Market Perspectives May 2021

Investor sentiment remains buoyant, despite accelerating Indian COVID-19 cases, with encouraging economic signs in the US and China.

07 May 2021

By Jai Lakhani, CFA, London UK, Investment Strategist EMEA

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

As we enter a post-pandemic world, can private markets play a role in helping governments invest in infrastructure assets in attempts to boost growth through an ESG lens?

Infrastructure investments are widely defined as physical assets needed for economic and social development. Large-scale investments can boost demand in the short-run, through the labour employed in constructing them, and lower supply-side costs in the longer term.

The sector lies at the core of many governments’ efforts to resuscitate economies in light of the COVID-19 pandemic. For instance, the US president’s $2.2tn infrastructure proposal, the EU’s €750bn recovery fund and the strong infrastructure demand from China so far this year.

Investors set to boost infrastructure allocations

Investors have long recognised the importance of infrastructure. Among those surveyed by alternatives data provider Preqin for their Future of Alternatives 2025 report published in November, 56% expect to increase their allocations to infrastructure assets in the next five years, with just 7% expecting to lower allocations.

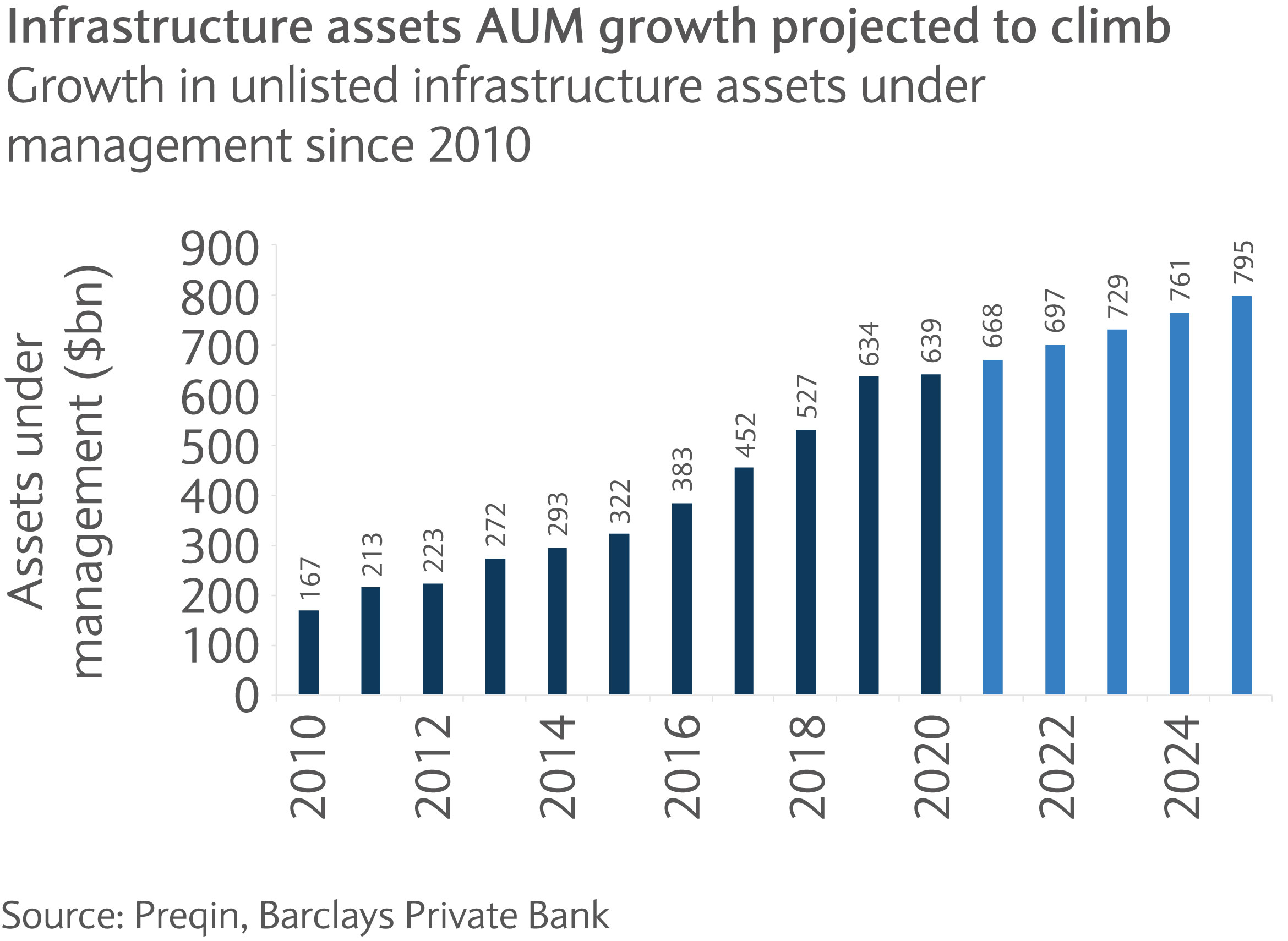

Preqin also forecasts that as a result of investor appetite, unlisted infrastructure assets under management will grow at a compound annual growth rate of 4.5% from $639bn in 2020 to $795bn in 2025 (see chart).

The attractions of infrastructure

The need for infrastructure has been even more pronounced given the pandemic. It has highlighted the fragility of supply chains, the attractions of technological advancements (especially in sectors reliant heavily on human capital) and the ever-growing focus on addressing climate change. Solving these issues will involve “smart” infrastructure.

In furthering innovation, digital infrastructure such as fibre networks, data storage facilities and telecommunication towers will move from being desirable to a must have.

What’s more, data storage facilities, alongside 5G networks and the internet of things (IoT), have the potential to revolutionise urban areas into “smart cities”. Urbanisation is a very important trend. According to the World Bank, urban areas are responsible for 85% of economic activity and as the world’s population increases, activity in cities will only go up.

Consequently, new transport systems will be required, buildings will need to be transformed and water and waste management facilities will have to address the extra demands of higher populations.

Helping to deliver smart cities and ESG goals

Infrastructure will help to develop smart cities that are more connected, while doing so through the lens of environmental, social and governance (ESG) factors.

Around 70% of future greenhouse gas emissions may come from infrastructure yet to be built. That means that data storage centres, for instance, will likely be evaluated against their energy usage given that they produce the same carbon footprint as the aviation sector.

Transport systems will need to be designed with clean energy and electric cars will likely continue to increase as the technology is developed and they become more affordable. This in itself provides an opportunity for infrastructure in terms of the growing need to adapt car parks into charging stations.

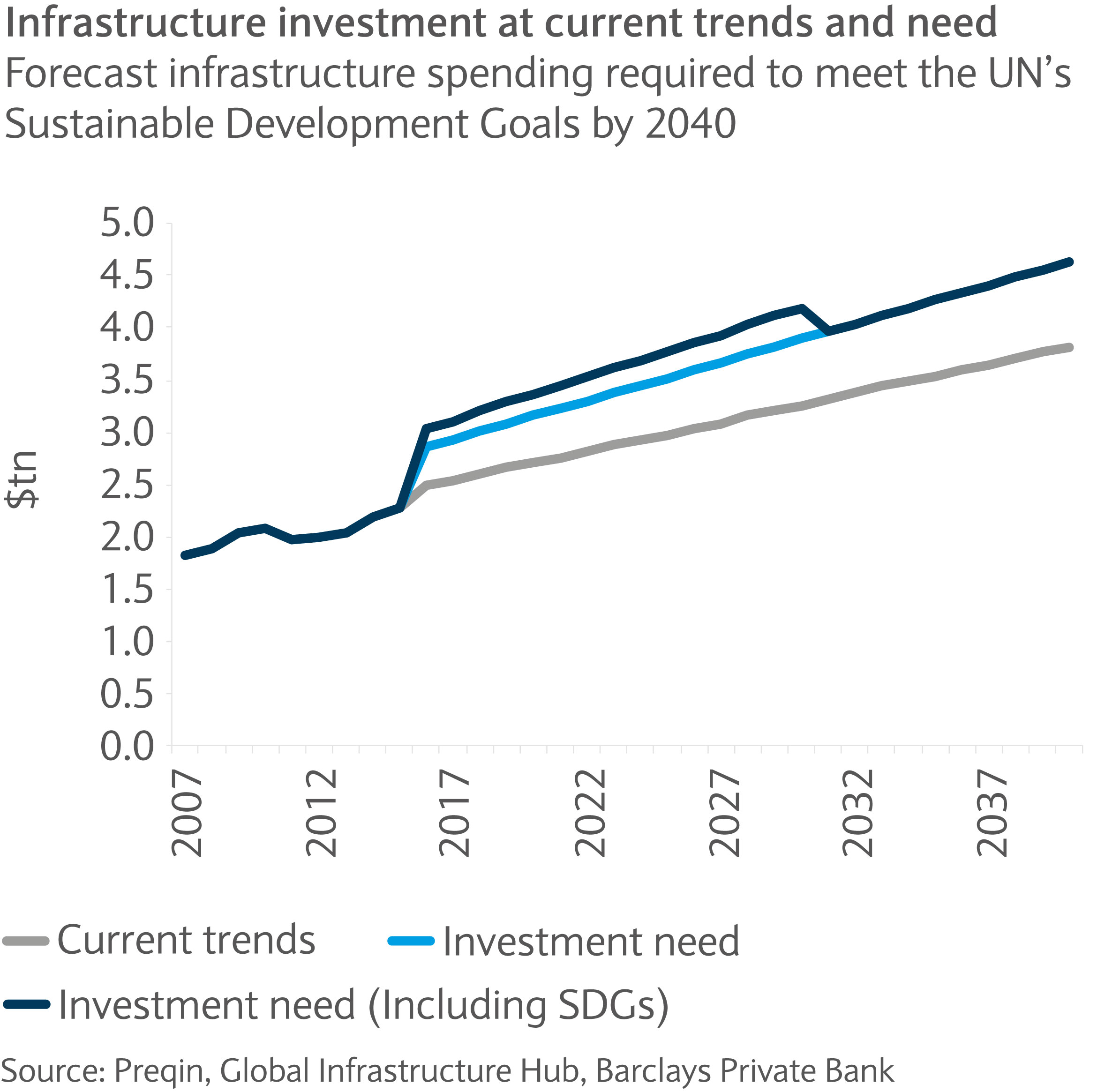

The G20 Global Infrastructure hub estimates that there will be an $18tn infrastructure gap in the period to 2040 to meet the UN’s Sustainable Development Goals. While there are government initiatives aimed at boosting infrastructure, it is doubtful that administrations can do it alone with fiscal constraints also tying their hands (see chart).

Opportunity available to private markets

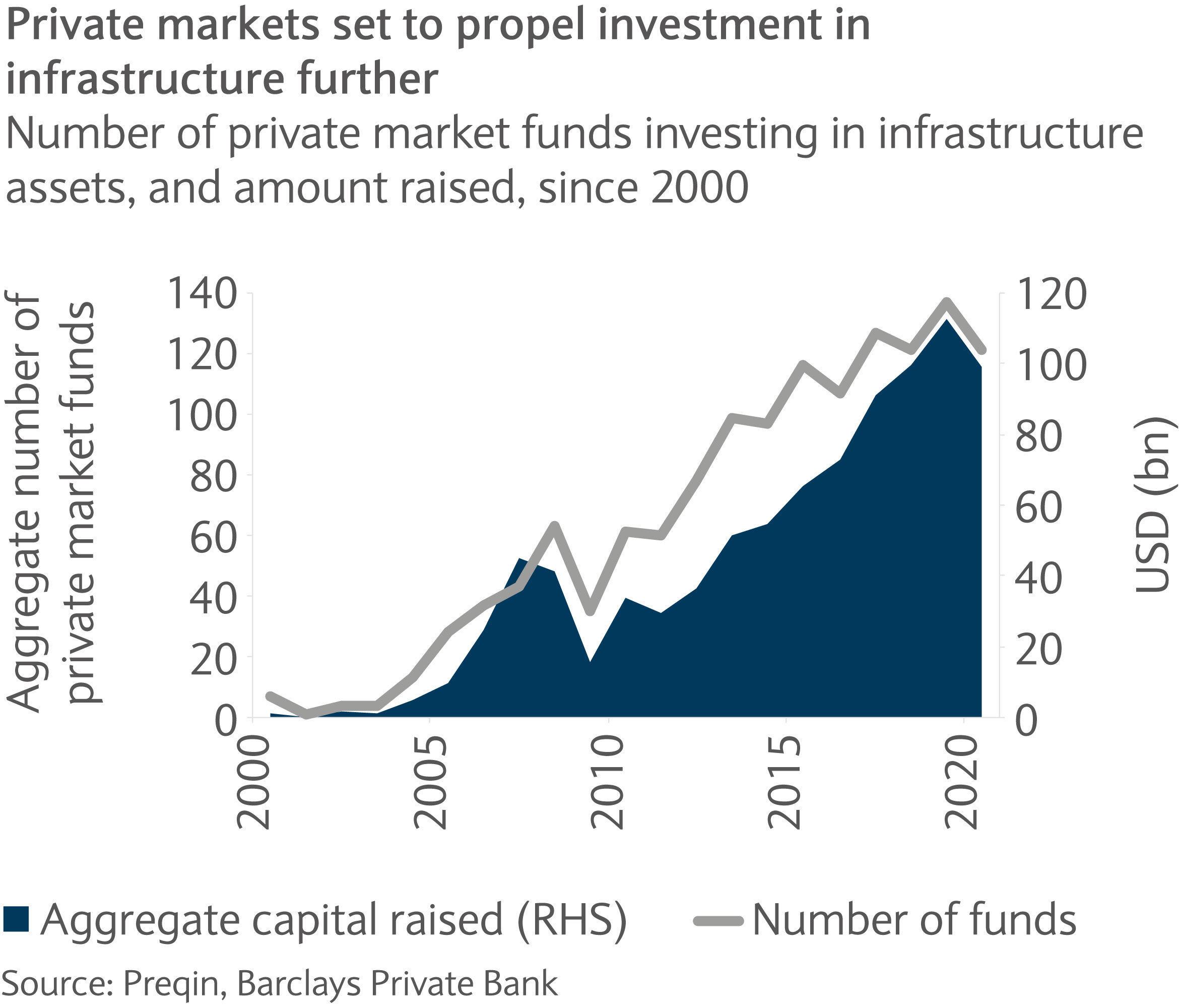

Furthermore, due to the innovation required, private markets appear more tailored to developing smart cities, improving internet infrastructure and driving the internet of things among other areas. Private markets certainly appear to be increasingly up for the challenge, with the capital raised growing rapidly over the past decade (see chart).

The chart highlights that the number of private markets funds investing in infrastructure assets has increased significantly. In other words, there is a wider opportunity set for investors to choose from.

Uninvested funds falling rapidly

Data from Preqin shows that dry powder’s, or un-invested funds, share of assets under management has fallen from 42% of infrastructure fund assets in 2010 to 35% at the end of 2019, suggesting fund managers are sourcing opportunities as the sector grows.

Private markets: mitigating equity and fixed income market risks

Investors currently face equity valuations that are, at least at an index level, somewhat stretched along with elevated levels of volatility. In the fixed income market, even after accounting for the recent rate sell-off, yields are at historical lows and in real terms, deeply negative and inflation risk is a rising concern. Accessing private market infrastructure opportunities could help to mitigate these problems.

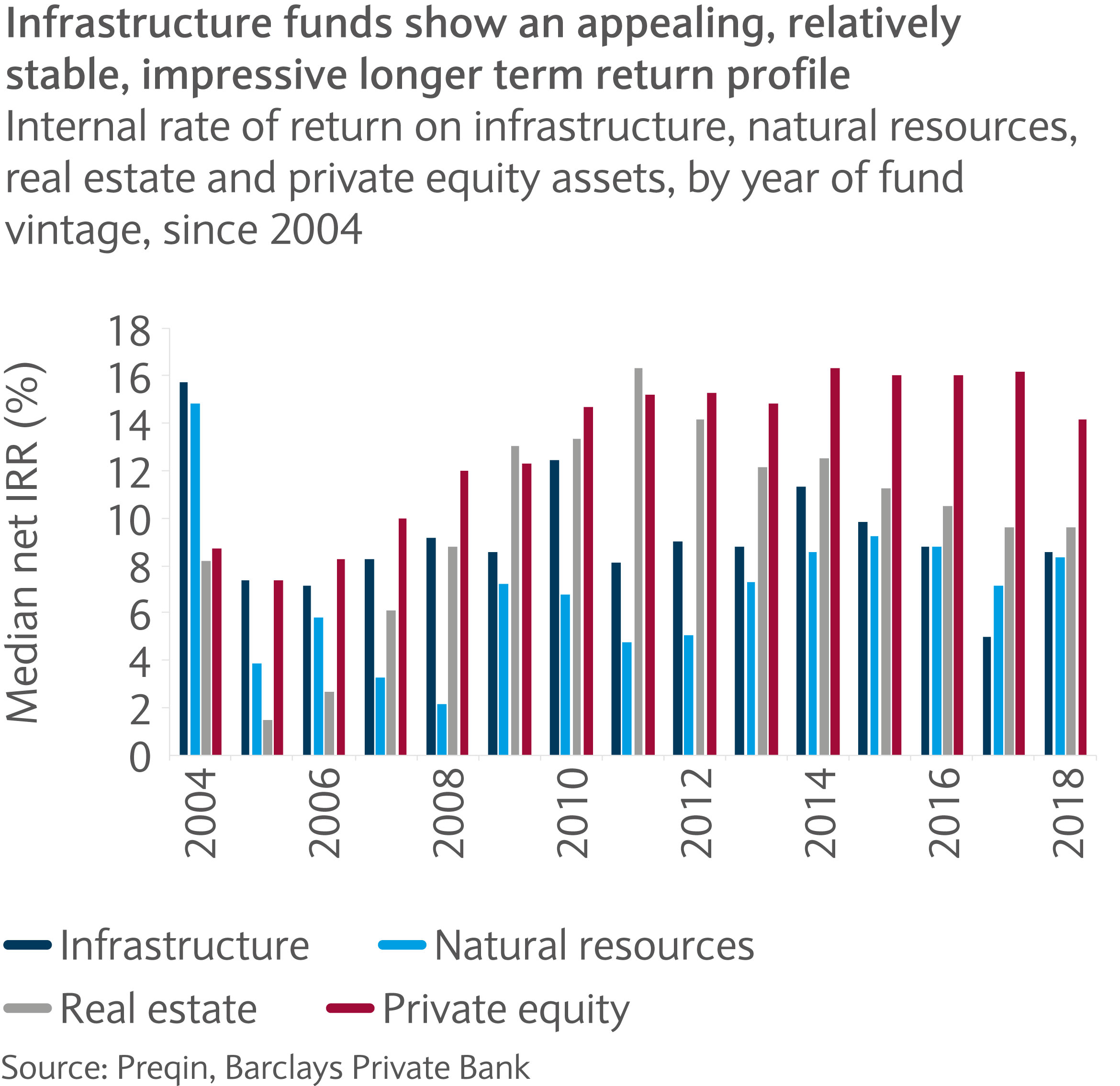

Investing through infrastructure assets can provide a hybrid between equities and fixed income in terms of the return profile. Not only is there potential for assets to experience capital appreciation, but the assets themselves generate cash flows through rents which can provide a stable source of income.

Infrastructure, being a real asset, has the added benefit of its income being tied to inflation. Thus, as markets increasingly focus on the risk of inflation being higher than expected in coming months, infrastructure assets can help put investors’ minds at ease (see chart).

Manager selection and ESG appear key to outperformance

The need for more infrastructure investment appears clear. Private markets offer a route to investing in infrastructure and the popularity of such investment seem poised to grow.

However, manager and fund selection is crucial. Furthermore, managers likely to outperform, and avoid regulatory risk, will deploy capital on infrastructure that is applied through an ESG framework and aimed at technological advancements. The trend towards smart cities in an increasingly urbanised world adds to the appeal of infrastructure assets.

Investor sentiment remains buoyant, despite accelerating Indian COVID-19 cases, with encouraging economic signs in the US and China.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.