US earnings growth expectations too low

Do encouraging first-quarter earnings signal a sustained period of earnings growth for companies?

17 May 2019

Investors look set to remain on alert as markets digest the latest developments in the US-China trade wars, with escalation of protectionism likely to affect macro data.

Given Europe’s large exposure to global trade, markets should turn their attention to May’s consumer confidence readings to gauge potential changes in sentiment in the region. May’s flash purchasing managers’ indexes for the US and the eurozone will likely provide clues on whether renewed trade tensions had a material impact on activity data. April’s readings were soft in both regions with manufacturing’s performance remaining weak and services cooling down.

Following a pick-up in Q1 UK gross domestic product growth, investors will assess whether next week’s UK consumer prices index and retail sales figures support the more hawkish tone adopted by the Bank of England. The central bank revised UK growth upwards earlier in the month despite the Brexit uncertainty.

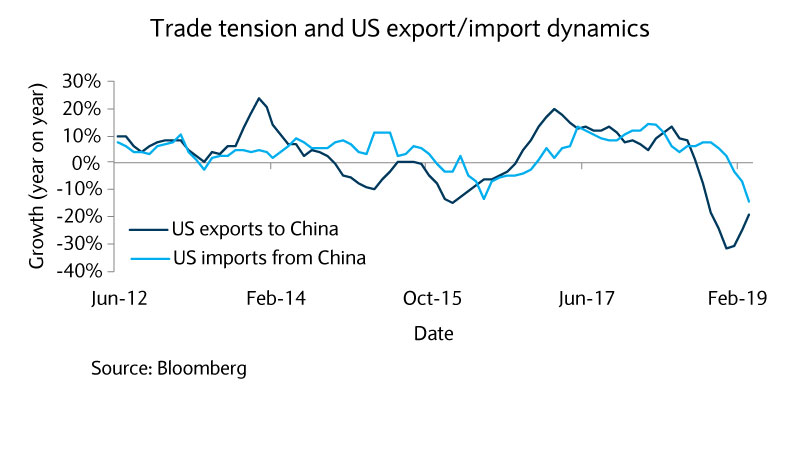

Although the US was the first to pull the trigger on trade tariffs in the trade tensions between America and China, the US suffered initially more than China. Indeed, US exports to China collapsed by more than 30% in the final quarter of 2018 compared to the previous year. The impact was much bigger than what a typical economic slowdown would usually trigger.

During the China economic slowdown at the end of 2015 and early 2016, US exports to the country “only” fell by 15% compared to the previous year. While the US relied on tariffs to improve its trade balance with China, the more centralised Chinese economy led to an initial stronger fall from US exports to China than US imports from China. In fact, imports from China continued to grow year over year until the end of 2018.

But since the beginning of the year, this dynamic has changed. US imports from China have continued to fall year over year while US exports to China have been improving, though the growth rate remains negative compared to a year ago. It looks likely that the bilateral deficit, which has continued to increase until March 2019 to reach more than $400 billion, is about to roll over.

Do encouraging first-quarter earnings signal a sustained period of earnings growth for companies?

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.