Higher US corporate taxes seem on the cards as Democrats advance infrastructure spending plans. Are US equities about to suffer as a result and should you adjust equity portfolios?

The Biden administration in the US has made clear that any large-scale infrastructure spending would likely be financed by higher tax rates. With the Democrats trying to advance their political agenda, should investors worry about a possible corporate tax rate hike?

Higher taxes on the horizon

A hike in American taxes looks likely soon, but there is no certainty as to what they would look like. Back in 2017, President Trump cut the US statutory corporate tax rate to 21% from 35%, the highest in the OECD. Current discussions seem to place a revised tax rate in the 25% to 26.5% range, taking away less than half of the deductions introduced four years ago.

For individuals, according to the Democratic proposal, the top marginal income-tax rate may return to 39.6% with a new 3% “surtax” potentially levied on incomes greater than $5 million. On the other hand, the long-term capital gains tax rate would be set at 25%. These, combined with the existing 3.8% investment-income tax and the surtax, would yield a top individual marginal tax rate of 31.8% at the federal level.

Companies would also face higher taxes on their foreign income with the minimum rate going up from 10.5% to 16.6%, although this would be offset by greater ability to offset foreign tax credits.

Assessing the impact

The Democrats’ razor-thin majority in the Congress means that any plan is likely to be subject to difficult negotiations and the end result could diverge widely from these opening bids. Nevertheless, the most probable outcome is that taxes, both for corporates and individuals, will rise in the short term.

However, any change in the tax code would most likely happen as part of a broader $3.5 trillion reconciliation bill and therefore be, at least in part, offset by increased government spending. As a result, it is extremely difficult to assess the ultimate net impact of the proposed legislation.

Estimates vary widely

Because of the tedious negotiating process in Washington and the various proposals being floated around by both sides of the aisle, analysts and investors are struggling to model the ultimate impact of proposed tax changes on markets.

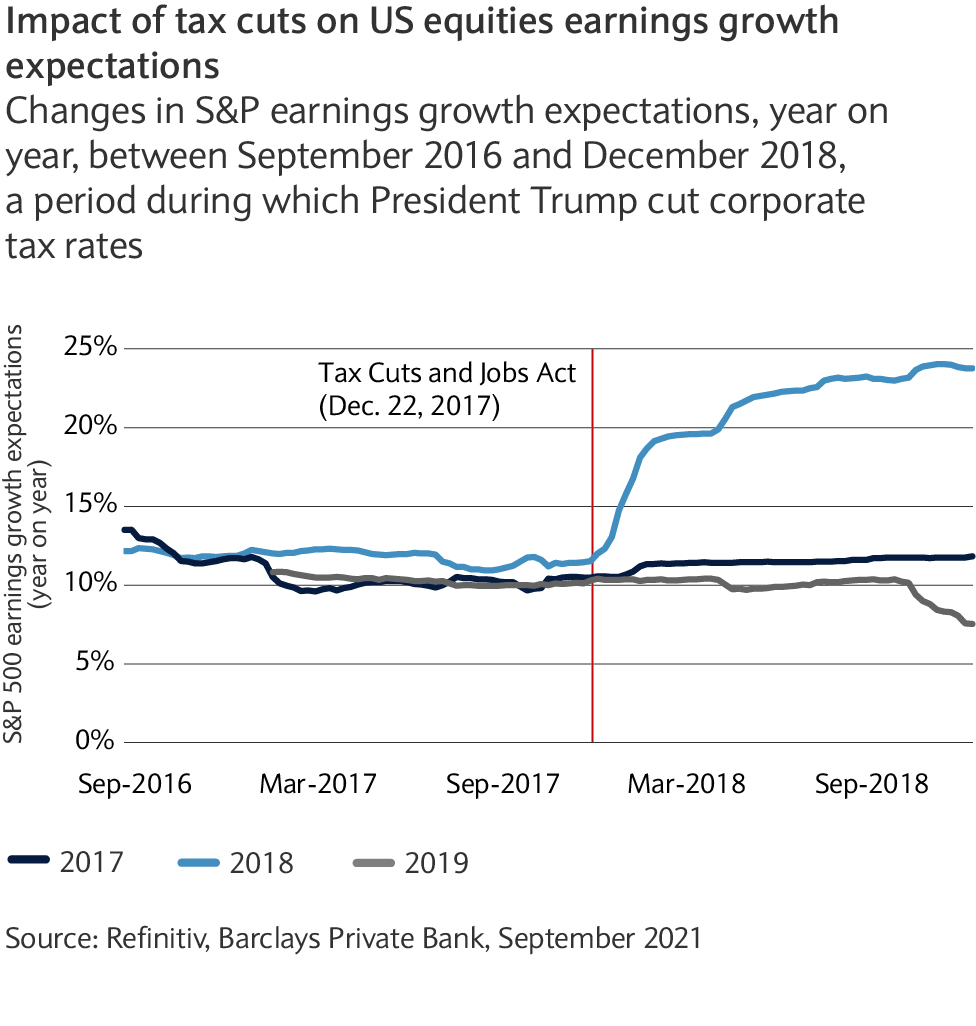

At the corporate level, the consensus seems to range from a “worst-case” scenario of an eight percentage point headwind to S&P 500 companies and a “best case” scenario of a mid-single digit hit. Yet, as was the case for the Trump tax cuts (see chart), we would expect analysts to wait until the proposal becomes law before updating their numbers.

Statutory versus effective

One other reason why modelling the impact of changes in the tax code is so difficult is the number of tax breaks that allow companies to lower their effective tax rate.

In fact, the majority of S&P 500 companies’ most recently reported effective tax rates were below the 21% statutory federal rate. As such, a 5% increase in the tax rate is unlikely to translate into a 5% downgrade in earnings. Similarly, the impact would vary sector by sector and company by company.

A 5% increase in the tax rate is unlikely to translate into a 5% downgrade in earnings. Similarly, the impact would vary sector by sector

Second round effects

Last but not least, in order to properly assess the impact of higher taxes, the second round effects must be considered. As mentioned previously, the Biden administration’s plan is challenging in that it combines a change in both corporate and individuals tax rates while increasing government spending. This may create offsetting factors, all with different timeframes.

For example, higher capital gains taxes could discourage some investors and weigh on stocks’ valuations while infrastructure spending may boost long-term growth prospects. Similarly, improved paid family leave and childcare might boost productivity, though this would be negated if lower corporate profits reduced companies’ ability to boost capital investments.

Wait and see

With all this uncertainty, the prudent approach is to wait and see rather than shifting portfolio allocation in anticipation of any potential tax changes. While we can establish that tax rates are likely to rise in the US and market participants haven’t seemed too worried about this until recently, the rest remains speculation at this point. In addition, the macroeconomic landscape (the outlook for inflation, COVID-19 and central bank policy) is likely to have a much larger influence on markets.

As such, we maintain our view that US earnings growth will slow and that valuations will struggle to expand over the rest of the year. This should translate into more modest upside at the index level and higher volatility overall.

We maintain our view that US earnings growth will slow and that valuations will struggle to expand