Investors can win the trade war

Is the recent sell-off inspired by rising trade tensions between the US and China a time to enter the market?

10 May 2019

May continues to be an eventful month for markets as US President Donald Trump raises trade tensions with China.

Investors should monitor Chinese data for any signs of improvement which could lift investor sentiment following Trump’s threat to increase tariffs on Chinese imports.

Next week we will look carefully at April’s industrial production and retail sales numbers to gauge the strength of the Chinese economy following seasonal softness that weighed on the purchasing managers’ index.

In the US, investors were pleased to see better than expected Q1 gross domestic product (GDP) growth. However, keep an eye on April’s industrial production and retail sales data to assess the health of the US economy further.

With Q1 GDP growth in the eurozone surprising to the upside, we await Q1 German GDP growth, April inflation data and March industrial production numbers for more signs of a better macroeconomic picture in the region.

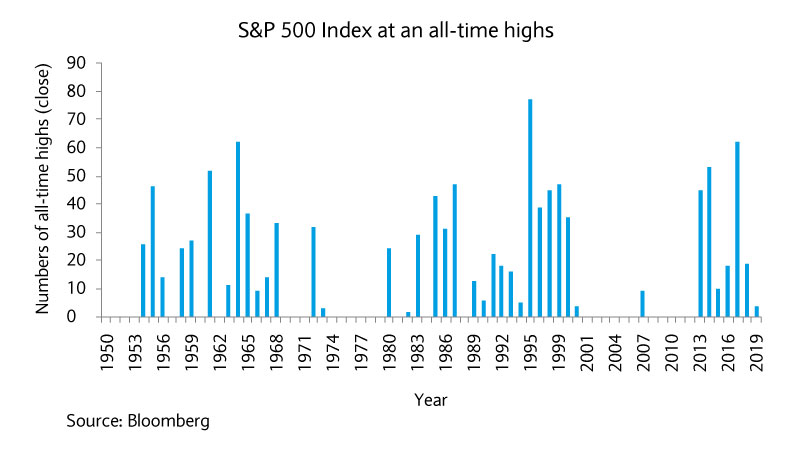

As sensational as they may sound, all-time highs for the S&P 500 Index come along quite frequently. In addition to the three we’ve had so far this year, more than 1,100 were recorded over the past 70 years. Put differently 6% of all trading days in this period were record-breaking day.

After all, unlike currencies for example, stocks are not a mean-reverting asset. They should continue to appreciate as long as earnings are growing which should be the case as long as wealth is being created around the world.

This is the main reason why we believe that staying invested in equity markets is the key to long-term performance. Of course, short-term traders may be keen to “wait for a pullback” and portfolios may need fine-tuning along the way. But for long-term investors, timing isn’t as crucial as acting, even at an all-time high.

Is the recent sell-off inspired by rising trade tensions between the US and China a time to enter the market?

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.