Central Securities Depositories Regulation – BBPLC Jersey Branch

The Central Securities Depositories Regulation (CSDR) level 1 text came into force 2014. Note that direct CSDR participants are not mandated to offer their clients an Individual Segregated Client Account until the Central Securities Depository (CSD) is authorised by the national competent authority in the jurisdiction of the CSD. Clearstream Banking S.A. (Clearstream Luxembourg) CSDs have achieved full CDSR compliance.

What is the CSDR?

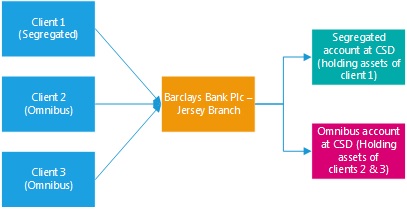

The CSDR is a European Union regulation that governs how the CSD and its participants operate. The aim of CSDR is to improve the functioning and stability of financial markets in the EU by enhancing the legal and operational conditions for cross border settlement. A CSD is responsible for custody, daily reconciliation, control, legal ownership of securities and must maintain the segregation of client assets. Barclays Bank PLC, Jersey Branch is a participant of Clearstream Luxembourg, an EU-based CSD, and hence must comply with CSDR. As a result, we must offer customers the option to continue to hold their investments in their Omnibus Client Segregated Account (also known as the pooled account) already provided or to hold their investments in an Individual Client Segregated Account with Clearstream Luxembourg.

What are the key objectives of CSDR?

- Introduce rules and safeguards in the event of CSD insolvency

- Standardises CSD regulations across all of Europe

- Provides greater transparency and more open access in the market

- Improve settlement timeframes and reduce the number of fails

What are the key CSDR themes?

- The offering of omnibus and segregated accounts in accordance with Article 38(5) of the CSDR

- The requirement to report internalised settlement

- The introduction of the settlement discipline regime

The different types of custody

Individual client segregated account

This account type is used to hold the securities of a single client and therefore the client’s securities are held separately from the securities of other clients and Barclays own proprietary securities. As such, each client is beneficially entitled to all of the securities held in their account.

Omnibus client segregated account

This account type is used to hold the securities of a number of clients on a pooled basis with client holdings recorded under a single account for a business. As such, each client is normally considered to have a beneficial interest in all of the securities in the relevant account proportionate to its holding of securities. Our books and records constitute evidence of our clients’ beneficial interests in the relevant securities. Client holdings are segregated from the holdings of other Barclays businesses and we do not hold our own proprietary securities in Omnibus Client Segregated Accounts.

What does this mean for you?

You can now request to hold any eligible assets, in an Individual Client Segregated Account with Clearstream Luxembourg. There will be no change to the way that you manage your investments. You can elect to return to pooled custody (Omnibus Client Segregated Account) at any time. In accordance with CSDR, the assets that are currently eligible to hold in an Individual Client Segregated Account are Collective Investments (Funds). Collective Investment (Funds) are not eligible for an Omnibus Client Segregated Account. All other asset types (such as shares in specific companies) that you hold can remain in an Omnibus Client Segregated Account.

What are the costs?

In accordance with Article 38(6) of the CSDR we are required publicly disclose the levels of protection and the costs associated with the different level of segregation. If you opt to hold your eligible assets in an Individual Client Segregated Account there will be an additional quarterly fee initially set at £1950 (or currency equivalent) to reflect the additional operational costs of an Individual Client Segregated Account due to its complexity. If you were to leave or join the service part way through a quarter, the fee would be charged on a monthly pro-rata basis. If you opt to hold your eligible assets in an Individual Client Segregated Account, we will advise you on how and when you will be charged any fees.

What are the risks, levels of protection, and legal implications of each custody account type?

The three main areas for consideration when comparing use of an Individual Client Segregated Account against an Omnibus Client Segregated Account are outlined below.

Further details can be found on our home.barclays website under ‘CSDR’.

| Consideration | Commentary |

|---|---|

| Insolvency |

|

| Shortfalls |

Note: Individual Client Segregated Accounts increase the risk of settlement failure which may in turn incur additional buy-in costs or penalties and/or delay settlement. |

| Security Interests | Securities held in an Individual Client Segregated Account or Omnibus Client Segregated Account could be used if the CSD benefits from a security interest over securities held for a client potentially causing a delay in returning assets to a client or a shortfall. The Client Asset Order restricts situations when this can happen. |

Article 38(6) CSDR Disclosure

For details of the Article 38(6) Disclosure, please download the PDF document [PDF, 269KB]

Contact

Please reach out to our dedicated team at CSDRProgramme@barclays.com if you have any questions or would like to discuss specific aspects of the CSDR Settlement Discipline Regime.