Market Perspectives May 2021

Investor sentiment remains buoyant, despite accelerating Indian COVID-19 cases, with encouraging economic signs in the US and China.

07 May 2021

By Michel Vernier, CFA, London UK, Head of Fixed Income Strategy

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

Emerging market bonds have recovered well since the depths of a financial markets sell-off in March last year. While opportunities remain, a cautious and selective approach seems warranted.

Are emerging market bonds cheap?

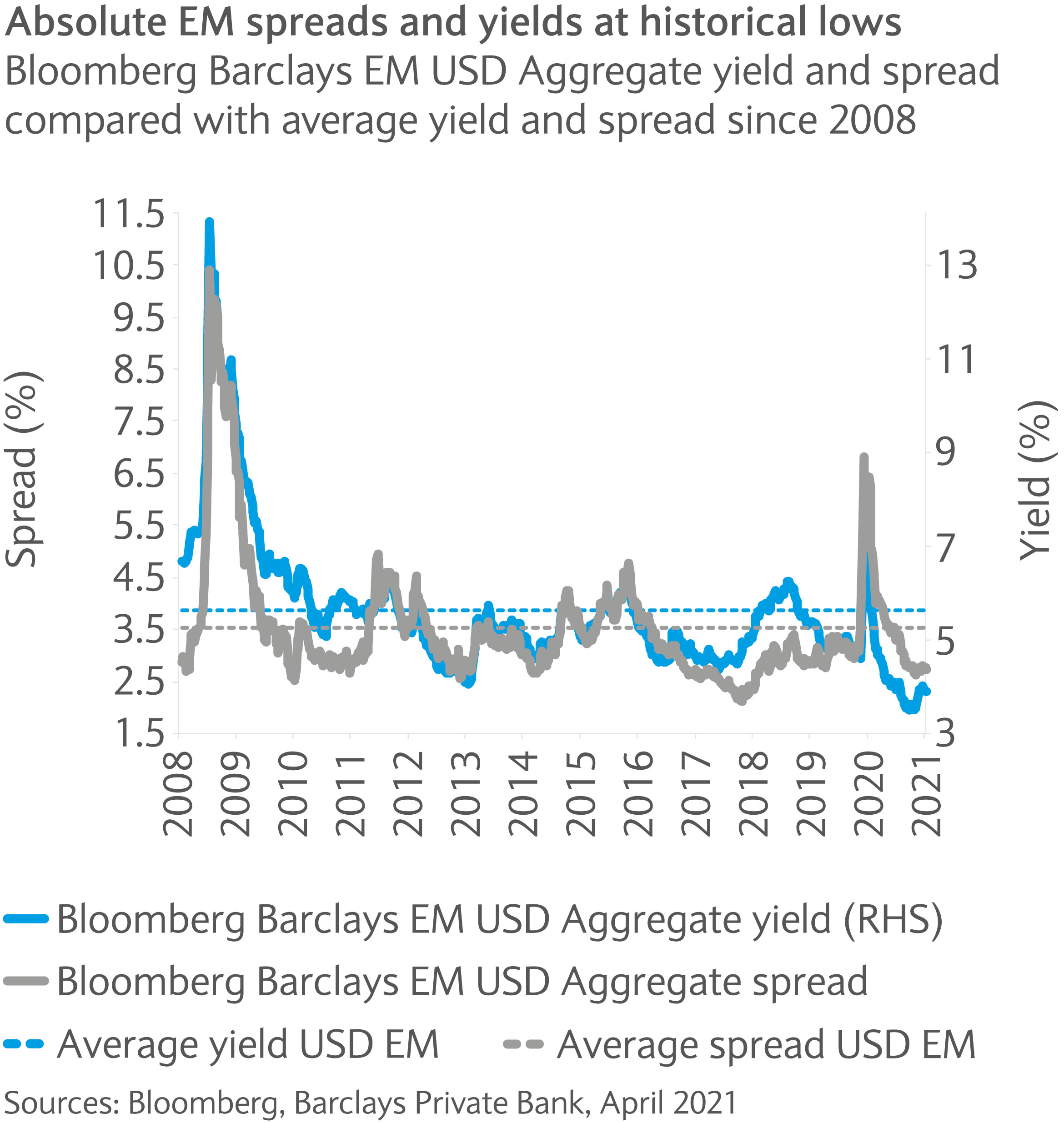

Since the peak of the market crisis 12 months ago, emerging market debt (EMD) has recovered in line with other riskier parts of the global bond segment. From a historical perspective both yields and spreads sit close to multi-year lows and do not appear cheap anymore. The average yield of the Bloomberg Barclays Emerging Market USD bond index is just below 4%, while spreads are just below 300 basis points (bp) on average.

However, in comparison to US high yield or BBB-rated US investment grade bonds, EMD seems reasonably valued. Spreads of emerging market US dollar bonds are only 20bp, lower than the ten-year average of 140bp. At the same time, EM dollar spreads offer 190bp more in yields compared to their BBB-rated US counterparts. Given the average rating of the respective EM USD bond index is at BBB-/Baa3, EM bond spreads seem to offer value (see chart). In order to draw an early conclusion, it seems crucial to consider the fundamental and risk aspects first.

How are EM countries coping with the COVID-19 pandemic?

Coronavirus infection trends, death tolls and vaccination rollouts suggests that EM countries have been hit disproportionally hard by the crisis. Brazil initially recorded the largest number of COVID-19 cases after America, and faces the second highest death toll after the US, according to Johns Hopkins University. Meanwhile, the trend in India worsens with daily new cases of the virus regularly breaking 300,000 in recent weeks, having overtaken Brazil on total cumulative cases. Also, Turkey is challenged by cases, now over 4.7m.

At the same time, a number of countries, like Russia, the Gulf region and Israel, appear to have contained infection rates relatively well. This seems to be largely a result of rapid and effective vaccine rollouts. The pace of the vaccine rollout and infection levels are likely to have a large bearing on the economic prospects and EM asset volatility in coming months. Furthermore, national efforts vary substantially which should be taken into account.

What is the growth outlook for EMs?

After the worst recession since the second world war, the global economy has rebounded strongly thanks to growth in the US and China that represents more than 40% of the world’s output. The higher activity and global demand is likely to provide a much needed boost for EM exports.

The US president’s $1.9tn US fiscal package and additional infrastructure plans seem particularly supportive for Asian exporters. While China has returned to trend growth, the International Monetary Fund (IMF) expects that many EM countries will only reach this point by 2023 at the earliest. The recovery in oil price is likely to help Gulf countries, Brazil and Russia (though detrimental for India or Turkey) while a slow recovery in tourism could put pressure on account balances of central Asia, Turkey and most Caribbean countries.

The above underlying trends are positive, but the recovery in EM will differ substantially. This will likely be reflected in the respective bond performance and credit rating transitions in each country.

Will a potential US rate rise cause another 2013 sell-off?

Ever since the so-called taper tantrum in 2013, when the US Federal Reserve announced plans to reduce its bond-buying programme, market participants are more sensitised to higher US rates and the potential negative repercussions for EM assets.

Higher US rates tend to lead to lower international flows into EM assets as the carry return appears less attractive. Indeed, since US rates started to rise on the back of Joe Biden’s victory in the presidential election, EM bond performance has lagged that of US high yield bonds for example. But this was more a result of the longer duration EM bonds carry in average. EM bond spreads in turn are less affected by higher nominal rates and were only to a certain extent affected by higher US real rates.

Especially rapidly and significant moves in real rates pushed EM spreads higher historically. A gradual rate surge by comparison often accompanies better economic global prospects along with higher oil prices, which tend to support emerging markets.

Are China’s state-owned enterprises facing a default wave?

China went first into the pandemic and was one of the first countries to reach trend growth again. Overall, the outlook for the country looks constructive. It seems likely that China’s gross domestic product (GDP) will grow by 9.4% this year. The brighter prospects should support Chinese bonds.

Markets, meanwhile, are more concerned about potential stress in state-owned-enterprises (SOE) after the restructuring of the deeply indebted asset management firm Huarong this year. The recent commitment of the central bank suggests a continuation of China’s unwritten support for SOEs. However, the situation may warrant increased selectiveness, especially with the country’s intention to reduce credit growth by implementing tighter financial conditions.

A tightening of financial conditions triggered a default cycle in the wider credit space in China in 2018. A repeat seems unlikely, but volatility may re-emerge, especially in the higher leveraged high yield property sector.

Will the latest sanctions put Russia’s recovery at risk?

Russia seems relatively well placed given its own vaccine, higher oil prices and relatively solid credit profile. Rating agency Moody’s expects the government debt-to-GDP ratio to remain below 20% by the end of this year. This is also reflected in relatively tight spreads in the Russian sovereign and corporate bond space.

The main challenge facing Russia may emerge from a widening of sanctions against it, after the US initiated its first measures under the Biden administration. While there is room for diplomatic solutions in the near future, bond markets will closely follow communications from each side. Russia has low dependency on external funding and credit quality is unlikely to be affected much. However, tight spread levels leave potential for volatility.

How much will the political environment affect Brazilian bonds?

The political landscape has already affected bond spreads and the currency significantly. On one hand Brazil has been early to implement fiscal measures in large scale. On the other hand, it failed to implement an effective strategy to contain the virus at an early stage and the president faces large political headwind domestically.

Record virus cases and an above average death toll rate are the biggest challenges for the country. Meanwhile, the government’s focus was on the “golden rule”, or debt limit. A breach has been circumvented as extraordinary aid spending has not been included in the deficit calculation. Brazil has blurred the lines between the debt rules and the actual spending, with a decline in investors’ confidence.

The Brazilian real has been one of the worst performing EM currencies versus G10 currencies since March 2020, reflecting a lack of trust. As of late, the government seems to have ended the budget deadlock with new rules implemented by President Bolsonaro. This paves the way for aid payments, while staying compliant with debt rules. Only time will tell if this will be sufficient to gain investors’ trust given higher debt levels, gross debt to GDP at almost 90%.

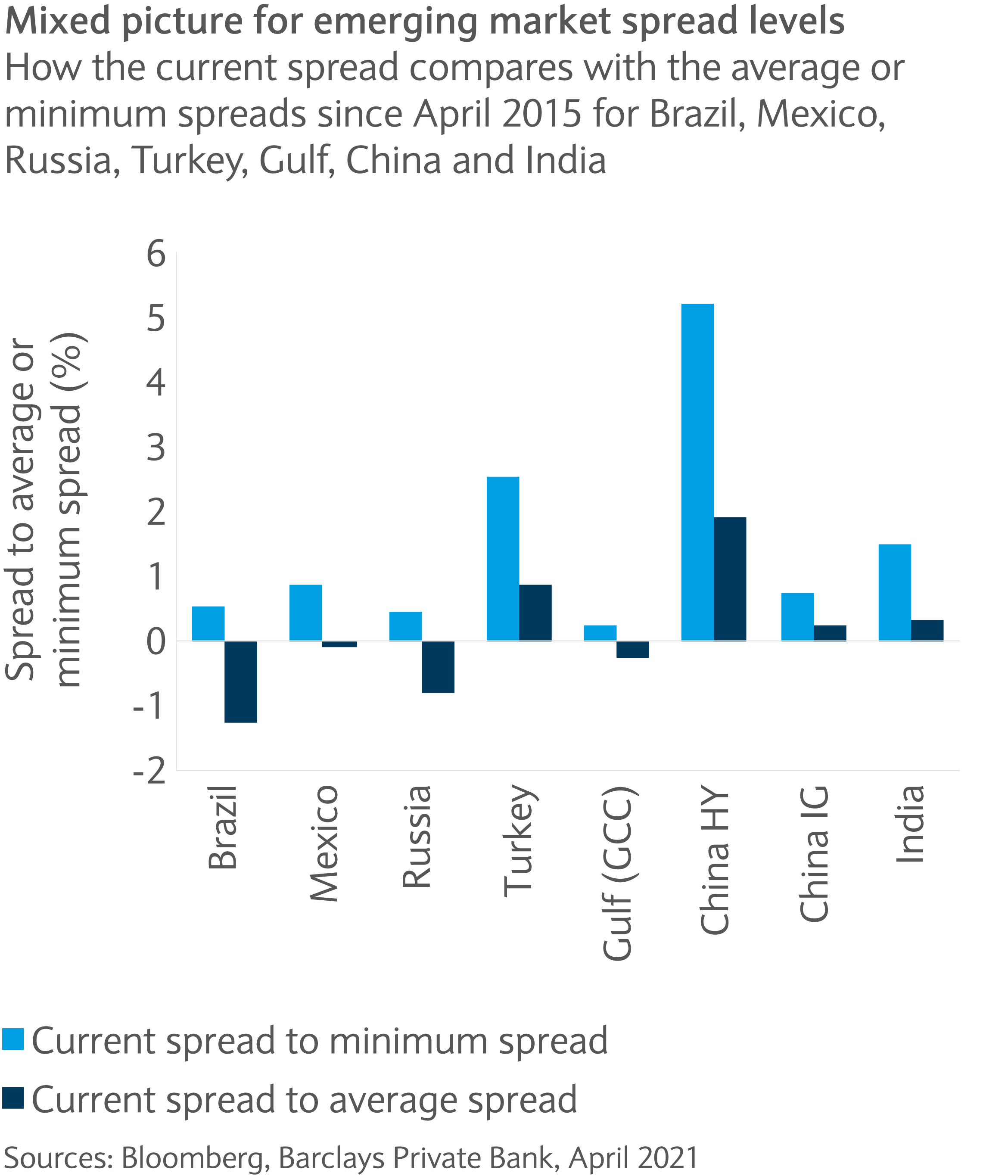

The central bank has the delicate task to fight inflation and currency weakness with rate hikes without compromising the vulnerable growth. Bond spreads in the region have underperformed, reflecting the risk to a large part (see chart). While volatility remains likely, bonds in the region seem to offer carry opportunities on a selective basis.

Turkey torn between high yields and high inflation. What is the way out?

In some ways Turkey appears in a similar situation to Brazil (high COVID-19 cases, weak currency, higher inflation, higher debt levels and political uncertainties). A closer look reveals that the nature of the challenges differs in many ways. Turkey is primarily challenged by low currency reserves (around $45bn) and high uncertainty around the central bank’s policy, the leadership changing three times in two years.

In addition, Turkey cannot take advantage of higher oil prices as, opposed to Brazil or many other emerging markets, the country is an importer of oil. This leaves Turkey highly dependent on revenues from tourism. Surging virus cases may put a recovery at risk. On the flip side the country’s debt level is lower and leaves room for spending. Turkey has also managed to deliver positive GDP growth in 2020 (1.8%).

Turkish bond spreads are generally high. While the banking sector may be most exposed to external funding uncertainties, domestic corporate bonds combine higher yields with reasonable stable credit profiles.

Will non-performing loans challenge Indian bank bonds?

The economic backdrop for India seems clouded given the surge in weekly cases which has an immediate effect on mobility and economic output. A fast pace vaccine rollout should help however to bring India back on a high growth path. India’s deficit has been smaller than expected and leaves further room if required. In addition, the Reserve Bank of India (RBI) has been early to support with large scale measures which also supported the financial sector.

Indian banks have been historically challenged with higher gross non-performing assets (GNPA) from its loan portfolios. At the same time the central bank is working on reforms in order to deal with a struggling shadow banking system. GNPA have been declining to 7.5% but the RBI expects that the ratio will increase by six percentage points (bank stress test baseline scenario) as we go along the crisis.

While this seems worrying, provisions are high and especially public sector banks should enjoy ample support while large private banks show solid tier 1 ratios of over 12.4% in average. However, any setbacks may particularly hit smaller banks and the shadow-banking sector, possibly leading to higher spread volatility for the banking sector. While larger banks seem well insulated from distressed risk, comparably tighter spread levels don’t seem to compensate for the risk in the sector.

What are the main risks and where are opportunities?

Most larger emerging markets acted early and in significant scale with monetary and fiscal support which should help in the recovery. As with developed countries, any growth setback poses a risk. Largely indebted countries in particular will reach their limits should additional support be required. Even if the region is finding its way to trend growth, inflation is likely to put pressure on consumers and central banks, which have already responded with rate hikes.

In this environment currency volatility can rapidly lead to capital market outflows with strong price repercussions. Countries like India or Russia seem more insulated from this risk than many, but with spreads close to multi-year tights the risk of widening is high. At the same time, Brazil and Turkey appear vulnerable but spreads, at least in the case of Turkey, have partly priced in the elevated risk. Company and sector selection in each market seems the most efficient approach.

Investor sentiment remains buoyant, despite accelerating Indian COVID-19 cases, with encouraging economic signs in the US and China.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.