Central Securities Depository Regulation – Private Bank UK

Central Securities Depository (CSD)

The CSD regulation level 1 text came into force 2014. Note that direct CSD participants are not mandated to offer their clients an Individual Segregated Client Account until the Central Securities Depository is authorised by the national competent authority in the jurisdiction of the CSD.

Central Securities Depositories Regulation (CSDR) factsheet – what is the CSDR?

The CSDR is a European Union regulation that governs how a CSD and its participants operate. A CSD is responsible for custody, control and legal ownership of securities. Barclays Bank Plc is a participant of Clearstream Banking S.A. Luxembourg, an EU-based CSD, and hence must comply with the regulation. As a result, we must offer customers the option to hold their fund investments in an Individual Client Segregated Account at Clearstream Banking S.A., Luxembourg. The current default is to hold client fund investments in an Omnibus Client Segregated Account (also known as a pooled account).

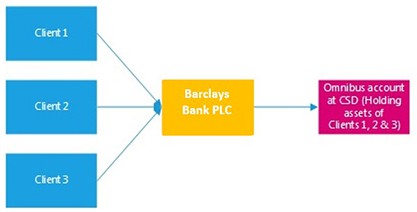

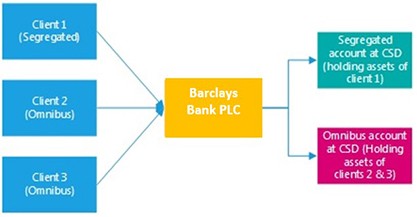

The different types of custody are illustrated below.

Omnibus client segregated account

This account type is used to hold the securities of a number of clients on a pooled basis with client holdings recorded under a single account for a business. As such, each client is normally considered to have a beneficial interest in all of the securities in the relevant account proportionate to its holding of securities. Our books and records constitute evidence of our clients’ beneficial interests in the relevant securities. Client holdings are segregated from the holdings of other Barclays businesses and we do not hold our own proprietary securities in Omnibus Client Segregated Accounts.

Individual client segregated account

This account type is used to hold the securities of a single client and therefore the client’s securities are held separately from the securities of other clients and our own proprietary securities. As such, each client is beneficially entitled to all of the securities held in their account.

What does this mean for you?

You can now request to hold any fund holdings (also known as collective investment schemes or fund securities) that are held with Clearstream Banking S.A., Luxembourg eligible assets, in an Individual Client Segregated Account. There will be no change to the way your investments are managed. You can elect to return to pooled custody at any time. All other asset types you hold (such as shares in specific companies) would remain in an Omnibus Client Segregated Account.

What are the costs?

If you opt to hold your eligible assets in an Individual Client Segregated Account, there will be an additional quarterly fee initially set at £1950 (or currency equivalent) to reflect the additional operational costs of an Individual Client Segregated Account. If you were to leave or join the service part way through a quarter, the fee would be charged on a monthly pro-rata basis. If you opt to hold your eligible assets in an Individual Client Segregated Account, we will advise you on how and when you will be charged any fees.

What are the risks, levels of protection, and legal implications of each custody account type?

The three main areas for consideration when comparing use of an Individual Client Segregated Account against an Omnibus Client Segregated Account are outlined below.

Further details can be found on our website under ‘CSDR’.

| Consideration | Commentary |

|---|---|

| Insolvency |

|

| Shortfalls |

Note: Where a client has insufficient securities held with us to carry out a settlement, we generally have two options: (i) in the case of both an Individual Client Segregated Account and an Omnibus Client Segregated Account, to only carry out the settlement once the client has delivered to us the securities needed to meet the settlement obligation; or Only option (i) is available to an Individual Client Segregated Account, therefore the risk of settlement failure may be higher for an Individual Client Segregated Account, which may in turn incur additional buy-in costs or penalties and/or delay settlement. |

| Security Interests | Securities held in an Individual Client Segregated Account or Omnibus Client Segregated Account could be used if the CSD benefits from a security interest over securities held for a client potentially causing a delay in returning assets to a client or a shortfall. The client asset rules of the UK Financial Conduct Authority (CASS Rules) restrict situations when this can happen. |

Article 38(6) CSDR Disclosure

For full details, download the Article 38(6) Disclosure [PDF, 225KB]