Market Perspectives August 2021

Financial markets remain in upbeat mood despite rising inflationary pressures and the increase in coronavirus cases due to the Delta variant.

06 August 2021

By Jai Lakhani, CFA, London UK, Investment Strategist

You’ll find a short briefing below. To read the full article, please select the ‘full article’ tab.

As inflation continues to come in higher than expected, is it time to reconsider the outlook for prices and portfolio positioning? We analyse the findings from Barclays’ 25th global annual inflation conference and what this might mean for investors.

There seems to be one topic investors cannot avoid thinking about and also fail to agree on: inflation. The disagreement is centred on transitory or permanent price pressures, with the latter a headwind to growth and likely resulting in restrictive monetary policy.

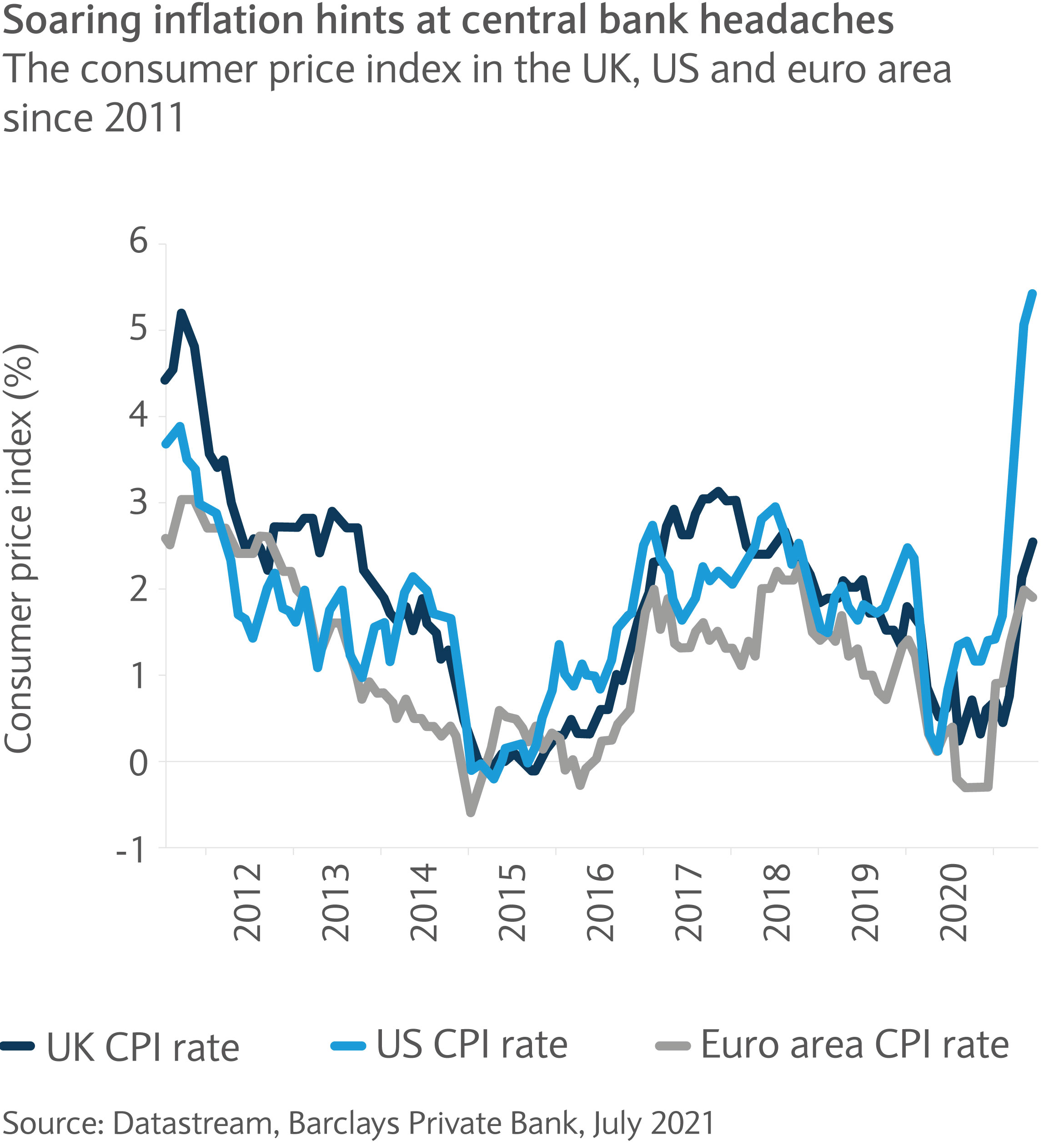

In June, the US consumer price index (CPI) surged to its highest rate in 13 years at 5.4%, UK inflation hit an almost three-year high of 2.5% and euro area inflation briefly overshot its target (see chart). In addition, Chinese producer prices hit an eight-year high.

Although we see inflationary pressures as transitory and likely to abate in the medium to longer term, we now analyse some important questions around the topic.

What’s been driving inflation?

The rise in inflation seen this year can be attributed to the previous period’s comparables, or base effects, stronger demand as economies reopen and consumers spending their excess savings, accommodative monetary and fiscal policy, and a mix of supply-side bottlenecks and constraints.

However, much of the price pressures have been focused on specific goods and services exposed to reopening as opposed to broad-based strength. Used cars, airline fares and lodging away from home contributed 58 basis points (bp) of the 88bp hike in June’s US core inflation. Used cars accounted for a third of the gain in CPI with production of new cars limited by a shortage in semiconductors.

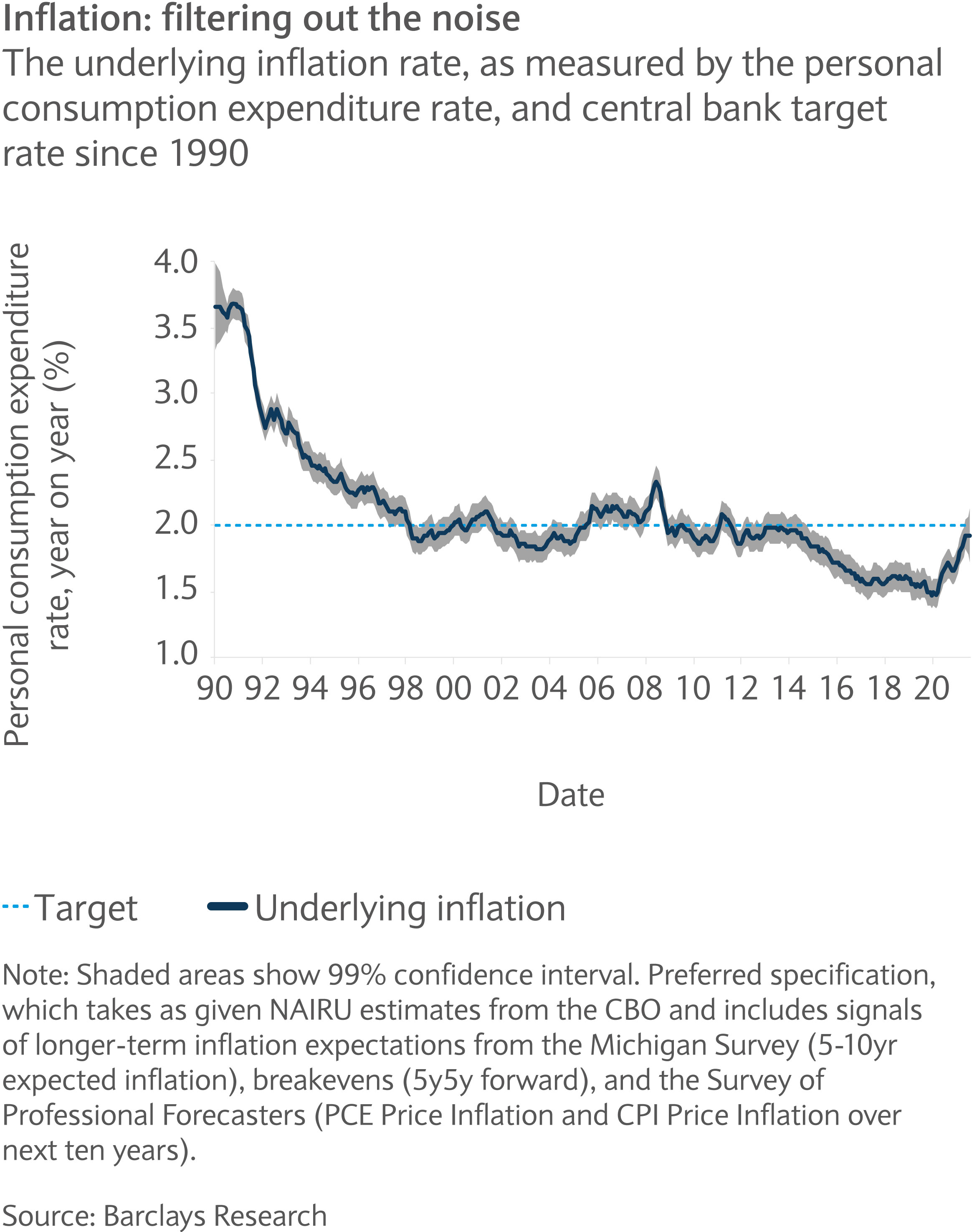

The semiconductor supply issue may abate once supply-side constraints fade and pent-up demand wanes. The Barclays Underlying Inflation Gauge for the US, which excludes transitory influences, supports this notion.

Underlying personal consumption expenditure (PCE) inflation is firming to levels approaching 2%, but is well short of recent incoming inflation data (see chart).

What’s the argument for higher-for-longer inflation?

The suggestion of more sustained upward price pressures in the US may stem from the potential impact of the Democrat administration’s fiscal stimulus. Professor Olivier Blanchard, the former chief economist at the International Monetary Fund, argues that President Biden’s $1.9tn stimulus plan is three-times the size of the output gap1, or the gap between actual and potential economic output.

Added to that, labour shortages may increase wage pressures as demand rises. Wage hikes tend to be hard to reverse and might translate into meaningful inflation that requires central bank intervention.

Why might inflation pressures be transitory?

There are three points worth considering when looking into whether more elevated levels of inflation are transitory rather than permanent. We look at them below:

First, the last year has seen the strongest economic recovery since any recession for 80 years. Bar the semiconductor supply shortages, which seem to be moderating, the bottlenecks affecting some supply chains probably result from a transient shock as opposed to structural constraints.

At Barclays’ latest global annual inflation conference in June, World Bank economist Franziska Ohnsorge attributes nine-tenths of inflation to the rise in demand, suggesting that supply is unable to react to the increase in demand. Longer term, the secular drivers of deflationary pressures, such as digitalisation and technology advancement, remain intact and should continue to lower input costs.

Second, the strong demand seen so far may not last long. In many regions, such as the US, UK and especially China, momentum is peaking. Furthermore, although the fiscal stimulus of the last year has been large, its impact could fade quickly, especially as we emerge out of the recovery and support schemes are unwound.

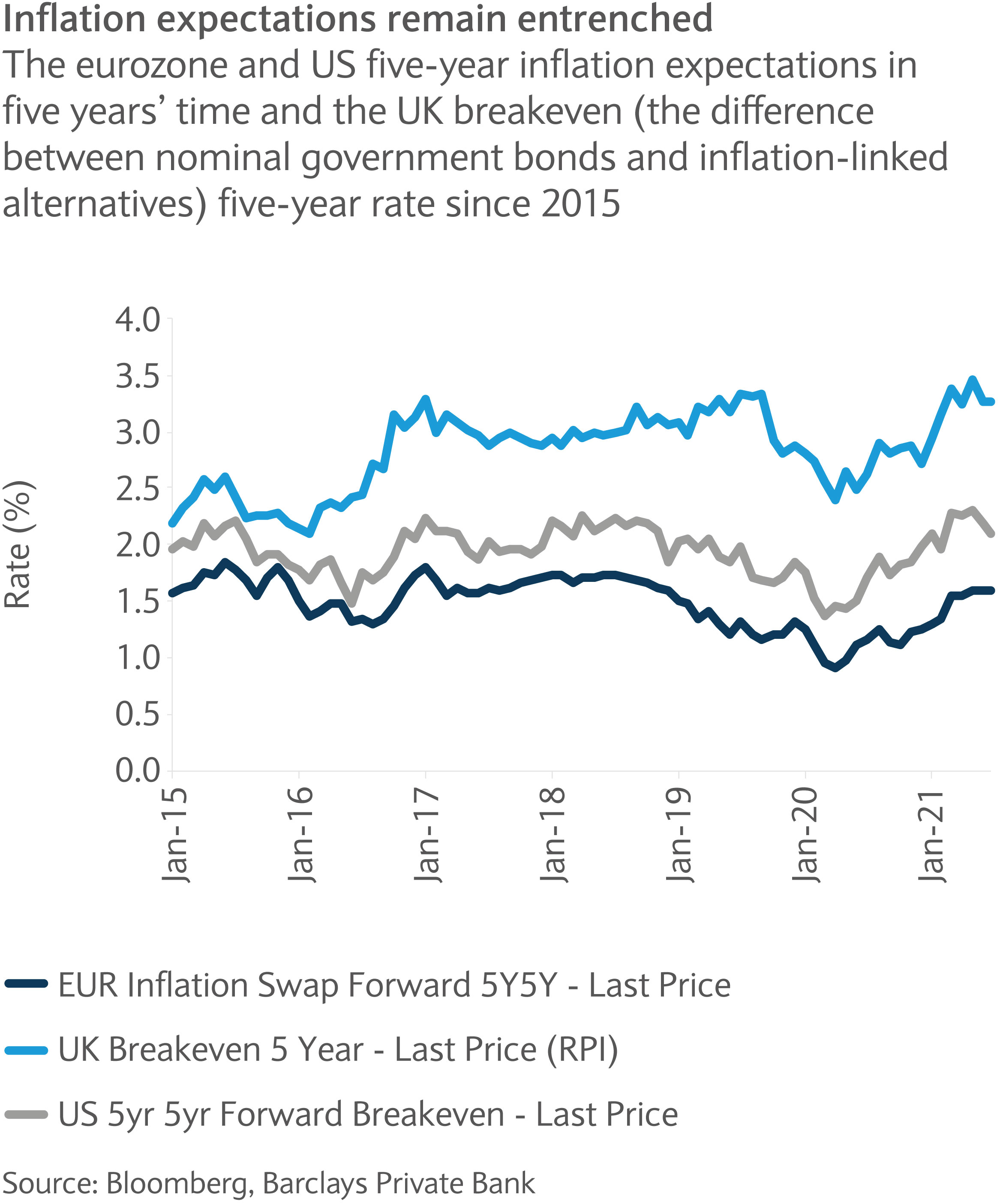

Finally, and most importantly, inflation expectations remain firmly entrenched (see chart) over the medium to longer term for both advanced and emerging economies. In fact, in emerging markets a one percentage point upward inflation surprise only raises the inflation expectations for five years ahead by 0.2 percentage points.

This has been driven by disciplined inflation targeting by central banks and fiscal rules being implemented. Agents in both developing and emerging market economies believe that permanent pressures in inflation will not be tolerated and rate hikes have begun in many emerging market regions. The US Federal Reserve’s hawkish surprise at its June meeting is further evidence of this.

What can investors do?

While investors may disagree on the underlying momentum of inflation, one thing remains clear: price pressures are likely to be higher this year and next than experienced in the past decade.

In trying to limit the effects of inflation risk on portfolios, investors can invest in high-quality companies exhibiting strong pricing power, inflation-linked bonds and, selectively, gain exposure to short-duration high-yield bonds. That said, upping exposure to private markets, hedge funds and real assets, such as infrastructure, very much warrants consideration (see June’s Market Perspectives).

Financial markets remain in upbeat mood despite rising inflationary pressures and the increase in coronavirus cases due to the Delta variant.

This communication:

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.