Market Perspectives June 2021

Investor sentiment has subsided as inflationary pressures build. Our investment experts highlight our main investment themes, examining if consumers can drive the recovery.

04 June 2021

By Michel Vernier, CFA, London UK, Head of Fixed Income Strategy

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

With US inflation rising and investors increasingly focusing on inflation risk, investing in inflation-linked bonds appears to be one solution to hedging against higher, persistent inflation.

Inflation-linked bonds in focus

Recently, higher rates have been driven by stronger trending breakeven yields (market-implied inflation). In earlier publications we noted that breakeven rates seem highly correlated with investor sentiment rather than actual inflation.

With the 10-year breakeven inflation rate now at the highest level since 2013, the question is whether the level will be matched by real inflation over the longer term and if inflation-linked bonds are still a good hedge against rising inflation.

Tourists investors have discovered inflation linked bonds Demand for inflation-linked bonds is typically found from pension funds and asset managers and is generally quite sticky. That said, recent inflows, as indicated by exchange-traded flows, into inflation-linked bonds were also driven by retail and tactical investor demand.

This extra demand has come at a time when the Fed has increased their holdings, now owning around a quarter of US inflation-linked bonds from 10% at the end of 2019. Another sign that the inflation trade, at least in the short term, seems crowded is the fact that inflation swaps volumes have increased by 40% (commonly used among tactical hedge fund investors) compared to pre-crisis levels.

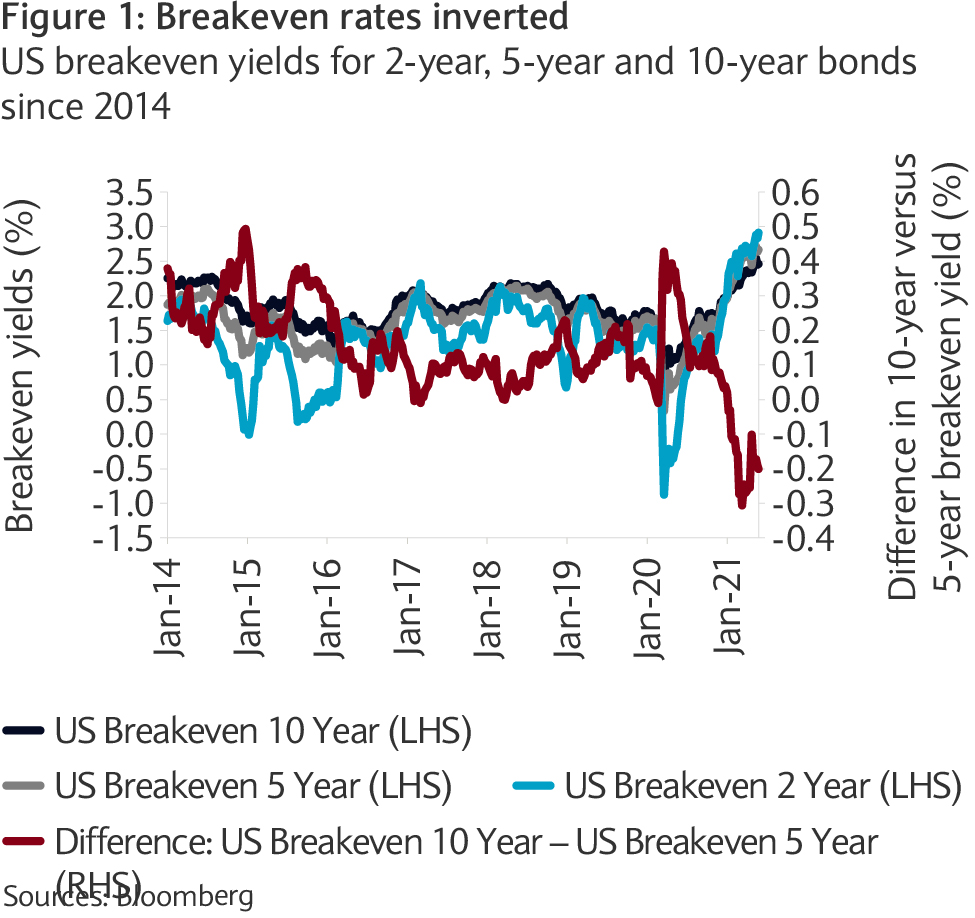

A closer look reveals that even investors seem to be placing more weight on the transitory nature of inflation. While in the past breakeven yields of longer tenors, like 10-year bonds, were trading above the shorter tenors, this year the breakeven yield curve has been inverted (see figure 1). The 2-year breakeven trades roughly 30 basis points (bp) higher than the 10-year breakeven rate, implying that inflation is likely to moderate again. The potential to earn “fast” money by investing in short tenors seems limited.

Focus on 2.5% inflation threshold

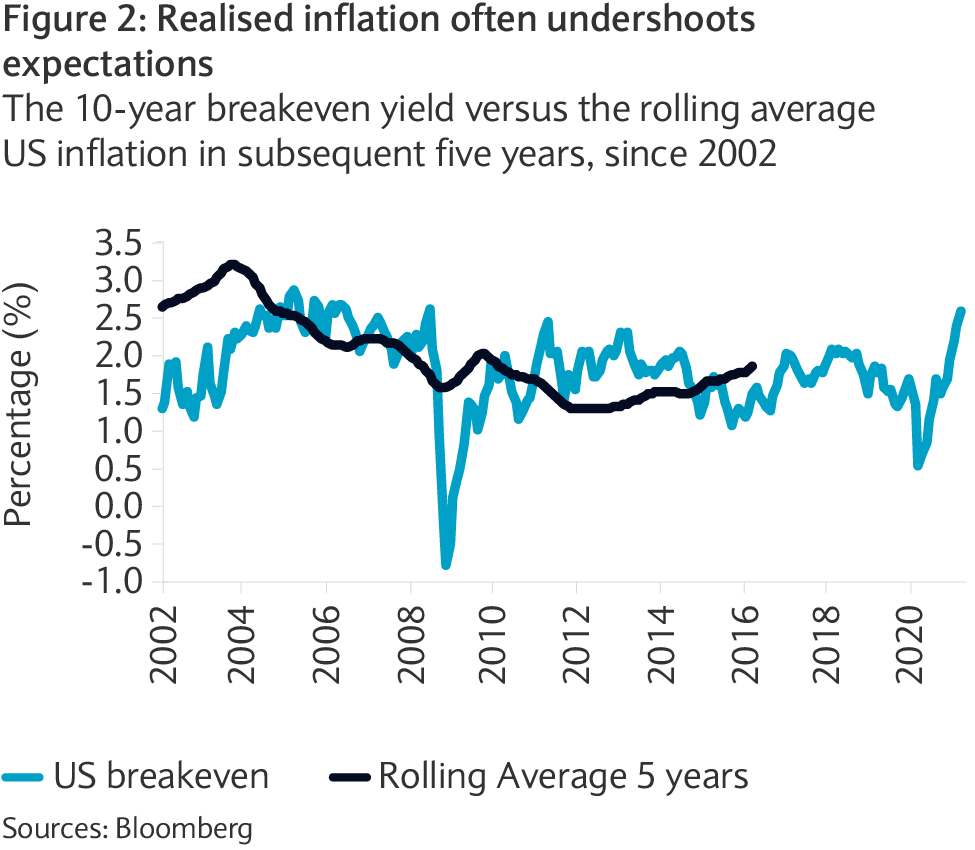

Over the last 20 years, breakeven yields seem to have overpriced realised inflation in the following years (see figure 2).

Admittedly realised inflation trended lower in the respective period. If a period of inflation persists of above the central bank target of 2%, 10-year inflation-linked bonds are likely to outperform their nominal counterparts. This is illustrated in the past performance of inflation-linked bonds plotted against nominal government bonds in different periods of inflation over the last 20 years.

An attractive proposition

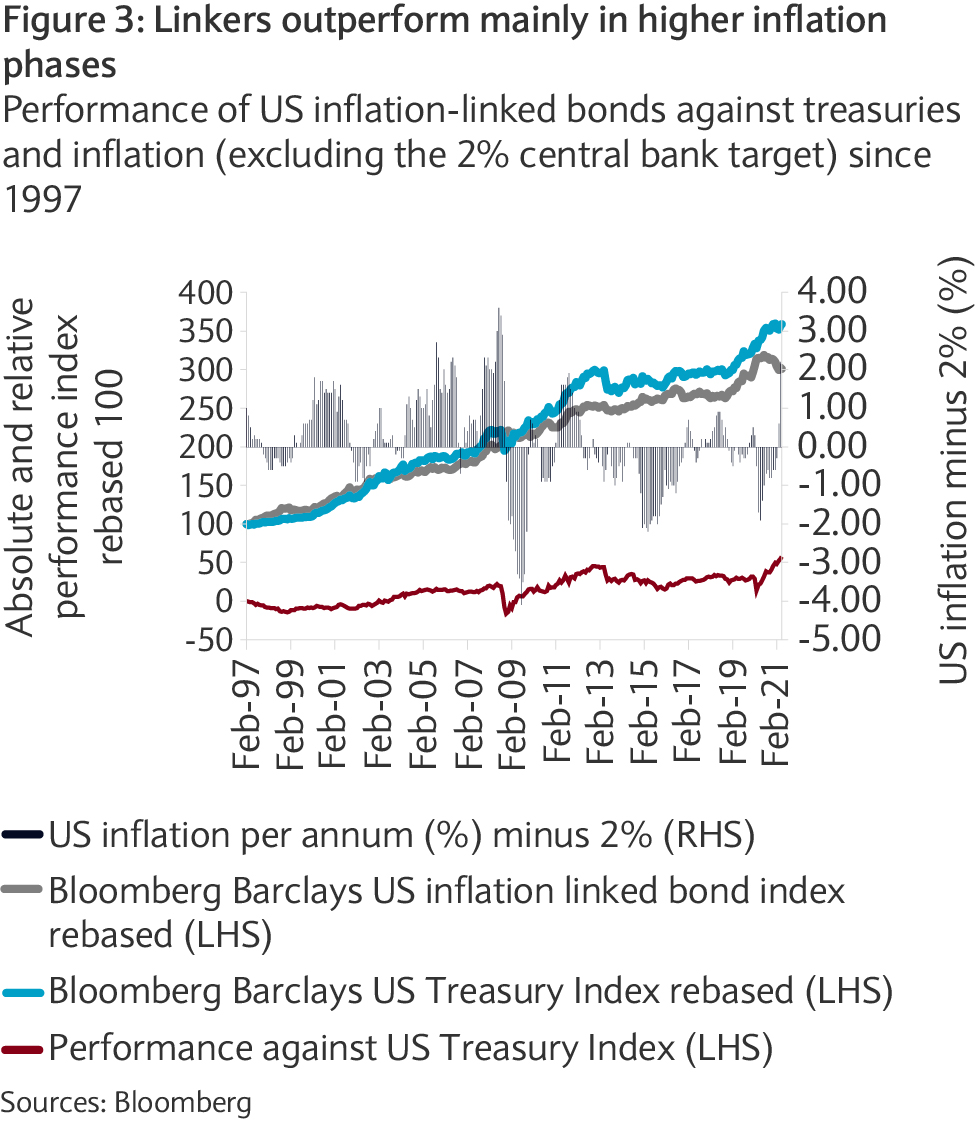

In periods of above-target inflation, some of the investment rationale for inflation-linked bonds lies on their performance against nominal treasuries (see figure 3). The grey-shaded area shows US inflation deducted by 2%, given this was and is until now the average Fed inflation target. Only in periods when inflation averaged persistently well over 2% have inflation-linked bonds outperformed nominal sovereign bonds.

While inflation has only recently started to increase and while it is still not clear whether inflation will stay at around 2.5% or higher for long, inflation-linked bonds are already anticipating such a move. This suggests that inflation-linked bonds are generally rich in pricing.

However, in the longer term, the performance of inflation- linked bonds at least matches sovereign bonds and with the additional potential of “known unknowns” inflation linkers might warrant consideration.

Investor sentiment has subsided as inflationary pressures build. Our investment experts highlight our main investment themes, examining if consumers can drive the recovery.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.