Market Perspectives June 2021

Investor sentiment has subsided as inflationary pressures build. Our investment experts highlight our main investment themes, examining if consumers can drive the recovery.

04 June 2021

By Henk Potts, London UK, Market Strategist EMEA and Julien Lafargue, CFA, London UK, Chief Market Strategist

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

Positioning portfolios for the post-pandemic economic recovery seems vital. Growth prospects appear encouraging. Starved of spending opportunities, consumers look set to hit the high street. But sectors likely to prosper may not be those that have suffered most.

The global economy suffered its worst performance since the Great Depression last year. A slump in household demand was a key element of the contraction as lockdown restrictions were implemented. However, there are increasing hopes that the reopening of economies and unleashing of pent-up demand will generate a powerful consumer-led recovery.

Steady personal incomes and cash hoarding

Despite the dramatic fall in output last year, personal incomes have remained relatively steady during the COVID-19 pandemic. Household balance sheets were stabilised by government job retention schemes, extended unemployment benefits and stimulus cheques.

Personal incomes in the US surged 21% in March, month on month (m/m), reflecting the changes in government social benefits. Additionally, historically low interest rates allowed home owners to refinance their properties and reduce monthly payments.

Consumers in the world economy are estimated to have accumulated excess savings of nearly $5.4tn according to credit rating agency Moody’s data1.

There are three major reasons why the cash hoard has developed. Firstly, forced savings: the closing of non- essential retail, as well as travel and leisure options, stopped consumers’ ability to spend their money even if they wanted to. Secondly, higher precautionary savings: nervous consumers have been concerned about rising unemployment so have been increasing their financial safety net. Thirdly, the fiscal transfer: the rise in household savings is the counterpart to government deficits.

Excess savings: where’s the money?

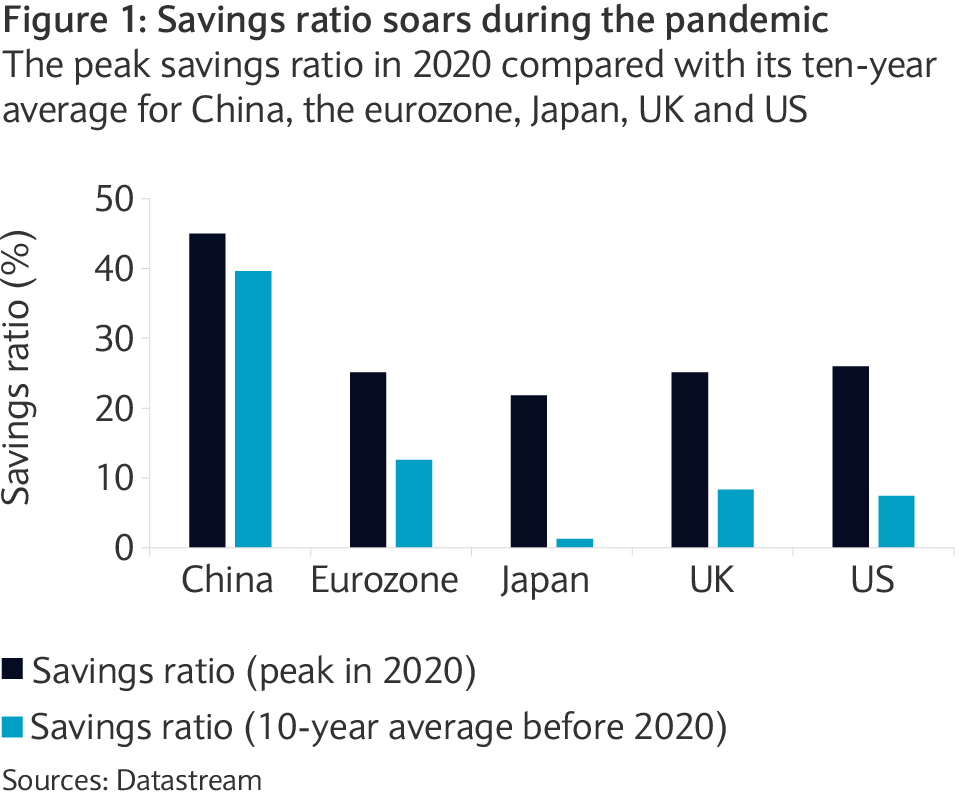

With an extra $2.6tn (12% as a share of GDP) squirreled away in bank accounts, the US is estimated to account for the large portion of the excess savings. Concerns around the medical and economic outlook in Europe encouraged people to save their money at record rates last year (see figure 1). The European household saving rate surged to 25% between April and June last year. Indeed, savings ratios were much higher last year than their average in the ten years to December 2019 in many leading economies.

The accumulated savings are not spread evenly across income groups. Higher earning households have saved considerably more than less wealthy ones. This may infringe on growth prospects, as wealthier households’ marginal propensity to consume tends to be considerably less than their poorer counterparts.

Rising consumer confidence

Improving sentiment surrounding vaccination programmes, the reopening of the services sector and the flow of fiscal stimulus has been reflected in recent retail sales and consumer confidence data. US retail sales boomed in March, rising 10.7% m/m and remaining at the same elevated level in April. Similarly, the Conference Board’s index of consumer confidence rose to a fresh one-year high in April.

UK consumers are also feeling more positive. The GFK UK consumer confidence index recently rose to its highest level since the UK economy went into lockdown in March 2020. Eurozone retail sales registered an impressive rise in March too, up 2.7% m/m, equating to a 12% annual increase.

Risks to the consumer recovery

There are still reasons why households may hold their money for a while longer. More cautious households might use the money to pay down debt or increase their safety net until the pandemic finishes or labour market conditions improve.

If coronavirus variants reduce vaccine efficacy rates and the recovery starts to stall, then consumer confidence could quickly deteriorate again.

The labour market recovery is key to consumption growth. As such, the return to work rate will be closely monitored by economists as governments withdraw furlough programmes. Rising price pressures could also reduce real disposable incomes and raise fears of an earlier hike in rates than expected.

Encouraging growth prospects

Moody’s estimates that the global figure for additional savings since the pandemic is more than 6% of gross domestic product1. If consumers were to spend a third of that, it would boost global output by two percentage points both this year and next.

The Bank of England has raised its 2021 growth forecast to a post-war high of 7.25%. This stronger growth profile is partly on the assumption that UK consumers will spend more of their £200bn of accumulated wealth than previously projected over the next year. Barclays Investment Bank forecasts that private consumption in the US will grow 8.1% this year, helping to propel growth in the world’s largest economy to above 7% in 2021.

We are of the view that the global vaccination programmes will help to arrest the virus, central bankers will look through any short-term spike in inflation and labour markets will recover (albeit at an uneven pace). Consequently, consumer confidence should continue to improve and support growth prospects.

Sectors where consumers likely to spend

When trying to capitalise on the global consumers’ war chest, investors may gravitate around the consumer discretionary sector. However, globally, this sector has already doubled from its pre-pandemic levels, raising questions as to where opportunities might lie.

With most households confined to home and so less likely to consume services, it is not surprising to see online retailers, home improvement stores and luxury companies being the main contributors to this outperformance.

On the other hand, many companies exposed to the travel and leisure industry, including restaurants, have lagged significantly.

With economies reopening, international travel gradually resuming and consumers starting to spend more on services, these would appear to be well positioned to benefit. On the goods side, apparel will most likely enjoy the strongest rebound as consumers feel the need to buy clothes again.

Focus on balance sheets, not price charts

For all the opportunities in the recovery, we don’t think the market has missed something here. The fact that the shares of many travel-exposed companies remain well below their pre-pandemic level is, in part, justified in our opinion. Indeed, many had to raise capital, either equity or debt, to survive over the past twelve months.

As a result, while revenues and profits for travel-exposed companies may recover relatively quickly, the shift in their capital structure justifies lower valuations. In this context, we believe investors need to proceed with caution and avoid bottom fishing.

In consumer discretionary, services providers with solid balance sheets look preferable. Alternatively, investors should consider payments companies, as they stand to benefit irrespective of where the money is spent. Finally, in case consumers decide not to spend but to invest, asset managers could profit.

Investor sentiment has subsided as inflationary pressures build. Our investment experts highlight our main investment themes, examining if consumers can drive the recovery.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.