As global growth slows from exceptionally high levels and a period of sub-par equity returns looks likely at the asset class level, where do opportunities lie and how should investors position portfolios?

We remain constructive on equities in the coming year, in absolute terms and relative to bonds. However, we expect returns to be more muted, as the economy slows from very elevated levels and prospects for the growth/inflation mix deteriorate.

Economic momentum is slowing

While global growth momentum has peaked, we believe it will remain robust in coming months. That said, momentum is likely to rotate from the US to the rest of the world, supported by the reopening of economies, further progress on the vaccination front and continued accommodative monetary and fiscal policies. In the G7 economies, we expect growth to slow from around 5.1% in 2021 to 4.0% in 2022, which remains well above trend growth of 1.4%.

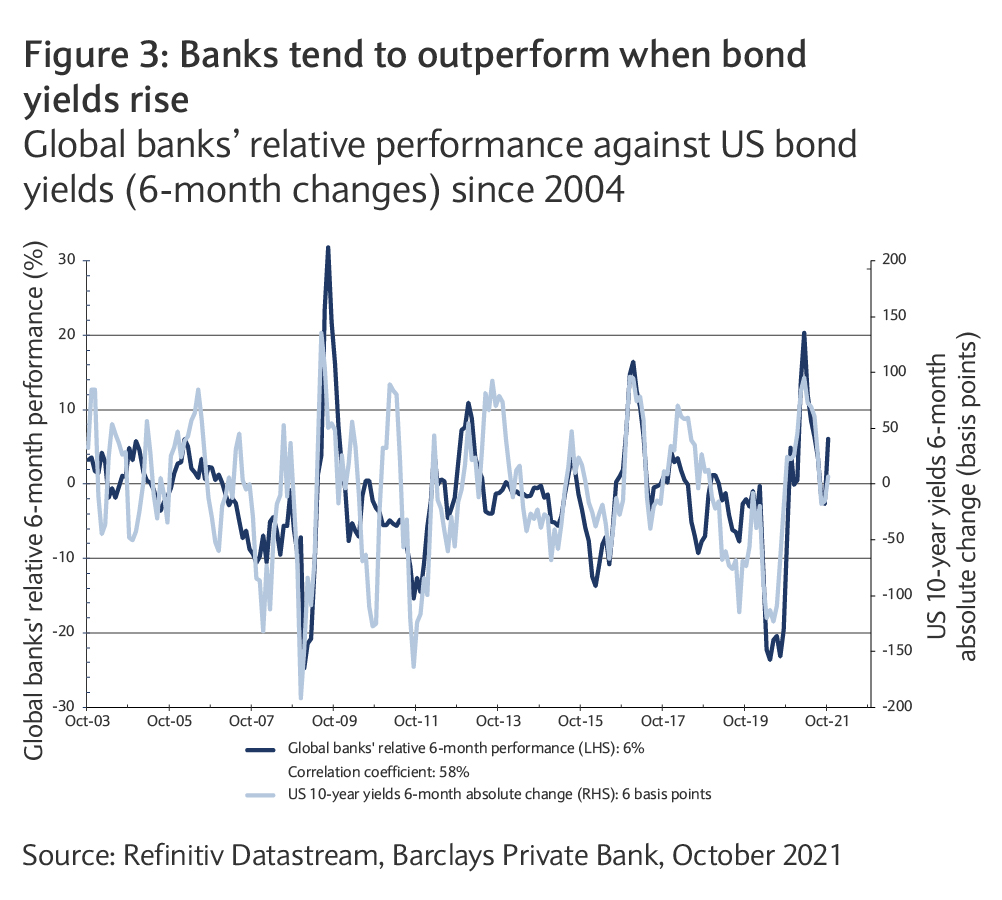

We believe that this environment will be accompanied by a modest rise in nominal yields and inflation, which is unlikely to hurt the economy and derail financial markets. Long- term rates remain well below trend nominal GDP growth of around 3.5%. Our economists forecast a gradual increase in US 10-year yields to 1.50% by the end of the year, and 1.65% by next September.

This environment of above-trend growth, low rates and accommodative policies, should support risk assets and warrants a modest pro-cyclical stance in portfolios.

Investment risks

However, the growth/inflation mix has deteriorated since August, fuelling concerns of stagflation among investors. Macro data have disappointed since August, especially in the US and China, while inflation expectations have been sticky in the US and rising in Europe.

The main risks to our base case scenario are:

- a disappointment in global growth, driven by resurging COVID-19 cases and the reintroduction of lockdowns, as well as a China slowdown;

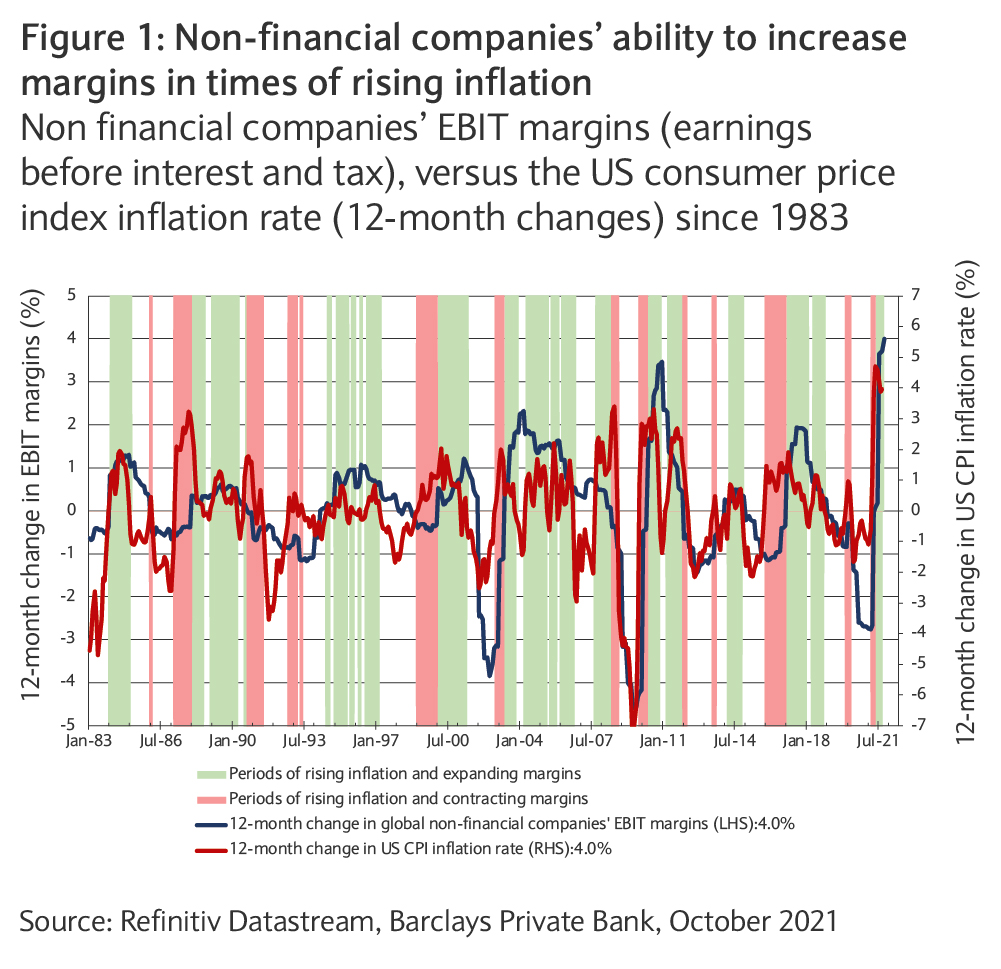

- a more persistent rise in inflation, putting pressure on central banks to tighten policy. As we move away from a post-COVID-19 recovery to a mid-cycle phase, inflation might be stickier than generally assumed. Additionally, supply-chain disruptions and labour shortages may persist for longer than expected, and the increase in energy and input costs might put more strain on businesses with more limited pricing power.

All in all, we feel that the risks to inflation and nominal yields are skewed to the upside, and portfolios should be positioned accordingly, see Our five-year forecast and scenarios: strap up for a two-speed recovery in this issue.

Equity market outlook: earnings versus valuations

We believe that markets will continue to be supported by earnings growth in 2022, albeit at a slower pace.

We also expect modest multiple contraction to persist as the growth/inflation mix deteriorates. According to IBES estimates, bottom-up analysts anticipate earnings growth to slow from 49% this year to 8% next. Given the macroeconomic backdrop, these expectations look reasonable. Factoring in some multiple contraction, to account for the risk of a growth slowdown and/or an inflation shock, would justify mid-to-high single-digit total returns for global equities in 2022.

Earnings

The stellar performance of equities since their March 2020 lows was driven by multiple expansion as earnings contracted. However, since January, this trend has reversed and equities have been driven by earnings growth, as economies have reopened, while valuations have contracted.

Valuations

From a valuation standpoint, equities may look rich on certain measures, but they are in line with their historical average relative to bonds. Global equities trade at 18-times forward 12-month earnings, versus 16 times on average over the past 30 years, and down from a recent high of 20 times last January. Relative to bonds, stock valuations are in line with history, with the global equity risk premium standing at 4.1%, essentially in line with its 20-year average.

Technology: selectivity is increasingly required

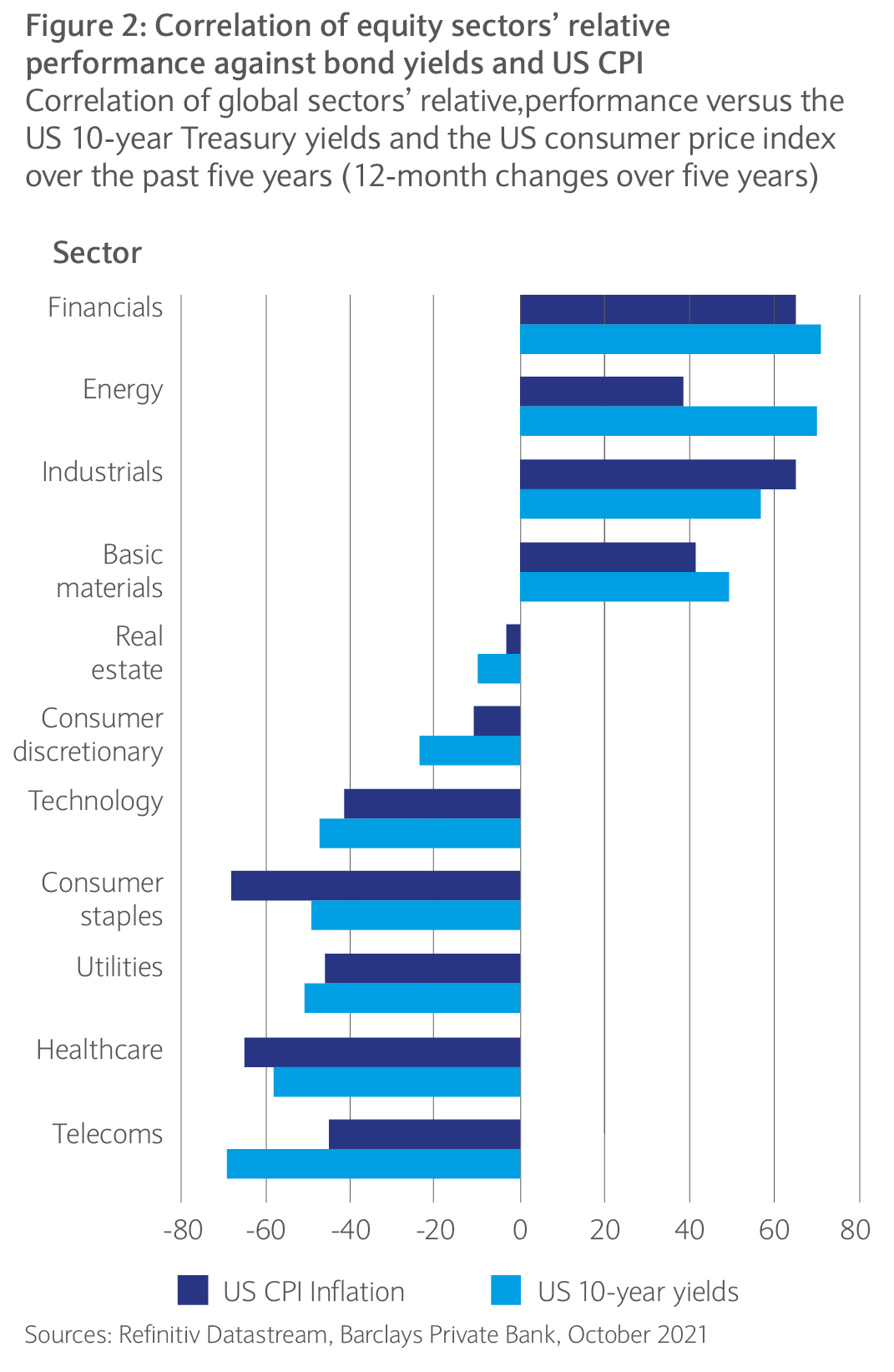

During the worst of the pandemic, the GICS technology sector became a “risk-off ” trade and a “place to hide”, due to the visibility it offered. As the global economy continues to recover, we believe that its risk-off status may be challenged. This might put pressure on the sector’s valuations, in particular if bond yields rise and work against the long duration of its cash flows.

Technology trades on a substantial 52% premium to the broader market, over two standard deviations above its 15-year average, which leaves it exposed to potential disappointments. While we continue to see attractive long-term opportunities within the sector, we believe that increased headwinds (greater regulatory oversight and possible far-reaching tax reforms) may weigh on sentiment and penalise parts of the industry in the short term.

Implications for regional equity allocations

Based on regional markets’ sector composition, our sector preferences point to increased support for non-US markets in the first half of 2022, and more specifically to Europe, including the UK, followed by Japan and emerging markets. Indeed, Europe and Japan, and to a lower extent emerging markets, have a greater exposure to the most cyclical parts of the market, with Europe and emerging markets being more heavily weighted towards financials.

Historically, non-US equities have tended to outperform in times of improving economic growth. With the dollar being a contra-cyclical currency, these periods have often coincided with a weaker dollar.