Managed futures: Portfolio diversifier?

22 February 2023

By Lukas Gehrig, Zurich Switzerland, Quantitative Strategist; Nikola Vasiljevic, PhD, Zurich, Switzerland, Head of Quantitative Strategy

Please note: This communication is for our more investment-savvy readers, due to its highly technical nature. Managed futures is a trend-following strategy involving futures contracts, which are not appropriate to most retail investors. Moreover, it is complex to implement and requires high levels of sophistication, market data access as well as robust risk-management tools. This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

Managed futures describe a hedge fund style which employs qualitative or quantitative methods to identify trends in economic variables, and the impact they have on financial markets. They fall under the category of macro hedge funds and are also referred to as Commodity Trading Advisors (CTAs). Contrary to their second name, they are not confined to investments in commodities but trade mostly equity and bond futures.

Managed futures strategies are typically implemented in the futures markets to express views on the continuation of identified trends. The biggest difference to other hedge fund styles, such as relative value strategies, is that managed futures primarily focus on trends, while mostly ignoring valuations.

Thriving with strong trends

One major appeal of managed futures is that they are agnostic to the overall market direction. This makes them a source of – nowadays highly coveted – uncorrelated returns. By following trends – either up or down – the strategy aims to perform as long as the direction of travel is clearly defined.

In markets without a clear direction, trend-following strategies struggle, which leads to the typical “smile” profile for managed futures returns - that is, one with a convex pay-off against broad equity market performance (see chart)1.

Source: Bloomberg, Barclays Private Bank, February 2023. Past performance is not a reliable indicator of future performance

The quest for uncorrelated returns

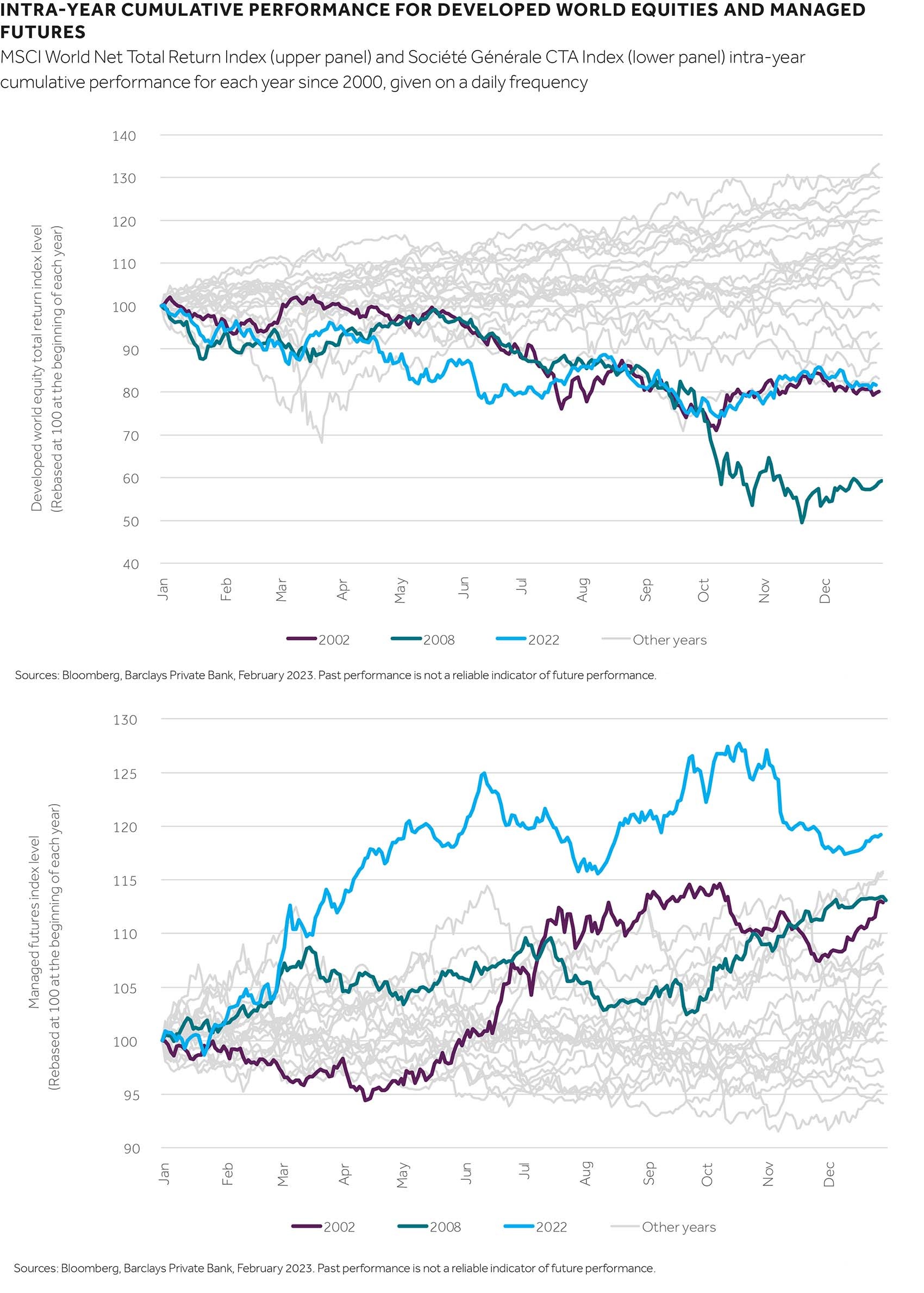

Having portfolio assets with a low correlation to equities is a highly sought-after characteristic these days, given the challenging macroeconomic climate. Historically, managed futures strategies have performed well when stocks have suffered the most (see chart).

By focusing on the last two decades, we can see that managed futures posted double-digit returns during the bursting of the dot-com bubble in 2002, and at the peak of the global financial crisis in 2008. Moreover, their best year-to-date performance was recorded in 2022, in an era characterised by a positive correlation between equities and bonds. As such, managed futures were one of the best performing investment strategies last year. The worst years for managed futures included 2018 or 2011 – periods that were characterised by volatile growth dynamics and relatively weak inflation.

Indeed, this timely example shows that uncorrelated returns could hold the key to successful investing in stressed markets. But what are the ingredients for uncorrelated returns? Two considerations, regarding correlation, can help to understand how trend-following strategies typically aim to add value to a portfolio.

Macro-neutral returns

First, let’s look at the origins of correlations between broad market indices and macro factors. In How to diversify investments whatever the macro weather, we showed how simple macro factors can be built from data on industrial production, inflation, inflation surprises, the fed funds rate, as well as the monetary aggregate M2, which essentially tracks the amount of money circulating in the economy. This allowed us to derive partial correlations between financial market returns and the three main macroeconomic factors – growth, inflation and monetary policy stimulus.

The above approach uncovers the main apparent reason for the highly unusual losses seen in both equities and bonds in 2022 – both asset classes are very negatively associated with the inflation factor. It also highlights that many parts of the investment universe share this weakness to inflation, a link that is obvious when looking at partial correlations. Had standard Pearson’s correlation coefficients been used instead, the fact that inflation is typically accompanied by strong growth would have diluted these findings.

In this sense, managed futures indices offer a unique blend of neutrality to all macro drivers and therefore could add an uncorrelated source of return, in the macro sense.

Non-standard premia harvest

Another approach to understanding the key drivers of correlations is to analyse cross-asset risk premia, which represent the ultimate return sources.

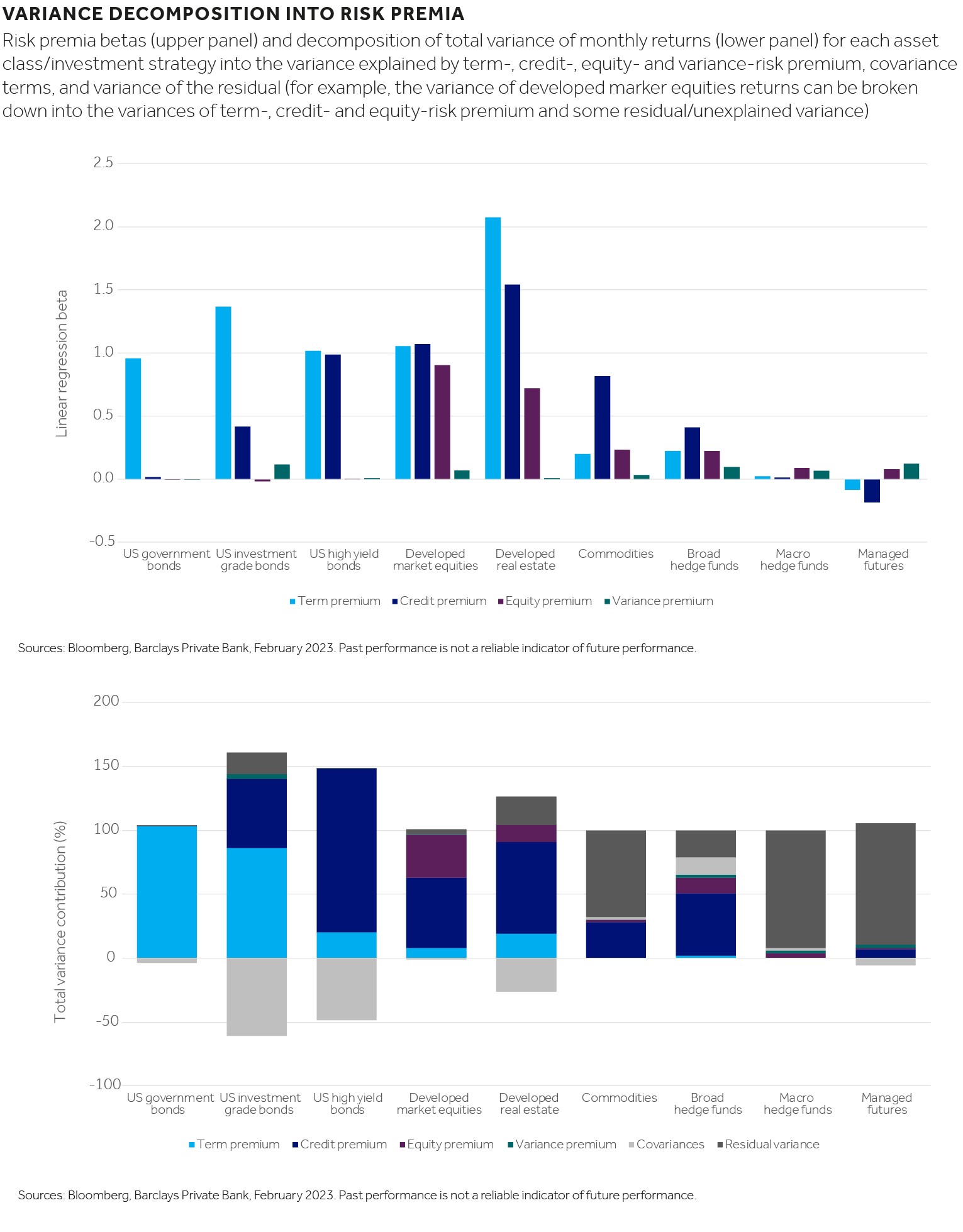

Looking at differences in realised returns between government bonds and cash rates (term premium), high yield bonds and government bonds (credit premium), equities, and high yield bonds (equity premium), and adding the returns of a short volatility strategy on top (variance premium), is a simple way to find the most common risk premia that different investments can collect2.

Regressing the monthly returns of an investment strategy onto these risk premia can help to show the sources of return that make up the performance of an asset. While government bonds are harvesting the term premium exclusively, the typical risk-on asset is collecting a mixture of term premium, credit premium and equity premium (see variance decompositions, in chart).

In our calculations, term premium is based on developed government bonds versus USD cash; for credit premium, US high yield bonds versus US government bonds; for equity premium, US equities versus US high yield bonds, and for variance premium, a short volatility index is used.

Interestingly, the above risk premia regressions can explain the returns of bonds, equities, real estate and even hedge funds very well (model R2 in excess of 0.7). They struggle to explain overall commodity returns and they fail when applied to macro hedge funds and managed futures strategies (model R2 is below 0.1).

This is insightful because it tells us that these strategies harvest returns that are very different to what the more standard asset classes are collecting.

Managed futures in a portfolio context

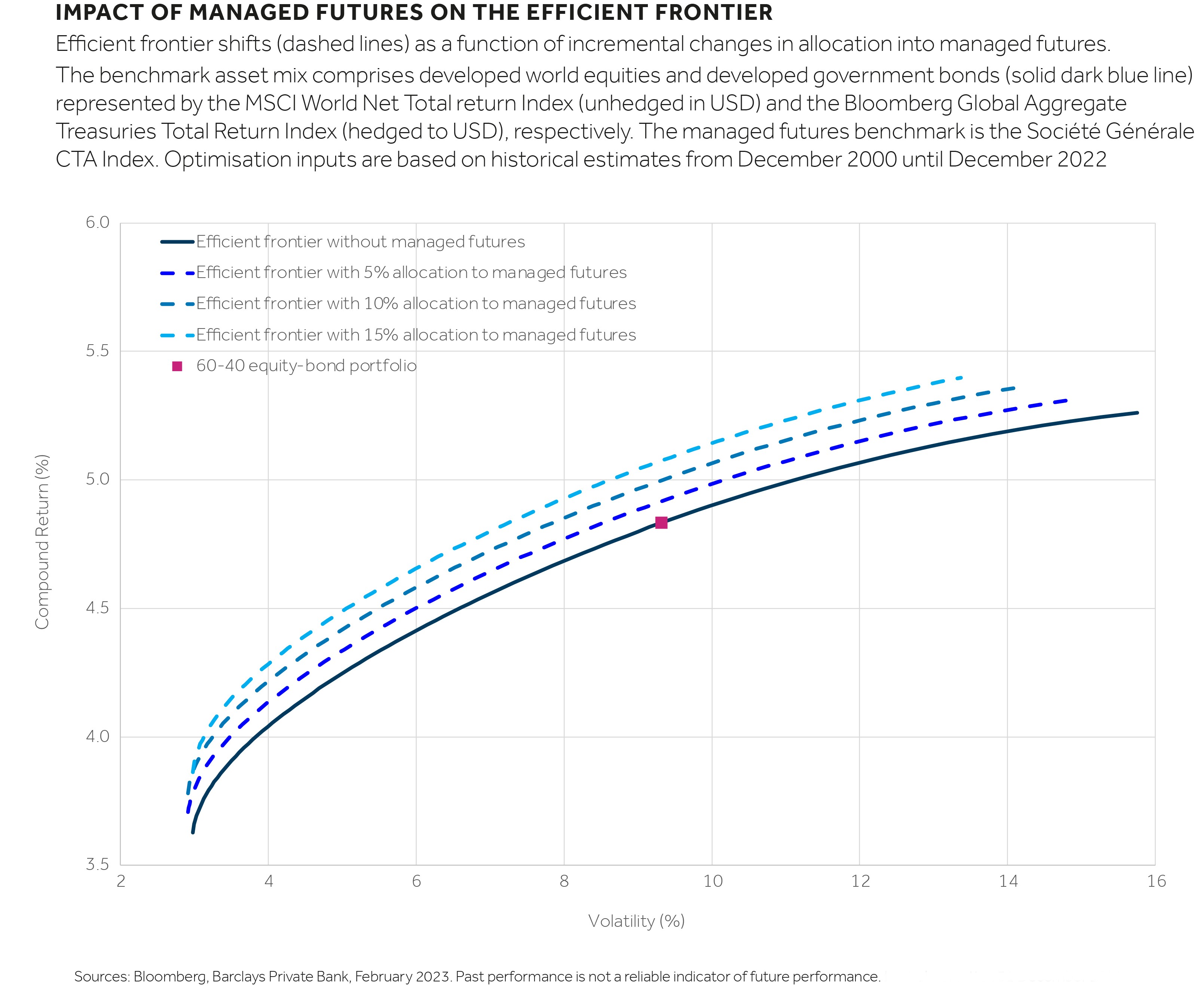

From a portfolio construction perspective, adding such an inherently different source of return can help to produce a portfolio that is expected to lower risk for a given expected return, or “shift the efficient frontier up”, to use financial terminology.

More specifically, adding a managed futures allocation to a traditional equity-bond portfolio can improve portfolio diversification by adding a new source of return. Our findings show that adding a 5% allocation to managed futures, for example, could enhance overall expected returns by around 5-10 basis points (subject to external conditions, and portfolio management strategy, each being conducive).

That said, a diverse source of performance also adds a new source for when portfolio returns hit trouble. Such bad times, for managed futures, are located at the bottom of the smile profile from the first chart. But if an investor can stomach low returns during a period without a clear trend, the benefits of managed futures could be considered from a portfolio construction point of view.

Outperformance from macro-neutral strategies, when all else fails, seems attractive. But, can last year’s outperformance last, or is it too late to allocate to it now?

It depends on your view on growth… and inflation

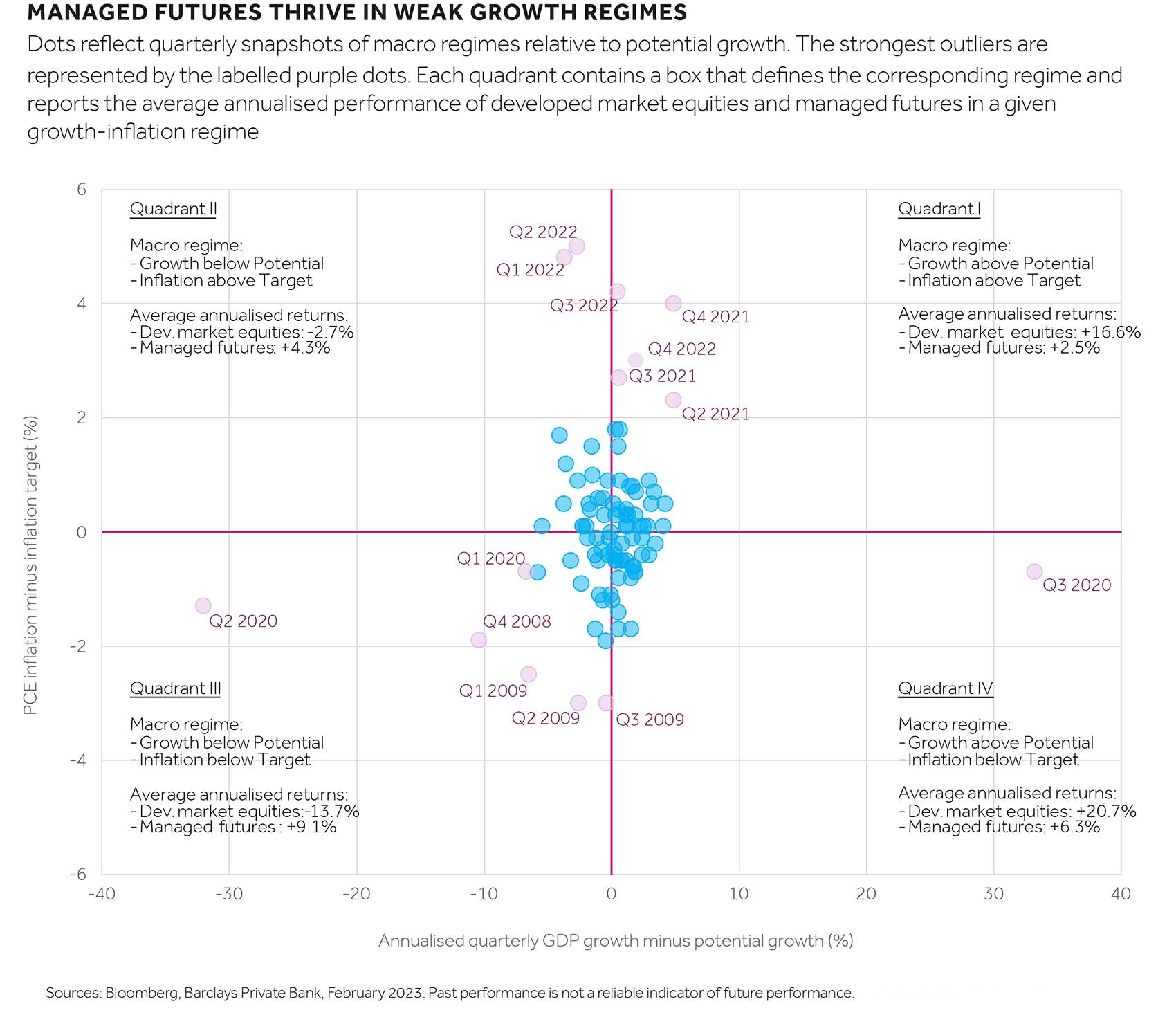

Whether investments into managed futures make sense over the short-to-medium term depends on your expectations for the economy. This can be demonstrated by breaking down the returns of managed futures and developed market equities by macro regimes (see chart).

To establish different macro regimes, we observe whether gross domestic product growth was in excess of the (time-varying) potential growth estimate by the Bloomberg Economics unit, and whether personal consumption expenditure (PCE) inflation was above or below the inflation target set by the US Federal Reserve.

Managed futures returns have been positive across all four macro regimes identified in the chart. This result explains why managed futures are often referred to as “absolute return” strategies.

However, our analysis shows that managed futures typically tend to thrive in weak growth environments, especially relative to developed market equities. Therefore, in an anticipated phase of below-potential growth, managed futures could provide an alternative to a broad equity basket.

That said, continuously strong macro performance and a mild slowdown – as seen in the final quarter of last year, when managed futures returns receded – would be a reason not to invest in managed futures.

What future holds for managed futures?

Our quantitative analysis is purely based on historical data spanning the last 20 years, a time that was marked by solidly anchored inflation expectations. As such, the ongoing de-anchoring of inflation expectations may make the coming decade different from the last two.

Arguably, confidence in the ability of developed market central banks to hit their inflation target is at rock bottom, as is portrayed in recent inflation expectation surveys conducted by the Federal Reserve Bank of Philadelphia, since the inception of the managed futures benchmark we used (the Société Générale CTA Index) in the early 2000s. This may contribute to a phase of elevated volatility in inflation and create a happy hunting ground for trend-following strategies.

This communication:

- Has been prepared by Barclays Private Bank (Barclays) and is provided for information purposes only and is subject to change. It is indicative only and not binding. References to Barclays means any entity within the Barclays Group of companies, where “Barclays Group” means Barclays and its affiliates, subsidiaries and undertakings.

- Is not research nor a product of the Barclays Research department. Any views expressed in this communication may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of this communication and are subject to change. Barclays is not obliged to inform recipients of this communication of any change to such opinions or estimates.

- Is general in nature and does not take into account any specific investment objectives, financial situation or particular needs of any particular person.

- Does not constitute an offer, an invitation or a recommendation to enter into any product or service and does not constitute investment advice, solicitation to buy or sell securities and/or a personal recommendation. Any entry into any product or service requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding documents.

- Is confidential and is for the benefit of the recipient. No part of it may be reproduced, distributed or transmitted without the prior written permission of Barclays.

- Has not been reviewed or approved by any regulatory authority.

- This communication is a marketing communication for the purposes of the relevant conduct of business requirements applicable to the communication.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. This communication is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

Barclays offers private and overseas banking, credit and investment solutions to its clients through Barclays Bank PLC and its subsidiary companies. Barclays Bank PLC is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register No. 122702) and is a member of the London Stock Exchange and Aquis. Registered in England. Registered No. 1026167. Registered Office: 1 Churchill Place, London E14 5HP.

Barclays Bank PLC, Jersey Branch has its principal business address in Jersey at 13 Library Place, St Helier, Jersey and is regulated by the Jersey Financial Services Commission. Barclays Bank PLC, Isle of Man Branch has its principal business address in the Isle of Man at Barclays House, Victoria Street, Douglas, Isle of Man and is licensed by the Isle of Man Financial Services Authority. Barclays Bank PLC, Guernsey Branch has its principal place of business at St Julian’s Court, St Julian’s Avenue, St Peter Port, Guernsey and is licensed by the Guernsey Financial Services Commission under the Banking Supervision (Bailiwick of Guernsey) Law 1994, as amended, and the Protection of Investors (Bailiwick of Guernsey) Law 1987, as amended.

Barclays Bank Ireland PLC, trading as Barclays and as Barclays Private Bank, is regulated by the Central Bank of Ireland. Registered in Ireland. Registered Office: One Molesworth Street, Dublin 2, Ireland, DO2 RF29. Registered Number: 396330. VAT Number: IE4524196D. Calls are recorded in line with our legal and regulatory obligations, and for quality and monitoring purposes.

Barclays Bank (Suisse) SA is a Bank registered in Switzerland and regulated and supervised by FINMA. Registered No. CH660.0.118.986-6. Registered Office: Chemin de Grange-Canal 18-20, P.O. Box 3941, 1211 Geneva 3, Switzerland. Registered branch: Beethovenstrasse 19, P.O. Box, 8027 Zurich. Registered VAT No. CHE106.002.386. Barclays Bank (Suisse) SA is a subsidiary of Barclays Bank PLC.

This document is not intended to disclose all risks related to financial instruments. Therefore, the recipient should consult the specific product documentation and the Swiss Bankers Association (SBA) brochure “Risks Involved in Trading Financial Instruments” available on the SBA website: https://www.swissbanking.org/en/services/library/guidelines

In the Principality of Monaco, Barclays Bank PLC operates through a branch which is duly authorised and falls under the dual supervision of the Monegasque regulator ‘Commission de Contrôle des Activités Financières’ (with regards to investment services) and the French regulator ‘Autorité de Contrôle Prudentiel et de Résolution’ (in respect of banking & credit services and prudential supervision). The registered office of Barclays Bank PLC Monaco branch is located at 31 avenue de La Costa, MC 98000 Monaco – Tel. + 377 93 15 35 35. Barclays Bank PLC Monaco branch is also registered with the Monaco Trade and Industry Registry under No. 68 S 01191. VAT No. FR 40 00002674 9.

Barclays Bank PLC (DIFC Branch) (Registered No. 0060) is regulated by the Dubai Financial Services Authority. Barclays Bank PLC (DIFC Branch) may only undertake the financial services activities that fall within the scope of its existing DFSA licence. Principal place of business: Private Bank, Dubai International Financial Centre, The Gate Village Building No. 10, Level 6, PO Box 506674, Dubai, UAE. This information has been distributed by Barclays Bank PLC (DIFC Branch). Certain products and services are only available to Professional Clients as defined by the DFSA.

Barclays Bank Plc (Incorporated in England and Wales) (Reg. No: 2018/599243/10) is an authorised financial services provider under the Financial Advisory and Intermediary Services Act (FSP 50570) in South Africa and a licensed representative office of a foreign bank under the Banks Act, 1990. Barclays Bank PLC, has its principal place of business in South Africa, at Level 5, Building 3, 11 Alice Lane, Sandton 2196.

Barclays Bank PLC Singapore Branch is a licenced bank in Singapore and is regulated by the Monetary Authority of Singapore. Registered in Singapore. Registered No. S73FC2302A. Registered Office: 10 Marina Boulevard, #25-01, Marina Bay Financial Centre Tower 2, Singapore 018983.

Registered Office in India: 801/808 Ceejay House, Shivsagar Estate, Dr Annie Besant Road, Worli Mumbai 400 018. Barclays Bank Plc is a member of Banking Codes and Standards Board of India.