Market Perspectives March 2021

Encouraging hopes of a vaccine-driven recovery are keeping investors in good spirits.

05 March 2021

9 minute read

By Damian Payiatakis, London UK, Head of Sustainable & Impact Investing and Olivia Nyikos, London UK, Responsible Investment Strategist

With increasing capital flowing into sustainable investing, there are suggestions of an emerging bubble. How can investors avoid the froth and find long-term investment opportunities?

In our 2020 Investing for Global Impact research with over 300 leading global families, we found that they planned to almost double their portfolio allocations to sustainable investing in the next five years.

Given the risks of delayed global economic recovery, it may be worth considering what this might mean for the current momentum in sustainable investing.

Popularity grows

As we analysed in Market Perspectives in June, the acceleration into sustainable investing occurred during the initial period of the pandemic when market volatility was particularly elevated. So if economic conditions deteriorate again, it seems unlikely that the current level of flows would be stemmed. Rather, such conditions might encourage more flows from new investors not wanting to miss out again.

Given this, and our more optimistic, base case for decent growth, it highlights the risk that enthusiasm is inflating the sustainability trend without a deeper understanding of the drivers and approaches for such investing. In essence, the emergence of what Nobel Laureate Eugene Fama calls an “irrational strong price increase that implies a predictable strong decline”1 or more simply, a bubble.

For investors, either committed to investing sustainably or considering starting, we review the potential for this emerging bubble and how to position portfolios for a potential burst.

Sustainable investing bubbles up

By the end of 2020, growth in assets invested sustainably during the year delivered on the phrase that was too frequently tossed around at the onset of the pandemic, “unprecedented”.

In Europe, Morningstar calculated that sustainable funds grew by 52% last year, crossing the €1tn mark for the first time in December 2020. In the fourth quarter alone, these funds attracted close to €100bn in net new money, absorbing 45% of total funds flows for the region2.

As money has flown into the sector, prices have risen accordingly. Moreover, a high commonality and concentration of names in the key holdings of thematic sustainable funds continues to fuel more pricing growth.

Whether these price increases can be supported by future cash flows, remains to be seen. At present, though, the valuation metrics show heightened levels across sustainability-related investments.

Relative outperformance

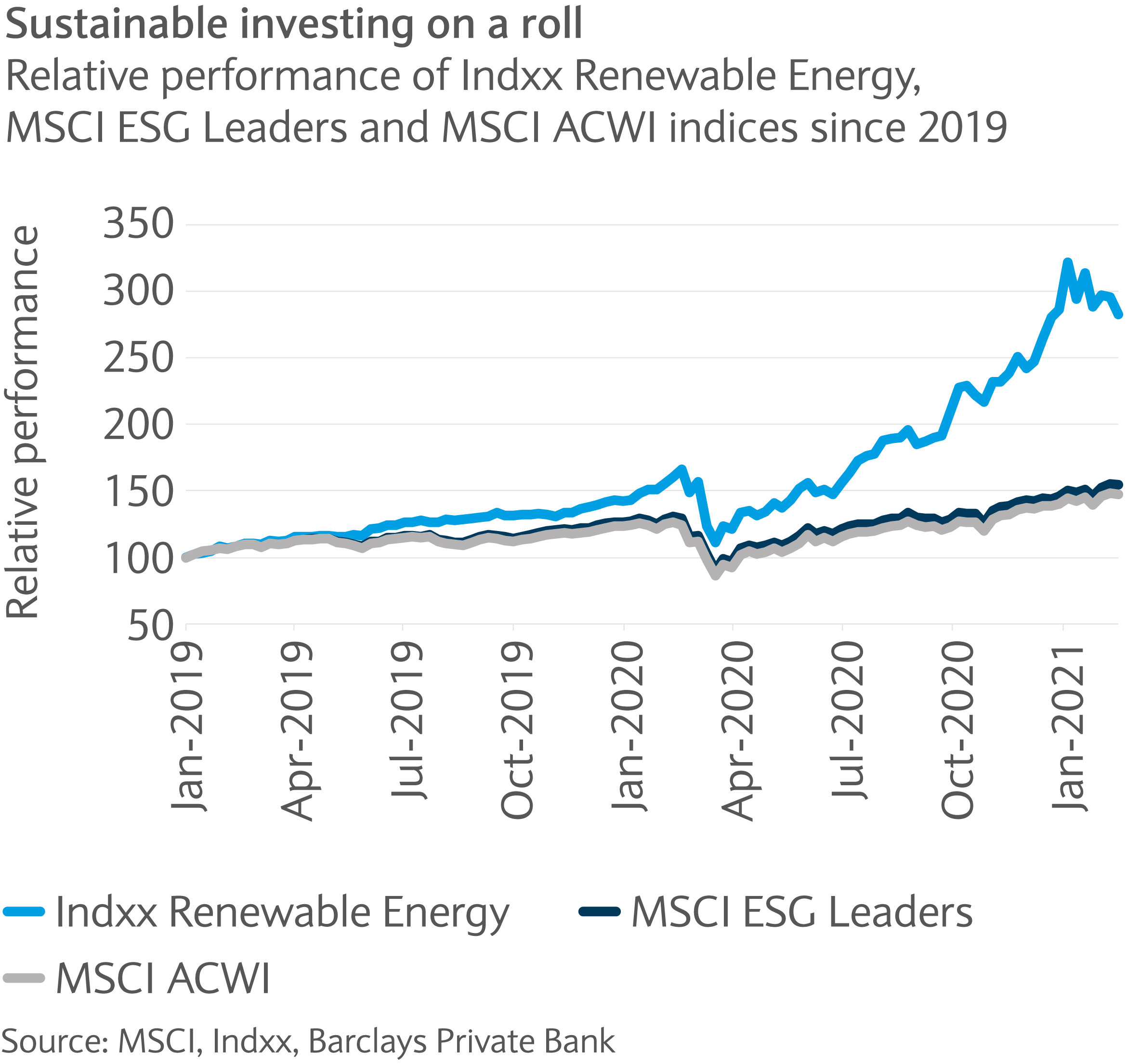

The Indxx Renewable Energy Index3, which tracks companies involved in producing energy from renewable sources such as wind, solar, hydroelectric, geothermal and biofuels, is trading at 42 times trailing earnings, double the multiple of the MSCI ACWI. That said, the MSCI Europe Energy index, which tracks the largest European companies in the traditional energy sector, is trading around 60 times trailing earnings, nearly three times that of MSCI Europe4.

Now, contrast these with the MSCI ESG Leaders Index, which tracks companies from across the world with high environmental, social and governance (ESG) performance relative to their sector peers. It, in fact, has a marginally lower price/earnings ratio compared with its parent MSCI ACWI5 with both around 27 times trailing earnings.

Charting the relative performance of these two different sustainability-related indices, compared to a standard benchmark, highlights the outperformance of both indices in the last year. While in both of these comparisons sustainability thinking is incorporated, how it is applied, on a thematic or factor basis, has a material difference on returns (see chart).

More money, more problems?

There are rational, and heartening, reasons for capital flowing into the field. However, one issue is that “ESG”, “sustainable”, and “green” are often used as catch-all buckets for what are very different strategies, sectors and investments.

Assessing the operating practices of a company using ESG data is as applicable to an oil and gas company as a solar energy provider. And a passive ESG fund that tilts market weightings based on ESG scores may hold both types of companies, which could be a surprise to uninformed investors.

Contrastingly, using ESG ratings to create a simple screen to exclude companies that manage relevant operating issues worse than their peers has different investment implications than using the source ESG data in bottom-up company analysis on specific financially material issues. However, both approaches can truthfully, if opaquely, be given a sustainable or ESG label.

Similarly, “green” investments can focus on projects or companies where goods and services are generating revenues by addressing environmental challenges and/or climate breakdown. Or, guided by the “E” in ESG, they can focus on companies whose business activities, energy consumption and supply chains are more environmentally friendly than competitors, irrespective of their industry sector.

Nuanced field

These examples illustrate the nuanced nature of this field. However, when we look at mainstream reporting and investment flows, they tend to oversimplify the situation. Investors following the herd may be whipping up these flows, and causing funds to appear to have performed well without the holdings supporting the increases.

Additionally, underlying stocks are trading at frothy levels. Notably, “green” companies providing solutions to environmental challenges, in sectors such as electric vehicles and associated fuel cells, renewable energy and waste and water management, are attracting much capital. Given price levels, they seem most at risk of not being able to deliver the long-term returns their earnings multiples suggest.

Bursting the bubble

For investors who want their capital to be invested sustainably, there is a conundrum. If a bubble exists, investing in it serves neither investor portfolio returns or provides the capital to catalyse solutions for our global challenges. Investors might consider three strategies to mitigate hazards or accept the risk associated with the issues.

Understand the terrain

Investors should start by understanding the different approaches to sustainable investing and their implications for both their family’s portfolio and preferences around sustainability.

Spend time reading about or discussing the different sustainable investing approaches in the context of your portfolio. In our Outlook 2021, we clarified potential options investors could incorporate in aiming to consider ESG effectively into their investment process and highlighted some of the key E, S and G factors for this year.

Armed with this knowledge, it’s easier to spot the hype that creates a bubble and not be confused or caught up by the terminology or marketing in the field.

Use ESG as means to ends

Investors should focus on the use of ESG as a fundamental part of the investment process, not a simplistic filter or shortcut to select funds based on name.

Within public markets, we see adding ESG factors can help make more informed investment decisions. Within our investment philosophy of preferring higher-quality companies, this provides a useful inspection of the internal operational quality of a business. Investment teams are incorporating ESG to select companies that should be less prone to internal issues and more resilient to external shocks.

In this way, bubbles become more avoidable or immaterial. Notably with active management, where undertaking fundamental analysis determines if a company is valuable to hold over a long term after any pop.

Going for green

Lastly, where green companies in public markets are getting swept upwards in seeming over-exuberance, an alternative is to look for opportunities in direct investments or funds in the private markets.

While not immune to investor excitement, valuations are generally not subject to the same momentum and volatility. As well, being mentally and legally committed to a long-term horizon reduces the risk of selling out at the wrong time and allows your investment time to mature. Moreover, both aspects help to avoid common behavioural biases around bubbles.

Previously we outlined four structural themes facing economies, and more recently delved deeper into Greening the Economy and Smart Cities, where there are entry points for long-term, growth-oriented investors.

From bubble to a tectonic shift

Increasingly global families appear to be allocating more of their portfolios to invest sustainability. Like any exciting investing idea, expectations can exceed reality for a time. It’s likely that this is the stage of the cycle for sustainable investing. But, as BlackRock’s Larry Fink noted recently in this year’s CEO letter6, this is a “tectonic shift” that is accelerating, rather than a bubble waiting to pop.

Encouraging hopes of a vaccine-driven recovery are keeping investors in good spirits.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.