With consumers ready to spend their pandemic savings, a surprisingly strong labour market and buoyant economic growth, inflation fears and a gradual tightening of central bank policy seem unlikely to spoil the recovery.

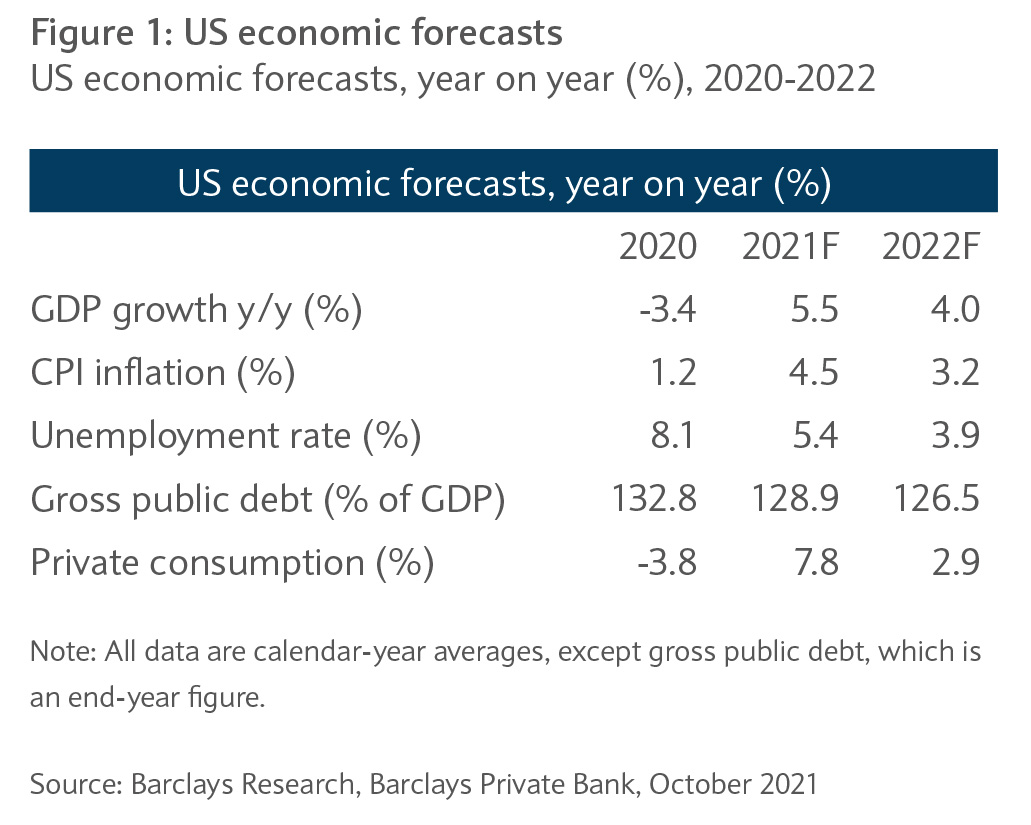

The US economy surpassed its pre-pandemic level in the second quarter (Q2), as the relaxation of restrictions, extraordinary policy support, and pent-up demand drove robust household consumption and vigorous business spending. We estimate that the US economy grew at 5.5% in 2021 (see figure 1).

The US growth rate appears to have peaked in Q2 with the highly transmissible Delta variant weighing on activity. Simultaneously, supply-chain bottlenecks have been disrupting production and waning fiscal support has led to a softening of final demand.

Prospects for 2022 will likely be determined by the level of domestic consumption, the size of additional fiscal spending, and the easing of supply constraints. The trajectory of policy normalisation will also play an important role in deciding the growth profile for the world’s largest economy.

US consumers happy to spend

The key driver of the US economy continues to be consumer spending. US retail sales numbers demonstrating the health of the recovery in August continued in September. Headline retail sales rose 13.9%, compared with the same period a year ago.

The increase in sales was driven by spending by students returning to school and workers to offices. There was also strong demand for clothing, general merchandise and non-store retailers. Another factor that may have driven sales of goods was the higher COVID-19 caseloads in August and September, which likely redirected spending away from services.

With stimulus effects fading we would expect year-on- year (y/y) sales growth rates to settle at lower levels once spending patterns normalise. Nevertheless, the outlook for the US consumer remains positive given the high levels of underlying demand, huge accumulation of excess savings during the pandemic and positive labour market recovery. We project private consumption growth of 2.9% in 2022, helping to support growth prospects next year.

Optimistic on output expansion prospects

Since the start of the pandemic, US consumers are estimated to have saved an extra $2.7 trillion

We remain optimistic about US growth prospects. One reason for this is that households are expected to spend the vast savings gathered during the pandemic. Since the start of the pandemic, US consumers are estimated to have saved an extra $2.7 trillion. While recent data show that spending has been outpacing income growth, households have not partaken in a wholesale spending spree over the past few months.

In September, the saving rate came in at 7.5%, still way above pre-pandemic levels, although substantially below the April 2020 peak of around 35%. We continue to expect these saving levels to be reduced over time and contribute to growth, although it may take longer than previously projected for this money to find its way into the tills of retailers.

Labour market on the mend

The strength of the labour market also directly affects household consumption levels. The US labour market recovery has been remarkable over the course of the past year, but recent reports suggest that the revival has been running out of steam.

The US unemployment rate fell to a post-pandemic low of 4.6% in October, compared to a peak of 14.7% in April 2020. However, we are mindful that this improvement is partly a reflection of a lower participation rate. The latest employment report also highlighted the uptick in hours worked and a robust increase in average hourly earnings.

While non-farm payroll figures fell short of expectations over the summer months, the softness was primarily due to supply issues rather than demand. We project that these supply constraints should resolve themselves in the coming months with coronavirus case rates falling, schools reopening and the scaling back of extended unemployment benefits. These factors should encourage the inactive younger and older populations to join the workforce and reduce the shortfall.

By the end of the next year, we anticipate that the US economy will have recovered the 22.4 million jobs lost during the pandemic. Furthermore, we anticipate that the US unemployment rate will approach 3.8% by the end of 2022, and be back to the multi-decade low of 3.6% in the last quarter of 2023. This is very close to the multi-decade low of 3.5% seen before the pandemic.

Fiscal spending package expected to boost long-term growth prospects

The Biden administration has pushed for a sizeable expansion in federal spending and tax credits focused on a wide range of areas from surface transportation, to elderly care and education. To fund these policies, the administration proposed raising taxes on upper income households and corporations.

Political momentum is building towards a scenario where another dose of fiscal spending may provide a boost to activity. Both chambers of Congress have now passed a budget blueprint that includes up to $3.5 trillion in additional infrastructure spending over ten years under budget reconciliation.

We do not believe, however, that a package of this size is feasible, given the Democrats’ narrow majority in Congress and the division among their moderate and progressive wings. Instead, we think a scaled-down package of $1.75 trillion in additional spending over ten years, $1.05 trillion of additional revenue raising measures, and $700 billion in additional borrowing, is more likely. This would provide a modest boost to gross domestic product (GDP) growth rates in the coming years and could leave the level of GDP around 1.3% above our current baseline at the end of 2026.

Inflation to finally come under control in 2022

US inflation has been more resilient than expected, hitting a 30 year high last month. The headline consumer price index (CPI) increased by 6.2% y/y in October, while core inflation rose 4.6% y/y. The latest inflation report demonstrated further weakness in used cars, hotels and airfares, due to continued COVID-19 disruption in consumer facing and travel related services, but this was offset by strength in energy, food and shelter costs.

We still believe that inflation will decelerate next year

We estimate that US inflationary pressure may be higher and for longer than previously projected, with supply-side problems taking longer to resolve. Therefore, we now see CPI peaking at 6.4% in December. However, we still believe that inflation will decelerate next year, with CPI averaging 3.2%.

US Federal Reserve may hike rates earlier, but will limit rate rises

Given the progress made on the dual mandate of maximum employment and 2% average inflation over time, it’s no surprise that the US Federal Reserve (Fed) took the first steps towards normalising its monetary policy. As expected, the central bank formally announced the moderation in the pace of asset purchases in its November meeting. The reduced level of purchases suggests that the programme will conclude by late Q2 2022.

Once the bond-buying programme has been completed, investors will quickly turn their focus to interest rates. The prospect of rate hikes in 2022 is likely to be determined by the path of inflation. If upside risks to inflation do materialise then the Fed would have a clean slate to lift the policy rate in the second half of the year. Conversely, if, as expected, supply constraints ease and some of the idiosyncratic price increases associated with the economy reopening reverse next year, then we would expect the start of the hiking cycle to be delayed, possibly until mid-2023.

More importantly still, for investors, is where rates settle and not the timing of the first hike. The latest “dot plot” projections from the Federal Open Markets Committee participants point to a target range for the federal funds rate of 1.75-2.0% by the end of 2024. This would be well below the committee’s estimated neutral rate at 2.5%.

Initial growth surge to ease

Inevitably, the US economy will ease back from the astonishingly high sequential growth rates achieved in the initial recovery from the pandemic. With policies remaining supportive, service sectors providing growth opportunities and employment prospects strengthening, we remain upbeat around US economic prospects in both 2022 and 2023, with an estimated growth rate of 4.0% and 2.3% respectively.