Ageing population: silver spending opportunities

Which travel and leisure sectors can profit most from strong anticipated growth among the over 50s?

12 July 2019

4 minute read

News will pick up pace next week on the micro side with the start of the second-quarter earnings season. But key macro data remain on investors’ watch list.

Chinese second-quarter gross domestic product and June’s industrial output and retail sales data are all out next week. Despite the G20 truce in June, headwinds to the Chinese economy persist as already levied tariffs remained in place. The data will show how much those are weighing on manufacturing activity and supply chains.

The US economy continued to show resilience after solid June payrolls. But downside risks could be exacerbated by weak business activity from June’s industrial production readings. June retail sales will indicate consumer strength, after rising in May. The housing market shows signs of cooling but June’s housing starts should stabilise amid lower borrowing costs.

The eurozone has a lighter schedule ahead. Germany’s July ZEW Economic Sentiment will be closely monitored for signs of lingering woes in Europe’s largest economy. June’s final harmonised indices of consumer prices for the region is expected to stay low at 1.2%, adding to pressure for a European Central Bank rate cut despite the steady increase in services prices.

Similar services inflation dynamics persist in the UK, where investors await consumer price inflation for June after it declined in May due to lower energy prices. June’s UK retail sales and UK labour market data for May are also on the radar. The International Labour Organization unemployment rate and average weekly earnings growth will likely disappoint after holding up in April. Most second-quarter data in the UK will be weak, as companies anticipated a Brexit at the end of March and brought forward activity to avoid any short-term disruption.

As investors look to avoid trade tensions and sanctions coming across the Atlantic, there is little harmony in a divided, Brexit impacted, UK. This stems from the likelihood of Boris Johnson taking the helm at 10 Downing Street in a few weeks. He plans to leave the EU on 31 October “come what may”.

The betting market is priced for a close to 30% chance of a no-deal Brexit and cannot even take solace from the other leadership candidate, Jeremy Hunt, who is increasingly following the same rhetoric.

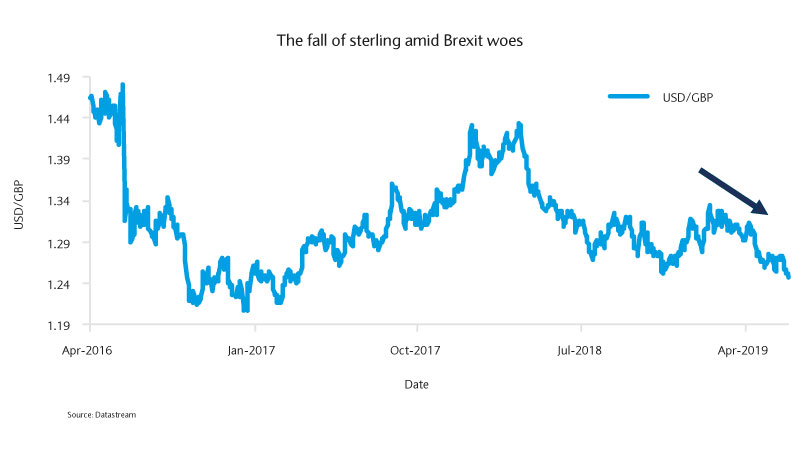

The result has been painful for sterling. The currency fell as much as 40 basis points on 9 July to 1.246 against the US dollar – the currency’s lowest point since April 2017. The prospect of a Bank of England rate cut in the event of a no-deal or deteriorating economic conditions provides even less support for sterling.

The Brexit uncertainty has already made its mark, with second-quarter output expected to contract. A no-deal departure from the EU, according to rating agency Moody’s, would spark a UK recession and not be the best outcome for the EU. For these reasons, we believe a resolution to the Brexit standoff is likely by the end of 2019.

Investors can expect volatility in sterling over most of 2019 and positioning should be managed accordingly to withstand it. Heightened volatility would have implications for equity markets. Although a weak sterling should benefit UK-listed multinationals with substantial overseas revenues, that report earnings in the home currency, we believe investors should remain selective in their UK equity exposure.

Which travel and leisure sectors can profit most from strong anticipated growth among the over 50s?

How much will trade tensions and slowing growth hit US earning?

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.