Markets Weekly

06 December 2019

5 minute read

Week ahead

The outcome of next Thursday’s UK general election will be a key talking point for markets near the end of next week, with a Conservative Party majority largely priced in financial markets.

On the data front, UK October gross domestic product is out on Tuesday. After avoiding a “technical recession” in the three months to September (Q3), but seeing the weakest year-on-year growth rate since 2010, the data will give the first insight into whether activity firmed in the early stages of Q4 or continue to remain vulnerable as a result of entrenched uncertainty. If leading indicators are to be believed, the latter is likely to be the case.

The US Federal Reserve’s (Fed) meeting on Wednesday should indicate whether a “mid-cycle adjustment” has now occurred. The minutes of the Fed’s October meeting appear to suggest that after three rate cuts this year, the rate-setting Federal Open Market Committee believes that the US economy is in a “good shape”. The day after is Christine Lagarde’s first meeting as the European Central Bank president. While further monetary stimulus may be on the cards in 2020, the market is not pricing in a change in the deposit rate.

Wednesday also sees eurozone industrial production data for October published. With market optimism over a “bottoming-out” of weak economic activity, this should indicate whether Europe’s lacklustre manufacturing and industrial production is starting to see a change in fortunes.

Ending the week in the US is November retail sales data. According to web analytics tool Adobe Analytics, US online shoppers spent $7.4bn on 29 November, Black Friday, up by 19.6% from last year. This would likely aid the monthly retail sales reading, after a prior month-on-month reading of 0.3%.

Chart of the week

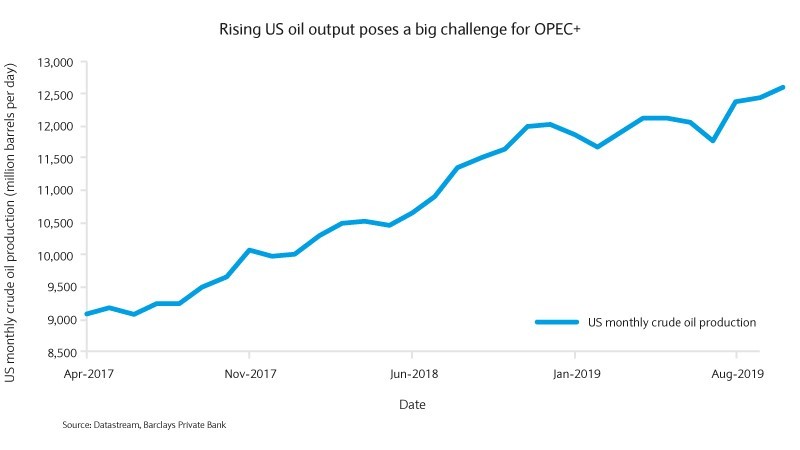

OPEC+’s dilemma

Looking into next year, markets will undoubtedly be focused on whether the Organization of the Petroleum Exporting Countries and allied producers (known as OPEC+) decide to extend cuts in oil production targets or not.

OPEC makes up a significant share of total production. Total daily production of oil, as of 4 September, was 82.5 million barrels per day (mbpd), with OPEC members producing 31.8mbpd and Russia 10.9mbpd.

OPEC+ lowered output by 1.2 mbpd earlier in 2019, with the agreement due to end in March 2020. Combined with geopolitical instability in Venezuela and Libya, tensions in the Middle East and US sanctions on Iran, the production cuts have reduced the supply of oil and been positive for the price of the commodity.

However, the upward pressure on oil prices has been offset by weakening global demand as the US-China trade dispute hits global growth prospects and non-OPEC supply of the commodity rises.

The US has significantly increased oil production over the past decade, becoming one of the largest producers globally and a net exporter, as opposed to net importer, of oil. Relative to the 82.5mbpd produced globally, the US accounted for 12.4mbpd of this.

Besides the US, supply growth from Brazil and Canada further increased aggregate supply in the non-OPEC+ world, which is now anticipated to be 1.7mbpd in 2020.

The fundamentals for oil suggests an imbalance in the market through 2020. Not only have non-OPEC+ countries (particularly the US) increased supply, but elevated trade tensions are doing little to provide upside support to oil prices.

OPEC+ members face a difficult decision in terms of making production cuts past March or not. While a continuation of the 1.2mbpd cut evidenced in 2019 seems likely, there is a possibility that further production is lowered in an effort to counter the downside pressures oil prices are facing. Such a move could increase the potential for an imbalance.

Previous editions of Markets Weekly

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.