Market Perspectives July 2021

Investor sentiment remains upbeat as signs of inflationary pressures grow. Our investment experts highlight our main investment themes and examine prospects for the global economy.

02 July 2021

By Nikola Vasiljevic, Zurich Switzerland, Head of Quantitative Strategy

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

The post-pandemic world will likely be challenging, characterised by low rates, elevated inflation risks, rebounding growth, rich equity valuations and structural changes and secular trends. Smart diversification may be one of the key elements for successful investing at such times.

Crafting a well-diversified portfolio is a key tenet for investment success and growing wealth over the long term. Spreading capital across different asset classes can help investors to keep portfolio volatility under control.

However, this is only half of the story. To mitigate the impact of potentially extreme tail events, it may be worth considering different scenarios and evaluating their impact on portfolio performance.

Investment goals and risk appetite

The investor is at the heart of every asset allocation and portfolio construction decision. Before delving into subtleties of financial markets, clearly defining investment needs and goals can help. For example, investors should specify their reference currency, investment horizon, liquidity requirements, need for steady cash flow, lifestyle requirements and aspirational goals. In addition, a firm understanding of their risk tolerance and risk capacity helps.

All these inputs are equally important to build an optimal portfolio that reflects an investor’s needs, risk attitude and investment style. Ultimately, a structured and diligent investment process can help to meet their long-term goals, while navigating risks and opportunities in fast-paced markets. As such, diversification is generally considered at the first stage of any investment process.

Safe-haven assets

Equities are an essential part of most portfolios, except for the most risk averse clients. Historically, the asset class has provided a hefty premium of 6-7% on top of the returns offered by risk-free assets. However, this excess return usually comes at the cost of higher volatility and large losses during market meltdowns (for instance, many equity markets suffered a drawdown of 40-50% within a short period of time in the global financial crisis of 2008-2009).

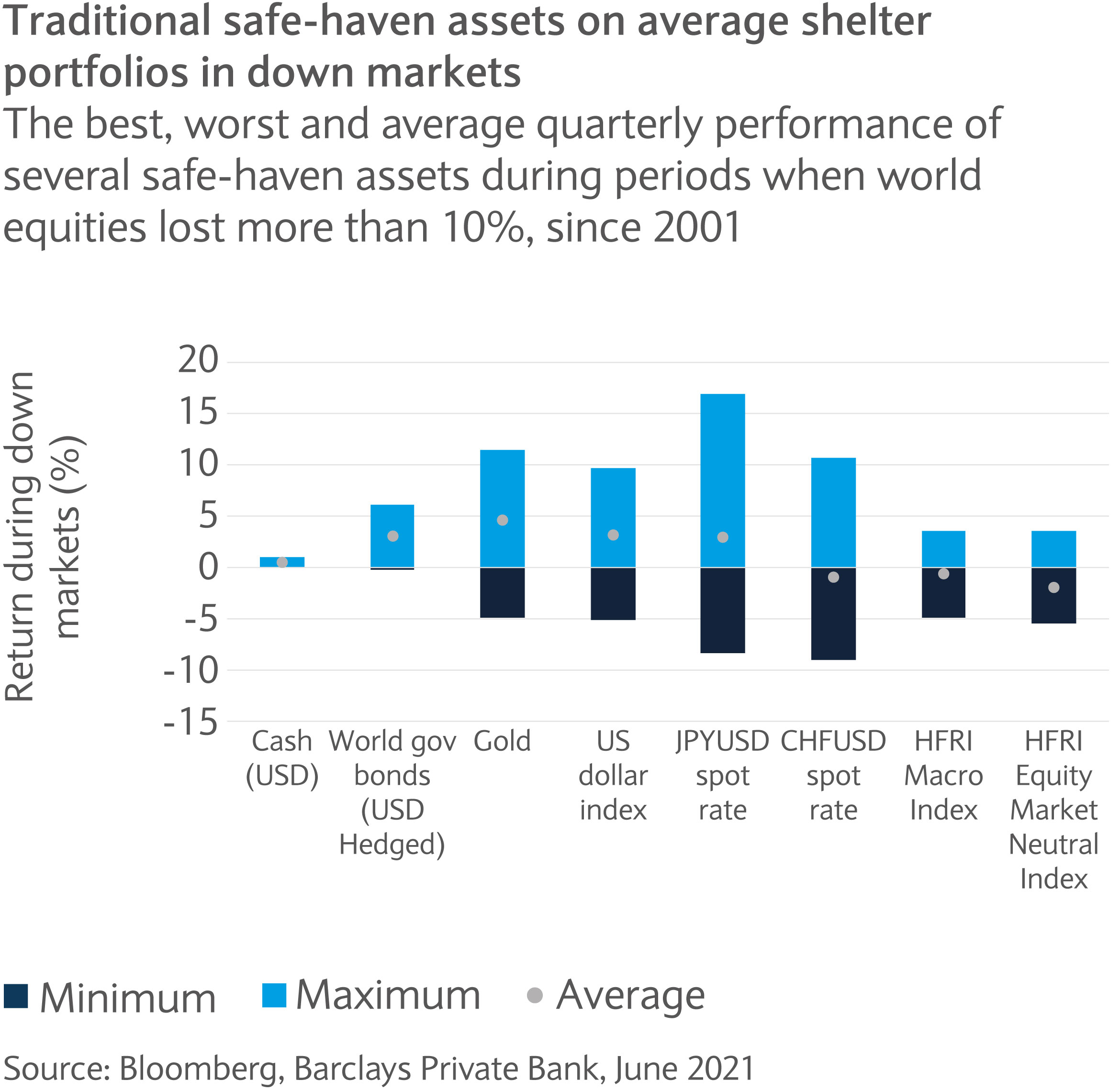

To mitigate the risks associated with investments in equities, a range of so-called “safe-haven assets” (or assets expected to provide protection when equities tank) might be considered in a portfolio context. Cash, government bonds, gold, certain currencies and hedge funds are among assets that typically help in down markets.

Since 2001, safe-haven assets like government bonds, gold, the US dollar and Japanese yen have averaged positive performance in the quarters when global equities lost more than 10% (see chart).

However, safe-haven assets can disappoint as well. Changing macroeconomic conditions may impact correlations, possibly diminishing their protective power. Moreover, safe-haven assets usually provide low income and represent a drag on performance over longer investment horizons. As such, there is a trade-off between portfolio return and risk.

Is your core protected?

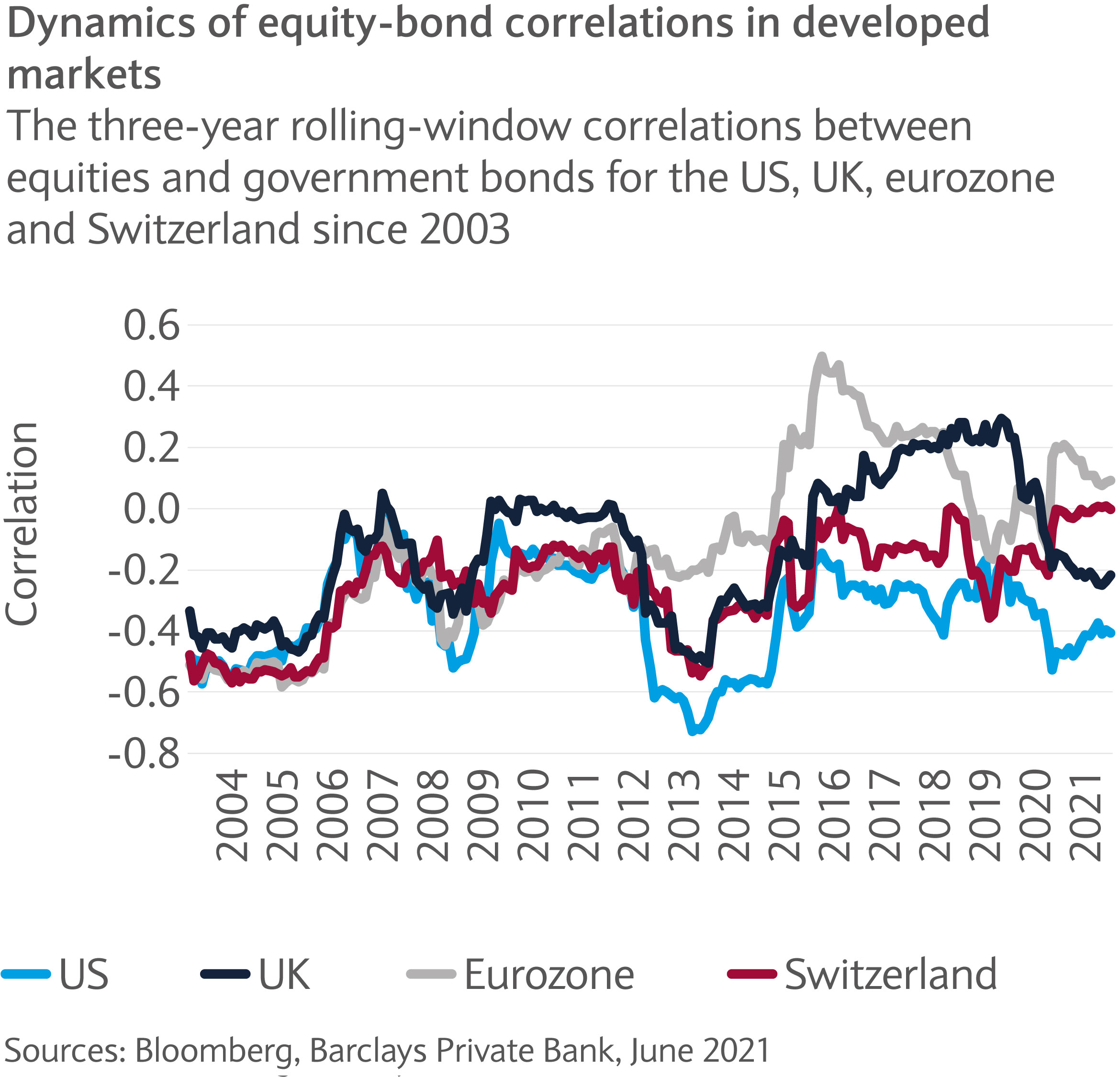

Like equities, government bonds often represent a core part of most portfolios. Investors in Treasuries can earn stable and secure income. For this reason, they typically exhibit a negative correlation with equities, especially during market downturns.

However, the correlation of government bonds with equities can change. Historically, the two asset classes become more correlated as inflation rises. Additionally, the current low-interest rate environment leaves limited scope for capital gains on government bond investments. Indeed, the combination of these macroeconomic factors has led many investors to question the diversification potential of Treasuries of late.

The dispersion of equity-bond correlations has increased significantly since 2003 for the US, UK, eurozone and Switzerland (see chart). Although equity- bond correlations are negative on average, the current correlation level is close to zero in Switzerland and around0.1 in the eurozone. Meanwhile, correlations are negative in the US (-0.4) and the UK (-0.2). This shows that the macroeconomic backdrop is an important driver of the interplay between equities and bonds.

The investor’s reference currency matters

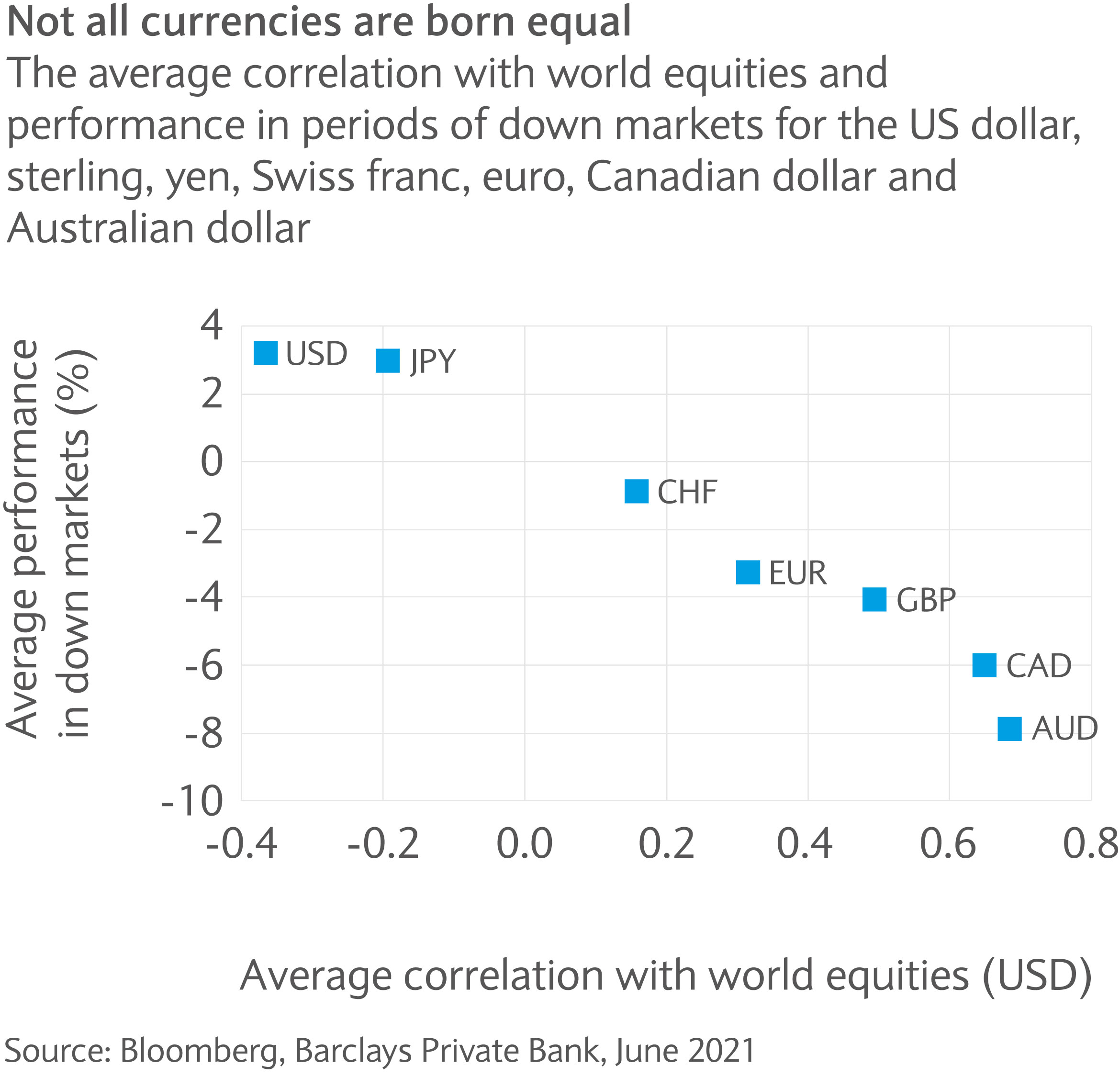

For those with exposure to global equities, currency effects matter. Our research shows that an investor’s reference currency can affect portfolio returns significantly in down markets.

In fact, it is possible to draw a spectrum of currencies, based on their average and tail correlation with global equities, ranging from the safe-haven currencies (such as the US dollar and yen) to their cyclical, commodities-driven peers (such as the Canadian and Australian dollars).

This analysis indicates that currencies play an important role in asset allocation and are an integral part of the diversification mosaic (see chart).

Stay calm and keep diversifying

Diversification lies at the crux of our investment philosophy. Finding an optimal asset mix requires a thorough analysis of many factors and their interconnectedness. However, there is no universal solution. Building a diversified portfolio that can serve investors well across various market regimes is predicated on a firm understanding of their investment goals and risk appetite.

Focusing on the potential long-term performance of portfolios, while keeping an eye on the short term and the potential impact of volatility on investors’ behaviour, seems to be the key to successful investing.

Investor sentiment remains upbeat as signs of inflationary pressures grow. Our investment experts highlight our main investment themes and examine prospects for the global economy.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.