Oil: taking the plunge

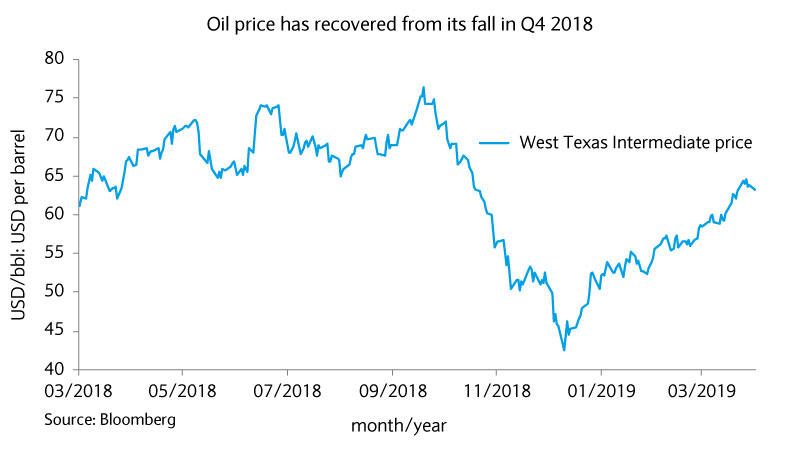

After spiralling by 45% in Q4 last year, oil prices have rebounded close to 50% from their lows, according to West Texas Intermediate figures.

18 April 2019

There’s no rest for investors: despite the Easter holiday, next week promises a shower of new data, both at the macro and micro level.

On the economic side, we look forward to a clearer view of the US housing market, with new home sales and mortgage applications numbers being announced for March and April respectively.

Last month’s weak mortgage application figures contrasted with a consistently positive surprise in new home sales over the last quarter.

The first estimate for the US’ Q1 GDP will be announced on Friday, alongside the latest personal consumption expenditure (PCE) figure - the Fed’s preferred measure for inflation.

Europe’s key releases will be consumer confidence on Tuesday and the German IFO on Wednesday – the most closely-watched economic leading indicator in Germany. We wait eagerly for the latter as we look for confirmation of the nascent recovery that was spotted last month.

On the micro side, next week is the busiest of this reporting season in the US.

More than a third of the S&P500 companies, by market cap, will report their quarterly earnings. We still believe that earnings surprises will be good enough to bolster earnings growth into positive territory from the currently expected small decline.

In Europe, the reporting also starts in earnest with a quarter of the Stoxx Europe 600 market cap posting results for the first quarter.

Oil price has risen 50% since its trough in December as measured by the West Texas Intermediate (WTI) price.

Despite a global economic slowdown, the WTI price is back to where it was a year ago. This is mostly explained by limited short-term supply.

Lower than expected US production, good compliance on production targets from OPEC and Russia, US sanctions on Venezuela and Iran’s oil exports, as well as renewed political instability in Libya, have all contributed to the recent price spike.

In the short term, the supply picture is likely to remain uncertain.

When the oil price was close to $80 a barrel last October, the US government issued a series of waivers to eight countries regarding the Iran sanction. This allowed them to continue Iranian oil imports.

Those waivers are up for review in a few weeks, and the direction of the oil price is likely to influence the US government’s decision.

The Organization of the Petroleum Exporting Countries (OPEC) and Russia will also review their output target at their next meeting in June. This is likely to create some short-term volatility in the oil market as visibility remains limited.

After spiralling by 45% in Q4 last year, oil prices have rebounded close to 50% from their lows, according to West Texas Intermediate figures.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.