What next for planet sub–zero bond yields?

Where should one invest in a world of negative yields? Our experts discuss the need for multi-asset portfolios that can withstand short-term volatility.

16 August 2019

4 minute read

After a particularly volatile couple of weeks for financial markets, little data is expected in the week ahead as second-quarter earnings season comes to an end.

Most macro news will come from the eurozone, with July’s harmonised index of consumer prices data likely to remain subdued after July’s core inflation came in weaker than forecast. This should keep the European Central Bank in dovish mode and we expect the central bank to provide additional monetary stimulus at its September meeting. August’s flash consumer confidence index will show how much sentiment has changed since the index improved in July, underpinned by a buoyant labour market and growth in real wages.

August’s IHS Markit flash purchasing managers’ index, for both the eurozone and the US, is likely to confirm that services activity continues to support growth while manufacturing acts as a significant drag amid mounting protectionism.

In the US, we await July’s existing and new home sales to assess the resilience of the housing sector. In light of recent rate cuts and trade tensions, the market will focus on comments made at the annual central banker bash at the Jackson Hole Annual Economic Symposium on 22 August. This is a key date to watch for hints on the outlook of the US economy and monetary policy.

In the UK, Brexit headlines keep weighing on expectations for the UK economy and we expect this to feed through to August’s CBI industrial trends survey as manufacturing activity continues to disappoint.

The US Federal Reserve’s (Fed) first cut since the financial crisis on 31 July appears to have shifted global central bank policy with it. The “mid-cycle cut” has seen emerging markets follow suit, with Brazil, Turkey, Russia, India, and Thailand delivering larger-than-expected rate cuts since.

In developed markets, New Zealand surprisingly cut interest rates and the European Central Bank is likely to lower interest rates at its September meeting. Indeed, the Fed may cut rates in the same month. Should a no-deal Brexit occur (as seems increasingly probable), the Bank of England (BOE) could also ease monetary policy soon.

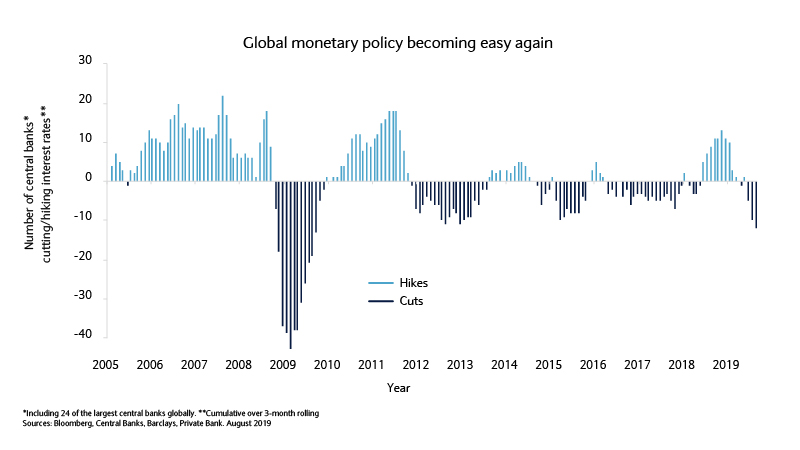

The chart looks at 24 of the largest central banks globally. Over a rolling three-month period, the number of central banks cutting rates in relation to those taking no action/hiking is noticeable.

Interestingly, the recent number of global central banks’ actions has pushed monetary policy to more accommodative levels than in the 2012-2013 period, when the euro area endured a recession, or when concerns around a possible “hard landing” in China emerged in 2016-2017.

In the current environment, yields will likely remain depressed, anchored down by easy monetary policy. As such, the search for yield” is set to continue and we believe that strategies aimed at enhancing income generation will remain attractive to investors.

Where should one invest in a world of negative yields? Our experts discuss the need for multi-asset portfolios that can withstand short-term volatility.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.