Market Perspectives May 2021

Investor sentiment remains buoyant, despite accelerating Indian COVID-19 cases, with encouraging economic signs in the US and China.

07 May 2021

By Julien Lafargue, CFA, London UK, Chief Market Strategist

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

Equity markets keep powering higher. But for how much longer, as several peaks in earnings, momentum and policy approach that may challenge the bullish sentiment. In this context, investors might look for quality and growth opportunities rather than speculative value ones.

Getting closer to our bull case

Earlier this year, following a stronger-than-expected fourth quarter earnings season, we revised higher our assessment of equity markets’ fair value. Although it is still very early days, initial results for the first quarter of 2021 seem to be heading that way.

In the US, over the last three months, the consensus for full-year 2021 earnings per share estimates has risen to $180 from $170 for the S&P 500. While we would not change our fair value estimate just yet (still around 3,900), our bull case scenario (4,200) is becoming increasing likely given the strong earnings backdrop.

A note of caution

Our reluctance to be more bullish stems from our concern that positive surprises will be much harder to come by.

Equity markets tend to respond to momentum, or the rate of change, rather than to absolute levels. This second derivative, is in our opinion, likely to deteriorate on several fronts in the coming months as we approach a series of “peaks”. While this is not necessarily the cue for a correction, it should limit short-term upside.

Peak economic momentum

The first of the peaks we see on the horizon is around economic momentum. This is particularly true in parts of the world where the pandemic is being brought under control. In this context, China and the US look particularly vulnerable.

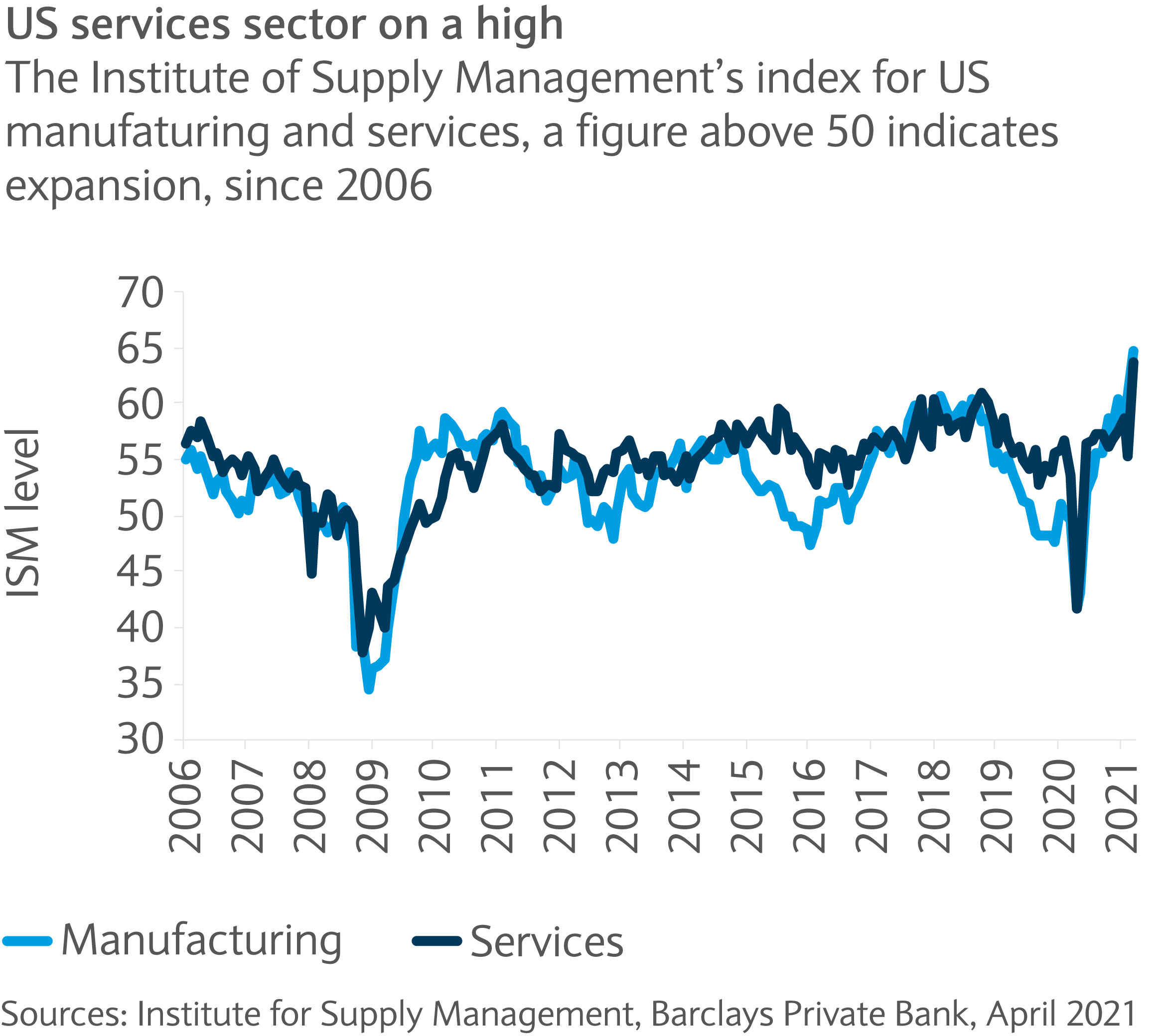

In China, while gross domestic product (GDP) leapt 18.3% year-on-year in the first three months of the year, this was a function of easy base effects. On a quarter-on-quarter basis however, the growth rate slowed to 0.6%, pointing to a decelerating recovery. Similarly, in the US, the ISM services index jumped to a record level of 63.7 in March as the economy started reopening (see chart). While the next couple of months are likely to show continued strength, the momentum will inevitably slow as economic life gets closer to normal.

Peak monetary easing

Central banks’ accommodative policy stance has been a key driver of the bull run in equities over the last twelve months. By pumping an unprecedented amount of liquidity into the system and keeping interest rates low, the policy boosted valuations and risk appetite. However, at this stage and bar a resurging pandemic, it’s hard to envisage a scenario where central banks would become even more dovish. While tightening may be at least a few quarters away, the liquidity impulse should start slowing in the coming months.

Peak fiscal support

Just like monetary support, fiscal stimuli appear to have peaked. In the US, there is now a better understanding of the size and scope of the various plans put forward by Joe Biden’s administration. Importantly, additional government spending isn’t unequivocally positive anymore as it comes with offsets in the form of higher tax rates.

In this context, the UK set a precedent by announcing a hike in corporate tax rates starting in 2023. In Europe, while there seems to be more room to manoeuvre, timing is an issue as member states are yet to receive money from the €750bn recovery package that was approved last year.

Peak earnings growth

One reason why we believe staying invested in equities is important is because, over the long term, there seems little reason to believe that earnings will stop growing. In the short term too, we expect positive earnings growth. However, the rate of that growth will likely slow significantly in the next few quarters.

Looking at the S&P 500, the consensus expects year-on-year EPS growth of 34%, 57%, 21% and 15%, respectively, in the four quarters of this year. While companies have demonstrated their ability to surpass expectations, it is likely that growth will slow sequentially starting in the third quarter (see chart). This change in momentum may challenge valuations, especially for companies with a strong cyclical and value tilt.

Other peaks ahead

On top of economic momentum, fiscal and monetary support, and earnings growth, a couple of other variables may peak this year. First, at least in the developed world, the marginal benefits of increased vaccinations are likely to diminish as herd immunity is reached. Second, as we have explained previously, inflationary pressures are likely to peak in the summer. While this may be seen positively, it also suggests that the recovery may be losing steam.

Reasons to be hopeful

Although the best may be behind us now, there are still a few parameters that could keep improving. First, while investor sentiment is generally positive and inflows have been strong so far this year, positioning remains relatively light based on both our observations and industry surveys. Second, while China, the US and the UK appear to have – or be close to – fully recovered, the same can’t be said about Europe and most emerging markets. This decoupling is somewhat encouraging as it could help drive the second leg of the recovery.

Finally, parts of the economy should continue to grow strongly, irrespective of the what’s happening on the COVID-19 front. This appears particularly true for sectors and industries linked to climate change, new technologies (such as artificial intelligence, cloud computing or automation) and healthcare.

Stay invested and diversified

In the current context, we believe investors should stay invested as the medium-term outlook remains constructive. Similarly, appropriate diversification and targeted use of active management remain essential to navigate what remains a very uncertain backdrop.

However, because of the peaks ahead this year, investors might want to dial down their cyclical exposure to more neutral levels. This combined with a continued focus on quality should allow portfolios to weather what is likely to be a bumpier road ahead.

Investor sentiment remains buoyant, despite accelerating Indian COVID-19 cases, with encouraging economic signs in the US and China.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.