In Switzerland

We wanted to celebrate our 35 years in Switzerland by publishing a collection of interesting stories from some of our clients and partners with whom we work.

28 June 2021

8 minute read

Head of Quantitative Strategy, Zurich at Barclays Private Bank

Every investor has an asset allocation. It’s the process of dividing investments between different asset classes, such as equities and bonds. And it is why strategic asset allocation lies at the heart of our investment process.

An optimal asset mix depends on a number of factors including the investor’s reference currency, investment strategy and risk profile, as well as our market views. Entire portfolios are then specifically designed to help clients achieve their long-term investment goals, while ensuring a superior risk- adjusted performance.

Five-year outlook in a nutshell

With COVID-19 vaccine rollouts accelerating in many countries, hopes of economic normalisation are rising. Expectations of a strong economic growth and promises of fiscal stimulus amid bloated government debt levels, historically low interest rates, and rising inflation risks, paint a constructive but cautious outlook.

Moreover, while many effects of the pandemic are transitory due to the exogenous nature of the shock, there are several structural changes and secular trends that should be closely monitored – for instance, globalisation reversion, sustainability, technology and demographic shifts.

Given the current macroeconomic backdrop, the prospective total returns on main asset classes over a strategic, five-year investment horizon are likely to be lower than the corresponding past realised returns. Historically low yields and rising inflation weigh on expected returns for developed market bonds via two channels – weak income return prospects and limited capital appreciation potential.

Equities might be under pressure as well due to uncertainty and expensive valuations. However, an accommodative monetary policy should provide support going forward. Over the next few years, growth is expected to be the main driver of equity returns. On a relative basis, equities are expected to offer decent investment opportunities.

Towards a robust and resilient asset allocation

Diversification is the bedrock of any investment process. Building a well-diversified portfolio can substantially reduce risks and enhance risk-adjusted returns. But we believe it is the time for investors to rethink their optimal asset allocation policies. In a post- pandemic world, three asset allocation themes require special attention.

First, historically depressed interest rates have lowered the attractiveness of the classical 60:40 equity-bond portfolio. Diversification benefits of government bonds have slowly eroded over time, which is ostensibly reflected in upward-trending equity-bond correlations.

Second, the socio-economic environment is rather complex with many risks lurking around the corner. Uncertainty will likely remain elevated for some time.

Third, the eagerly anticipated revival of the economic growth – coupled with a number of ongoing structural changes and secular trends – should provide a tailwind for equities and offer alpha-generating opportunities.

Diversification and private equity in the spotlight

To address the issue of lower returns and higher uncertainty, a carefully tailored multi-asset portfolio approach seems needed more than ever. The reinforced appeal of diversification and active management are at the forefront of asset allocation in a post-pandemic world. The most efficient and flexible way to improve upon the traditional 60:40 portfolio is to consider inclusion of other asset classes.

For investors who can tolerate some illiquidity in their portfolios, private equity (PE) is particularly interesting because of the promise of higher (growth-driven) absolute and risk-adjusted returns, and diversification benefits. From 2007 until 2020, PE posted average cumulative return of 11.1% per annum. It was ranked among the three best performing asset classes in 10 out of 14 years in the sample. A negative return was recorded only in 2008. In other years, the return on PE varied between 7.9% and 22.4%.

The nuts and bolts of private equity investing

PE represents ownership in privately held companies. Investors can tap into PE market through direct investments or indirectly via funds. The latter require commitments over a longer period of time – for instance, ten years – over which investors deploy capital and receive income and capital distributions.

Liquidity represents the fundamental difference between public and private markets. PE investors face systematic illiquidity due to long capital lock-up periods.

Historically, the liquidity premium is about 2% on average. Over longer periods of time, the compounding effect boosts the wealth accumulation process.

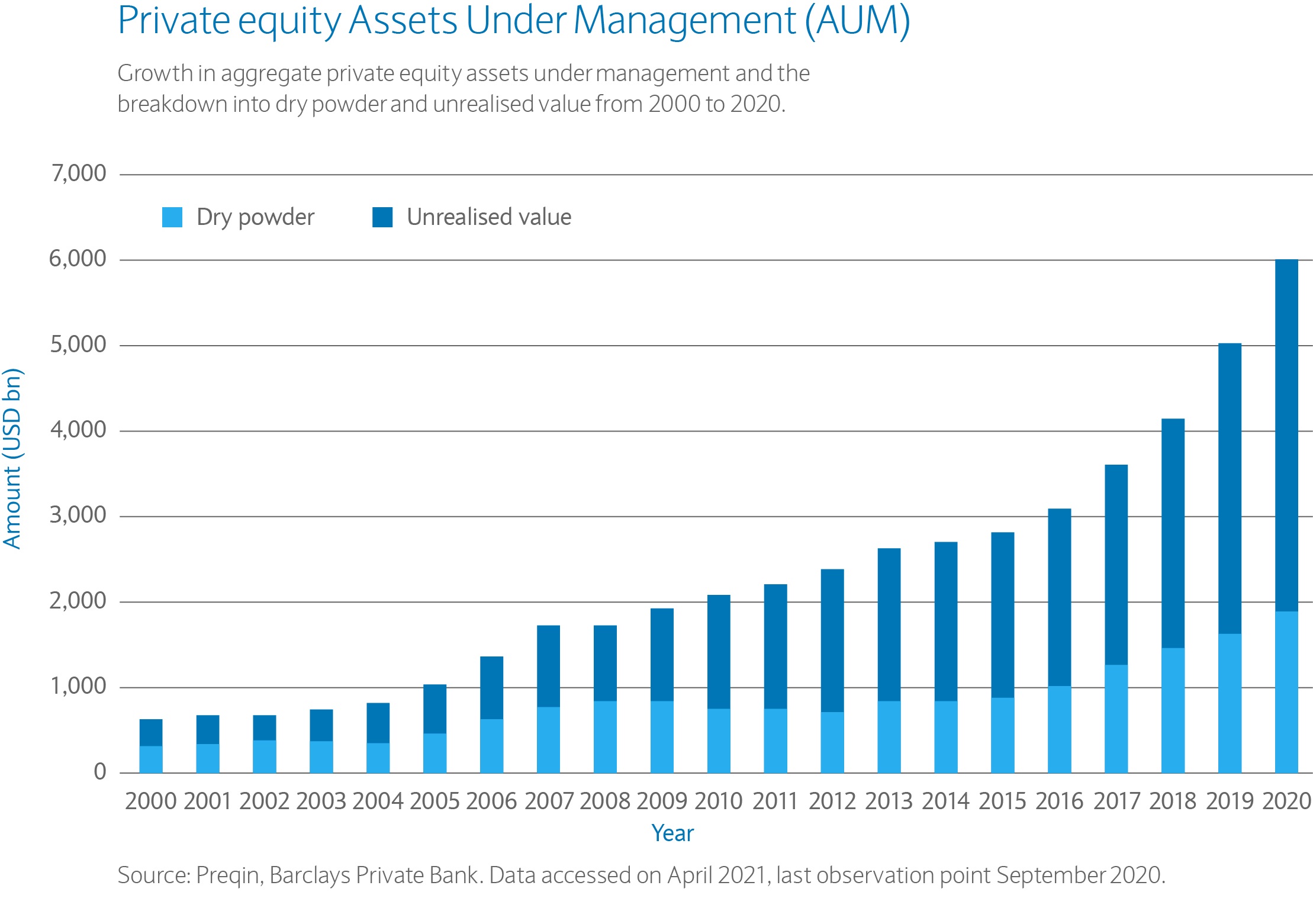

During the past two decades, PE has earned the status of a stand-alone asset class. Active ownership, specific value creation and exposure to different businesses and factors relative to comparable public markets contribute to a unique investment profile and significant diversification benefits. Chart 1 shows an estimate of assets under management (AUM) in the equity industry and its decomposition into dry powder and unrealised value. Nearly a tenfold increase (from US$650bn to US$6,000bn) in AUM was recorded from 2000 to 2020.

PE investments are very diverse and heterogeneous. High performance dispersion is the key to unlocking alpha generation potential. Skilled managers who have informational advantage and expertise in identifying entrepreneurial skill can significantly enhance returns through the selection process and active management.

Investments in illiquid markets introduce specific rigidities and opportunity costs. In particular, short- termism and financial conservatism do not bode well with investments in PE. Instead, investors who have long-term aspirations and liabilities, possess the capacity to hold illiquid assets in their portfolios, and can make significant capital commitments are best positioned to harvest the liquidity premium.

Demystifying the illiquidity premium

To understand return and risk drivers of PE, we need to unveil the inner workings of liquidity. Liquidity risk is an umbrella term that straddles two distinct but mutually reinforcing types of risk. The funding liquidity risk is associated with the costs of generating cash in order to meet capital commitment calls. The market liquidity risk is related to transactional costs; in other words, the ability to liquidate assets relatively quickly at minimum cost.

Funding illiquidity can pose a steep challenge for investors, especially in times of market stress. Fund managers have full discretion regarding the timing and size of capital calls. Therefore, investors can be exposed to a liquidity squeeze during turmoil in financial markets when liquidity dries up everywhere.

The ability of PE investors to sell their holdings in a secondary market is severely limited due to market illiquidity. First, exiting a position in a PE fund is subject to a general partner’s approval. Second, investors have to find a counterparty and negotiate a deal, often at a discount.

Market liquidity risk is a consequence of various market frictions, most notably asymmetric information and complexity. In the absence of a centralised marketplace, good quality data is not readily available. Significant resources and expertise are required to collect, process and analyse the data. Search and discovery of investment opportunities, as well as private deal negotiations are time consuming and costly.

Therefore, many investors opt to get access to PE via funds, hence effectively delegating the analysis and management of PE companies to skilled fund managers. Highly complex PE investments incentivise fund managers to engage in relentless alpha hunting. The end result is that investors – being liquidity suppliers – are compensated with a liquidity premium.

Impact of private equity on the efficient frontier

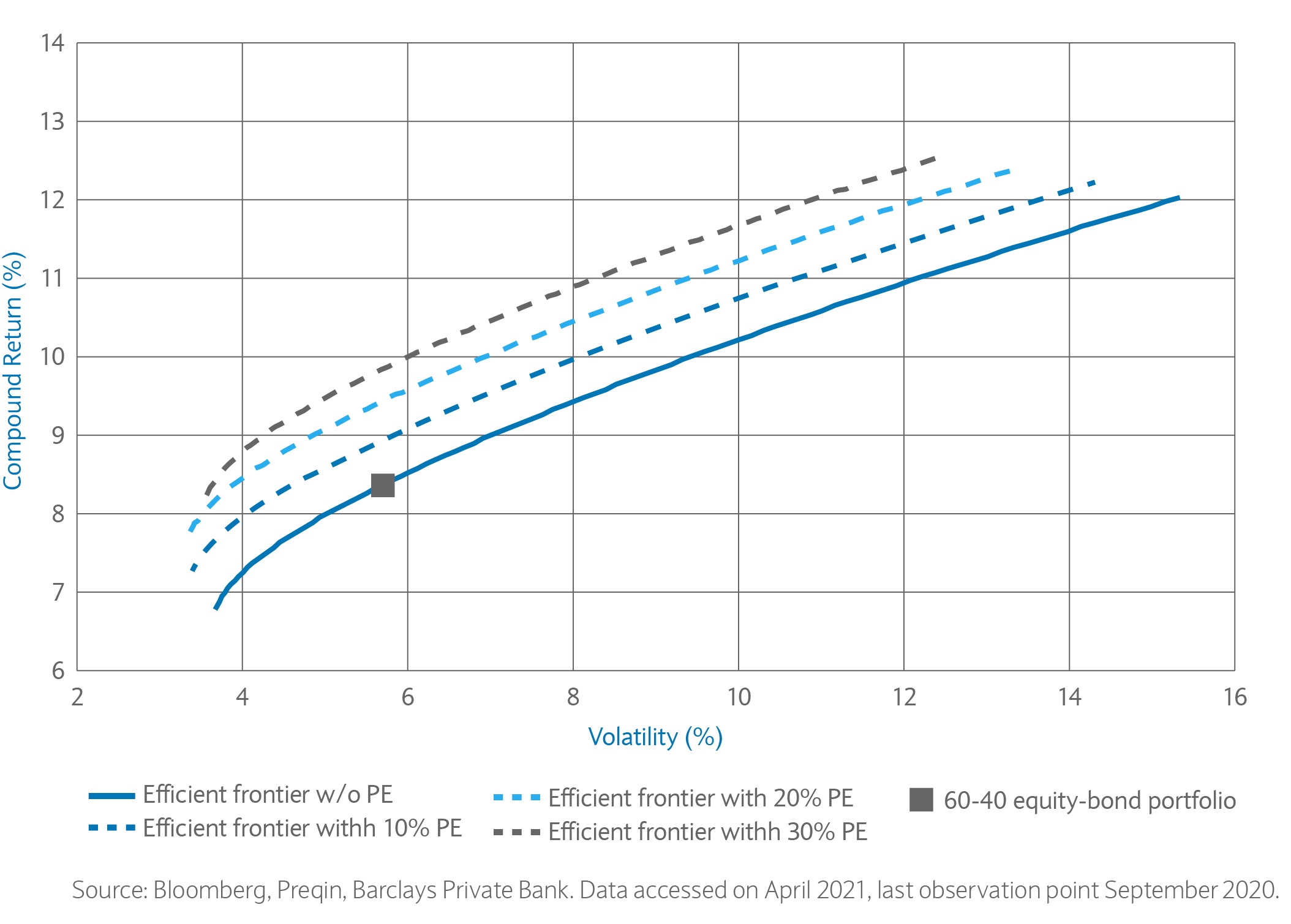

Efficient frontier shifts (dashed lines) as a function of incremental changes in allocation into private equity. The benchmark asset mix comprises US equities and government bonds (solid dark blue line), represented by the MSCI USA Net Total Return Index and the Bloomberg Barclays US Treasury Index, respectively, which were obtained for Bloomberg.

Our private equity index is the PrEQIn Private Equity Quarterly Index, available on Preqin. Optimisation inputs are based on historical estimates from September 2010 until September 2020. Risk model for private equity includes a de-smoothing algorithm to transform appraised into economic returns.

The above analysis provides an illustration of the importance of PE in asset allocation. In practice, there is no universal solution because the optimal portfolio is a function of an investor’s risk tolerance, time horizon, liquidity constraints, goals and liabilities, and other requirements.

However, diversification remains the key guiding principle – investors should aim to spread out their capital across managers, different segments of the PE market, industries, geographies, and vintages. Given our optimisation results and practical diversification requirements, an allocation of 10%-20% in PE seems appropriate for a balanced investment strategy.

Private equity in a portfolio context

To understand the role of PE in asset allocation, we consider an investment opportunity set comprising core asset classes (US equities and government bonds) and a PE index. We compute the efficient frontier with and without PE to gauge the incremental impact of PE on portfolio return and risk (see chart 2).

The optimisation inputs are based on historical estimates of returns, volatilities, and correlations from September 2010 until September 2020.

Our findings indicate that adding PE to a traditional equity-bond asset mix substantially improves the risk-adjusted returns of the optimal portfolios. For a given risk level, adding 10% PE enhances portfolio returns by around 50-60 basis points.

We wanted to celebrate our 35 years in Switzerland by publishing a collection of interesting stories from some of our clients and partners with whom we work.