Market Perspectives May 2021

Investor sentiment remains buoyant, despite accelerating Indian COVID-19 cases, with encouraging economic signs in the US and China.

07 May 2021

By Damian Payiatakis, London UK, Head of Sustainable & Impact Investing and Olivia Nyikos, London UK, Responsible Investment Strategist

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

Carbon markets play a critical role to support companies and governments transition to a low-carbon economy. Do they offer an opportunity for investors to boost returns while making a better world?

More governments and companies are committing to net zero targets, where any greenhouse gas (GHG) emissions are balanced by absorbing an equivalent amount from the atmosphere.

But achieving this ambition is not possible immediately; nor potentially at all for some industries. Carbon credits and offsets provide a mechanism to counterbalance GHG emissions by paying for another activity that avoids or reduces the equivalent emissions.

With increasing demand and, in some cases, a limited supply, investors are starting to consider whether carbon markets provide an attractive market play. We review whether the carbon credit market can generate alpha as well as to make a positive contribution with their capital.

Understanding carbon credits

A carbon credit, or allowance, is a tradable permit or certificate that provides its holder with the right to emit, or have emitted, one ton of carbon dioxide (CO2) or an equivalent of another greenhouse gas.

Carbon credits were created to mitigate climate change by encouraging the reduction of GHG emissions. They generally come from four categories of activity: avoided nature loss (including deforestation); nature-based sequestration of carbon, such as reforestation; avoidance or reduction of emissions, such as reducing methane release from landfills; and technology-based capture and removal of carbon from the atmosphere.

Two types of markets

Carbon credits are available through two types of markets: cap-and-trade and voluntary. Cap-and-trade markets (also known as compliance or regulatory markets) are those which have mandatory upper limits (“caps”) on the carbon emission a single unit can produce. Governments or regulatory authorities set the caps on greenhouse gas emissions at either national and/or sector levels.

For some companies within the regulation, the reduction of emissions is not economically viable, and instead, they purchase carbon credits to comply with their emission cap. Conversely, companies that achieve their emissions reductions are usually rewarded with additional carbon credits. This surplus can be sold to generate revenue or subsidise future projects for reducing emissions.

Voluntary carbon credits do not have any governmental mandate but exist due to the willingness of private investors, governments, non-governmental organisations and businesses to reduce their net emissions. Carbon credits are typically referred to as “offsets” and originate from carbon reductions outside of regulated industries.

The evolution of trading credits

Carbon trading began as part of the 1997 UN Kyoto Protocol, the first international agreement to cut CO2 emissions. Its Clean Development Mechanism (CDM) allowed industrialised countries with commitments to reduce or limit emissions to implement emission-reduction projects in developing countries.

Since that time, the popularity of carbon trading has been varied. Some regional schemes, such as the EU’s emissions trading system (ETS), have gained ground. But, so far, they cover between them just 16% of emissions and are still priced below the $40-$80 per ton level recommended, according to the Carbon Pricing Leadership Coalition1.

There are significant differences in pricing between credits generated by regulation in specific industries and approved offsets in alternative industries and projects.

Demand set to rise

However, as efforts to decarbonise the economy increase, demand for carbon credits will likely continue to rise. Consultancy McKinsey estimates that the annual global demand for carbon credits could reach 1.5 to 2.0 gigatons of carbon dioxide (GtCO2e) by 2030 and up to 7 to 13 GtCO2e by 2050.

With governments accelerating their commitments to net- zero timelines, this likely means that the supply of available credits will shrink even faster. Indeed, from 2013 to 2020, the volume of issued EU permits fell by 1.7% annually.

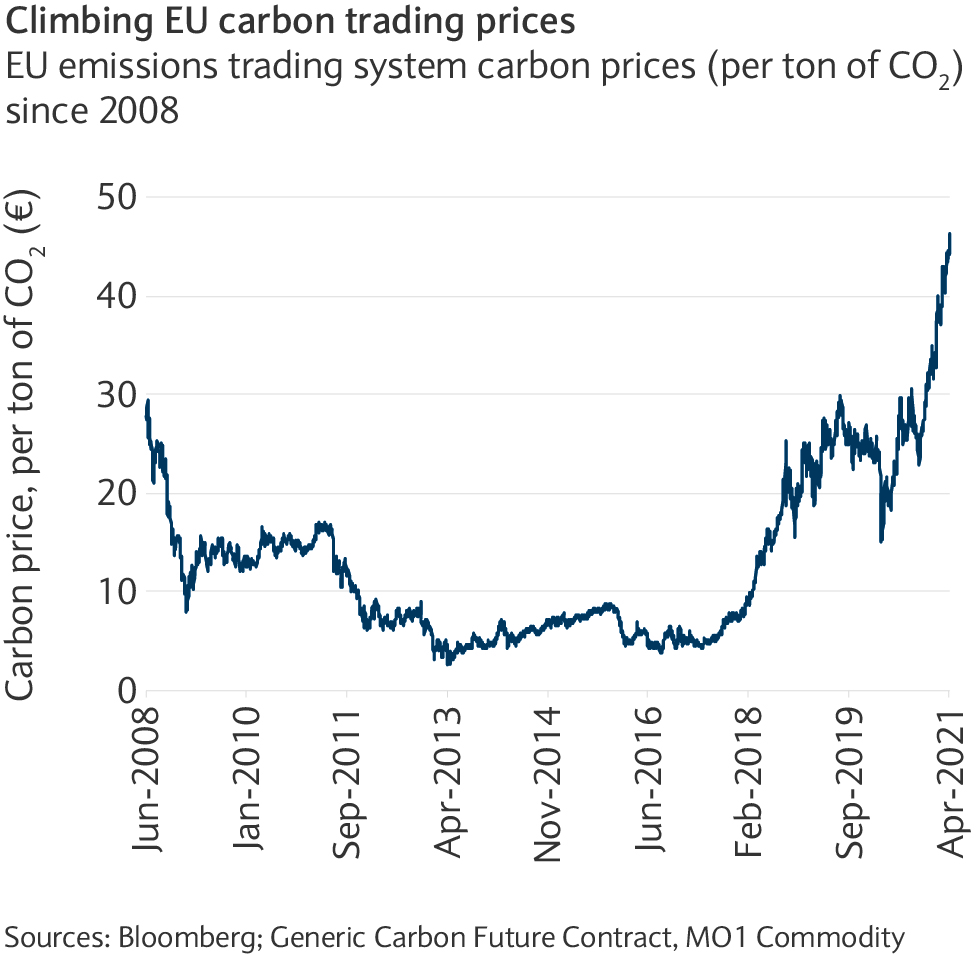

From this year, the permits will drop by 2.2% until 20302. This has revived EU emissions trading system (ETS) prices (see chart). Oversupply of available credits caused a price collapse in 2012. On the current trajectory, this would mean pricing the cost of emissions could be between $50-80 per ton by 2024.

A challenging market

A market with growing demand and, in some cases, limited supply should provide scope for attractive for potential investment opportunities. However, the opportunity seems less clear than economic theory would suggest.

While credits provide the most direct and regulated markets, most of the available opportunities are in offsets. Credits from independent crediting mechanisms in this voluntary market have accounted for almost two-thirds of those issued in 20193.

While offsets grow in availability, high-quality ones are scarcer given diverging accounting and verification methodologies. Some offsets have represented emissions reductions that were questionable at best. Additionally, credible emerging arguments suggest that offsets should only be available as a last choice, rather than first, for companies to mitigate their emissions.

Even when using science-based verification, suppliers endure long lead times to get assurance for new offsets. Then, they face unpredictable demand and highly variable spot prices. Limited pricing data makes it difficult for suppliers to manage the risk they take on by financing and working on carbon-reduction projects without knowing how much buyers will ultimately pay. It can also be challenging for buyers to know whether they are paying a fair price.

Regulatory risk

Even the value of existing credits may be called into question as they age or become “legacy” projects which may be a decade or older. A risk exists that regulators, wanting to accelerate GHG emissions reduction, may withdraw acceptance of these credits, rendering them worthless at a particular point.

Given various country and regional schemes, each with its own systems, this divides the overall market further. Some efforts to coordinate and connect various schemes have been initiated, such as Swiss and European emissions trading systems becoming interchangeable in 2020. But overall, much awaits COP26 in November as carbon markets and pricing are key topics for the conference.

The market potential

The result of the above challenges is a carbon trading market that is fragmented and complex. Overall, it can be characterised by low liquidity, scarce financing, limited risk-management services and imperfect data availability.

For those with strong risk tolerance and a willingness to speculate, these may provide ideal conditions for active investment. For most, accessing the market directly and trading in offsets is likely to be more a wager than an investment. However, new offerings have started to come to market to structure and, partially, de-risk the carbon trading market. Such markets may provide investors access and more clarity along with additional costs for those considering the long-term investment potential.

For investors looking to profit from the transition to a lower-carbon economy, selecting companies whose products and services reduce emissions may offer a simpler and more direct way to achieve environmental objectives and attractive returns.

Investor sentiment remains buoyant, despite accelerating Indian COVID-19 cases, with encouraging economic signs in the US and China.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.