Market Perspectives June 2021

Investor sentiment has subsided as inflationary pressures build. Our investment experts highlight our main investment themes, examining if consumers can drive the recovery.

04 June 2021

By Michel Vernier, CFA, London UK, Head of Fixed Income Strategy

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

As bond investors look for ways to optimise returns for acceptable levels of risk at a time of low rates, leveraged bond investing may be one way to achieve this.

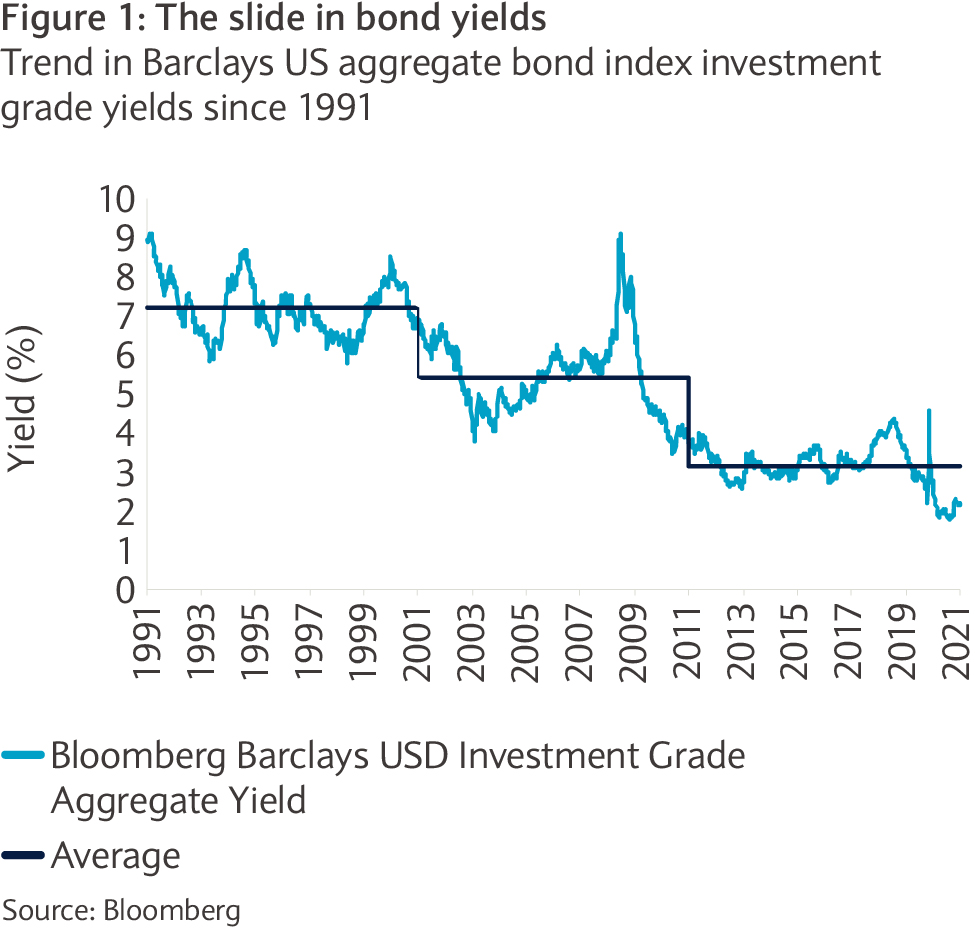

Investing in bonds is increasingly challenging as a result of record low yields in most bond segments (see figure 1).

In seeking to improve yields, investors may be tempted to compromise on the quality of their bond investments. This carries extra portfolio risks.

Best of both worlds

By using securities lending, higher returns can potentially be achieved without compromising on the credit quality. In addition, securitised lending can provide more portfolio flexibility in managing liquidity, potentially useful at times of heightened volatility and in order to avoid selling investments at distressed prices.

At the same time, additional lending increases loss potential given the leveraged exposure. An understanding of how lending can help and what risks are involved is paramount.

Leverage in this context describes using additional borrowing in order to fund part of the investment portfolio. This results in “leveraged” exposure to the investment portfolio given not only is an investor’s own capital used but also additional borrowed capital, which comes at a cost. Given the leveraged exposure, the loss (risk) and return potential are greater compared to an unlevered portfolio using only own funds.

The following sections explain the basics when using borrowing when investing in fixed income portfolios.

Leveraged bond investing: main considerations

Many factors come into play when combining additional borrowing with bond investments. The key elements include the borrowing allowance which is dependent on the lending value percentage of the bonds serving as collateral. This percentage in turn is determined by the quality and level of liquidity.

Meanwhile, the level of the borrowing cost depends on market rates and the composition of the collateral portfolio.

In this context, rising borrowing costs could have the effect that leveraged returns can decline or even become negative.

It also seems important to consider the leveraged exposure which can lead to leveraged profits but also to higher loss potential compared to non-levered portfolios.

Portfolio effect

Using leverage does not change the approach of investing as return and risk should always be considered. By using leverage, and by considering the important additional risk factors, portfolio return and flexibility can potentially be increased, helping investors to target their long-term goals despite persisting low rates.

You can find out more about how leveraged investing might help you in our next education series, to be published later in June. The series looks at the basics of the approach and its potential effects on portfolio dynamics while examining the most important factors to consider when using additional borrowing.

Investor sentiment has subsided as inflationary pressures build. Our investment experts highlight our main investment themes, examining if consumers can drive the recovery.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.