spending is anticipated to be inhibited by high debt levels and limited fiscal headroom.

The recovery in emerging markets should help to partially offset the weakness in advanced economies, as they continue to benefit from pent-up demand, improving industrial production levels and strong secular growth. That said, weaker external demand and trade conflicts could slow growth prospects.

Turning to prospects for next year, GDP growth is anticipated to remain below trend, with the world economy predicted to expand by just 2.4%. The good news is that easing inflationary pressures and interest rate cuts should help to stabilise sentiment and allow activity to gradually improve in 2024.

Explore our “Mid-Year Outlook”, the investment strategy update from Barclays Private Bank.