Can US earnings support equities?

Can second-quarter US earnings support American equities in the face of worsening sentiment?

09 August 2019

4 minute read

Markets are keeping their hopes up for positive macro readings next week, after sentiment soured following the recent worsening in trade relations.

In the US, July’s consumer price index (CPI) will be a key metric to watch. Subdued inflation could increase the prospect of further US rate cuts this year. Investors will also find out whether July’s retail sales and industrial production benefited from the temporary trade truce reached at the G20 meeting of world leaders. The August Philadelphia Fed manufacturing index and the preliminary University of Michigan consumer sentiment index will provide a further indication of the health of the economy following the latest escalation in trade tensions.

In China, M2 money growth should remain steady as the country maintains its stimulus measures to support economic growth. Markets will assess whether industrial production and retail sales continued their upward trend in July after recovering in June as they shrugged off geopolitical tensions.

Economic reporting in the eurozone will be quiet next week. The second Q2 gross domestic product estimate is expected to be in line with preliminary readings of just 1.1% growth, reflecting ongoing economic weakness in the region. June’s industrial production data should soften after rebounding in May, in line with weak manufacturing activity.

In the UK, July’s CPI inflation rate is likely to remain around target level as declining energy prices offset a weaker pound. Despite signs of a slowing economy and heightened fears of a no-deal Brexit, June’s International Labour Organization unemployment rate will likely stay at multi-decade lows while July’s retail sales should continue to benefit from upbeat consumer confidence.

Over the past few weeks, the macro landscape has not been what equity markets were looking for. While the US Federal Reserve delivered on a rate cut, the hawkish tilt in its communication was unwelcome.

This was compounded by escalating protectionism fears worldwide. President Trump threatened tariffs on $300bn of Chinese goods and Japan and South Korea revived their trade disputes. To complete the gloomy picture, the increasing probability of a no-deal Brexit and global tensions such as India’s decision to revoke Kashmir’s autonomy sent markets on aggregate into “risk-off” mode.

The worsening sentiment had sent the MSCI World index 5.71% off its 24 July peak by the 5th of August before a slight recovery over the subsequent three days.

The sell-off has investors questioning whether there is worse to come. However, it is worth putting the drawdown into perspective.

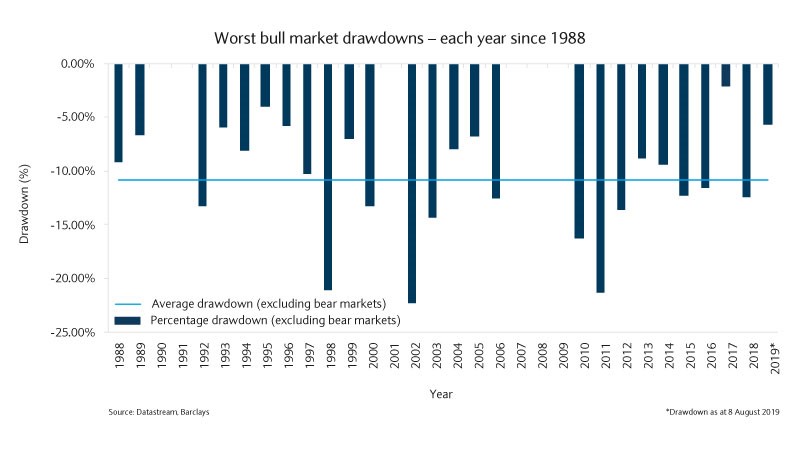

Taking into consideration the worst annual drawdown every year since 1988 (excluding years when there were recessions or bear markets), the average drawdown (the fall from the peak to the trough) in the MSCI World index has been 10.8%, and the median was 10.2%. Furthermore, 13 of the last 26 years had an average drawdown greater than 10%.

Should the current drawdown end up being less than 5.95%, it would be the third smallest in 26 years of a bull market. For the moment, while caution is advised, it is too early to start ringing recession alarm bells.

Can second-quarter US earnings support American equities in the face of worsening sentiment?

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.