Market Perspectives August 2021

Financial markets remain in upbeat mood despite rising inflationary pressures and the increase in coronavirus cases due to the Delta variant.

06 August 2021

By Julien Lafargue, CFA, London UK, Chief Market Strategist

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

With European equities underperforming US peers again and the pace of the recovery in doubt as COVID-19 infection levels rise, are opportunities emerging for investors in the region?

Continental European equities were seen as the perfect “value” trade, set to outperform in an economic reopening and recovery scenario, by an ever increasing proportion of investors earlier this year. While we were sympathetic to this rationale, we’ve always thought that any outperformance would be short-lived. Fast forward to today and eurozone indices are once again lagging their US peers, reinforcing our view that active management is key in the region.

Europe as a value play

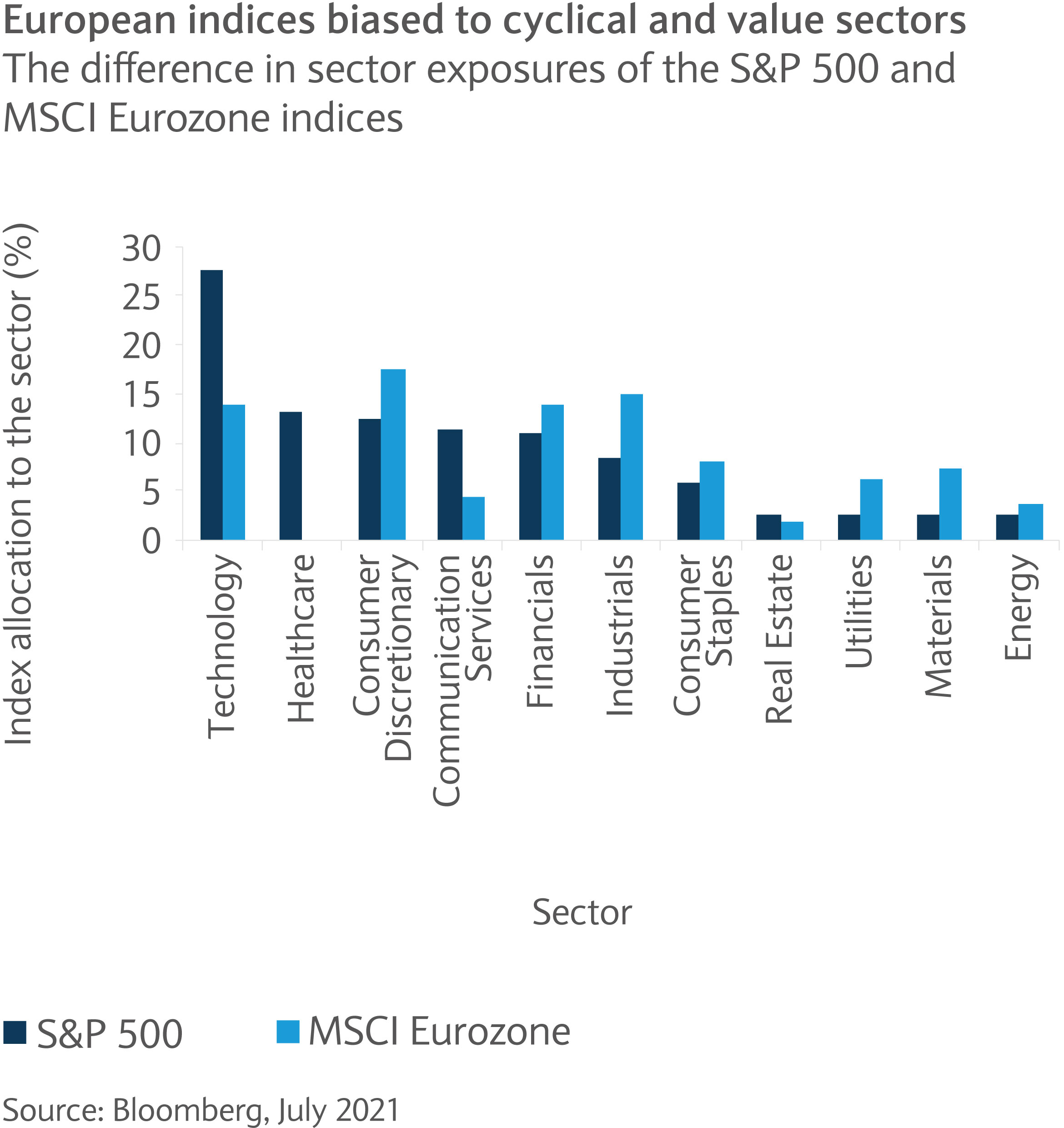

European indices remain geared towards cyclical and value sectors such as financials, industrials and certain parts of consumer discretionary such as autos and retail (see chart). This makes them well positioned to profit from accelerating economic activity. And because European companies tend to be more exposed to global trade (the eurozone’s trade-to-gross domestic product stands at 82%, versus 26% in the US, according to the World Bank1), the eurozone appears to be great global recovery play.

Timing is of the essence

However, as we’ve highlighted before, the post-pandemic rebound in financial markets was likely to be similar to the collapse that occurred in early 2020: violent and short-lived, requiring spot-on timing. This is exactly what happened as, over the first two weeks of November, eurozone indices outperformed their US counterparts by around 6%. After that, stocks in both areas moved in tandem.

More recently, in May and June, eurozone stocks extended their lead slightly over US peers but then lost all of their total outperformance in June and July as concerns over global growth re-emerge. Because timing both the entry and exit points to perfection is near impossible, we suspect most investors did not capitalise on this opportunity and would have been better off maintaining a preference for higher quality and higher growth exposure.

Growth may disappoint

While the late reopening of eurozone economies may hit the growth differential versus the rest of the world in the second half of this year, we remain sceptical of this view. First, we believe that this timing difference, in terms of peak growth, is well understood and therefore largely priced in markets. Second, with COVID-19 cases on the rise, economic activity may not rebound as strongly as expected.

Finally, Europe’s growth is highly dependent on the rest of the world and on Chinese demand in particular. Economic momentum in China has slowed in the last few months and is likely to translate into lower demand for European exports.

Structural challenges remain

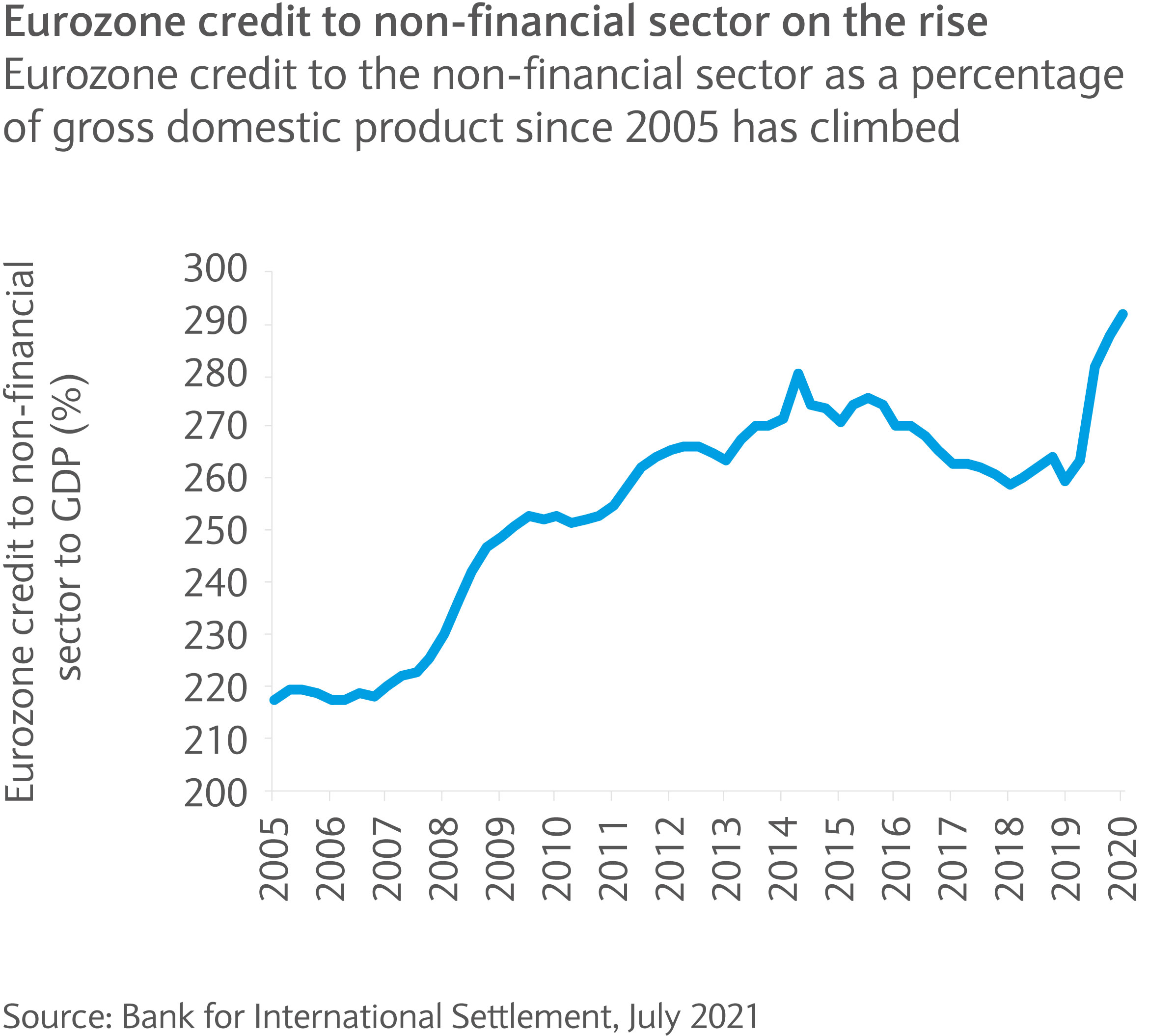

Beyond pandemic-related considerations, the eurozone’s long-term outlook remains unappealing in our view. Through the crisis, the debt load on economies has increased meaningfully with total non-financial debt approaching 300% of the region’s output, albeit with divergences at the country level (see chart). This burden may dampen growth, in particular for companies as interest expenses on the debt may continue to consume much free cash flow.

At the same time, innovation remains hampered by heavy regulation and the overall return on equity generated by European companies continues to trail US peers. Finally, with twenty-eight different members, political gridlocks and risk surrounding national elections are a regular occurrence in the region, creating additional sources of uncertainty for investors.

Reasons not to dismiss Europe

While European equities may be best suited for opportunistic trading-oriented investors, they should not be completely dismissed by those with a longer investment horizon. Indeed, for those willing to focus on sector or stock-specific opportunities, the euro area seems an attractive hunting ground: so far this year about half of the MSCI Euro index components have delivered a performance equal or superior to that of the S&P 500.

In addition, while Europe lags in term of growth exposure, given the limited number of listed tech companies, the region is a clear leader with respect to environmental, social and governance (ESG) matters.

Where to focus

In European equities, similar to the US, we believe that investors should focus on higher quality companies offering strong balance sheets, pricing power and good earnings visibility.

With the technology sector being a small universe in the region, companies exhibiting these characteristics are most frequently found in industries such as luxury, industrials (software-driven or linked to the energy transition) and healthcare. Given valuation levels and the risk around growth in China, the healthcare sector may be better positioned in the short term, in our opinion.

Financial markets remain in upbeat mood despite rising inflationary pressures and the increase in coronavirus cases due to the Delta variant.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.