With only two months until the COP26 climate talks, as the impact of climate breakdown becomes more visible, what investors should know about this event for their portfolios

In the fight against global warming, time is fast running out. Quick action is needed to avoid the risks of even more frequent extreme weather. Business as usual would mean global temperatures likely climbing by 1.5 degrees Celsius or more beyond pre-industrial levels within two decades, triggering more violent weather patterns.

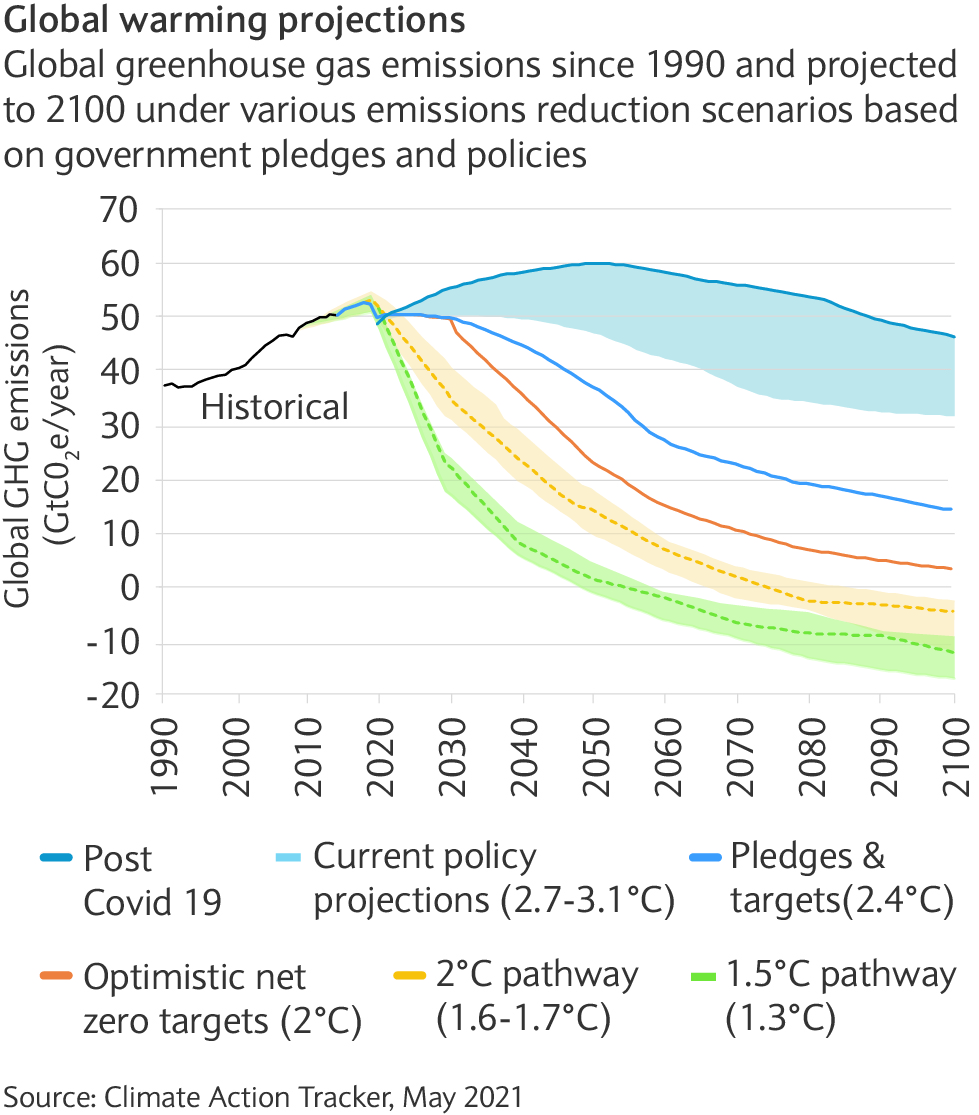

The sixth Intergovernmental Panel on Climate Change (IPCC) report, published in August, warns that unless action is taken to reduce emissions, the world is on course for a catastrophic climate disaster (see chart).

As the UK prepares to host the UN climate summit in November, the path to limiting global warming to 2 degrees Celsius (and ideally 1.5 degrees) degrees is narrowing.

Commitments from governments, the private sector and investors need to be backed with sufficient action to avert climate warming too much and causing massive changes in how people live while hitting global economic growth.

What is the climate conference?

The Conference of the Parties (COP) assembles governments, climate experts and campaigners to decide coordinated action to tackle climate change. The goal (involving more than 190 countries that signed up to the United Nations Framework Convention on Climate Change) is to agree and accelerate action on the Paris Agreement.

After being postponed a year due to the COVID-19 pandemic, COP26 will be crucial for making up for lost time and ushering in a green recovery. The aim is to restrict global warming to well below 2.0 degrees Celsius, preferably to 1.5 degrees Celsius, compared to pre-industrial levels – putting the world on a path to reduce climate change and shift towards a low-carbon, more-inclusive society.

Going beyond climate change

Key topics raised at COP26 will include:

- Adaptation, resilience and “just transition”: Delivering practical solutions to help people, economies and the environment adapt and prepare for the impacts of climate change and address loss and damage

- Nature: Safeguarding nature and ecosystems. Ensuring sustainable land use is part of the action on climate change and the green recovery (such as biodiversity, land and forest conservation, and climate-friendly farming)

- Energy transition: Accelerating the global transition to clean energy (such as renewables and storage)

- Transport: Accelerating the move to zero-emission transport (for instance, electric vehicles)

- Cities, regions and the built environment: Advancing action in the places we live, from communities, through to cities and regions (circular cities, sustainable buildings and infrastructure)

- Finance: Mobilising public and private finance flows at scale to make the transition to a climate-conscious society and power the shift to a zero carbon economy.

Wider implications

With 2021 branded a “make-or-break year” by the UN, COP26 has set out ambitious goals around mitigation, adaptation, finance, and collaboration in the fight against climate change.

As governments, policymakers and regulators act to prevent a climate catastrophe, the implications for businesses and investments are real. To gain further insight, earlier this year we invited sustainable finance expert Dr Ben Caldecott to present a webinar about how investors can navigate this transition to a low-carbon world.

According to Caldecott, the COVID-19 pandemic has accelerated the trend to a more sustainable approach to investing. And with the UN’s climate summit speeding into view, recent shifts in geopolitics may yet see rhetoric translated into real change.

How might COP26 affects investors?

As a first step to achieving the climate goals, governments and similar parties to the event are expected to submit updated nationally determined contributions (NDCs) and determine how they will reach net-zero emissions of greenhouse gases. This may result in legislation requiring organisations to reduce greenhouse gas emissions and act as a catalyst for greater ambition from the private sector and investors.

Furthermore, fresh climate change legislation may boost the appetite for more accountability, transparency and adoption of quantitative and qualitative climate disclosures.

For investors, such disclosures can guide how a company may profit or be hurt by a net-zero economy. Investors looking to make a real impact should be “leaning in” through stewardship to change corporate behaviours, notes Caldecott.

Common carbon market

A common carbon market may be one way to deliver on contributions to reach net-zero greenhouse gas emissions.

Suppose there is a compromise made regarding Article 6 of the Paris Agreement (market and non-market approaches) and the framework is given a robust set of rules. In that case, COP26 could open the door to a global carbon market. This could further increase climate ambition globally and give those already using ambitious climate strategies a competitive advantage.

Green finance solutions

To deliver on the goals, developed nations committed to mobilising at least $100 billion in climate finance per year by 2020. By making good on their promise, various investment opportunities are expected to emerge.

COP26 is also expected to unlock further green finance solutions. Initiatives such as the UN-convened Net Zero Banking Alliance are likely to provide investors and organisations with a new rulebook with which to evaluate sustainability. This will signal that share prices, asset valuations and the cost of capital will be affected if urgent climate action is not taken.

According to Caldecott, we have trillions of dollars of assets under management committed to net-zero. Assuming these commitments are credible, they will “help drive demand and shift capital flows in a particular direction” – a sustainable one.

Now is the time to act

While climate change brings many investment risks and opportunities, the decisions made in the short term can significantly shape long-term climate trends and risks and opportunities. As such, now seems to be the time to start raising the climate targets of your portfolio. Any delays may be costly.

For those investors that can transition their investment portfolio to a zero-carbon world, a brighter future beckons.