Market Perspectives June 2021

Investor sentiment has subsided as inflationary pressures build. Our investment experts highlight our main investment themes, examining if consumers can drive the recovery.

04 June 2021

By Michel Vernier, CFA, London UK, Head of Fixed Income Strategy

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

Financial markets seem gripped by inflation risk. Default and downgrade risk remain in the early stages of the recovery though the risk seems to have declined. However, rate volatility appears the dominant factor ahead and the Fed’s “holding the line” patient approach may lead to more of it.

Inflation print just tip of the iceberg?

The big bond market puzzle is around the question of whether the recent surge in US inflation, and elsewhere, is transitory or just the beginning of a higher inflation era.

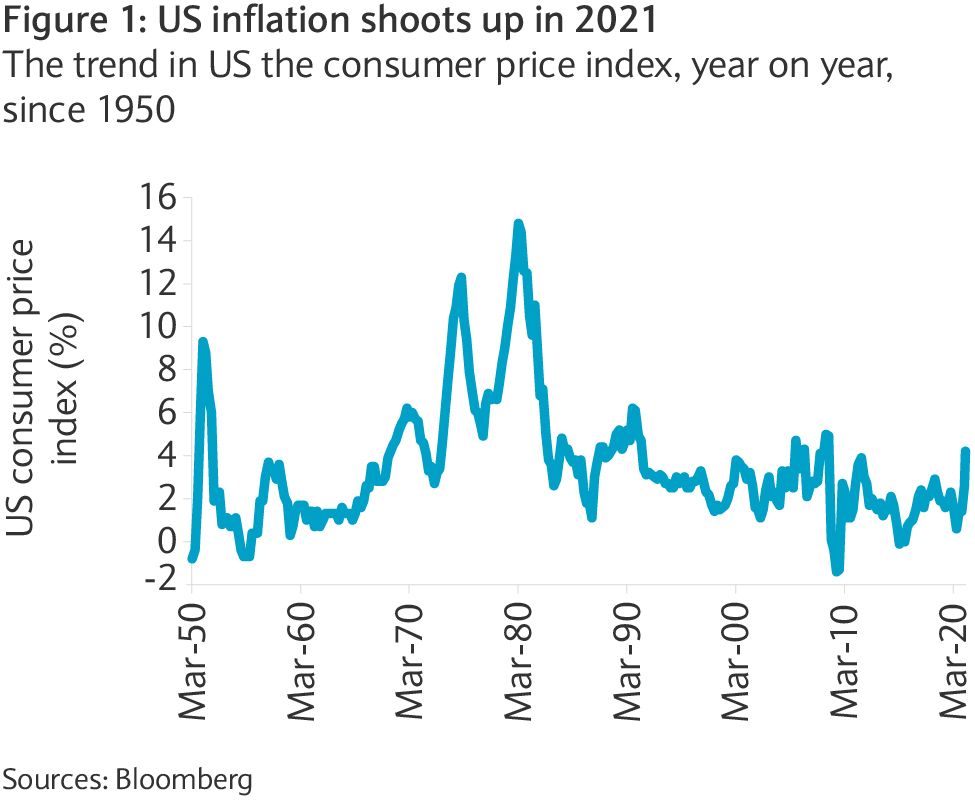

April’s US inflation jumped the most since 1981 on a month-on-month comparison (0.92%) and the most since 2008 on an annual basis (4.2%). This was also the biggest overshoot compared to consensus since 1996 (see figure 1). And for the first time since records began, according to Bloomberg, the print was above the highest consensus estimate. It seems that even the most bearish economists have underestimated the inflationary forces in play.

What a high number does not tell, is whether the surge in inflation is transitory or if the acceleration is part of a secular trend change. Given the importance of inflation expectations to the bond market, a closer look at the drivers of it seems justified.

The six main inflation drivers

The April inflation surge was largely driven by a sharp rise in household energy prices, airline fares, lodging from home and the prices for used cars. Various forces appear to have affected the print. Therefore, categorising the inflationary drivers seems warranted to make a better judgement. The following list is by no means exhaustive, and most driver categories are likely to be connected in some way:

The hike in the energy price component can be easily explained by base effects given the depressed prices witnessed a year ago. These base effects are also likely to be dominant in the next readings and will likely occur in other parts of the economy pushing inflation further up.

The increase in airline fares and lodging from home can be associated with the pent-up demand which is also likely to be a dominant factor in the next quarters as economies are opening up gradually. In the case of airlines, fares would still need to increase by almost 20% before catching up to pre-crisis levels while lodging from home is still another 8% away from its pre-crisis levels.

Pent-up demand is likely to be supported by excess savings of around $2.6tn in the US1 and given that around 20% of that cash could be spent in the economy, helping to power the recovery.

Bottlenecks everywhere

Higher demand is meeting supply constraints and the increase in used car prices is a perfect example of that imbalance. Inventories for motor vehicles and parts fell by 16%, according to the Bureau of Economic Analysis. This was exacerbated by the shortage of chips. This shortage directed demand to used vehicles.

Companies have pointed to supply constraints in most industries and it is likely to be a main driver of inflation in the coming quarters. The constraints may also be witnessed in the labour market in coming quarters. Given the US government’s relatively generous fiscal aid packages, transition back to employment might be slow, putting pressure on wages (see figure 2).

Backwardation in the commodity markets, whereby spot prices are higher than future prices, is also a proof of the supply bottlenecks at the moment.

Transitory versus persistent

Most of the described inflation factors can be classified as transient in nature as demand should moderate and supply may adjust relatively quickly. Such a rebalancing usually pulls inflation down in the subsequent periods of higher prices, one of the main reasons why most economists and central banks believe inflation towards 2023 will moderate again. Consensus shows the US consumer price index coming back under 3% by the first quarter of next year and averaging 2.3% in 2022, which seems realistic.

In fact, US Fed Vice Chair Richard Clarida reinforced the message in May: “One-time increases in prices are likely to have only transitory effects on underlying inflation, and I expect inflation to return to – or perhaps run somewhat above – our 2% longer-run goal in 2022 and 2023.”

There is a risk that that even a temporary period of higher inflation could be amplified by a stronger than anticipated business cycle, the third factor as mentioned earlier. A stronger recovery beyond the catch up to pre-crisis levels has the potential to support consumer demand and economic output building up additional inflationary pressure.

The fiscal package signed off by the Biden administration of over $4tn (“build back better”) is likely to lead to such additional demand. However, most economic and inflation forecasts have already encountered the additional infrastructure stimulus while the stimulus may not be as inflationary given it is spread over several years. Business cycle-related inflationary pressure, as described, would be likely detected in the labour market as well as in shelter price level trends.

Are the 1970s back?

These risks are often highlighted by the so-called “inflationistas” who think that we are entering an era of structurally higher inflation. Some economists, like Larry Summers, have pointed out the combination of excessive monetary growth and high fiscal deficits which is reminiscent of the 1970s, when inflation jumped to over 14%.

As we’ve previously written, the correlation between a large level of debt, high monetary growth, inflation and higher rates was not obvious in the past and even negative at times. It is also important to stress that the record fiscal deficit is likely to fall again towards 5% by 2023 which would reduce the pressure for rate rises over time.

What is clear though is that apart from the fiscal deficit (Vietnam War, great society programme) monetary policy errors were committed back in the 1970s, which even the Fed acknowledged. First, the central bank did not challenge strongly enough the then prevailing “even-keel policy” which prohibited rate hikes during treasury debt issuance. Second, the Fed and most economists failed to recognise the Philips curve – the trade-off between unemployment and inflation – had broken down, as higher inflation did not lead to higher employment in the end.

Too early to conclude the long-term outlook

Structural changes such as new global supply chains and technological advancements are likely to have an impact on inflation, but it seems less obvious whether these factors are going to be inflationary or disinflationary over the longer term.

In addition, the planned energy transition and increased focus on environmental sustainability may increase inflationary pressures over the long term. But new technologies and processes may equally lead to more efficient production processes which may ultimately put a cap on inflation. We would therefore be cautious to conclude that structural changes and a stronger environmental focus will lead to an excessive inflationary environment.

In conclusion it seems likely that inflation will increase substantially over the coming months due to the transitory effects as described. In addition, there is a risk that cyclical factors may add to the inflationary trend. However, it seems impossible to predict where inflation will be in the long run and if the current environment will lead to a trend change of the disinflationary environment witnessed over the past decades.

Fed is “holding the line”

What can be expected from the central bank and policy rates in this context? In the past, market participants have been sensitised to higher policy rates leading to higher rates along the yield curve. This time the concern is that the Fed is pursuing the strategy of “holding the line” (like in the movie Gladiator) for too long with low rates providing the feeding ground for excessive inflation subsequently.

The Fed defends its positioning by reiterating that inflation and dynamics are well understood today, contrary to the 1970s. Apart from the higher tolerance for inflation, the Fed seems to have a strong focus on the labour market.

In hindsight, the Fed may have accepted that the last hiking cycle was too sharp and quick for the labour market (despite low unemployment rates) given the existing “slack”. With this in mind, the central bank will likely hold the line longer than for most market participants liking.

The Fed’s envisaged policy rate path, shown in its latest dot plot estimates, does not include a hike in 2023. There is a strong likelihood that with higher inflation, the dot plot for 2023 may show a first rate hike in the coming months given that only two additional voting members would need to envisage a hike. This is unlikely to spur the bond market as the market already implies a first move by March 2023.

Further rate volatility likely

Rates could, however, face renewed volatility as we approach the start of the tapering of the existing bond- buying programme.

The Fed might become more vocal in August/September with first action as early as March/April 2022 and by the latest when the Fed has evidence of “substantial progress” in the labour market. While volatility could lift rates as high as 2% temporarily, a range of 1.6%-1.75% seems more likely in our view.

Investor sentiment has subsided as inflationary pressures build. Our investment experts highlight our main investment themes, examining if consumers can drive the recovery.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.

Hot start for high yield, April 2021, Moody's Analytics [PDF, 756KB]Return to reference