Market Perspectives June 2021

Investor sentiment has subsided as inflationary pressures build. Our investment experts highlight our main investment themes, examining if consumers can drive the recovery.

04 June 2021

By Julien Lafargue, CFA, London UK, Chief Market Strategist

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

With economic warning signs flashing and inflationary pressures building, volatility may spike. Equities appear to face a tougher few months too. Investing in private markets, to improve diversification, and volatility-related options may be part of the answer.

We suggested that investors should reduce cyclical exposure in portfolios as the pace of the recovery was likely to slow in May’s Market Perspectives. Since then, volatility has picked up, global equity markets have been range-bound and the macroeconomic data have deteriorated versus elevated expectations.

We expect more of the same during the next few months and see benefits in thinking differently than usual when constructing portfolios.

More challenging period as warning signs flash

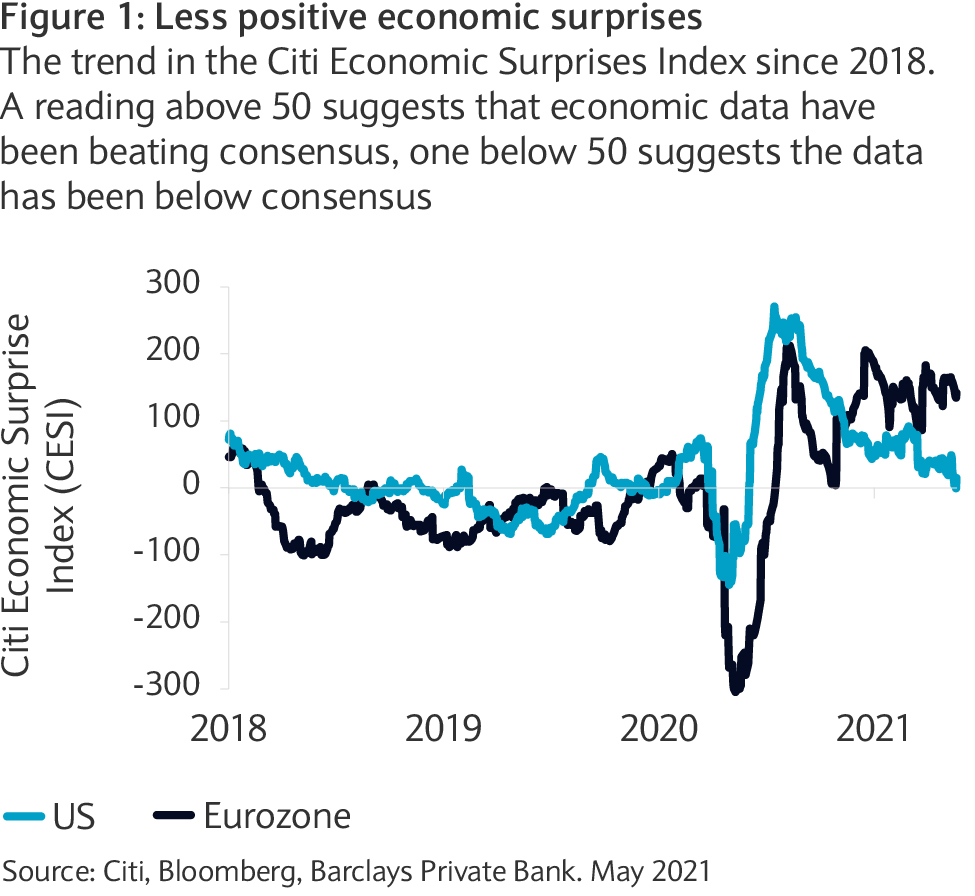

As expected, while the macroeconomic picture remains encouraging in absolute terms, recent data have failed to match expectations, especially in the US. Worse, some parts of the global economy are flashing warning signs as inflationary pressures build faster than expected (see figure 1).

Furthermore, the shine has started to come off of previously very popular and speculative assets such as cryptocurrencies and special purpose acquisition companies. As the widespread euphoria dissipates, the next few months may prove more challenging.

Focus on inflation

Equities find themselves at a tipping point following their rally from the pandemic lows seen last March. What happens next will likely be decided by inflation and whether, as the US Federal Reserve expects, the recent jump in consumer prices will be “transitory”.

While there is debate about what transitory really means, economies seem unlikely to enter a period of sustained and higher inflation fuelled by a sharp increase in wages (see What next for inflation as the Fed holds steady?).

As such, we remain broadly constructive on equities, especially versus bonds. That said, volatility should remain elevated as central banks are likely to remain patient before committing to their next move.

Ignore the rotation, focus on quality

Many commentators remain fixated on the “value versus growth” debate and if investors should own one or the other. As we have mentioned previously, we don’t believe in this debate. Year-to-date, global value – as illustrated by the MSCI World Value index – has outperformed its growth counterpart by 11%. However most of this outperformance materialised in the three weeks between 15 February and 8 March.

Since then the performance differential between value and growth has not been too significant. This shows how difficult it can be to capture these moves. In addition, on a 10-year basis, growth is still outperforming value by 130%. As such, for long-term investors, sticking with companies offering superior growth appears a more rewarding strategy. Our stance remains unchanged with a strong preference for quality over any other factor.

Positioning for volatility ahead

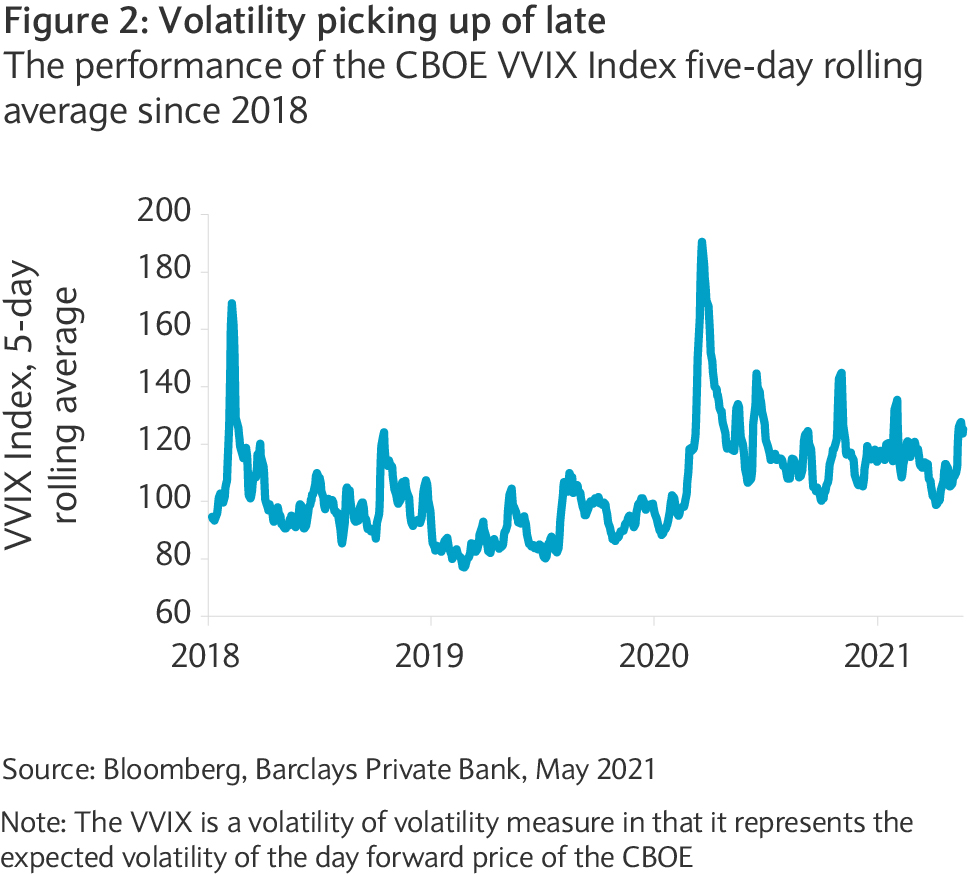

In the current context, relying on high-conviction active management seems appropriate to navigate what is likely to be an uncertain summer. In addition, with volatility having jumped recently, now seems a good time to revisit portfolio construction and think “outside the box” to improve the risk/reward profile of equity exposure.

In practice, investors might consider three different approaches: improved diversification, increased exposure to private markets and using options.

Improving diversification

With bonds providing little cushion during inflation- driven risk-off moves, the typical 60/40 portfolio is being challenged. Adding uncorrelated assets can help to diversify portfolios further and aim to reduce downside capture.

In looking for appropriate uncorrelated assets, certain alternative strategies with limited directional exposure may help. Similarly, maintaining a balanced geographical and sectorial exposure can provide added diversification benefits. Here we reiterate our view around a barbell approach between US and Asian equities together with a focus on healthcare, technology and part of the industrials and consumer discretionary complexes.

Going private

Similarly, when possible, increasing exposure to private markets can help dampen portfolio’s volatility by removing the need for immediate mark to market. Additionally, with a much larger opportunity set compared to public equities, private markets can help investors fine-tune their exposure and capitalise on otherwise unavailable opportunities. As a result, it’s unsurprising to see that, private assets have tended to contribute positively to overall returns in the long run.

Making volatility your friend

While volatility is often feared, we believe that investors should embrace it and look for ways to profit from it. With higher volatility comes investment opportunities, whether in the form of better entry points in high quality stocks or more attractive payouts in options market.

Indeed, as uncertainty abounds and implied volatility increases (see figure 2), so does the value of certain options, all else being equal. This makes it a great time for investors to sell this volatility for a higher premium. Such additional performance can be used to boost portfolio returns or finance protection against a large pull-back in equities.

Investor sentiment has subsided as inflationary pressures build. Our investment experts highlight our main investment themes, examining if consumers can drive the recovery.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.