UK rates are on hold… but for how long?

Markets are now pricing in a 30% probability of a rate hike by the end of 2019, as opposed to 0% in early April.

26 April 2019

With the second quarter of the year well underway, next week’s crowded economic calendar will certainly keep investors busy.

A batch of data from the eurozone, including the manufacturing purchasing managers’ index and core consumer price index readings, will give more clarity on the region’s outlook following recent signs of improvement amid strong domestic demand and resilient services activity.

US manufacturing and payroll data will indicate whether the resilience of the American economy is likely to persist in Q2 on the back of a solid jobs market and improving trade balance.

We expect central banks on both sides of the Atlantic to leave monetary policy unchanged for the time being, as inflation remains subdued both in the US and the UK.

We discuss further the UK inflation outlook in our focus article of the week.

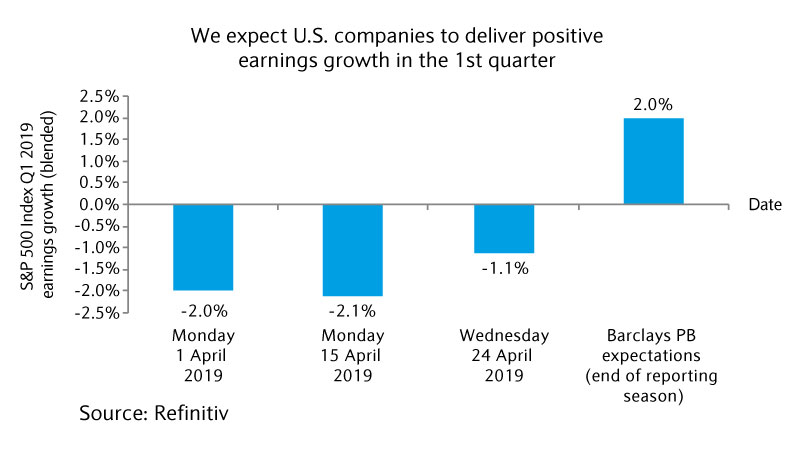

Earnings season in the US is in full swing with a third of the S&P 500 Index constituents having published Q1 2019 results. While it may be premature to draw any conclusion, the early indication is that companies are delivering significantly better-than-feared earnings. A couple of weeks ago we highlighted that consensus expectations appeared conservative with earnings forecasted to decline by 3% compared with the same period last year.

Our view was that with revenues growing by close to +5%, margins were unlikely to contract much, if at all. So far, the blended rate (i.e. actual earnings numbers combined with expectations for those companies that still have to report) of contraction is around -1%. This compares with -2% at the beginning of April. In other words, companies that have reported have surprised positively by around +6% on average, significantly above the usual +3.5% positive surprise.

More importantly, many high profile companies have raised their full-year guidance providing support to 2019 earnings expectations. We should have more clarity by the end of the month, but our conviction in our above-consensus 2019 earnings growth forecast of +5% has been strengthened further. However, with the S&P 500 Index flirting with record high levels, we feel that a period of consolidation is now likely as investors’ focus gradually reverts back to macroeconomic issues.

Markets are now pricing in a 30% probability of a rate hike by the end of 2019, as opposed to 0% in early April.

This document has been issued by the Investments division at Barclays Private Banking and Overseas Services (“PBOS”) division and is not a product of the Barclays Research department. Any views expressed may differ from those of Barclays Research. All opinions and estimates included in this document constitute our judgment as of the date of the document and may be subject to change without notice. No representation is made as to the accuracy of the assumptions made within, or completeness of, any modeling, scenario analysis or back-testing.

Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services, and we do not guarantee the information’s accuracy which may be incomplete or condensed.

This document has been prepared for information purposes only and does not constitute a prospectus, an offer, invitation or solicitation to buy or sell securities and is not intended to provide the sole basis for any evaluation of the securities or any other instrument, which may be discussed in it.

Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Any past or simulated past performance including back-testing, modeling or scenario analysis contained herein does not predict and is no indication as to future performance. The value of any investment may also fluctuate as a result of market changes.

Neither Barclays, its affiliates nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation..

This document and the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permitted. You may not distribute this document, in whole or part, without our prior, express written permission. Law or regulation in certain countries may restrict the manner of distribution of this document and persons who come into possession of this document are required to inform themselves of and observe such restrictions.

The contents herein do not constitute investment, legal, tax, accounting or other advice. You should consider your own financial situation, objectives and needs, and conduct your own independent investigation and assessment of the contents of this document, including obtaining investment, legal, tax, accounting and such other advice as you consider necessary or appropriate, before making any investment or other decision.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.