Consumer spending supports growth

With restrictions incrementally lifted from May, many Europeans seized the opportunity to go to restaurants, shop and travel. The resumption of this activity helped sales bounce back from the very depressed levels of the lockdown.

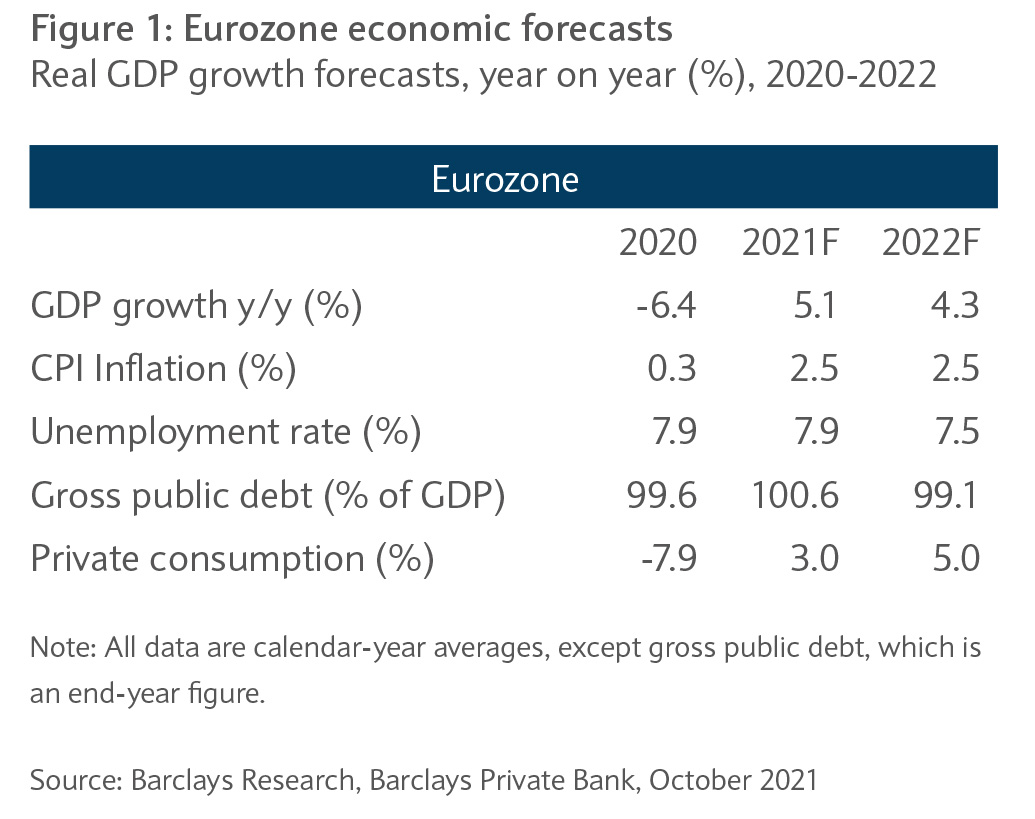

Despite elevated inflation levels, fading reopening effects and surging energy prices, the outlook for consumer activity still remains positive. Eurozone consumers are estimated to have accumulated almost €400 billion of excess savings during the course of the pandemic. The latest data show that consumer confidence is improving and the saving rate is starting to decline. Household consumption should also benefit from a more active labour market. We estimate that private consumption will be around 5% in 2022, compared with 3% in 2020, helping to support growth.

Bounce in jobs stronger than expected

The rebound in the eurozone’s labour market has been faster than expected, with few signs of long-term scarring that many had once feared. The number of furloughed workers has fallen and hours worked have returned to pre-crisis levels in most sectors and countries in the region. The unemployment rate fell to 7.5% in August, which is only 0.4% above the level set March 2020, the lowest since the introduction of the euro.

The unwinding of job retention schemes and the return of discouraged workers are likely to increase job seekers and put renewed pressure on the labour market. We anticipate that a further gradual improvement will be possible next year, with the unemployment rate finishing the year at 7.4%.

Economic recovery frictions hit inflation prospects

Europe’s industrial sector is clearly being impacted by supply bottlenecks. Manufacturers are struggling with a shortage of components and availability of materials. They are also navigating the disruption in global shipping that has been causing delays and creating chaos for just-in-time supply chains, while pushing up producer prices. The share of producers experiencing supply-side constraints is near to all-time highs. We predict that many of these supply complications will ease as global restrictions are removed and capacity increases over the next few quarters, but are still likely to be a drag on production levels in 2022.

Supply bottlenecks, strong demand and surging energy prices pushed eurozone inflation up 4.1% year on year in October. The latest inflation print was a 13-year high and consensus sees it rising into year end. The energy component has been a key driver, with growing cost-side pressures from the rapid rise in crude, wholesale gas and electricity prices.

Services inflation has also been accelerating, as seasonal price cuts have been lower than previous years as strong demand increased companies’ pricing power.

We continue to expect headline inflation will moderate over the next year, averaging 2.5% in 2022. The risk to our forecast remains to the upside, particularly if the supply- side disruption continues longer than expected and rising energy prices feed through to underlying inflation, which, in turn, might drive wage inflation.

Eurozone central bank policy

The European Central Bank (ECB) Strategy Review, published in July, gave the central bank greater flexibility. The policy revamp has raised the ECB’s inflation target to 2% over the medium term and allows for a temporary and moderate overshoot.

This change has encouraged market participants to speculate that rates in the region will remain low for longer. The road to policy normalisation in the eurozone therefore, is expected to be a considerably slower and longer journey than their US or UK counterparts.

We expect the ECB to end its €1.85 trillion pandemic emergency purchase programme ( PEPP) in March 2022. However, the central bank will remain accommodative by either expanding the asset purchase programme (APP) or establishing a replacement programme that would continue to buy assets next year.

The ECB’s expansive quantitative easing exercise is anticipated to last until 2023 at which point the central bank may start to guide markets to the possibility of a rate hike. We envisage that a rate hike in the eurozone is unlikely to materialise before the end of 2023 or beginning of 2024.

Fiscal support for pandemic recovery

Disbursements from the €750 billion Next Generation EU (NGEU) fund, along with the €1.1 trillion EU long-term budget, should help support growth in the eurozone and help to transform the economy over the next few years.

The recovery fund pledges to mitigate the economic and social impact of the pandemic and make European economies and societies greener, more digital and more resilient. The Recovery and Resilience Facility (RRF) makes up the bulk of NGEU and offers loans and grants to member states for investment and reforms up until 2026. Governments are entitled to request the payment of instalments up to twice a year after achieving the corresponding milestones and targets.

The package of projects, reforms and investments is focused on key policy areas, including the green transition and digital transformation; smart, sustainable and inclusive growth and jobs; social and territorial cohesion; health and resilience; education and skills policies for the next generation.

Leaders have stressed the importance of full and timely implementation of the recovery fund in order to be successful. Italy and Spain are expected to be the biggest beneficiaries, and may receive around €280 billion. The monitoring of relevant milestones and targets are a key element of the process. If the European Commission discovers countries have failed to meet their objectives, they can suspend all or part of the payment until the member state has taken the necessary action.

Encouraging growth outlook

The combination of plentiful fiscal and monetary stimulus, private consumption growth and a recovery in business investment, should continue to support above trend growth over the next couple of years. We believe that eurozone growth will be a very credible 4.3% in 2022 and then 2.5% in 2023.