Inflationary pressures and supply-chain disruptions should ease gradually, laying the foundations for the global economy to post above-trend growth in 2022, even if governments and central banks curtail their support.

In order to revive the global economy from the devastating impact of the coronavirus pandemic, policymakers injected enormous doses of fiscal and monetary “medicine”.

Fortunately, this has proved to be successful, with activity this year bouncing back at the strongest post-recession pace in more than eight decades.

As we look towards 2022, we anticipate above-trend global growth as the recovery phase plays out. However, many risks might derail the recovery: the path of the pandemic is unclear, inflation appears to be more ingrained than many hoped, growth in some key regions is slowing and policy normalisation is back on the agenda.

The question for investors is how quickly the fiscal and monetary policy remedy will be withdrawn, and whether the patient, or global economy, can stand again unaided?

A year of successes

This year will go down in the economic annals as one of exceptional growth. A mixture of the improving health situation, relaxing of restrictions and ongoing aggressive policy support allowed the global economy to expand by around 6.2%. This is far better than the 4.7% we predicted at the start of the year. It also compares with an average annual growth rate of 2.7% between 2000 and 2019.

This year will go down in the economic annals as one of exceptional growth

The biggest vaccination programme in history has been the key to the surge in activity. Around 7.3 billion doses have been administered across 184 countries, as at the date of writing. The latest figures show that more than 30 million doses are being dispensed each day. While not eradicating the virus, the vaccines have proved to be highly effective in breaking the chain between case numbers and severe illness. Consequently, and even though booster shots may be needed, hospitalisations, intensive care unit occupancy levels and deaths have all fallen in regions with elevated vaccination levels.

COVID-19 challenges remain

Victory over the virus is far from assured, particularly given the wide dispersion of vaccination rates. Advanced economies have rapidly outpaced those in emerging and developing economies. While the US, EU and UK have fully vaccinated more than 50% of their population, in excess of 50 countries have failed to achieve the goal of 10%, by the end of September. African countries, in particular, languish at the bottom of the league table with less than 5% of citizens fully vaccinated.

Along with the global distribution challenge is a broad range of unknown factors, including efficacy against variants, length of immunity and long-term side effects. As such, the path to herd immunity (thought to be 75% of the population vaccinated) is likely to continue to be a challenging one.

Our expectation is that the virus will evolve to become endemic, rather than being arrested. Production facilities and transportation hubs will continue to be impacted in areas where vaccination rates are low or in regions that are pursuing a zero-COVID-19 strategy. This disruption will continue to affect global supply chains and, in turn, growth prospects in 2022.

Inflation should be less of a concern by the end of 2022

Given the broad range of both demand-pull and cost-push inflationary pressures, it’s perhaps no surprise that year-on-year inflation has risen significantly since the second quarter of the year. The relaxation of restrictions unleashed pent-up demand. Supply bottlenecks, in areas such as computer chips, container shipping and labour shortages, are also keeping inflation measures higher for longer than central bankers had hoped.

Price pressures are also coming from ultra-accommodative monetary policy and the flood of fiscal support. Technical and statistical factors, along with surging commodity prices, have added to short-term price pressures.

While a number of factors suggest that some of the inflationary pressures are transitory, there is evidence that implies price pressures may be more persistent than originally projected.

The level of spare capacity in many economies reduced as the economic recovery gathered pace. Labour and logistical obstacles have seen production struggling to keep pace with demand and inventory building. Lower participation rates in workforces have resulted in wage inflation becoming more ingrained than anticipated. Supply and demand imbalances suggest that commodity prices may remain elevated for some time.

In the medium term, supply-chain disruption is expected to ease as restrictions are removed and capacity increases

Nonetheless, in the medium term, supply-chain disruption is expected to ease as restrictions are removed and capacity increases. Labour supply ought to pick up among the inactive older and younger populations as furlough programmes are closed, schools reopen and medical risks diminish. Price pressure should also moderate as global demand is likely to rebalance away from goods into services.

The rapid digitisation and ongoing investment in technology may also help to dampen long-term price pressures.

But upside risks remain

The upside risks to our inflation forecasts could be generated by a prolonged period of supply-chain disruption, or labour market stress in the scenario where a shortage of supply allows workers to demand higher wages.

Will central banks bow to the inflationary pressures?

How long central bankers can stretch the term “transitory” and stomach the spike in prices will be fundamental for policy rates and growth prospects in 2022. If price pressures trend back towards mandated levels in the second half of next year, as we expect, the impact on rates of the current elevated inflation data may be subtler than market pricing indicates.

While policymakers are clearly keen to normalise policy, we do not think that central bankers will embark on an overly aggressive or extended rate-hiking cycle. The first stage of normalisation will be to taper the extraordinary measures implemented during the pandemic, such as asset-purchase programmes, as announced by the US central bank this month.

Following the closure of the pandemic-related packages, central bankers’ attention will turn to interest rates. While hikes may come earlier than previously projected, rates are likely to settle below neutral levels and remain some way beneath their historical averages.

Regional growth drivers to change

While the world is likely to grow robustly in 2022, we acknowledge that the peak of the pandemic recovery has passed

While the world is likely to grow robustly in 2022, we acknowledge that the peak of the pandemic recovery has passed. The fading of the one-off boost from economies reopening and reduced impact from fiscal support, will weigh on year-on-year comparisons.

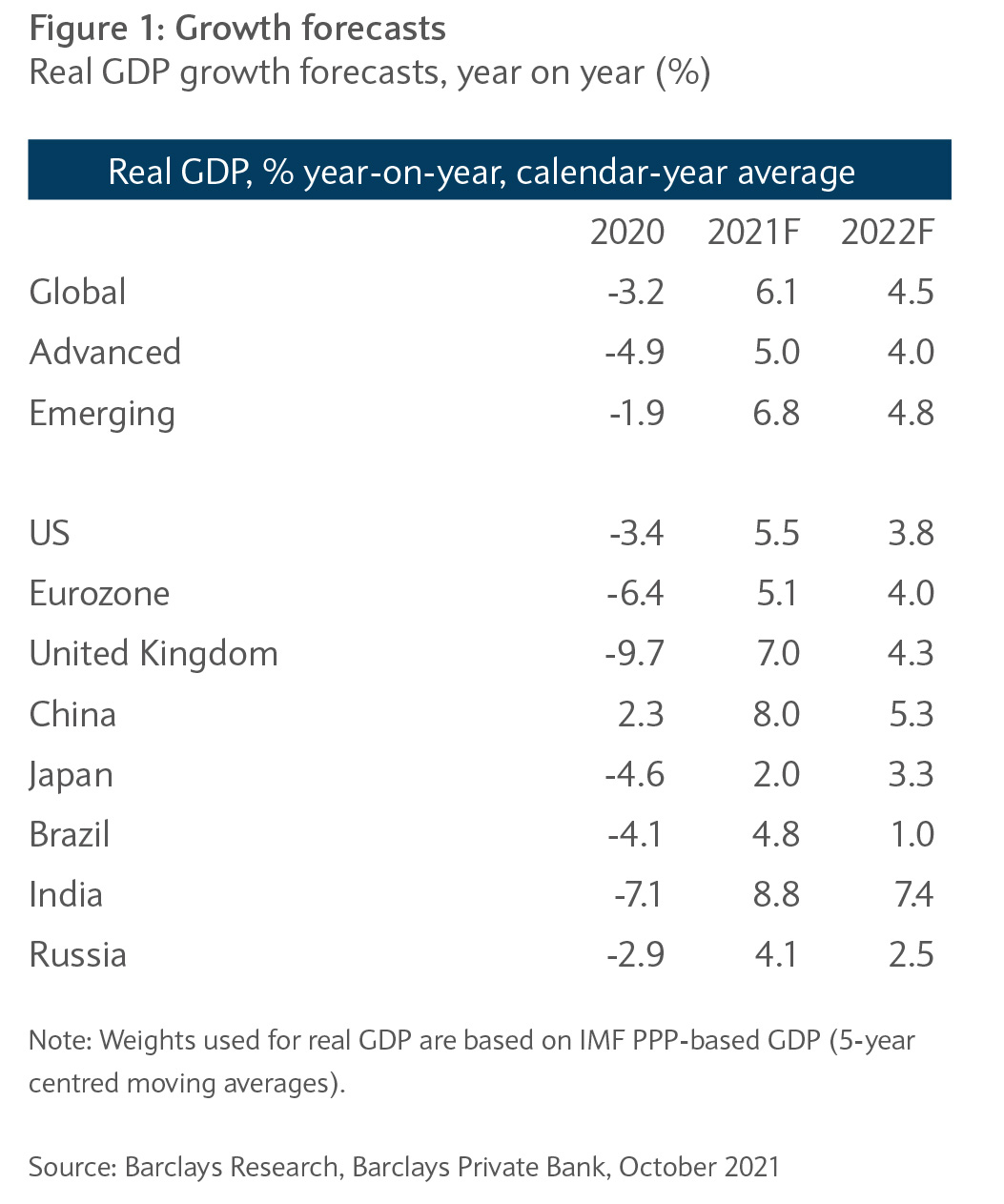

There are clear signs that the two largest economies have already achieved their highest growth rates in the recovery. In the US, we expect a significant step down in growth in the first half of next year and its economy to generate growth of around 2% in the second half. That said, a forecast annual growth figure of 4.0% is still very respectable. China’s zero-COVID-19 strategy, moderation in credit growth and energy shortage lead us to expect that growth will ease to 5.3% in 2022, from 8.0% this year.

Even after accounting for the slowdown in the US and China next year, we still think global growth will be supported by the robust recovery in economic areas such as Europe and India. After a slow start to 2021, momentum in European activity has tangibly accelerated over the past few months. Progress on vaccinations, rebounding consumer spending, the accommodative central bank and the fiscal support provided by disbursement of the Next Generation European Union (NGEU) fund should allow Europe to grow at 4.3% next year.

Another bastion of growth in 2022 is likely to be India, as its economy continues to bounce back from a second coronavirus wave. Indian exports have been rising, while the agricultural sector recovers and service sector rebounds. We expect the Indian economy to grow by 7.4% next year.

Robust recovery set to continue in 2022, then revert to trend

We predict that 2022 will deliver another year of impressive growth, with the global economy growing by 4.5%

Considering the relatively accommodative policy stance, recovery in labour markets and strength of the global consumer, we predict that 2022 will deliver another year of impressive growth, with the global economy growing by 4.5% (see figure 1).

As we start to contemplate the landscape beyond next year, the global economy exiting the recovery phase and policy normalisation regulating activity, lead us to anticipate an orderly decent back towards the long-term trend averages.