Are prospects bright for Asian equities?

With US-Chinese trade tensions, how bright are the prospects for Asian equities?

19 July 2019

4 minute read

Markets are braced for a busy week ahead as more second-quarter (Q2) gross domestic product (GDP) and corporate earnings numbers are published. That said, the main economic news will be concentrated in select geographies.

In the US, the key figure to look for is the Q2 GDP advance reading. The reading is going to show a slowdown from the previous quarter number. Nonetheless, it will confirm that the US economy is still resilient despite reaching a record 10-year expansion earlier this month.

While backward looking, GDP data will give an important signal on the health of the US economy ahead of July’s US Federal Reserve policy meeting and in anticipation of a new round of US-China trade talks. The IHS Markit flash purchasing managers’ index (PMI) readings for July are also out next week, providing the market with a more timely indication on the health of the manufacturing part of the economy.

Expectations are that the recent contraction in manufacturing activity will come to a halt and services will stay resilient. Investors will also scrutinise June’s existing and new home sales data to assess the state of the housing sector.

In the eurozone, the European Central Bank meeting scheduled for 25 July is the main event in the spotlight. The central bank remains ready to ease policy after citing “heightened uncertainty” in the region, with markets pricing-in a possible deposit rate cut as early as this month. Investors will closely monitor July’s flash consumer confidence index and IHS Markit’s flash PMIs after May’s industrial production came out better than anticipated. That said, we forecast activity to remain muted although services should continue to look healthier than manufacturing.

We expect a quiet week in China and the UK with no major economic events scheduled. On the political front, we impatiently await the result of the Conservative Party leadership race on 22 July, which will see Boris Johnson or Jeremy Hunt emerge as Britain’s next prime minister.

This week’s second-quarter Chinese gross domestic product data showed retail sales growing at 9.8% year on year (yoy). The figure comfortably beat expectations, accelerating from the 8.6% yoy growth registered in June (although these figures were partly boosted by rising auto sales ahead of new environmental tariffs coming into force).

Historically we have thought of China as an arena for state investment and a manufacturing powerhouse. However, increasingly China is transitioning into a domestic consumption-led economy. In turn, the country’s retail sales trends are becoming ever more important to global growth prospects and market sentiment.

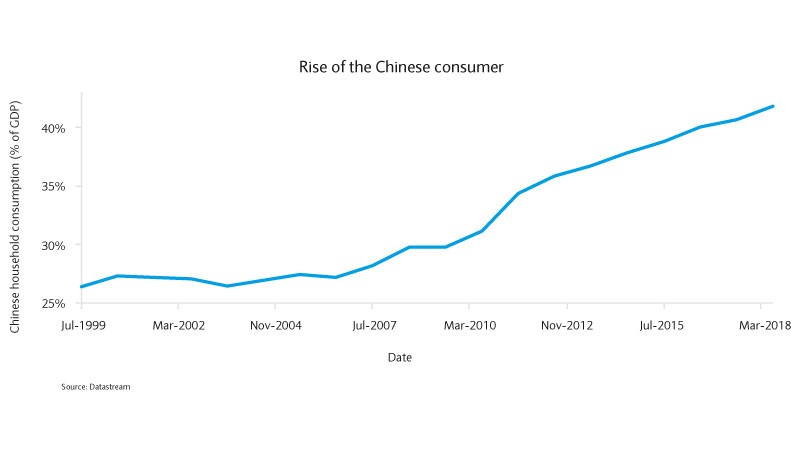

Chinese household spending power has risen rapidly over the past two decades as average wages have surged and its middle class continues to rapidly expand. (The World Economic Forum estimates China’s middle class will be 65% of all households by 2027). Domestic household consumption as a proportion of gross domestic product has risen from 26% twenty years ago to 42% today. Improving product supply chains, rapid digitalisation and rising urbanisation are also likely to support domestic demand in the future.

China is already the world’s largest market for cars, computers and mobile phones, the country boasting 1.4bn mobile subscribers. Furthermore, Chinese consumer spending on products and services shot up to $4.7tn in 2017, from £.3.2tn in 2012, according to the National Bureau of Statistics.

A range of international brands are already profiting from Chinese consumers’ rising demand for products and services, most notably in the luxury goods sector. Research shows that one in three of all luxury purchases around the world are made by a Chinese consumer. Lower price differentials with other countries, a reduction in import taxes and crackdown on unofficial suppliers have also helped to drive mainland China’s designer goods sales.

With US-Chinese trade tensions, how bright are the prospects for Asian equities?

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.