Growth has slowed in China, after booming in the first quarter of 2021, suffering from a slump in the property market, energy supply shortages and the effects of a zero-COVID-19 strategy. Growth will likely remain below-trend until authorities boost stimulus, possibly later in 2022.

China emerged from the COVID-19-induced recession ahead of its peers with output back to its pre-pandemic levels in second quarter of 2020. The early reopening of its economy, rapid industrial production and booming exports resulted in a record-breaking annualised growth rate of 18.3% in the first quarter (Q1) of 2021. However, growth rates have slowed sharply since as pressures from the slump in the property market, energy crisis and its zero COVID-19 strategy took their toll.

China’s economic growth in Q3 was the slowest in a year, with gross domestic product expanding by 4.9% compared to the 7.9% increase registered in Q2. Underneath the headline number, industrial production rose 3.1%, retail sales popped up 4.4% and fixed asset investment rose 7.3% over the first nine months of the year.

As the world’s largest exporter, China has benefited from the robust rebound in global demand. Appetite for both COVID-19 products (masks, medical and IT supplies) and non-COVID-19 products has soared over the past year, with exports registering around 39% growth year on year (y/y), in the first half.

Look forward to 2022, we expect coronavirus-related exports to contract as populations become vaccinated and restrictions are eased. We also anticipate that non-COVID-19 export growth will moderate next year to around 5% y/y, down from the lofty levels of around 25% in 2021.

Property market

In an effort to cool the housing market and reduce the risk of financial imbalances developing, Chinese authorities have tightened access to financing for real estate developers and reduced the pace of mortgage lending to home buyers.

The property sector has also been reeling from the troubles faced by the debt-laden property giant Evergrande.

The slowdown in the real estate sector is likely to worsen in the coming year and may see a 2-5% contraction in property investment by Q1. This decline will inevitably put pressure on China’s immediate growth profile, given that housing activity (including construction and property- related goods and services) accounts for around 30% of gross domestic product (GDP).

Energy crunch

A mixture of local and global pressures has created a major shortage of energy in China over recent months. Supply was impacted by the rush to hit energy-control targets, power-generation deficits on coal shortages and unstable renewable supply. The supply and demand imbalance was further exacerbated by burgeoning demand for Chinese manufactured goods as the global economy emerged from the pandemic lockdown.

Energy-intensive sectors, such as cement, steel and chemicals, as well as downstream car manufacturers, have faced the greatest impact from the energy shortfall

Around two-thirds of Chinese provinces have introduced power rationing, forcing many manufacturers to slow, or even stop, production. Energy-intensive sectors, such as cement, steel and chemicals, as well as downstream car manufacturers, have faced the greatest impact from the energy shortfall.

Outlook for energy

Even with the government relaxing energy-control targets (total energy consumption and reducing energy intensity), rationing of the industrial sector will likely persist into 2022, given the colder winter and air-quality assurances for the winter Olympics being held in the country. We project that the energy shortage will create a 50 basis point drag on growth through Q1. In an effort to offset some of the supply deficit, China is likely to expand its natural gas imports in coming months, potentially exacerbating supply issues in the global natural gas market.

The slowdown in the supply of credit is also impacting growth prospects. The expansion in credit growth in September was the slowest since 2003. The weakness is a reflection of sustained low levels of household loans, persistent shrinkage in shadow financing and contraction in government bond issuance relative to last year. This reduction has particularly weighed on credit-intensive sectors, with fixed asset investment growth almost halving this year compared to the 25.6% recorded in the first quarter of 2021.

Shift to services

For the past forty years China’s astonishing growth rate has primarily been driven by a mixture of robust manufacturing, exports and state investment. While these pillars of growth will continue to be important, it is anticipated that services will be the main driver propelling Chinese economic expansion over the next few decades. As such, economists closely monitor the growth rates of domestic consumption.

Unfortunately, the recovery in consumer spending has been far shallower than expected and continues to weigh on growth figures. China’s zero-COVID-19 strategy has encouraged authorities to introduce strict measures to moderate travel and reduce social interaction. These restrictions have held back sales across service sectors. The mixture of limitations on movement, changes in consumer behaviour and higher precautionary savings have also kept savings rates at elevated levels. Retail sales growth in September was nearly half the pace registered in July.

We expect retail sales averages to moderate further in 2022, with y/y growth of 6%, lower than the 8% registered in 2019 and 12-13% pencilled in for 2021. Long term, we believe the growing middle class population, rising urbanisation (70% of citizens by 2030) and wage increases will support both domestic and international growth.

Regulatory crackdown

The ramping up of regulatory control is a further factor that has impacted activity and investor sentiment. China has been tightening its grip on the technology sector, with regulators launching investigations into suspected monopolistic practices.

The State Administration for Market Regulation has focused its attention on internet-based platforms. The regulator has imposed harsh restrictions and demanded that firms overhaul their operations. In August, measures were imposed to restrict children’s online gaming time to three hours a week. The technology industry is not the only sector which has been facing greater scrutiny, with China also banning private education companies from going public or making a profit. A review of casino operators in Macau also sent a shockwave through the sector.

The rationale put forward by authorities for the measures are threefold: first, to guide resources away from the internet sector and back into core technology sectors; second, to better protect consumers and mitigate social issues; and third, to address data and national security issues.

The broader macroeconomic hit [from regulatory interventions] has been less pronounced…we believe that the worst from the regulatory shocks may now have passed

While the intensified regulatory interventions may have affected related equities, the broader macroeconomic hit has been less pronounced. Households are expected to switch their consumption away from afflicted areas. The higher levels of uncertainty are expected to reduce IT services growth and provide a short-term impact on services employment. But we believe that the worst from the regulatory shocks may now have passed.

Growth profile

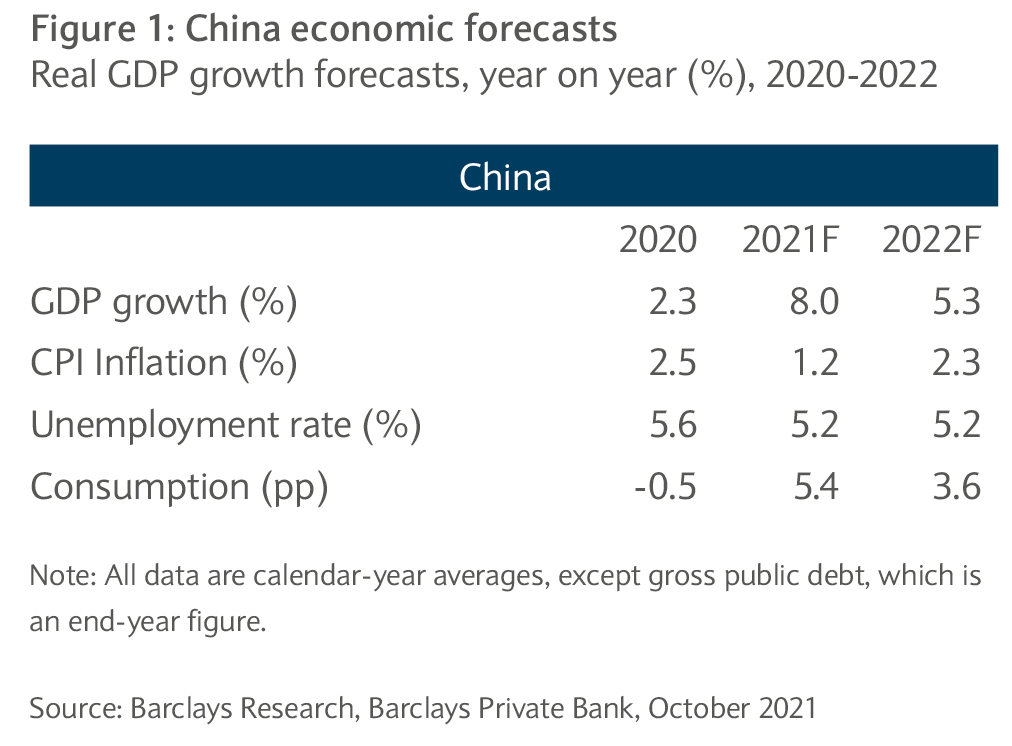

With the two main drivers of property and exports output easing, and only a gradual pace of recovery in consumption and investment, we think that Chinese GDP growth will moderate to 5.3% in 2022 (see figure 1), from 8% in the prior year. With few signs that authorities are prepared to abandon a zero-tolerance policy, the emergence of a new COVID-19 variant continues to be the biggest risk to growth.

Despite the downward pressure on activity, the People’s Bank of China, at least in the short term, is expected to focus on maintaining liquidity in the financial system through its medium-term lending facility. We predict that further injections of liquidity are more likely than a cut to its benchmark loan prime rate, or further reduction in the reserve requirement ratio.