Market Perspectives July 2021

Investor sentiment remains upbeat as signs of inflationary pressures grow. Our investment experts highlight our main investment themes and examine prospects for the global economy.

02 July 2021

By Michel Vernier, CFA, London UK, Head of Fixed Income Strategy

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

Yields seem to be taking a breather now, after a significant surge earlier in the year. Even two consecutive months of record inflation prints were not sufficient to lift US rates to new highs. Can a closer look at the Fed’s mindset reveal what might drive interest rates next?

Investors seem puzzled why higher debt, the prospect of higher inflation and potentially less monetary accommodation are not lifting bond yields more.

As highlighted in April’s Market Perspectives, the relationship between the above factors and yields has been murkier in the past and may not be as obvious in the future. What can bond investors do?

Tapering and hiking plans

What the main driver of rates will be over the rest of the year is likely to be the key question on investors’ minds. Presumably the most important factor, for now, seems to be the US Federal Reserve’s (Fed) monetary policy and approach going forward. When, and by how much, will the central bank raise policy rates and will the tapering of its bond-buying programme affect yields?

The biggest input factor for the Fed is naturally inflation and this time, more importantly, the nature of it. The central bank has said it expects price rises will, for the most part, be transient in nature rather than persistent.

Higher inflation, as seen recently, is partly explained by base effects from the first half of last year and pent-up demand.

The Fed indicated that its policy will see through such a period while the newly implemented average inflation target (AIT), that provides more flexibility on the timing of rate moves, would require higher inflation to make up for undershoots in previous years.

As described in last month’s Market Perspectives, the majority of the factors contributing to the rise in inflation are volatile or flexible and are not sticky.

Cutting the inflation noise

The US central bank is likely to focus on the changes of sticky prices, given that these, according to the Atlanta Fed, are more helpful in assessing future inflation. The sticky price CPI (consumer price index) stands currently at 2.4% year on year compared to 2.8% pre-pandemic.

At the same time, the Dallas Fed calculates a trimmed mean personal consumption expenditure. Here, the most volatile components are eliminated or “trimmed” (regardless of which category this occurs in) to gain better insights of underlying trends. As with the sticky price CPI, this measure is still relatively moderate and does not hint at this being a start of a high-inflation era.

Labour market is now a priority

Since the central bankers’ Jackson Hole meeting last August, when the Fed’s “renewed” dual mandate (inflation and employment) was presented, increasing emphasis has been placed on the job market, which seems to have become the priority lately.

But a lower headline unemployment rate, as such, might not be sufficient to keep inflationary pressures subdued enough for the central bank this time. The central bank may still regret having hiked rates too early in 2015, and by too much, and thus ignoring the slack in the labour market. The Fed chair, Jerome Powell, seems to feel obliged to put things right this time.

To make a better judgement of the labour market slack, Fed member John Williams pointed out recently that the Fed preferably looks at broader measures, like the employment to working population (EPOP) that is similar to the participation rate.

According to Williams, the EPOP has recovered well from last year’s crisis lows. However, the number is still comparably low at 61%, according to the St Louis Fed, and “translates to about eight and a half million fewer people working”1, compared to pre-pandemic levels. For now, it remains to be seen if the current lag in recovery is mainly due to workforce supply constraints or slack or a combination of it.

Fed with additional social mandate

Powell goes even further than Williams. He believes very strongly that monetary policy must support the government’s strategy of fighting inequalities among Americans. When referring to the Fed’s survey of household economics and decision-making (SHED), he pointed out that the “labour force participation declined around 4 percentage points for Black and Hispanic women compared to 1.6 percentage points for white women and about 2 percentage points for men overall”2.

The Fed’s approach of how to assess inflation and employment numbers are important to obtaining a greater sense of when rates might lift off and for bond-purchase tapering: inflation above 2% and unemployment below 5% or 4% might not be the ultimate trigger for policymakers.

As per the usual playbook, it can be expected that tapering will commence before any rate hikes. The central bank has already acknowledged the economic progress that has been made and may announce tapering in the third or fourth quarter this year. Indeed, it might occur as early as during the Jackson Hole summit on 26-28 August.

Tapering could come earlier

Recent surprisingly low job numbers may be a reason to leave policy accommodative longer, though Jerome Powell expects to see “a labour market that shows low unemployment, high participation, rising wages for people across the spectrum within the next two years”. Equally, there are strong arguments for an earlier tapering.

For example, the housing market soared by 13% on a year-by-year comparison in March, the highest since 2005. Fed member Robert Kaplan argued, “I don’t think the housing market needs the level of support that the Fed is currently providing and I would love to see, sooner (tapering) rather than later”.3

We believe that the US central bank will communicate well in advance of tapering and the market is fully aware it will happen sooner or later. While the official announcement may cause some volatility, it will likely not spark rising bond yields as seen in 2013. The move has already been well advertised. Reducing bond purchases earlier or later than the market expects will have limited impact in our view.

No rate hikes likely until early 2023

The latest update of the central bank’s “dot plot” rate forecasts shows that policymakers see two hikes in 2023 compared to no hikes previously. The dot plot also shows that more Fed members not only favour hikes in 2023 but also in 2022. Jerome Powell noted, however, that “the dots should be taken with a big grain of salt,” while discussion about raising rates now are, “highly premature”.

The Fed still sees inflation being only slightly above 2% in 2022 and 2023, which would not justify large hikes.

Still, should inflation remain stickier, the central bank may consider an earlier rate move. The most likely scenario remains that the Fed will start the hiking cycle towards the first half of 2023.

Beware of political noise

A factor which has not been articulated as much by the markets is political dynamics. US treasury secretary, and former Fed chair, Janet Yellen advocated higher policy rates recently: “If we ended up with a slightly higher interest rate environment it would actually be a plus for society’s point of view and the Fed’s point of view”.4

This was the second time that she expressed these views. It seems to prefer the Fed to act quicker to tame any further rate volatility caused by inflationary fears. Interestingly, Powell’s term as Fed chair ends in February 2022 which may lead to further rate volatility, should the US administration plump for a candidate likely to act more swiftly and with more determination.

Another myth: hikes cause higher yields

There seem to be plenty of arguments for more interest rate volatility in coming months. At the same time, it is unlikely that US long-end rates will enter a new upward trend on higher possible policy rates. We argued before that while the rate curve may have room to steepen further, it is more likely that with higher policy rates the curve will start to flatten with long-end yields only marginally trending higher from this point.

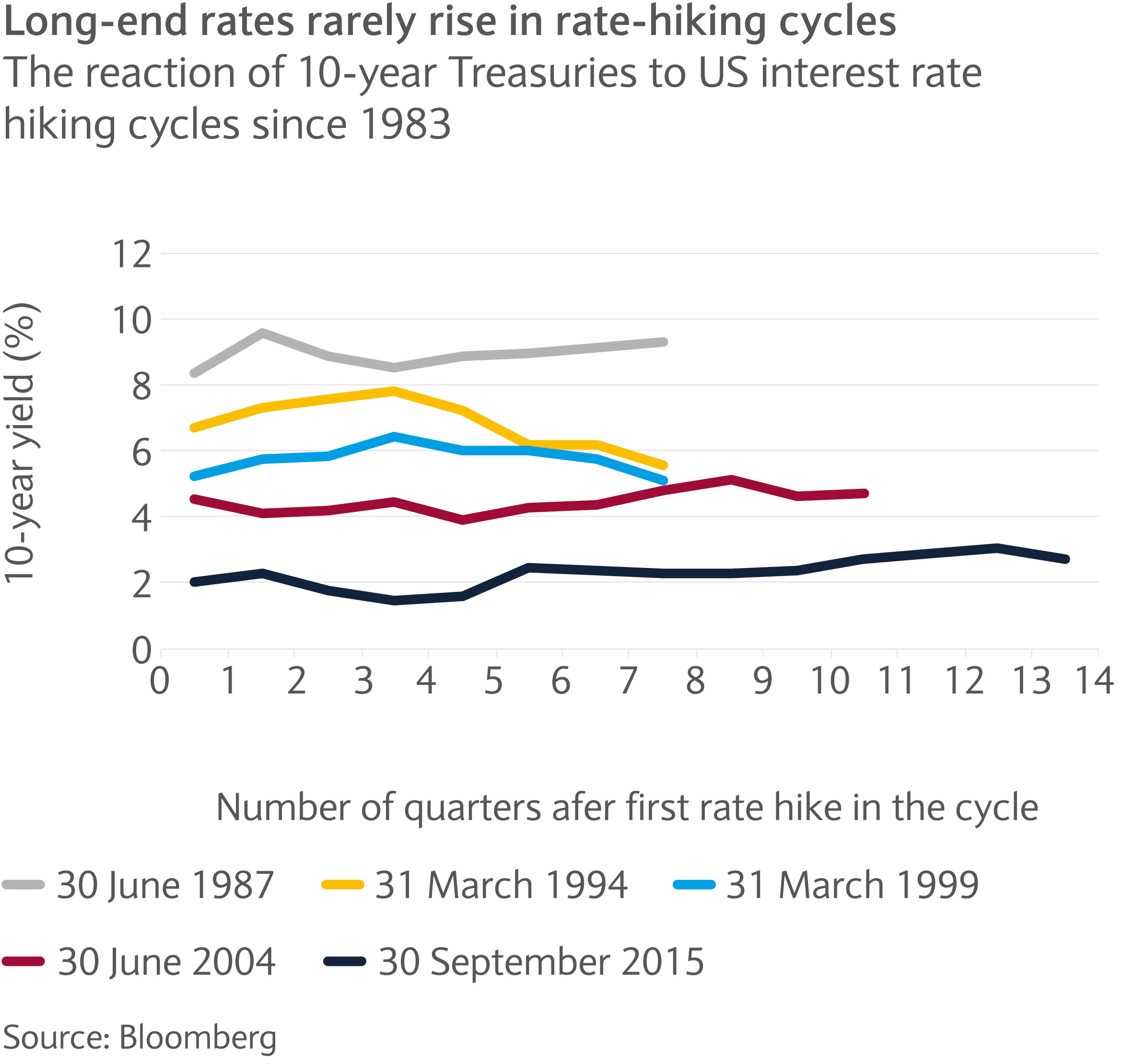

During the past six hiking cycles, back to 1983, the long end moved lower (see chart). After we examined the correlation between debt, inflation and yields in April’s Market Perspectives, this is another myth which may be of importance to keep in mind.

“5-year yields”, says the butterfly

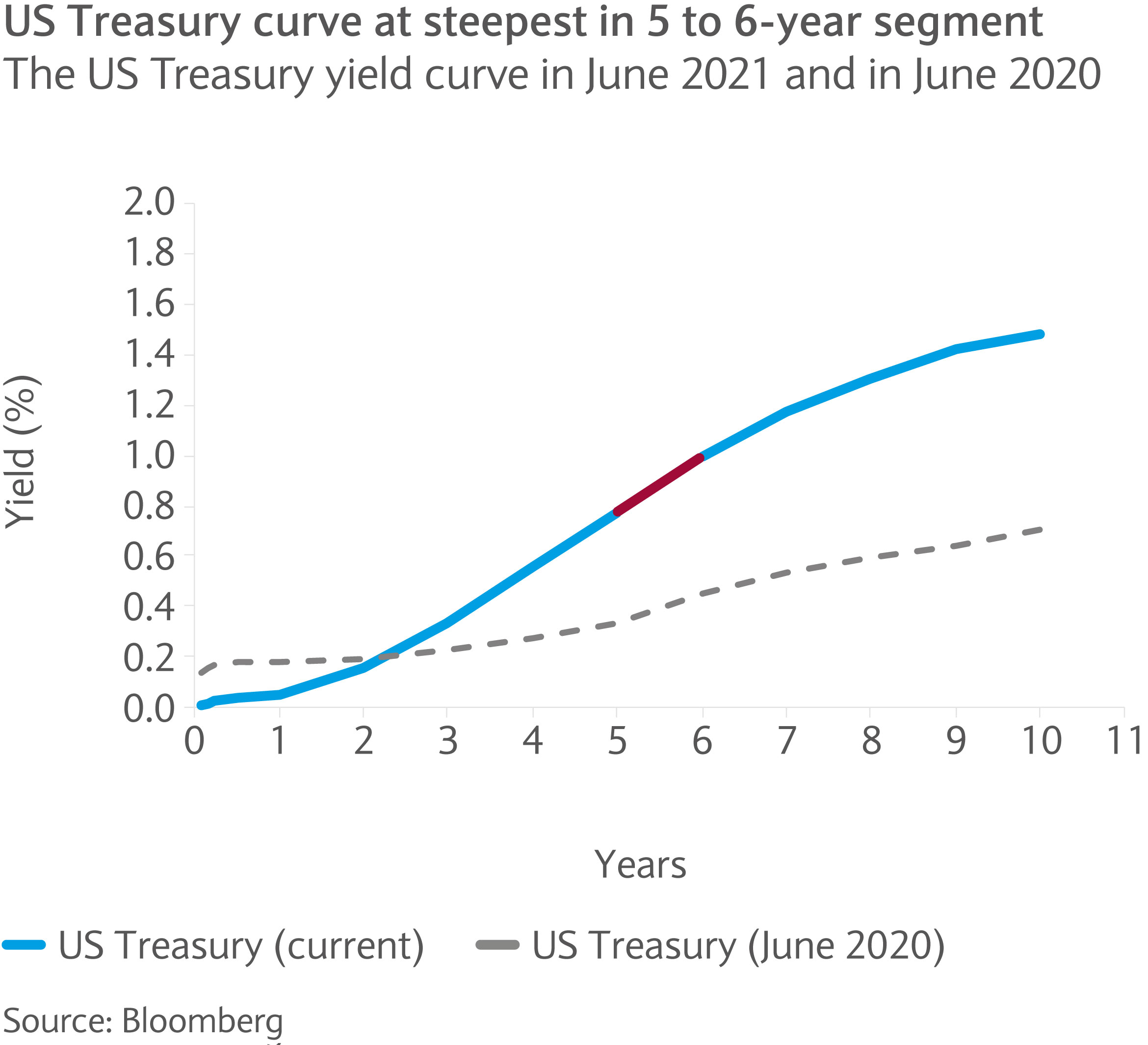

In the current rate environment, it seems that the 5 to 6-year segment of the curve offers an adequate risk-reward. While the duration risk may be relatively contained, compared to long-dated bonds, the steepness up to this point offers higher roll yields (the price gain by holding bonds).

The 5 to 6-year range seems better priced relative to recent history (see chart). This can be illustrated by the so-called butterfly spread that compares a position of one unit each of the 2-year and 10-year yields against two units of the 5-year yield. This spread climbed this year to its 10-year average, last, and indeed only, seen one and three years ago.

How can investors improve yield?

Depressed yields and rate volatility do not offer the best environment for bond investors. Also, corporate bond yields are at historical lows thanks to an almost unprecedented rally in spreads. Spreads have recovered from where they were at the peak of the pandemic crisis in only 14 months. Indeed, they have reached 20-year tights. From here, further price gains due to spread tightening are limited, if not absent, and carry remains the main performance driver, in our view.

Investment-grade bonds seem expensive at first sight and due to the low spread are most exposed to rate volatility, especially for bonds with long maturities, which appear to offer the least value. Within the investment-grade segment, BBB-rated bonds seem to offer a mix of relatively higher yields combined with improving “technical” factors.

First, fallen-angel risk (or the risk of a downgrade to high yield status) has declined significantly and may account for only $40-50bn of US bonds in the next 12 months. BBB-rated corporate issuers in particular are likely to act more defensively to protect their investment-grade ratings.

Second, the recovery and growth in earnings is likely to translate into lower leverage on corporate balance sheets, all else being equal. BBB-rated bonds do not screen as being particularly cheap on absolute and relative spread terms (relative to other rating categories). Compared to the diminished downgrade risk and the low-rate environment, however, they seem preferable within the higher quality bond segment at least.

BB-bonds offer value

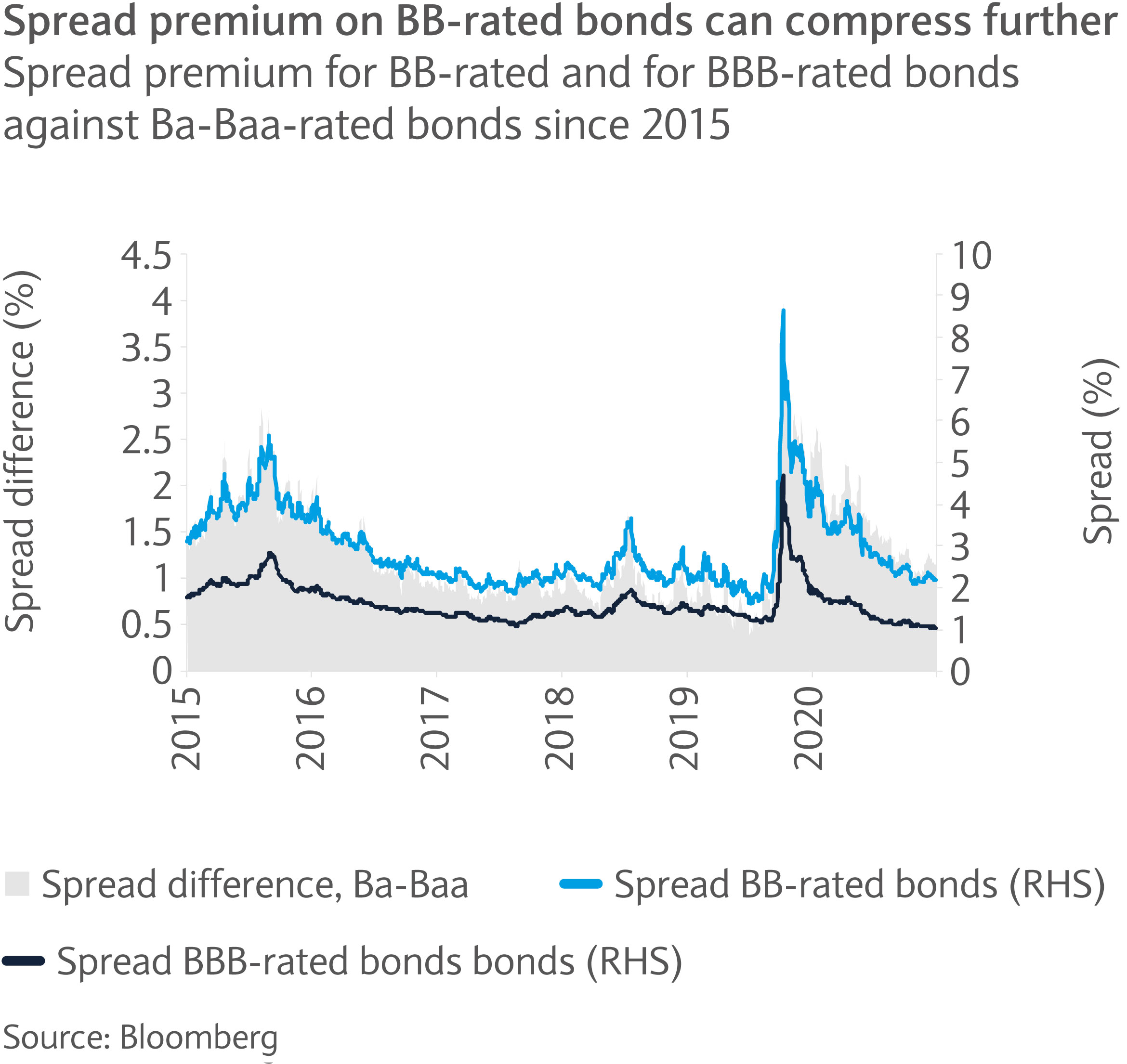

Higher carry meanwhile can be earned with BB-rated bonds. The segment, like most, has witnessed significant spread tightening and while spreads appear to be rich, there is probably still more tightening potential.

Default rates within the broader high yield market are declining faster than initially anticipated and are expected to fall as low as 1.8%, according to Moody’s. In addition, BB-rated bond spreads are still above pre-pandemic levels compared with BBB-rated bonds or general Treasury yield levels (see chart). Carry flows will likely continue and support this cohort of the market in this environment.

Risks remain and selection is key

At the same time, pockets of risk still exist. While leverage may decline from current levels, it is still close to record levels. Corporate behaviour will be crucial in coming quarters. Not only the quantity of issuance (reaching record levels) is important, but also its quality. Debt-funded dividend and buyback deals are on the rise as well as debt-funded M&A deals. Considering the pipeline of debt deals, funding M&A transactions may be up to 20% of debt issuance, compared to 9% last year.

With this in mind, selection remains key. Especially since corporates with already excessive leverage have increased net debt by 30% since the end of 2019. This group is expanding and represents 17.4% of the high-yield market compared to only 13.5% in 2019. While lower interest rates may help for now, those with less stable cash flow can be easily exposed to more default risk.

Investor sentiment remains upbeat as signs of inflationary pressures grow. Our investment experts highlight our main investment themes and examine prospects for the global economy.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.