Cryptocurrencies: the new gold?

15 January 2021

8 minute read

Cryptocurrencies, and bitcoin in particular, have once again grabbed the headlines, performing very strongly in recent months. Bitcoin is up more than 200% since October while Ethereum, the second most popular cryptocurrency, climbed by 190% over the same period. The total value of cryptocurrencies briefly reached $1tn in the first week of 2021, with bitcoin accounting for around 70% of that, before losing 20% within a week. The current volatile episode echoes the exponential rise observed during a short period in 2018, followed by a sharp reversion of most of the previous gains.

As was the case in 2018, the recent performance was accompanied by high volumes and a growing number of retail investors dipping their toes into the asset class. Cryptocurrency spot trading volumes last month were up 700% compared to trading seen in December 2019. With interest increasing again, this article weighs the pros and cons of allocating to cryptocurrencies in investment portfolios.

Are cryptocurrencies really a currency?

For a currency to thrive, trust in it is usually the most important factor. After all, money is not real. It is credit that a currency’s users give to the issuer. For a long time, paper money was backed by gold holdings. But even the yellow metal has no real tangible value. It is only collective thinking that gold is valuable that makes it so. This is why most successful long-term currencies have been issued by sovereign entities.

Sovereigns are the most powerful economic entity and typically deemed to be the most trustworthy. Throughout history, the currency of the most powerful state at any point in time has been seen as the world reserve currency. While sterling played this role between 1800 and 1945, the US dollar has been the reserve currency since the second world war.

Thanks to strong legal and economic means, sovereigns are most likely to be able to build trust in a currency. When economic cracks emerge, a currency loses its value. If the economic damage seems irreversible, a currency’s value may collapse and be rendered useless.

Difficulty in passing the test

Bitcoin and other cryptocurrencies are non-sovereign currencies. This means they have no state backing and are completely decentralised. The issuance of bitcoins is a transparent process, with a finite number that can be “mined”. This is often touted as being a positive as it means that cryptocurrencies can’t be manipulated, especially in light of central banks’ quantitative easing seen since the global financial crisis and fears of fiat currency debasement.

As a non-sovereign asset, it means that a cryptocurrency’s value, like gold, is purely based on collective thinking as there is no issuer’s economic power behind it. As the collective opinion on say bitcoin’s value fluctuates, this volatility can reduce the appeal of bitcoin as a storage of value (see below).

As bitcoin is not widely recognised as a mean of payment (certain countries have banned the use of cryptocurrency), it also fails to serve as a medium of exchange, a key trait of fiat money. Cryptocurrency value is at the mercy of sovereign countries’ decisions to recognise it or not as a legal means of payment.

Even though the name “cryptocurrency” suggests that those assets are a currency, it is difficult to envisage a strong development of those assets as currencies in the near future.

Time to add to a portfolio?

There has been a lot of talk about bitcoin, and cryptocurrencies in general, being a “digital” gold. Similar to gold, there is a finite amount, it is not backed by any sovereign and no single-entity controls its production. But for bitcoin to be considered in a portfolio and to become an investable asset, similar to gold, the asset would need to improve the risk/return profile of that portfolio. This seems a tall order.

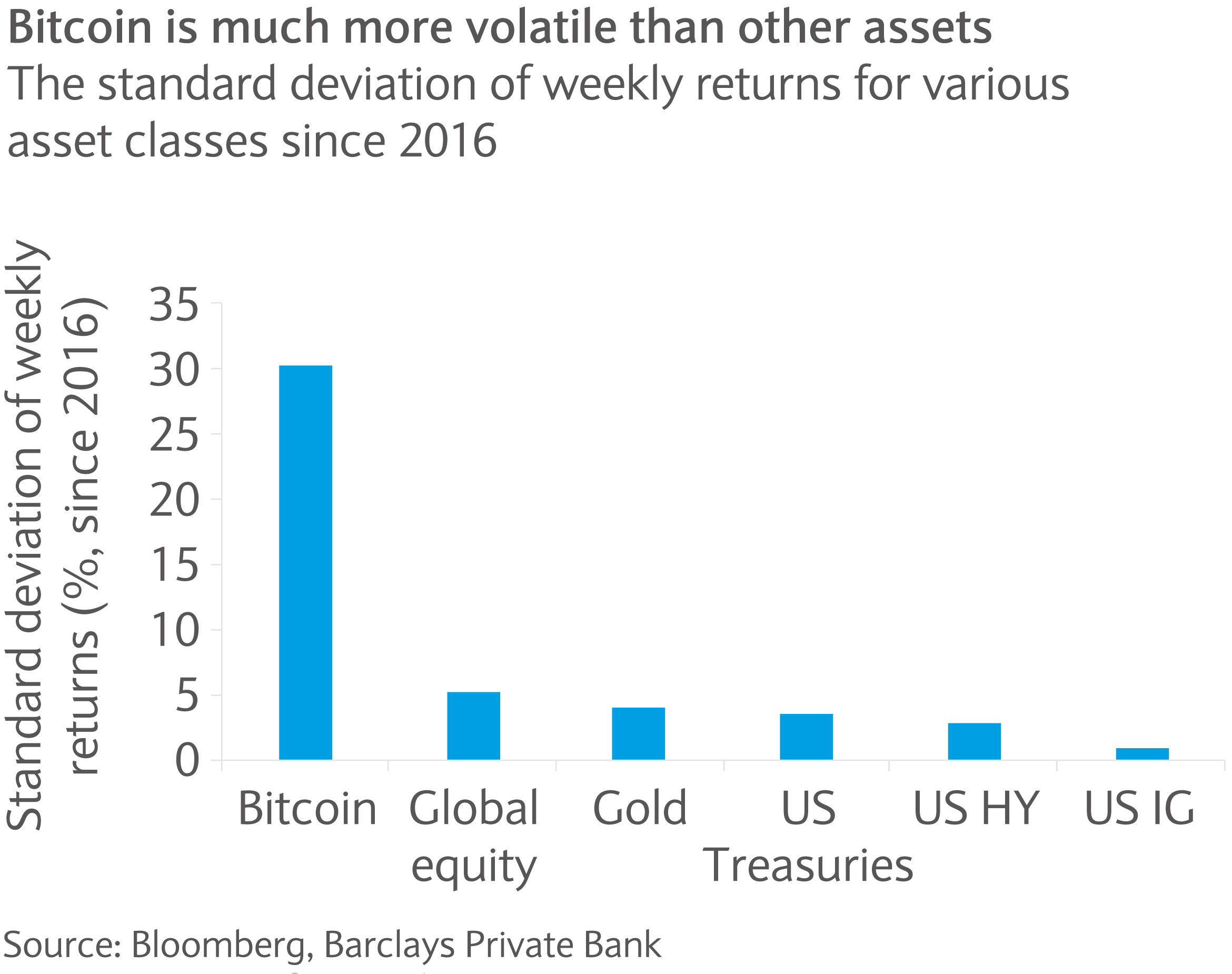

While it is nigh on impossible to forecast an expected return for bitcoin, its volatility makes the asset almost “uninvestable” from a portfolio perspective. With spikes in volatility that are multiples of that typically experienced by risk assets such as equities or oil, many would probably throw the cryptocurrency out of any portfolio in a typical mean-variance optimisation.

Poor diversifier

And while bitcoin’s correlation measures are relatively supportive, it seems to falter when diversification is most needed, such as during sharp downturns in financial markets. Looking at weekly return correlations since 2016 shows that bitcoin is not strongly correlated with any assets (see below). It is however only second to US high yield in its correlation with equities. US Treasuries, gold and US investment grade were better diversifiers than bitcoin when it comes to equities.

| Global equity | Bitcoin | Gold | US Treasuries | US investment grade | US high yield | |

|---|---|---|---|---|---|---|

| Global equity | 100% | 29% | 11% | -38% | 8% | 88% |

| Bitcoin | 100% | 8% | 0% | 12% | 24% | |

| Gold | 100% | 48% | 58% | 17% | ||

| US Treasuries | 100% | 83% | -27% | |||

| US investment grade | 100% | 25% | ||||

| US high yield | 100% |

Source: Bloomberg, Barclays Private Bank

Furthermore, looking at global equity corrections since 2015 (see below), it is noticeable that bitcoin has performed even worse than equities over the last three corrections. And while gold and fixed income provided some relief during those corrections, bitcoin compounded the loss that investors would have incurred from equities exposure.

| Equity market corrections | Performance of assets | ||||||

|---|---|---|---|---|---|---|---|

| Top | Bottom | Global equity | Bitcoin | Gold | US Treasury | US IG | US HY |

| May 2015 | August 2015 | -13% | -4% | -4% | 1% | 0% | -4% |

| November 2015 | February 2016 | -15% | -5% | 12% | 10% | 2% | -10% |

| January 2018 | February 2018 | -9% | -25% | -2% | -4% | -1% | -1% |

| September 2018 | December 2018 | -17% | -44% | 6% | 5% | 2% | -5% |

| February 2020 | March 2020 | -34% | -38% | -1% | 14% | -1% | -21% |

Source: Bloomberg, Barclays Private Bank

The fact that cryptocurrencies also fluctuate alongside equities suggests that investment in bitcoin is more akin to a bubble phenomenon rather than a rational, long-term investment decision. The performance of the cryptocurrency has been mostly driven by retail investors joining a seemingly unsustainable rally rather than institutional money investing on a long-term basis.

Several studies around market structure have shown that emerging markets with high retail/low institutional participation are more unstable and more likely subject to financial bubbles than mature markets with institutional participation. And while more leading financial houses seem to be taking an interest in cryptocurrencies, the market's behaviour suggests that the level of institutional involvement is still limited. Another issue is around its concentration: about 2% of bitcoin accounts control 95% of all bitcoins.

In summary, difficulty to forecast return, lack of diversification and high volatility makes it hard to consider bitcoin as a standalone asset in a diversified portfolio for long-term investors.

An inflation hedge?

Another point widely quoted in favour of cryptocurrencies is that they provide an inflation hedge. This might be a valid point, if inflation stems from fiat currency debasement. As mentioned above, a currency’s worth comes from the trust economic agents have in it. If unsustainable amounts of debt and large money creation shatter belief in sovereign-backed currencies through spiralling inflation, cryptocurrencies could be seen as an alternative.

Regardless of its price, bitcoin’s production is set on a precise schedule and cannot be changed. If oil or copper prices go up, there is an incentive to produce more. This is not the case for cryptocurrencies. In a very specific and highly hypothetical scenario of all fiat currency collapsing, this could be positive. But other real assets such as precious metals, inflation-linked bonds or real estate usually provide a hedge against inflation.

Other considerations

Bitcoin’s technology should theoretically make it extremely secure. As there is no intermediary, each transaction is reviewed by a large number of participants which can all certify the transaction. However, there have been frauds and thefts from exchanges. Another point to consider is the risk of “losing” bitcoins. According to the cryptocurrency data firm Chainanalysis, around 20% of the existing 18.5m bitcoins are lost or stranded in wallets, with no mean of being recovered. As there is no intermediary, there is no backup for a lost bitcoin.

From a sustainability point of view, adding cryptocurrencies to a portfolio will make it less green. Mining and exchanging them is highly energy intensive. According to estimates published by Alex de Vries, data scientist at the Dutch Central Bank, the bitcoin mining network possibly consumed as much in 2018 as the electricity consumed by a country like Switzerland. This translates to an average carbon footprint per transaction in the range of 230-360kg of CO2. In comparison, the average carbon footprint of a VISA transaction is 0.4g of CO2.

Beyond energy use, the mining process generates a large amount of electronic waste (e-waste). As mining requires a growing amount of computational power, the study estimates that mining equipment becomes obsolete every 18 months. The study suggests that the bitcoin industry generates an annual amount of e-waste similar to a country like Luxembourg.

Cryptocurrencies are here to stay

Innovation in digital assets continues rapidly and will likely drive increased participation, both from retail and institutional investors. The underlying blockchain technology behind bitcoin was meant to disrupt a few different industries. While results have not lived up to the initial hype, more sectors are investigating the use of the technology.

And with Facebook announcing a stablecoin, or a cryptocurrency pegged to a basket of different fiat currencies, central banks have accelerated the movement towards central bank digital currencies. Those could improve payment systems resilience and facilitate cross-border payments.

Related articles

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This communication:

- Has been prepared by Barclays Private Bank and is provided for information purposes only

- Is not research nor a product of the Barclays Research department. Any views expressed in this communication may differ from those of the Barclays Research department

- All opinions and estimates are given as of the date of this communication and are subject to change. Barclays Private Bank is not obliged to inform recipients of this communication of any change to such opinions or estimates

- Is general in nature and does not take into account any specific investment objectives, financial situation or particular needs of any particular person

- Does not constitute an offer, an invitation or a recommendation to enter into any product or service and does not constitute investment advice, solicitation to buy or sell securities and/or a personal recommendation. Any entry into any product or service requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding documents

- Is confidential and is for the benefit of the recipient. No part of it may be reproduced, distributed or transmitted without the prior written permission of Barclays Private Bank

- Has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.