Market Perspectives June 2021

Investor sentiment has subsided as inflationary pressures build. Our investment experts highlight our main investment themes, examining if consumers can drive the recovery.

04 June 2021

By Alexander Joshi, London UK, Behavioural Finance Specialist

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

Bias and noise can affect investors’ decision-making, and market sentiment can overreact in the short term. Investment success rests on distilling market noise and focusing on what really matters, with diversification key to help investors with this.

In their latest book, Noise: A flaw in human judgement, Nobel laureate Daniel Kahneman and distinguished behavioural economists argue that society has rightly devoted much attention to the problem of bias – predictable errors that incline a person’s judgment in a particular direction – but should also pay attention to another type of error: noise.

Consider your bathroom scale. If on average its readings are too high, the scale is biased. If it displays different readings when used several times in quick succession, the scale is noisy. While bias is the average of errors, noise is their variability. Investors may have observed that forecasts of economic outcomes can be notoriously noisy.

What does this mean for investors?

The central tenet of financial markets is the efficient market hypothesis. It states that share prices reflect all information, and with stocks always trading at their fair value it would be impossible to consistently generate alpha and outperform the overall market.

As professional investors we see that inefficiencies and therefore opportunities do exist, due to a range of reasons, including market psychology and human emotion. Market sentiment can become excessively optimistic or pessimistic, which can lead to market overreaction to events and news. This can steer investors off course, as well as provide them with opportunities.

Challenging investing times

We are now entering a potentially challenging period for investors, with the potential for market turbulence. The recovery is underway, spurred by successful vaccination drives, pent-up savings and government support. However, the pandemic is far from over, with daily recorded cases globally still at very high levels and the risk of new variants a concern.

Meanwhile, inflation data is prompting a rethink about asset valuations in parts of financial markets. It is imperative for investors to know what, and what not, to focus on.

Distilling the noise

In a world of real time news reporting, there is no shortage of voices trying to grab the attention of investors. Ever shortening news cycles can induce short-term thinking in investors, which can threaten to derail long-term success.

With markets composed of many different individual agents, there is ample opportunity for noise. Successful investment performance, on a continued basis, rests on distilling the noise and focusing on the fundamentals which really matter. Much of the market commentary will not be material to a diversified investment portfolio.

Having a robust investment process and discipline when changes are made to investments, alongside a plan and rules for when changes are made, may be one way for investors to reduce bias and noise in their own decision-making. A robust process can also reduce the impact of external noise on decisions.

Beware of extreme moves

Being aware of the role of noise and aspects of investor psychology can help investors to not get swept up by market sentiment. Sentiment can become extremely bullish or bearish in the short term, and also swing from one end to the other extremely quickly.

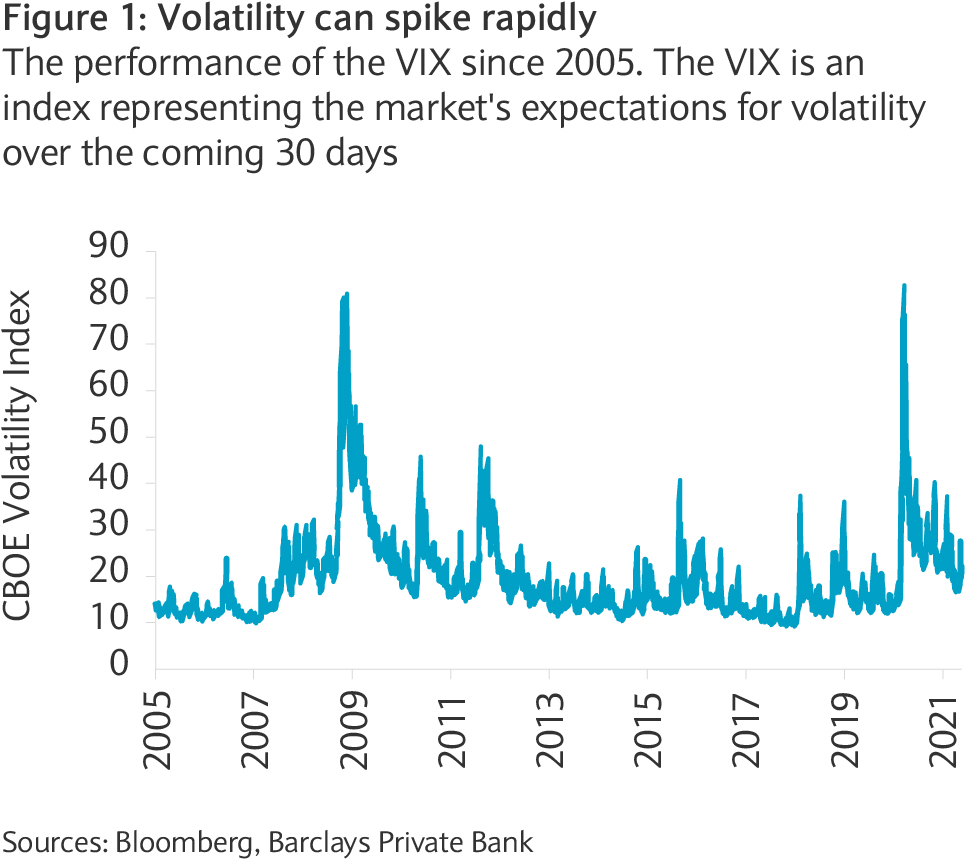

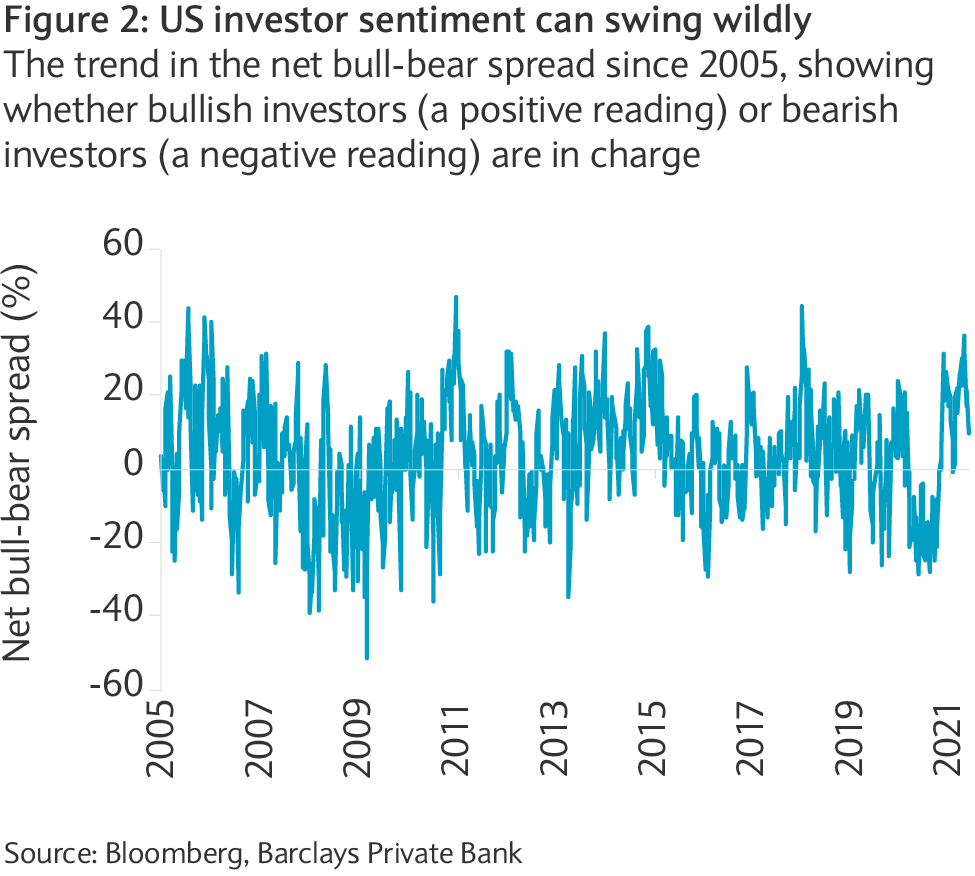

This is demonstrated by the speed at which the VIX, the widely used volatility index that gauges market sentiment and points to the degree of fear among market participants, can spike during times of market stress (see figure 1). This is mirrored by investor sentiment indicator data (see figure 2).

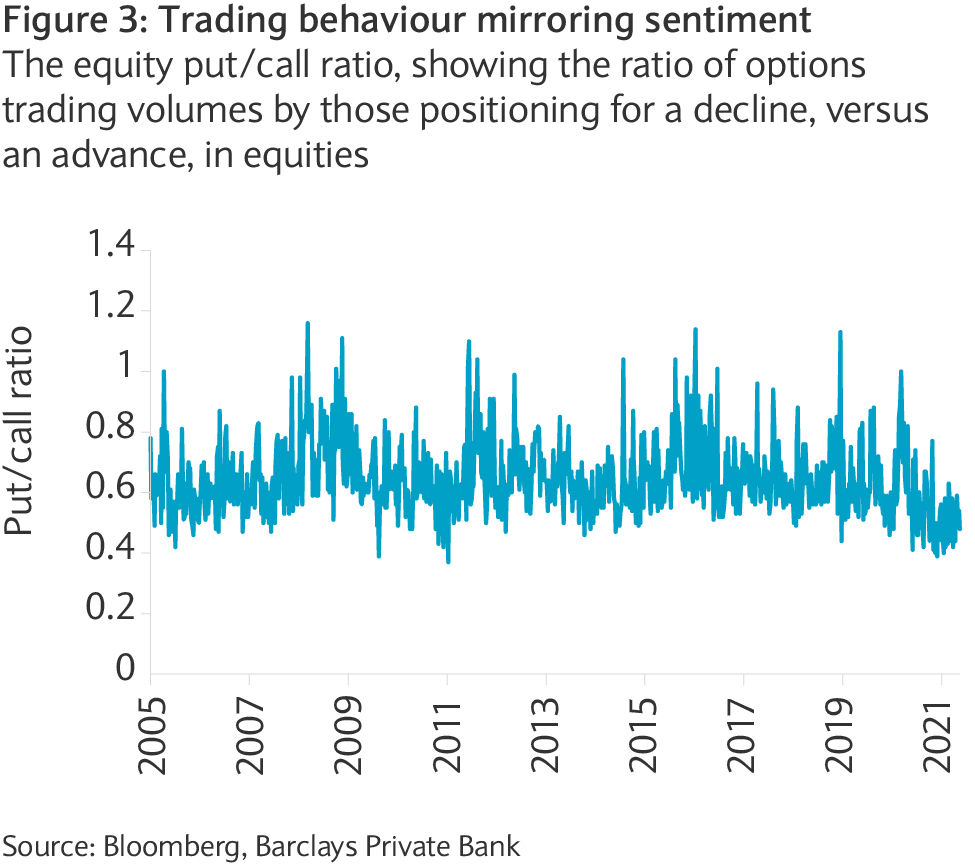

Equally striking is the speed at which these elevated levels can fall and how investor positioning closely mirrors sentiment indicators (see figure 3). The implication is that investors that get swept by excessively strong sentiment in a particular direction and act upon it may take actions that are not in their long-term interest; for example, selling during a bout of volatility and a short correction that very quickly fades away.

Investing doesn’t have to be difficult, but it is complex

It is important to appreciate the speed and efficiency with which information is priced into markets and their forward-looking nature.

For investors attempting to make sense of events and the reaction of the market to them, reactions can appear to be counter-intuitive, like a pull-back on what appears to be positive news. Forward-looking market participants may be looking more at aspects such as the rate of change of a certain data series than the headline figures (the second derivative).

While investing does not have to be difficult, financial markets are complex. Unpicking the drivers of events and understanding causation can be challenging.

We believe that investors may receive the best returns by focusing on having in place the fundamental building blocks for long-term investment success – asset allocation, diversification and active management – than the minutiae of short-term movements. A professional investment adviser can support the investor by making sense of them.

Diversification offers protection

So what can an investor do to protect themselves from the so-called “animal spirits” of markets? The first thing to keep in mind during times of stress (or excessive exuberance) is that the market isn’t one single entity that moves as one. Financial markets are composed of many moving parts.

One of the best ways for investors to remind themselves of the market complexity, and be better protected from its effects, is to hold a diverse portfolio of investments that spans asset classes, sectors and quality companies.

A diversified portfolio can better protect from the effects of volatility due to the correlations between asset classes. It may also insulate the investor from being caught up in the emotions induced from experiencing that volatility in the portfolio. Together, these can provide a solid foundation for protecting and growing your wealth.

Investor sentiment has subsided as inflationary pressures build. Our investment experts highlight our main investment themes, examining if consumers can drive the recovery.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.